Gold (XAU/USD), Silver (XAG/USD) Evaluation

- Gold heads decrease as US yields and the greenback get better misplaced floor

- XAU/USD pullback assessments essential degree of confluence assist

- Silver assessments well-defined assist degree because the week involves a detailed

- The evaluation on this article makes use of chart patterns and key assist and resistance ranges. For extra data go to our complete training library

Really useful by Richard Snow

See what our analysts foresee in Q3 for gold

Gold Heads Decrease as US Yields and the US Greenback Get better Misplaced Floor

Gold has turned decrease, with the latest carry within the greenback and US yields weighing on the non-interest-bearing metallic. The chart beneath reveals the very dynamic at play, sending gold decrease within the short-term, however doubts stay across the longevity of the decline.

Gold dips decrease as US 2-year treasury yields and USD rise

Supply: TradingView, ready by Richard Snow

Gold Pullback Checks Essential Stage of Confluence Help

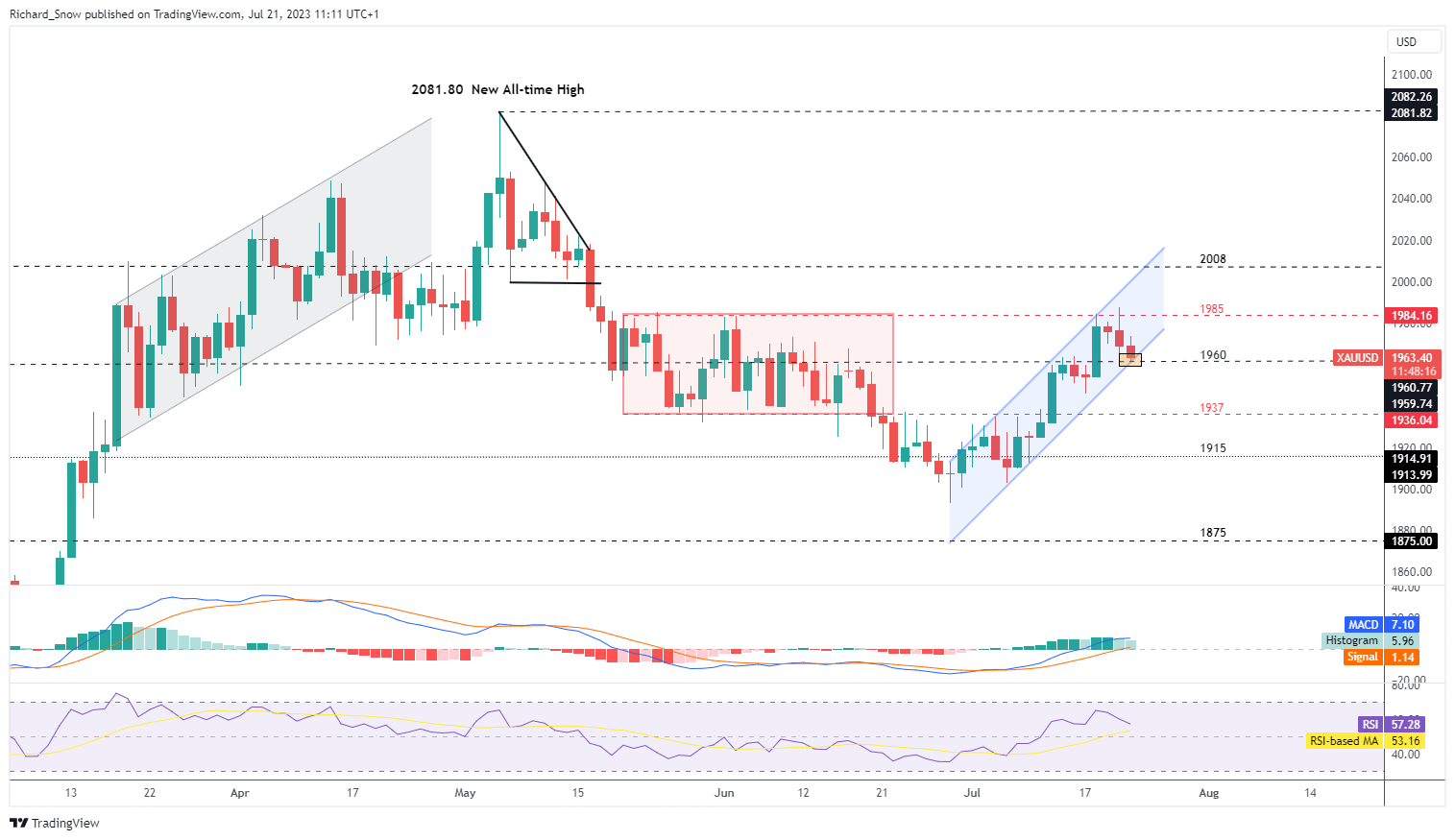

Gold continues to commerce inside an ascending channel. The catalyst for the bullish transfer appeared by way of a welcomed print decrease in core inflation which seems to have despatched US markets into disinflation mode. With stickier measures of inflation making progress, markets naturally start to cost out the chance of additional fee hikes past July. Regardless of the latest directional transfer within the greenback, this typically factors to a weaker greenback over time offered there aren’t any systemic shocks that will elevate recession dangers.

Gold at the moment assessments the confluence assist degree at 1960 – the intersection of the Feb 2023 excessive and the decrease sure of the channel. Gold bulls can be eying this important degree, hoping for a bounce increased and a push in direction of the 1985 degree. 1985 saved increased costs at bay when gold was buying and selling inside a sideways channel between mid-Might and mid-June. If costs break and shut beneath 1960, the closest degree of curiosity on the draw back seems at 1937.

The MACD index means that upside momentum stays in paly whereas the RSI heads decrease earlier than even coming into into oversold territory.

Gold (XAU/USD) Every day Chart

Supply: TradingView, ready by Richard Snow

Really useful by Richard Snow

See the place the alternatives lie in Q3

Silver Checks Nicely-Outlined Help Stage because the Week Involves a Shut

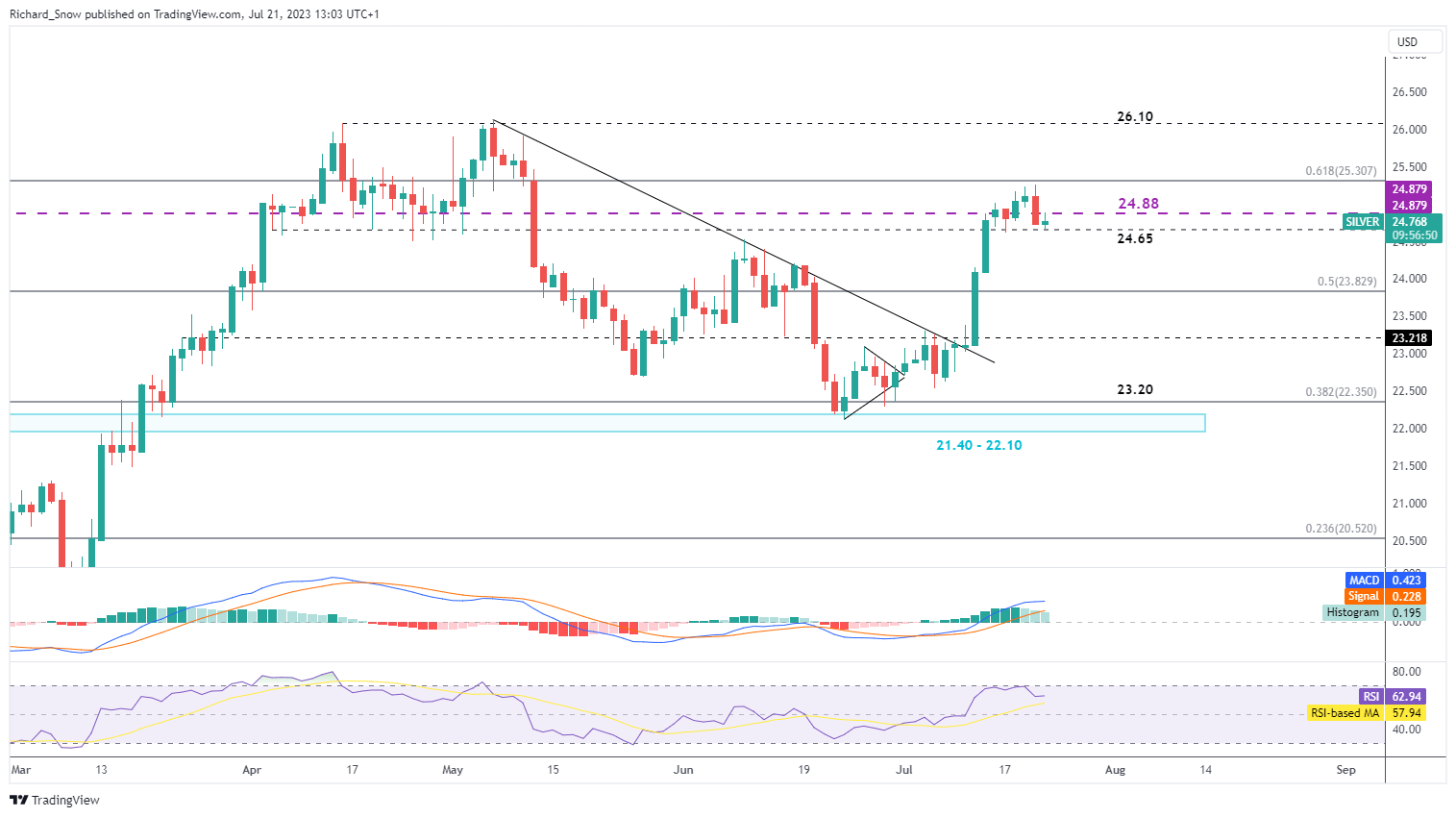

Silver, not like gold, has solely witnessed its bullish extra just lately. Earlier than then, the dear metallic had been caught inside a longer-term downtrend ever which had begun in early Might. With US inflation knowledge proving to be the catalyst, silver has risen a powerful 7% over the two-day interval starting on June the twelfth. Additional bullish momentum has been exhausting to return by, seeing costs reject the 61.8% Fibonacci retracement of the 2021-2022 main transfer (25.30). Since then, costs dropped beneath 24.88 and at the moment check 24.65. A detailed above this degree is constructive for potential bullish continuation whereas a break and shut beneath brings 23.89 and 23.22 into focus.

Silver (XAG/USD) Every day Chart

Supply: TradingView, ready by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and comply with Richard on Twitter: @RichardSnowFX