Nasdaq 100 (.NDX) Information and Evaluation

- SVB sale to First Residents ushers in an eerily calm to the beginning of the week

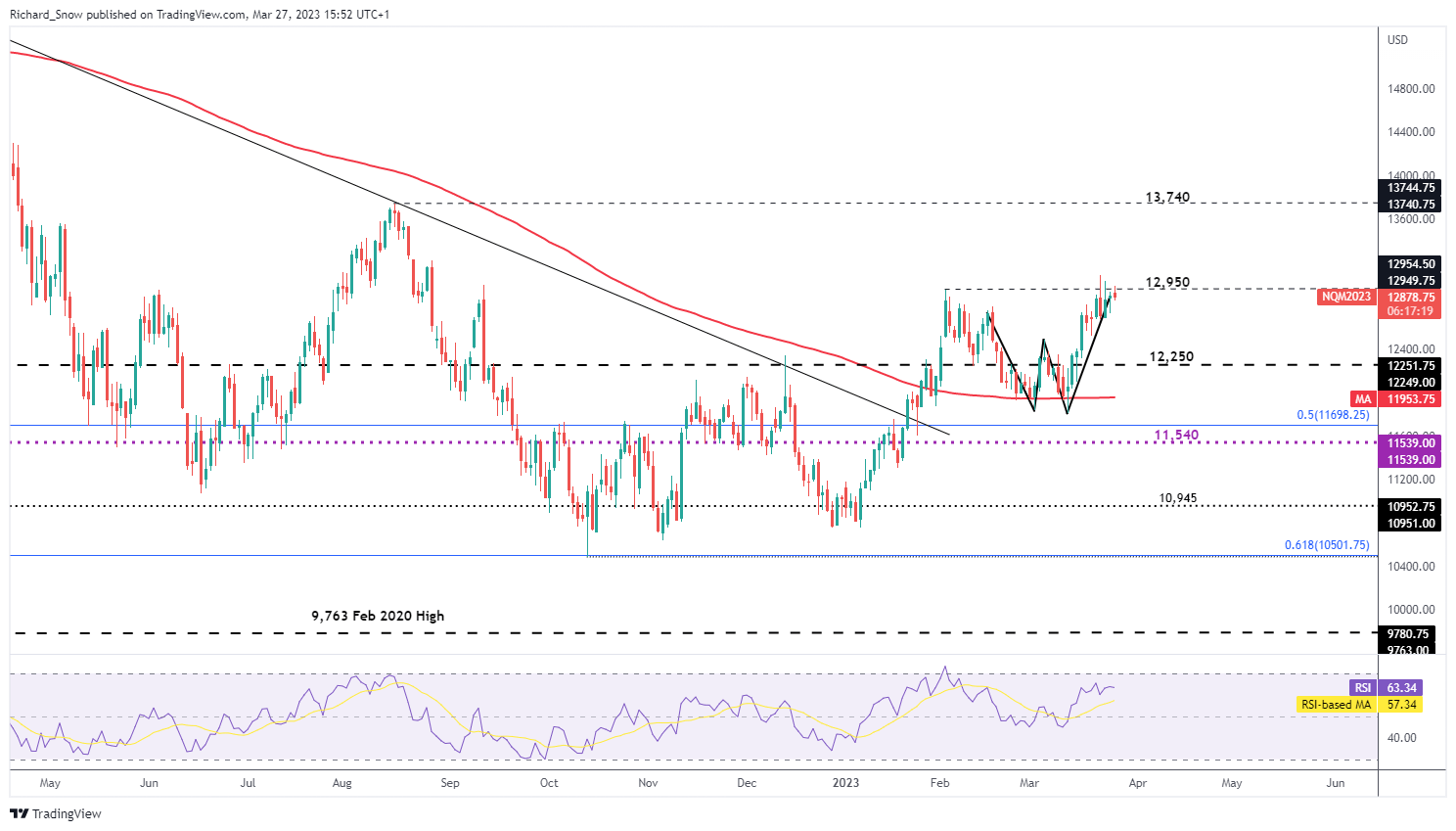

- Nasdaq 100 technical concerns and ranges to observe: ‘W formation

- With markets anticipating fee cuts from the Fed, large tech finds room to over carry out on a relative foundation

- The evaluation on this article makes use of chart patterns and key assist and resistance ranges. For extra info go to our complete training library

Really useful by Richard Snow

Commerce FX with Your Inventory Buying and selling Technique

SVB Sale to First Residents Units the Tone for the Week

Forward of the European session information broke of Silicon Valley Financial institution’s (SVB) sale to First Residents Bancshares, probably the most outstanding regional banks within the US, after weeks with few suitors. The Federal Deposit Insurance coverage Corp (FDIC) confirmed that every one of SVB’s deposits, masses and branches will proceed beneath new possession.

The deal seems to have helped calm fears within the banking sector on Monday the place extra constructive information surfaced as Deutsche Financial institution clawed again a few of Friday’s losses. Regardless of a largely profitable restructuring and inspiring revenue figures, traders flew to security as Deutsche Financial institution’s credit score default swaps (insurance coverage in opposition to a default) soared. Within the present setting, it seems the market is content material to promote now and ask questions later because the potential for panic reactions continues.

No early jitters for US banks on the open

Supply: TradingView, ready by Richard Snow

Nasdaq 100 Technical Concerns: ‘W’ Sample Suggests Bullish Impetus

The Nasdaq 100 has put in a powerful sequence of candles to maneuver greater and now checks the yearly excessive set in February. The truth is, worth motion reveals a ‘W’ formation, which is often a sign of a bullish reversal. The sample sometimes gives the strongest sign when showing at new lows, nonetheless, the failure to increase the sell-off and subsequent rise nonetheless gives a significant indication of bullish intent.

The index didn’t extend promoting under the 200-day easy transferring common (SMA) on the second time of asking and proceeded greater thereafter. 12,950 seems because the fast degree of resistance with the psychological 13,000 degree thereafter and 13,750 a way away nonetheless. Assist seems by way of the 12,250 degree with the 200 day SMA and the double backside linked to the ‘w’ formation, thereafter.

Nasdaq 100 revealing a ‘W’ sample because it makes an attempt to make a contemporary yearly excessive

Supply: TradingView, ready by Richard Snow

Really useful by Richard Snow

Enhance your buying and selling with IG Consumer Sentiment Information

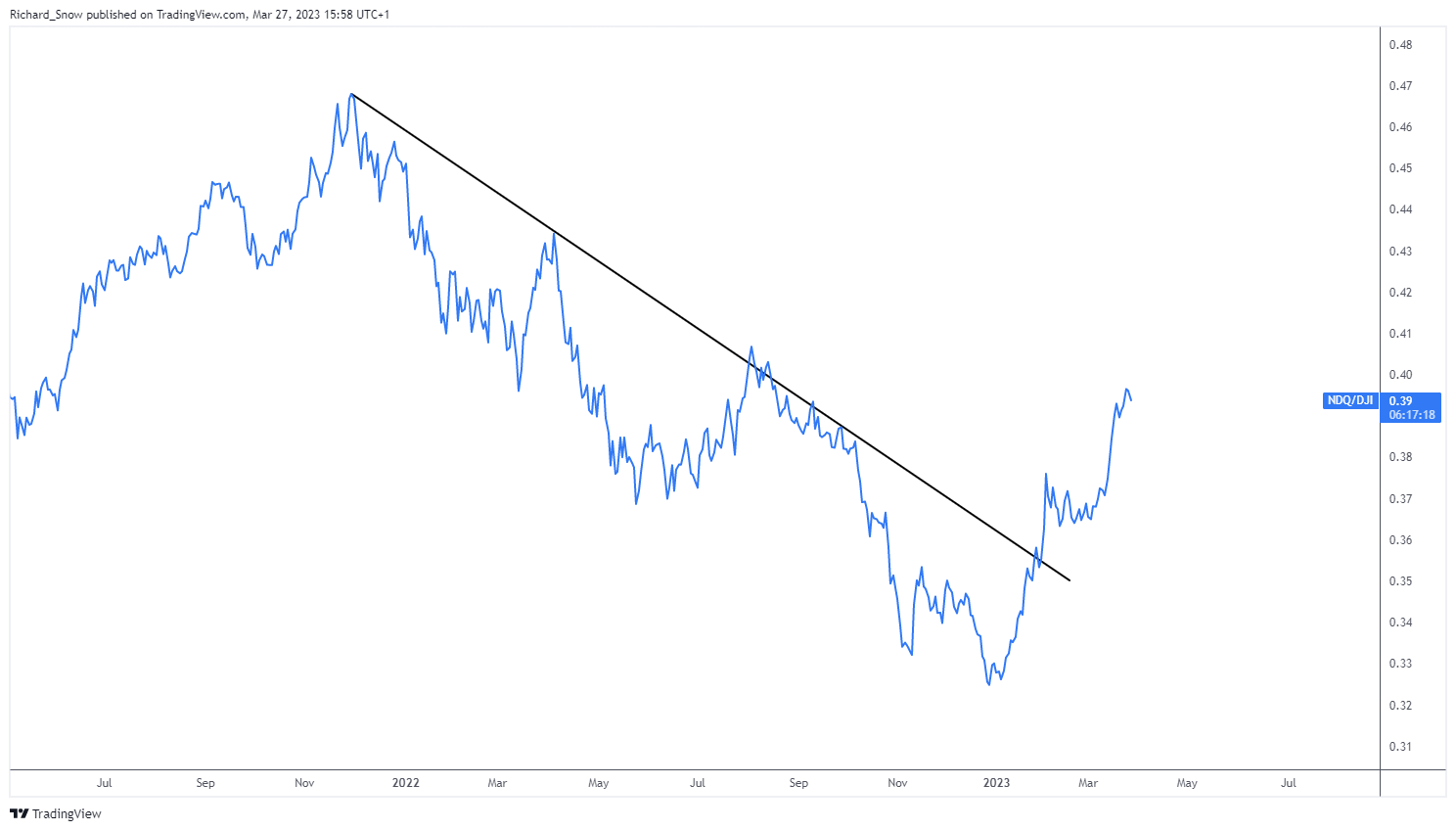

Whereas most of 2022 noticed the Nasdaq underperform the extra consultant Dow Jones Industrial Common, current worth motion signifies that the tech heavy Nasdaq is making nice strides because the Fed downshifts to a extra impartial/dovish trajectory. Markets proceed to downplay the potential for extra hikes from the Fed and as an alternative, worth in round 75 foundation factors of cuts earlier than yr finish. The prospect of fee cuts flatters tech inventory valuations and regardless of there being no decision to the banking woes simply but, large tech shares are discovering some room to maneuver greater.

The chart under signifies the relative efficiency of the Nasdaq vs the dow:

Nasdaq/Dow Jones Industrial Common (NDX/DJI) Offers an Indication of non-financial agency efficiency

Supply: TradingView, ready by Richard Snow

Really useful by Richard Snow

Constructing Confidence in Buying and selling

— Written by Richard Snow for DailyFX.com

Contact and observe Richard on Twitter: @RichardSnowFX