Tech shares fell globally after the Trump administration imposed new restrictions on Nvidia’s chip exports to China, worsening commerce tensions.

dropped 1.5%, and Nvidia (NASDAQ:) shares fell about 6% in premarket buying and selling. ASML (NASDAQ:) shares plunged over 7% after reporting fewer-than-expected orders, blaming weak point within the chip business. European markets additionally felt the strain, with the down 0.8%.

Within the European session market strikes appeared extra measured in comparison with current swings, as hopes grew for attainable talks on Trump’s reciprocal tariffs.

costs are again above the $3300 deal with following a quick pullback. Dangers are elevated following a report that the US administration plans to make international locations select between the US and China and supply favorable tariffs as an incentive.

This took place after a quick enchancment in sentiment as information filtered by that Chinese language authorities are asking the Trump administration to take sure actions earlier than agreeing to talks, together with displaying extra respect and curbing offensive feedback from cupboard members, in line with a supply near the Chinese language authorities.

China’s Overseas Ministry issued a press release earlier within the day saying that if the US desires to resolve points by dialogue, it ought to cease exerting most strain

For now, tariff developments proceed to sway markets backwards and forwards as information filters by. This can proceed within the US session with President Trump confirming Japan is to barter at the moment with the US concerning tariffs & the price of army help. President Trump mentioned he’ll attend the assembly himself, together with the Treasury & Commerce Secretaries, and hopefully one thing will be labored out.

Financial information forward

The US session will deliver US information into focus however the larger information is more likely to be a speech by . The has the unenviable process of planning their and choices within the present local weather which is rife with uncertainties.

Relying on the character of Powell’s testimony, markets might react as properly, however any information about financial coverage is unlikely to have a long-lasting influence.

The Financial institution of Canada (BoC) is due later within the day with forecast cut up on whether or not the Central Financial institution will reduce charges. At the moment, markets are pricing in 55% likelihood of a price reduce.

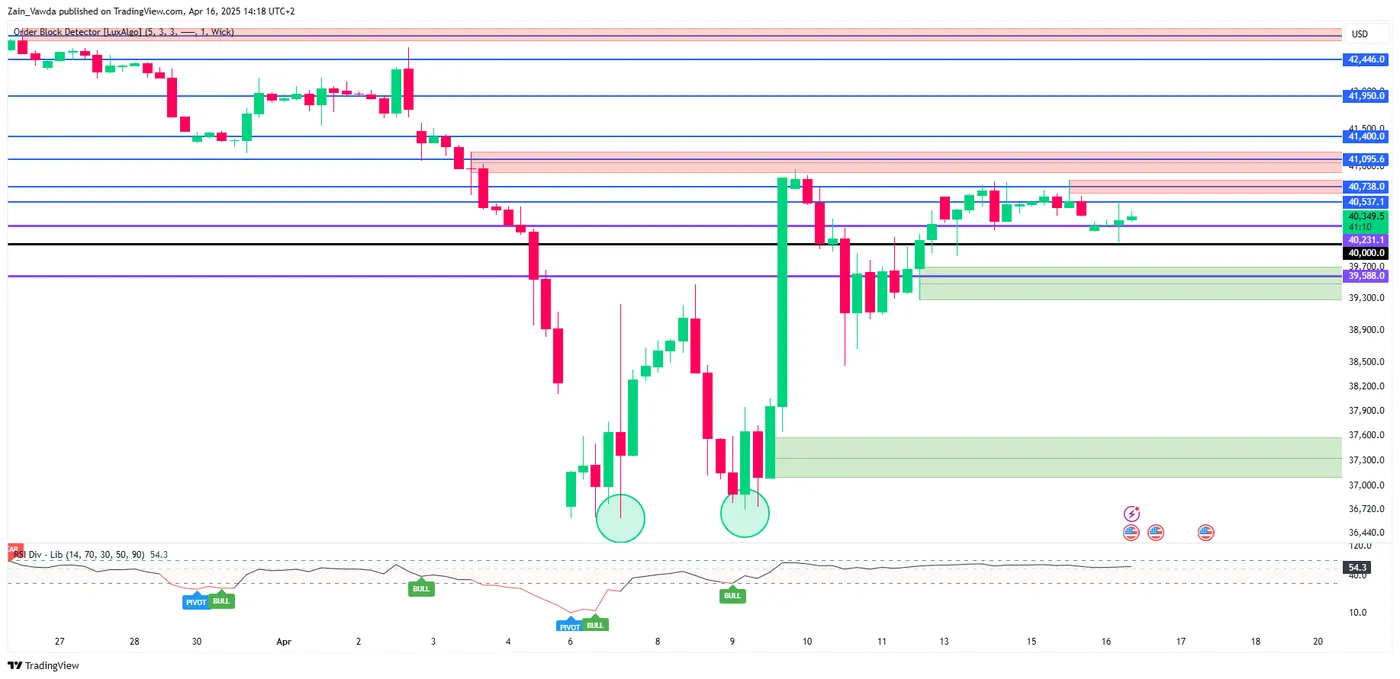

Chart of the Day – Dow Jones

The continues to carry the excessive floor regardless of the commerce tensions in play.

The index has held above the 40000 psychological stage since reclaiming it on April 9. A retest within the European session occurred as soon as extra earlier than the index pushed larger however draw back strain does stay a priority.

Rapid resistance rests at 40537 earlier than the 40738 and 41095 handles come into focus.

Help at 40000 has held agency however a break of this key stage might open up a run towards 39588, 38500 and doubtlessly current lows across the 36720 mark.

Dow Jones Index Chart, April 16, 2025

Supply: TradingView.com

Most Learn:

Unique Submit