- US shares droop in worst day since 2020 Covid disaster amid tariff blitz

- Greenback hits 6-month low as Treasury bonds outshine, yields sink

- However world fairness selloff eases barely forward of NFP report, Powell speech

- Oil plunges after OPEC+ output hike, gold loses out in safe-haven rush

Tariff Shock Reverberates Throughout Markets

International markets continued their meltdown on Thursday as Wall Avenue digested President Trump’s tariff blitz from a day earlier. It’s protected to say that there have been no ‘Liberation Day’ celebrations for traders as the brand new tariff ranges had been far worse than what most had been anticipating, fuelling fears of a worldwide recession.

On the very least, a pointy financial slowdown appears sure within the US, to not point out a protracted interval of uncertainty, as even when Trump had been to barter commerce offers over the approaching months that scale back among the introduced levy charges, greater tariffs are right here to remain.

The long-term influence of Trump’s protectionist insurance policies may take years to unfold, disrupting world provide chains and commerce flows. That is heightening the jitters forward of the Q1 earnings season, which kicks off subsequent week and will flag the primary cracks showing within the US financial system.

Within the meantime, shares on Wall Avenue had their worst session because the 2020 Covid days on Thursday. The tumbled 4.8% to its lowest since August 2024, whereas the nosedived by 5.4%.

Trump Open to “Phenomenal” Affords

The selloff seems to be easing at this time, nonetheless, most likely on the indicators that Trump is open to decreasing among the tariffs. Talking to reporters on Thursday, the President signalled that he would rethink among the punitive measures if different international locations supplied one thing that was “phenomenal”, arguing that tariffs give the US “nice energy to barter”.

Nevertheless, these feedback have supplied solely a small enhance, as Trump strongly indicated that sectoral tariffs on prescription drugs shall be introduced quickly, possible adopted by chip levies.

No matter occurs to the reciprocal tariffs, it appears that evidently the particular duties on sure sectors aren’t negotiable. Except for the truth that the Trump administration wants to boost billions to finance the promised tax cuts, ditching the sectoral tariffs could be a compromise too far given how strongly Trump feels about his “make America nice once more” mantra. However after all, he may but change his thoughts if Wall Avenue continues to sink.

NFP Report and Powell Eyed

A ‘Fed put’ doesn’t appear possible both within the close to future. is because of converse at 15:25 GMT at this time and can most likely preserve his wait-and-see stance even because the US financial system is at a rising threat of stagflation.

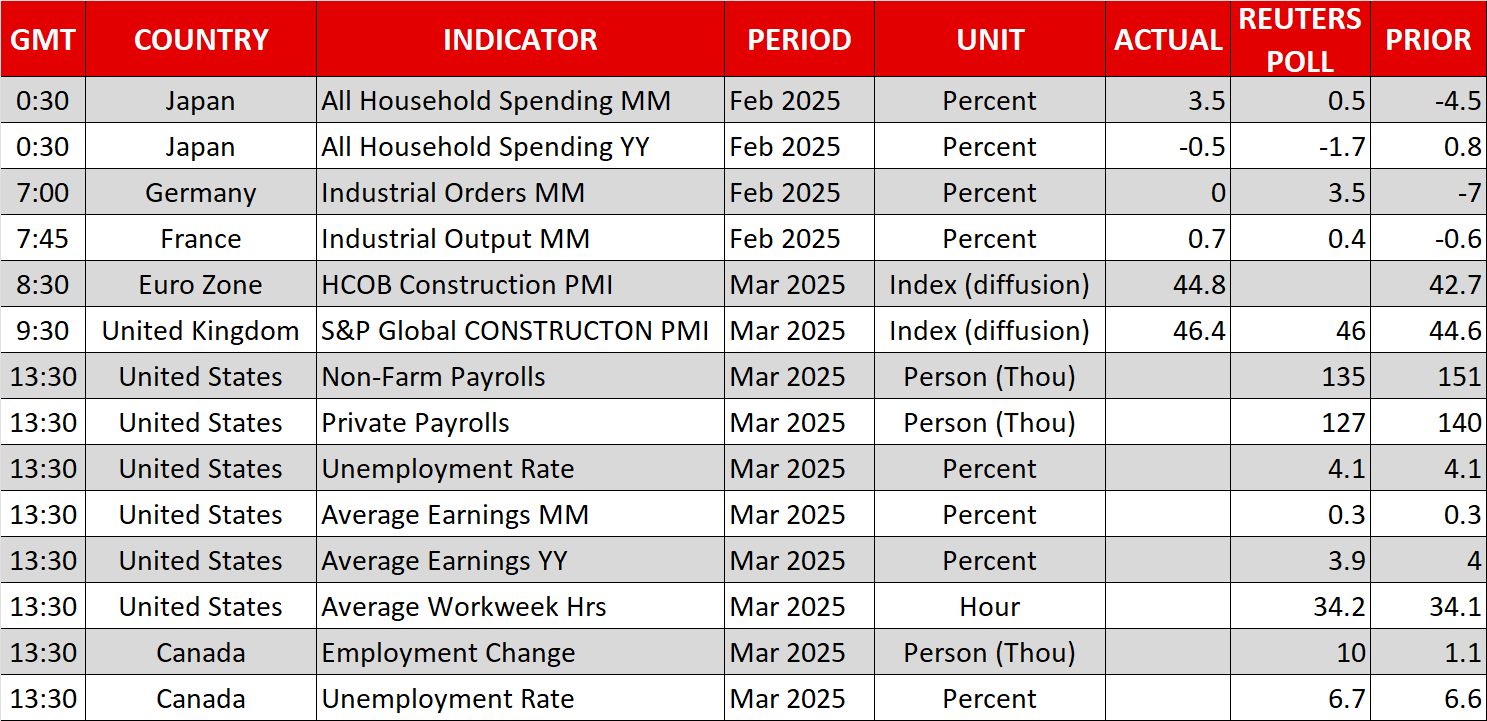

The and readings had been considerably extra encouraging than the ISM’s from earlier within the week. If the official jobs report, which is due earlier than Powell’s remarks, doesn’t ring any alarm bells both, the Fed chief received’t have any purpose to vary his tune. But, markets shall be hoping for some phrases of reassurance so a late rebound in US equities can’t be dominated out.

Greenback Licks Its Wounds

Amidst all of the uncertainty, the has been hammered in FX markets. Its index towards a basket of currencies hit a six-month low on Thursday, because the euro briefly spiked above $1.11 and the yen strengthened to 145.18 per greenback.

The buck seems to be recovering a bit at this time, as rising rate-cut expectations for different central banks, notably the Financial institution of England, RBA and RBNZ, are pressuring the opposite majors.

Furthermore, the risk-off sentiment is lastly catching up with the risk-sensitive and . The 2 are down by nearly 2% towards the US greenback on Friday.

Gold and Oil Below Stress as Bonds Rally

Authorities bonds have been the shock beneficiaries of the present threat aversion, with US Treasuries, specifically, rallying exhausting. This has pushed the beneath 4.0% for the primary time since October. It’s not clear if recession dangers have been totally priced in but, particularly contemplating how fluid Trump’s tariff coverage is, however additional declines in bond yields are possible.

, alternatively, has suffered a setback, sliding beneath $3,100 to round $3,080. The exclusion of gold and another metals from reciprocal tariffs is probably going behind the pullback, as some traders had been stocking up on the valuable metallic forward of Trump’s announcement.

are the week’s greatest losers, nonetheless, as on prime of the worsening demand outlook for the commodity, the OPEC and non-OPEC alliance yesterday introduced a larger-than-expected enhance in manufacturing. OPEC+ international locations have agreed to pump an additional 411,000 barrels of oil a day beginning in Could – thrice greater than the deliberate quantity.

Each WTI and futures are extending their decline at this time, plummeting by round 3.5% to take the weekly losses to between 7% and eight%.