- Wall Road goes deeper into the crimson as traders money in on 2024 rally

- US greenback and yields slip as Treasuries boosted by threat aversion

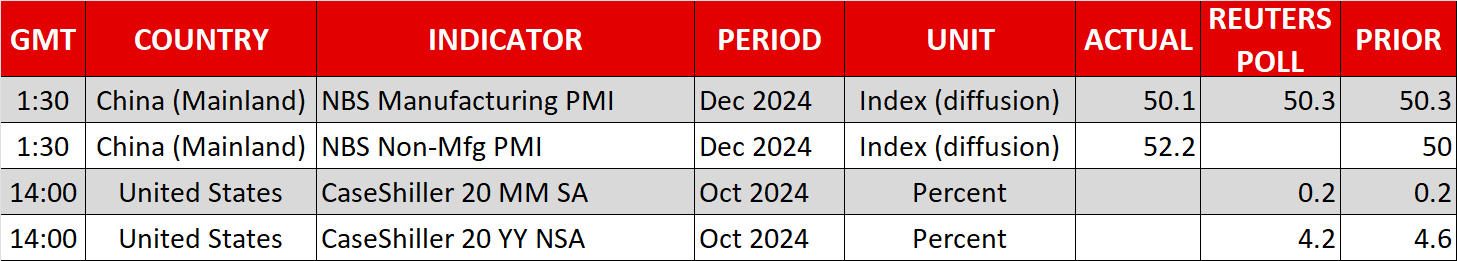

- Combined Chinese language PMIs fail to offer a lot course

Inventory Market Rally Turns Into Yr-Finish Selloff

After a record-breaking 12 months for Wall Road, there was no Santa rally to cap off 2024, with the US election enhance stalling in early December. Given the dimensions of the previous 12 months’s rally, which was principally pushed by the Magnificent 7 and AI-related shares, some end-of-year profit-taking shouldn’t be solely overdue however affordable when contemplating all of the uncertainties that await in 2025.

The euphoria about Fed price cuts and Trump’s pro-business insurance policies that dominated the market theme in November quickly became warning. The Fed could have slashed rates of interest by a full proportion level in 2024 however the overriding message of its ultimate coverage resolution of the 12 months was that it’ll doubtless go on pause in early 2025, with merchants eyeing Might because the earliest potential assembly for a 25-basis-point price reduce.

Traders have additionally soured on Trump in latest weeks amid the massive query mark about how far he’ll take his tariff struggle with America’s main buying and selling companions. Furthermore, with markets turning into reacquainted with Trump’s chaotic fashion of management since his re-election, any additional features in equities are unlikely till there may be extra readability about what the incoming administration’s tax and tariff insurance policies will appear to be.

A Sturdy Yr for Equities

How earnings expectations evolve within the coming months may even be essential for Wall Road, significantly for tech and AI shares. The is the one one of many main US indices that has held onto a few of its month-to-month features, whereas the and are on monitor to complete December within the crimson.

Nonetheless, the Nasdaq and S&P 500 are headed for features of round 25% for the 12 months and even European indices, clouded by financial gloom and political uncertainty, can boast strong will increase, with France’s being the exception.

In Asia, Japan’s is the star performer, helped largely by the ’s slide, whereas Chinese language indices bought a shot within the arm by Beijing’s stimulus insurance policies.

A Gentle Calendar Amid New Yr’s Celebrations

PMI knowledge out of China did little, nevertheless, in lifting sentiment on the final buying and selling day of the 12 months. Regardless of the non-manufacturing PMI providing some reduction because the providers sector grew at its quickest tempo since March, the manufacturing PMI printed under expectations simply above 50. Nonetheless, the indicators of stronger home demand buoyed oil costs immediately.

Manufacturing exercise can be in focus later within the week as properly when the ISM’s equal gauge is launched on Friday in america. Forward of that, the weekly jobless claims on Thursday is the one different top-tier knowledge as markets are shut globally on Wednesday for New Yr’s Day, and buying and selling volumes can be extremely mild immediately, with solely the US inventory change working regular hours.

Greenback Softer as Yields Drop Sharply

Within the FX area, the is having its first destructive week in 5, however it’s down solely barely. Treasury yields took a tumble on Monday as traders poured into bonds as they divested a few of their inventory holdings, although is surprisingly regular this week.

However the pullback in yields is prone to be short-lived because the short-term suspension of the US debt ceiling expires on January 1 and Congress must attain a brand new deal by the center of the month if it desires to keep away from a debt default.

Within the meantime, the buck seems to be set to complete 2024 on a excessive, whereas the yen fares the worst, even because it finds some assist this week from intervention fears and price hike hypothesis.