Markets have been greater on Friday, easing a few of the ache inflicted all through the week, rising by round 1%, with the down 83 foundation factors for the week. This week, it will likely be all in regards to the knowledge, central financial institution choices, and earnings, which possible implies that the bond market and foreign money actions will likely be in focus.

Yield Curve to Break Out This Week?

The largest driver of markets will proceed to be the yield curve, largely decided by financial knowledge and commentary from the and conferences, as they may have probably the most important impacts on the yield curve. The yield curve has been steepening, nevertheless it has not but damaged out of any ranges.

The massive query is that if the curve can escape and head above -15 foundation factors. That has been the extent the place it has stopped twice earlier than, since October 2023.

Granted, for various causes: with the rising to fulfill the in the summertime of 2023, and now the 2-year yield falling to fulfill the 10-year yield in the summertime of 2024. Each carry very completely different messages—certainly one of financial power, whereas the latter suggests Fed charge cuts.

It’s potential that if this summer season’s breakout has legs, the advance forward of us may very well be reasonably steep.

One issue that might affect charges, which is flying underneath the radar, is that this week’s quarterly refunding announcement. The estimates are due right now afternoon at 3 PM, with the precise breakdowns approaching Wednesday at 8:30 AM. The dimensions of the issuances and the length breakdowns will matter.

The Treasury has leaned on issuing extra Treasury payments in latest months, which has helped drain the reverse repurchase facility on the Fed. A shift from payments to longer durations may sluggish that course of. Moreover, with a presidential election cycle and a pending debt ceiling debate early subsequent yr, it will likely be fascinating to see the place the Treasury estimates the Treasury Common Account (TGA) to be at year-end. A better TGA and decrease invoice issuance possible imply that reserve balances on the Fed will decline additional, whereas a decrease TGA and higher invoice issuance in all probability imply that reserves will climb.

Furthermore, with the prospects of charge cuts coming in 2025, we may see a shift from threat belongings into Treasuries later this yr, as rates of interest will diminish because the peak within the climbing cycle and financial cycle has possible handed.

I’d think about {that a} steeper yield curve led by a falling 2-year charge implies that the continues to say no. If and once we see the US10Y-US02Y break the -15 foundation factors barrier, we’ll see the USD/JPY break the 152 degree of assist.

Yen Might Sign Market Path

I’d additionally think about that the place the yen goes will decide the place the fairness market goes as a result of, since March 2023, the to ratio has traded virtually completely according to the USD/JPY. The commerce because the SVB collapse could have merely been brief yen, brief small caps, and lengthy mega-cap tech. That is why a steeper yield curve and a decrease USD/JPY could proceed to inflict ache on the market-cap-weighted indexes which have outperformed.

In fact, the low volatility nature of the commerce could have pushed the brief volatility commerce to extremes as effectively, resembling when the one-month implied correlation index closed under 3 on July 12. Nonetheless, implied volatility is predicted to be seasonal.

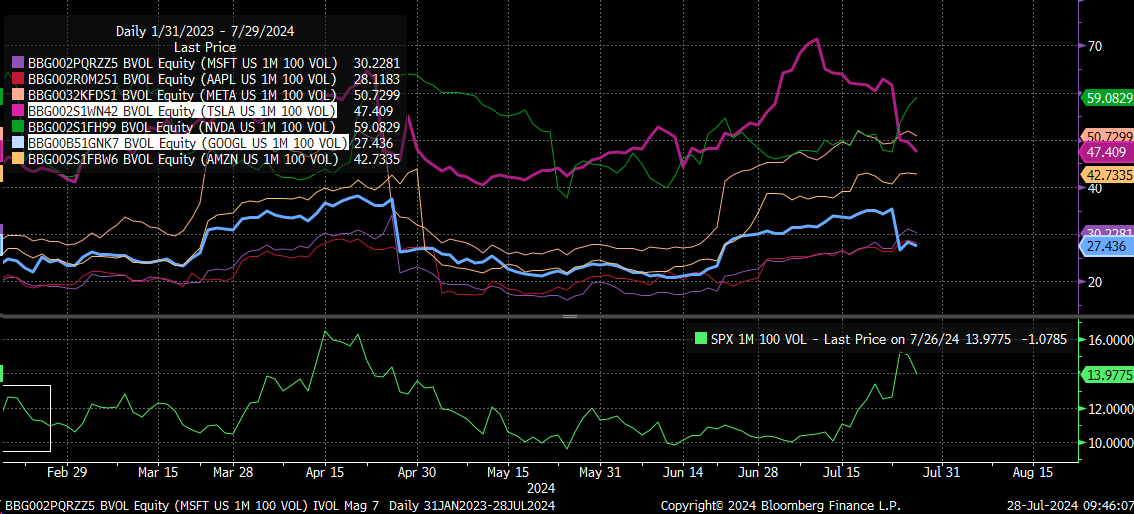

It ought to principally finish this week after we get outcomes from Apple (NASDAQ:), Meta (NASDAQ:), Amazon (NASDAQ:), and Microsoft (NASDAQ:). The implied volatility ranges for Alphabet (NASDAQ:) and Tesla (NASDAQ:) plunged following their outcomes, as anticipated, and the identical will possible occur to the opposite 4.

This implies the volatility dispersion commerce, which pushed these 4 shares, is because of unwind this week.

USD/CAD: Resistance Breakout to Point out S&P500’s Subsequent Transfer

On prime of that, the is knocking on the door of the 1.385 degree once more, and this can now be the fifth time. The final 4 instances it was unable to push by way of, it marked a backside within the S&P 500. The query is, what’s going to occur on the fifth try?

Sadly, I wouldn’t have all of the solutions, and I’m ready to seek out out, like everybody else. Whereas I take into consideration what could occur, I want to attend and see. However there isn’t a doubt that this is a vital week.

I feel the commerce talked about above is nearing its expiration date; the Fed will lower charges sooner or later, and the BOJ will elevate charges sooner or later. The yield curve has already been inverted for a really very long time, and it’s within the Fed’s finest curiosity to get the yield to steepen.

It’s only a matter of when the tectonic plates shift, and once they do, it will likely be felt by all. Whether or not it comes this week or subsequent quarter, I have no idea, however every little thing is in place for it to occur, and it may occur this week if situations align.

Unique Put up