It will likely be an essential week, with finalized third-quarter information on Tuesday, the on Wednesday, the on Thursday, and Import/Export costs on Friday.

The CPI is predicted to point out a 0.3% m/m enhance, up from 0.2% final month, whereas core CPI can also be projected to rise by 0.3% m/m.

Headline CPI is anticipated to climb to 2.7% y/y, up from 2.6%, whereas core CPI is predicted to rise by 3.3% y/y, in keeping with final month. PPI numbers are additionally forecasted to extend in November to 0.3% m/m from 0.2% and to 2.6% y/y from 2.4%.

The CPI on a m/m foundation has been steadily rising because it bottomed in June. If the CPI Swap market is appropriate and the determine is available in at 0.27%, it might mark the very best CPI enhance since April.

The priority is that December is at present pricing in a 0.4% m/m rise. The believes inflation is again to 2%, so the result stays unsure.

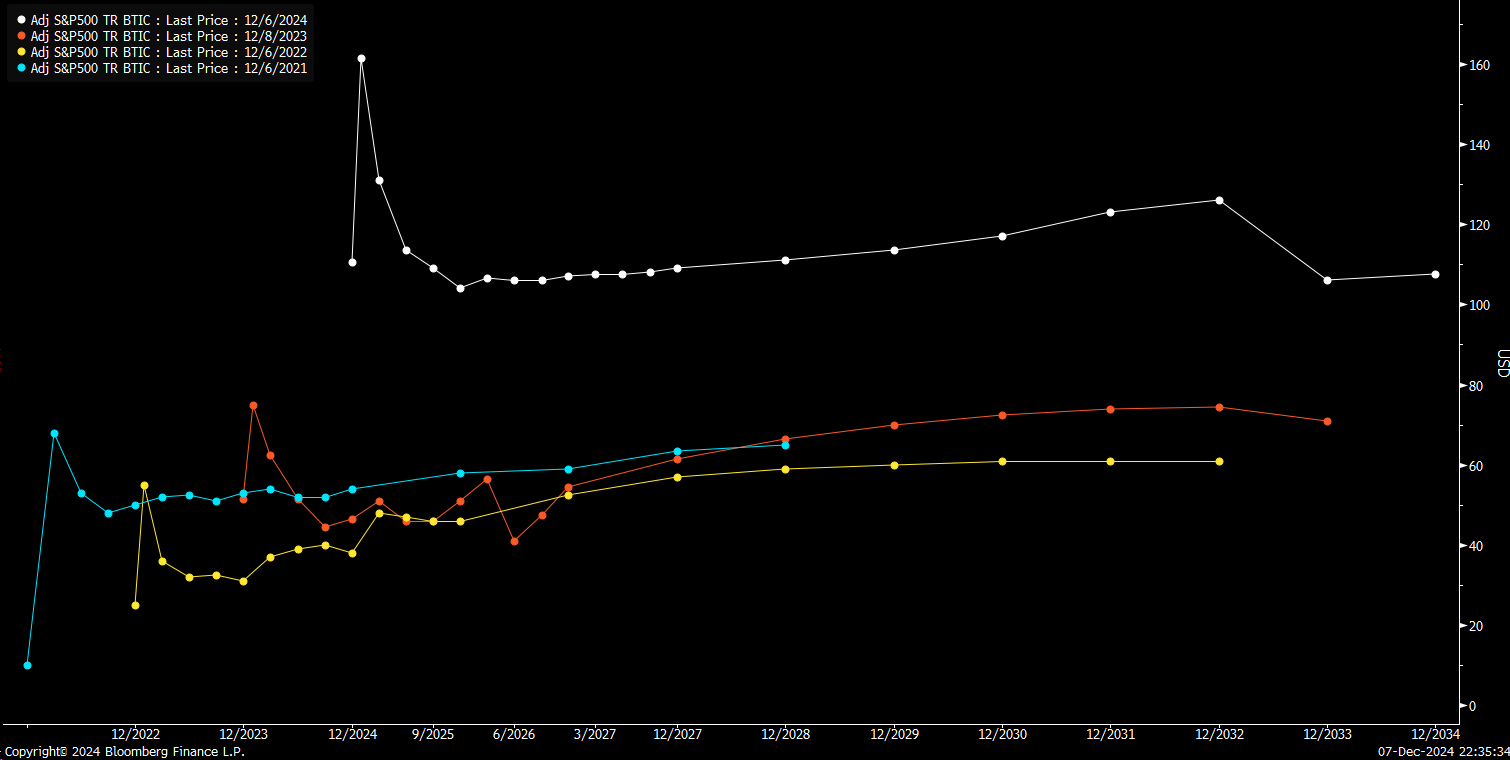

Within the meantime, market strains seem like persisting, as famous final week. The unfold between the December and January contracts of the Whole Return Index Futures is round 57.5, with these spreads turning damaging for the March contracts.

This means that, at current, there’s a excessive value related to contracts expiring in January, however this value declines quickly for March.

This may occasionally point out a rising funding value and that the market is starting to expertise some type of pressure. If these pressures persist or worsen, it may set off a deleveraging occasion as prices turn into unsustainably excessive.

It isn’t uncommon to see one of these bump in prices across the flip of the brand new yr, as this has been the case over the previous three years. Nonetheless, this yr’s prices are practically double what they’ve been in earlier years, making this an particularly fascinating state of affairs.

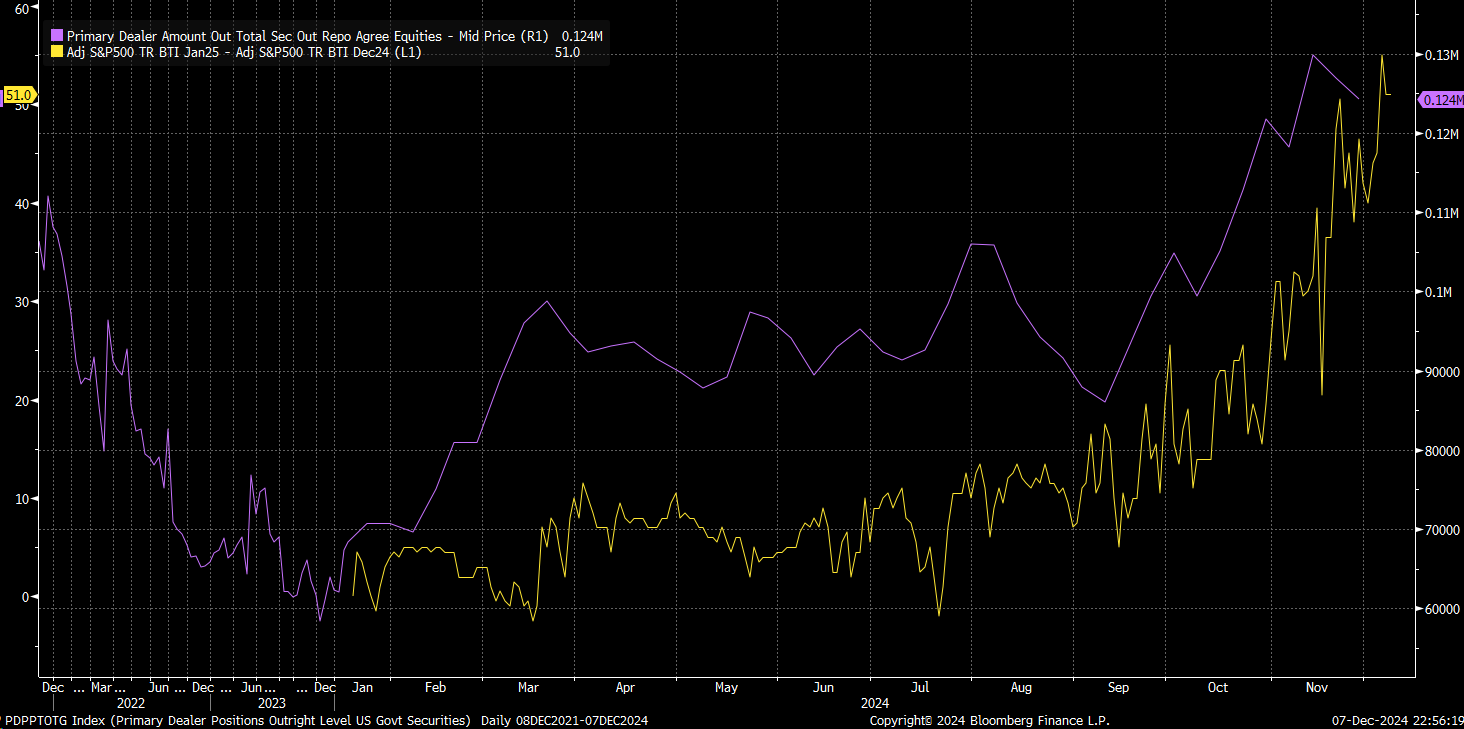

There may be undoubtedly much less liquidity out there in comparison with previous years, with the reverse repo facility now at simply $130 billion, down from a peak of $2.5 trillion.

Moreover, major seller repo exercise has surged lately, indicating a rise in equity-backed repo agreements, the place equities are used as collateral to lift money. This might be an indication of rising liquidity pressure.

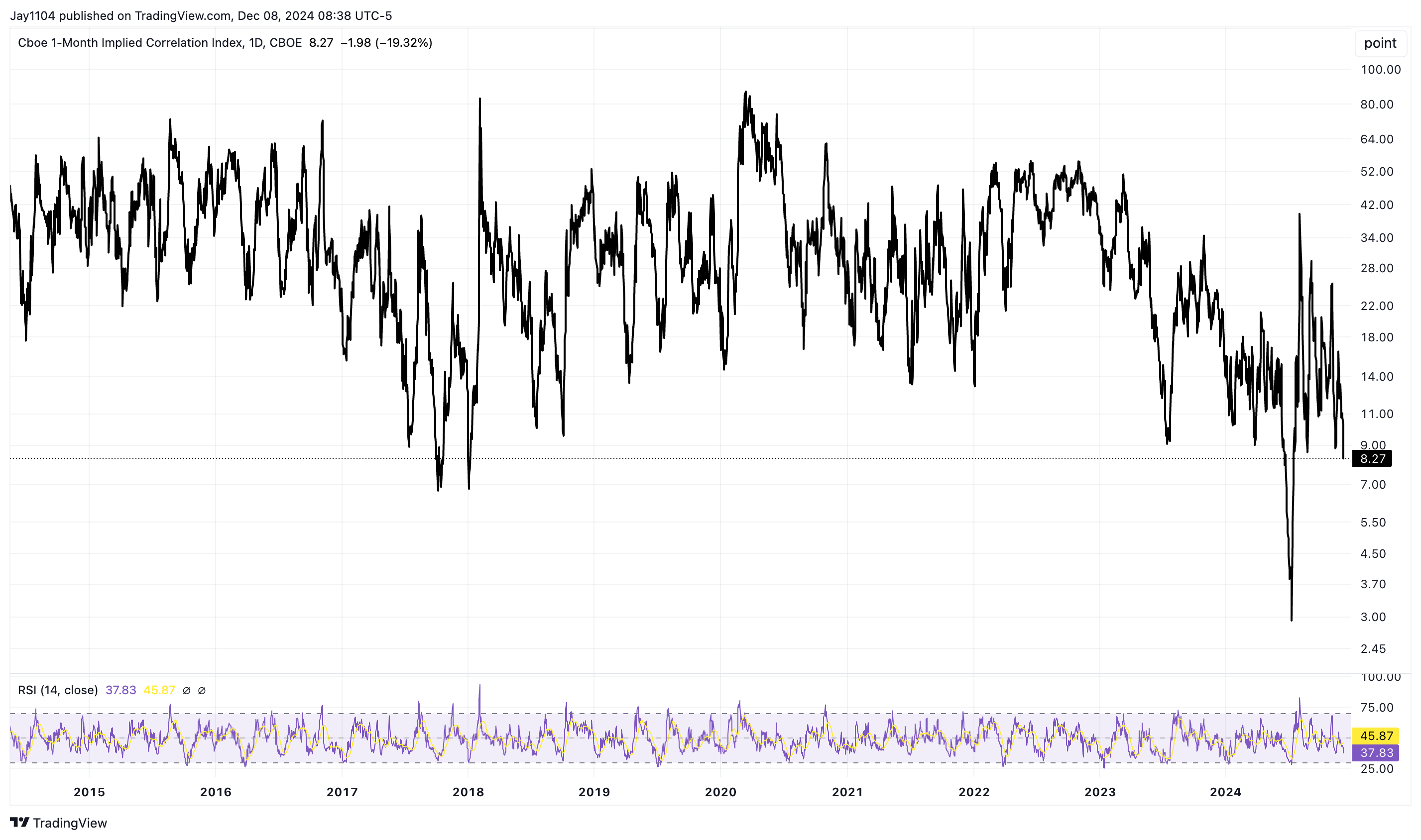

This comes at a time when 10- and 20-day realized volatility has plummeted and appears to be approaching a backside, at the very least for now. This means that realized volatility probably has just one route to maneuver subsequent—upward.

Moreover, the 1-month implied correlation index has dropped under 10, a traditionally uncommon situation. Ranges this low have solely been noticed in late 2017, previous the January 2018 decline, and in July 2024, previous the August 2024 decline.

That is additional amplified by the truth that, primarily based on metrics reminiscent of price-to-book, price-to-earnings, price-to-sales, and dividend yield, that is probably one of the vital costly markets of the trendy period.

Valuation alone can’t pinpoint a market prime, however when mixed with different elements, it might strongly recommend {that a} climactic occasion could also be approaching.

Unique Put up