A variety of challenges loom for the way forward for alcohol. Alcoholic drinks are going out of trend with younger customers, such because the sober curious Gen Zers, who’re recognising how they compromise sleep, trigger mortality, and overburden well being companies. These alcohol moderation tendencies are reshaping the way in which we view consuming, because the rise of low/no alcohol positive factors momentum. Local weather change and a heightened concentrate on sustainability are additional difficult conventional alcohol tendencies, with customers questioning drinks that dehydrate relatively than rehydrate.

But, alcohol has a protracted social and cultural historical past in delivering indulgence, de-stressing and enhancing conviviality. These wants usually are not going to vanish. In actual fact, they’re going to develop in a world the place we discover ourselves more and more urbanised, digitised, remoted and anxious.

To remain related, manufacturers should adapt to those shifting alcohol trade tendencies. This implies manufacturers might want to reformulate their merchandise to match the continued repositioning and the broader perspective of what the way forward for alcohol seems like. Alcoholic drinks manufacturers could must grow to be broader drinks manufacturers as a substitute.

Demographic and Well being: Debunking Alcohol Myths

As the way forward for the alcohol trade unfolds, a shift in consumption tendencies is changing into tough to disregard. Whereas alcohol manufacturers could be tempted to stay with the ‘devils they know’ and depend on acquainted ways, the most recent tendencies reveal shifting priorities. In America, within the twenty years to 2023, the variety of over-55s who used alcohol grew a powerful 10 factors to 59%. But, general consumption fell by 10 factors, signalling a rising shopper development in alcohol moderation.

Youthful generations symbolize the sharp finish of this decline. A major 38% of UK 16-24s had not consumed an alcoholic drink previously 12 months in 2021, up from 19% in 2011.

One other technique being adopted by alcohol manufacturers mirrors tobacco corporations – specializing in cultivating rising markets as a substitute. Nevertheless, this method additionally ignores the quick that the common annual international consumption of alcohol peaked over a decade in the past at 6 litres per capita yearly, and has since fallen to 4.9 litres in 2020.

The long-held beliefs concerning the well being advantages of reasonable alcohol consumption are evaporating quick. These embody the concept that ‘each day wine’ contributes to an extended lifespan of these inhabiting the world’s ‘blue zones’, or the concept that 1-2 drinks a day reduces the danger of coronary coronary heart illness, are more and more being challenged.

As a substitute, analysis from the World Burden of Illness knowledge and research printed in The Lancet present that even the occasional alcoholic drink is dangerous to well being. Alcohol was liable for inflicting 20% of untimely deaths amongst 15-49-year-olds and a couple of.44 million deaths worldwide in 2019.

Within the UK, NHS knowledge reveals that the Authorities spends as much as £52 billion a 12 months coping with alcohol-related hurt and that consuming alcohol was the primary motive for about 980,000 admissions to hospital in 2019-2020.

Alcohol Business Tendencies: Customers are Rethinking their Relationship with Alcohol

We nonetheless want what alcohol provides – or at the very least what it used to.

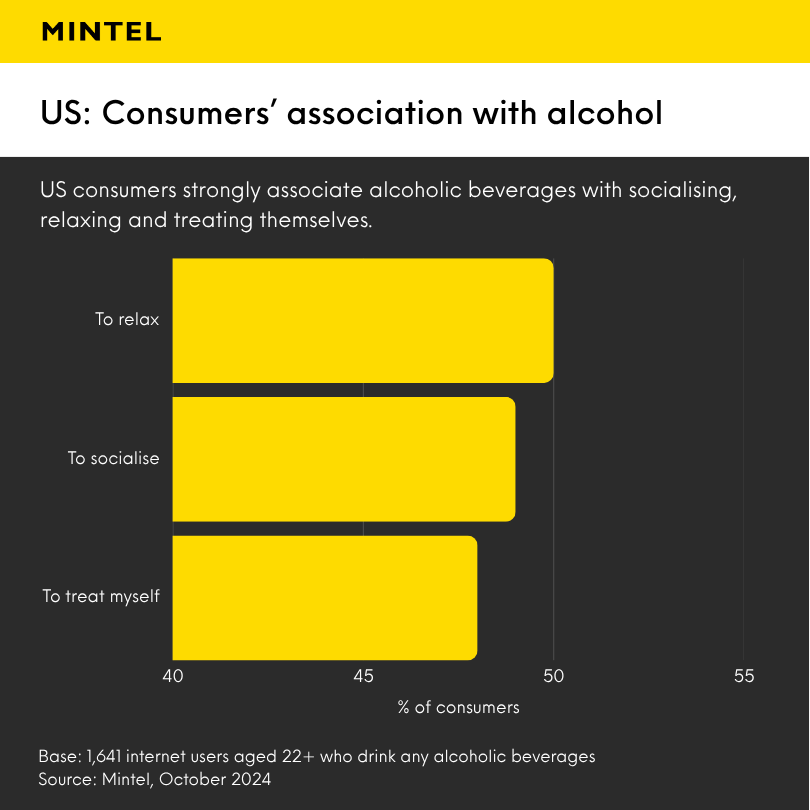

We want drinks that stimulate our senses and supply conviviality. This shopper development is showcased by Mintel’s analysis, which reveals that 36% of French customers say that “share[ing] with somebody” is what makes a drink an indulgent deal with (client-access hyperlink solely), whereas 60% of US-Individuals prioritise a drink that’s “wealthy/flavourful”. Moreover, we additionally see that 49% of US customers proceed to strongly affiliate alcoholic drinks with socialising, whereas half of US customers affiliate them with stress-free.

Alcohol various manufacturers might argue that reformulation can ship all the above. With improvements like Sentia Black, a £32 premium bottle that includes a “distinctive mix of useful botanicals that stimulate the discharge of Gaba”, a neurotransmitter that slows down the mind – gently mimicking the convivial feeling of alcohol with out the following unwanted effects. This provides customers a glimpse of what the way forward for consuming might appear to be.

Celeb-backed, non-alcoholic manufacturers like Louis Hamilton’s blue agave spirit Almave and actor Tom Hollands’ non-alcoholic beer model BERO try to repeat and replicate alcohol’s conventional aspirational imagery and positioning.

Nevertheless, customers could be prepared to maneuver even farther from low/no alcohol classes for his or her social repair. For instance, 74% of Canadians agree that espresso outlets are place to satisfy pals to socialize. In the meantime, within the US, 46% of customers buy tea as an alternative choice to alcohol, in comparison with 14% for non-alcoholic beer. Alcohol manufacturers can take learnings from how tea and tea soda manufacturers are encroaching on the mocktail area. In the meantime, US manufacturers like Collider, Psychedelic Water and Hiyo are embracing adaptogens and nootropics to vow qualities similar to leisure, sociability and buzz.

Tips on how to Meet Customers’ Wants for Rest and Coolness within the Alcohol Business

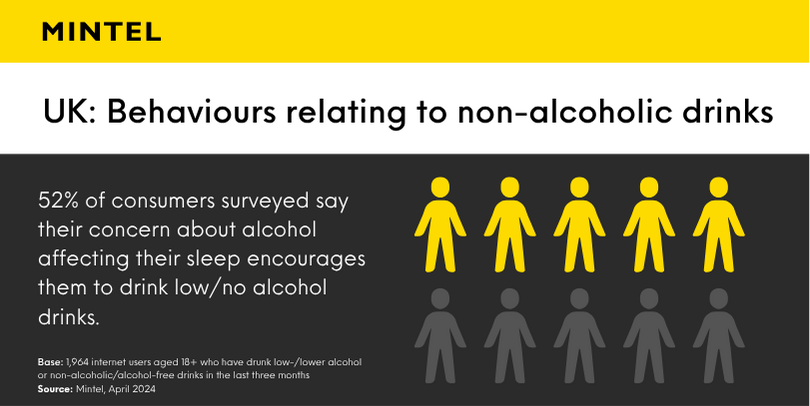

The demand for merchandise that assist us loosen up and sleep is on the rise. This shift is influencing tendencies within the alcohol trade, as alcohol and caffeine could be seen as problematic. In actual fact, 52% of UK low/no-alcohol drinkers cite issues about alcohol affecting sleep as a key motive for selecting low/no-alcohol drinks.

Analysis from Philips reveals that fifty% determine sleep as having the best affect on general well being and wellbeing, in comparison with weight loss program (41%) and train (40%). These two want states have already carved out monumental FMCG markets in their very own proper, and the drinks trade is now following go well with. Throughout all Mintel’s surveyed markets, train is used as a stress reliever by twice as many individuals as these turning to alcohol. This highlights the rising significance of wellness-focused alternate options in reshaping alcohol consumption tendencies.

Sustainability, well being issues and international challenges don’t essentially should sign a decline in alcohol gross sales. Traditionally, two of Britain’s iconic contributions to drinks tradition – India Pale Ale and the Gin and Tonic – emerged from useful wants tied to international journey and well being challenges. Hops served as preservatives for IPA, permitting it to journey lengthy distances, whereas quinine in tonic water helped fight malaria, made palatable by gin. At this time, innovation continues to outline the alcohol trade. For instance, Jopen has developed a Summer season Session IPA that’s brewed with seawater, showcasing how the trade can prioritise sustainability by innovating to preserve freshwater and obtain model differentiation within the course of.

Nevertheless, even underneath essentially the most optimistic 1.5 °C rise in temperature situation, excessive warmth occasions are anticipated to grow to be 4.1 occasions extra more likely to happen globally. This creates a rising shopper concentrate on hydration, not dehydration. The rise of water filter jugs and chilly brew coffees is an instance of broader cooling tendencies within the drinks trade.

What’s Subsequent? Diversify to Meet Evolving Alcohol Tendencies

Alcoholic drinks can survive the turbulence within the brief time period by satisfying the established preferences of child boomers or the evolving tastes of rising markets.

In the long term, although, it’s clear that alcoholic consumption ranges and habits are steadily declining. Nevertheless, the underlying wants which gave rise to alcohol tradition, similar to indulgence, leisure, style, expertise and sociability, are definitely not. Drinks throughout all classes will more and more innovate to satisfy customers to meet these timeless needs.

Alcohol is unlikely to vanish totally, both as a vice or a responsibly consumed indulgence. Nevertheless, there are many examples the place established manufacturers have efficiently tailored in industries which were essentially reshaped by altering shopper consumption tendencies and behaviours. Alcohol manufacturers can undertake a equally forward-thinking method to navigate and thrive on this evolving panorama.

Navigate Shifting Priorities with Mintel Consulting

When you’re seeking to perceive how these adjustments in consumption have an effect on your individual model, your prospects, and your innovation technique, then get in contact with Mintel Consulting to study extra about how we will use our strategies to assist drive your progress methods.

We may help you determine what’s already occurring in your sector, predict what’s coming subsequent, and perceive what it means for what you are promoting’s technique.

Guide a Advisor Technique Session