da-kuk

TD SYNNEX Company (NYSE:SNX) works as a options aggregator and distributor for the IT ecosystem. They supply private computing gadgets, cellphones, printers, knowledge middle applied sciences, and so forth. SNX not too long ago posted its Q2 FY23 outcomes. I’ll do its monetary, technical, and elementary evaluation on this report. I imagine they’re undervalued, however there are some headwinds which may have an effect on them in FY23. Therefore I assign a maintain ranking on SNX.

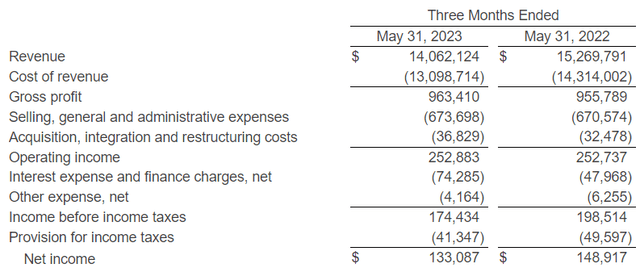

Monetary Evaluation

SNX not too long ago introduced its Q2 FY23 outcomes. The income for Q2 FY23 was $14 billion, a decline of seven.9% in comparison with Q2 FY22. Because the market continued to expertise post-pandemic drops in demand for PC ecosystem merchandise, I imagine a decline of their Endpoint Options portfolio was the foremost cause behind the decline in income. Their revenues dropped within the Americas and European area by 11% and 4.1% in Q2 FY23 in comparison with Q2 FY22. The gross revenue margin for Q2 FY23 was 6.8% which was 6.2% in Q2 FY22. I imagine the rise in gross margins was primarily as a consequence of a blended shift to high-growth applied sciences and superior options.

SNX’s Investor Relations

The web earnings for Q2 FY23 was $133 million, a decline of 10.6% in comparison with Q2 FY22. The decline in revenues and $8 million improve in SG&A bills was the explanation behind the decline. In my view, their monetary efficiency in Q2 FY23 was disappointing; the weak spot in Finish Level Options impacted their income progress.

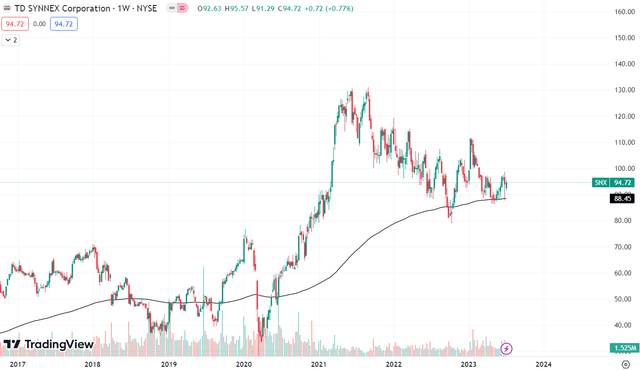

Technical Evaluation

Buying and selling View

SNX is buying and selling on the $94.7 degree. In March 2020, the inventory began its upward journey, and until August 2021, the inventory elevated by greater than 280%, which is a major transfer. However since then, the inventory has been in a downtrend. It has fallen greater than 25% from the $130 degree, which is its all-time excessive. If we take a look at the chart, we are able to see that after forming decrease highs and decrease lows since August 2021, it has not too long ago damaged the construction and fashioned a brand new increased excessive, which is a constructive signal and would possibly point out a development reversal. However there’s a chance that it could be a entice; therefore I might personally await the inventory to cross the $115 degree as a result of it is going to verify the construction change is real, and development reversal could be potential from that degree. However till then, I might advise ready as a result of, with time, we are going to get a extra clear image.

Ought to One Make investments In SNX?

First, take a look at SNX’s valuation. I’ll use PEG and EV / EBITDA ratios to evaluate its valuation. The PEG ratio is calculated by dividing earnings per share by the annual EPS progress, and the EV / EBITDA ratio is calculated by dividing an enterprise worth by its EBITDA. SNX has a PEG [FWD] ratio of 1.05x in comparison with the sector ratio of 1.87x and has an EV / EBITDA [FWD] ratio of 7x in comparison with the sector ratio of 14.49x. It clearly exhibits that SNX is undervalued, and its monetary efficiency over the previous two monetary years has been fairly strong. Their revenues in FY21 and FY22 grew by 58.2% and 97.2%, respectively, which is important, and I believe a progress price like that is fairly uncommon; to remind you, SNX shouldn’t be a small capitalization firm which makes the expansion much more spectacular. As well as, if we evaluate SNX to its friends, we are going to get to know that it has outperformed virtually every of its friends. SNX has a three-year income [CAGR] of 41.7%, and its friends like ARW, NSIT, AVT, PLUS, and CNXN have a three-year income [CAGR] of 9.34%, 7.25%, 13.23%, 9.19%, 1.86%. Therefore wanting on the ratios and its progress price over the previous two monetary years, I believe SNX is undervalued.

Now speaking about its steadiness sheet, its Money and money equivalents by the tip of Might 2023 was $852 million, which was $522.6 million in November 2022, and its long-term borrowings additionally lowered barely in Q2 FY23, which is a constructive signal. However I’ve a priority their income progress was hampered by weak spot in Finish Level Options, which occurred as a result of decrease demand for PC merchandise, and I count on the decline in PC merchandise would possibly proceed within the coming quarters, which could proceed to have an effect on the demand for its Finish Level Options and this might need an hostile impact on their monetary efficiency in FY23. So I believe SNX would possibly keep underneath strain in FY23. Therefore regardless of the fast progress price and the undervaluation, I assign a maintain ranking on SNX.

Threat

The marketplace for IT merchandise is impacted by fast expertise developments, new and improved product specification wants, and altering trade norms. The present stock may see a major worth loss or shortly grow to be out of date as a consequence of these modifications. Most of its OEM suppliers solely present rudimentary insurance coverage in opposition to stock worth loss. Within the occasion of a provider value drop, they will, for example, obtain credit score from many OEM suppliers for items stored in stock. Moreover, most OEM suppliers grant them a restricted proper to return a particular proportion of orders. These plans incessantly have deadlines and do not all the time defend homeowners in opposition to drops in stock worth.

Moreover, their OEM suppliers can lose the power or wish to perform their safety tasks to the enterprise. Their gross margins could possibly be lowered, leading to stock write-downs, if value safety was lowered or eradicated, or if their OEM suppliers couldn’t uphold their safety duties. They might have extra stock, which might necessitate stock write-downs, or they could have inadequate product provides, which could possibly be detrimental to their enterprise, monetary place, and working outcomes if they can not handle their stock with their OEM suppliers with a excessive diploma of precision.

Backside Line

SNX is a basically sturdy firm, and up to now two monetary years, it has outperformed virtually all of its rivals. I imagine it’s undervalued, however I believe it would battle financially in FY23 as a result of decrease demand for PC merchandise. Therefore I assign a maintain ranking on SNX.