If you’re taking a trip this week, you selected the incorrect week. From Tuesday till Friday, there might be a large knowledge dump. Beginning Tuesday, we get the and .

On Wednesday, we get , , , and the . Thursday, prices, , , and .

On Friday, the and the .

That is the kind of knowledge that isn’t going solely to maneuver the markets but in addition set the tone and the dialogue for fourth-quarter progress.

This implies the and charges might be extra risky, and the fairness market might be buying and selling off greenback and fee modifications.

US Greenback Poised to Go Increased?

The greenback appears to be like prefer it desires to go larger from right here primarily based on what seems to be a bull flag that has shaped. That sample within the greenback may very well be organising for a substantial transfer larger again in direction of 109.50 on the greenback index.

The info that comes this week might want to assist that narrative, and the Fed messaging will, too. Nonetheless, primarily based on how the greenback seems to be organising heading into this week, it appears the greenback could get the recent knowledge and hawkish Fed.

Euro in Bear Flag: What Awaits?

Related patterns are current within the with what seems to be a bear flag, which is smart given the euro’s weighting within the greenback index. This bearish sample within the euro suggests a drop again to round 1.03.

10-12 months Consolidating Across the 5% Degree

In the meantime, we’re seeing the additionally consolidate across the 5% degree and look like forming a bull flag, too, which is suggestive of a 10-year fee that can also be prone to transfer larger and see a transfer maybe to that 5.25% degree.

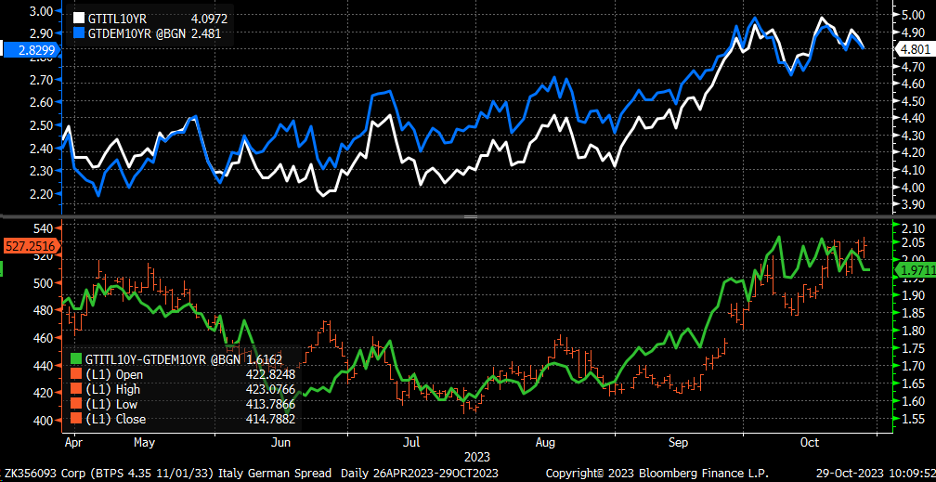

It isn’t that we’re solely seeing larger charges, however we’re lastly witnessing spreads widen as traders reassess the charges they’re getting paid for the quantity of threat they’re taking.

That is taking place not simply within the US however in Europe, too, with German and Italian sovereign spreads widening, which has resulted in high-yield spreads right here within the US widening, too.

Widening spreads within the US have led to rising ranges of implied volatility for the fairness market and better incomes yields, which have led to decrease fairness costs.

What’s pushing equities decrease just isn’t solely larger charges however the repricing of threat as a consequence of these larger charges.

The market appeared to assume that charges would keep low, and since, out there’s view, charges would stay low, there was no motive to reprice threat. However that has all modified.

So, so long as charges and the greenback proceed to climb, the repricing of threat shall doubtless proceed as a result of it doesn’t appear that, on the present degree, shares are accurately priced given bond yields.

The to ratio reveals that shares will doubtless underperform relative to bonds over the brief time period.

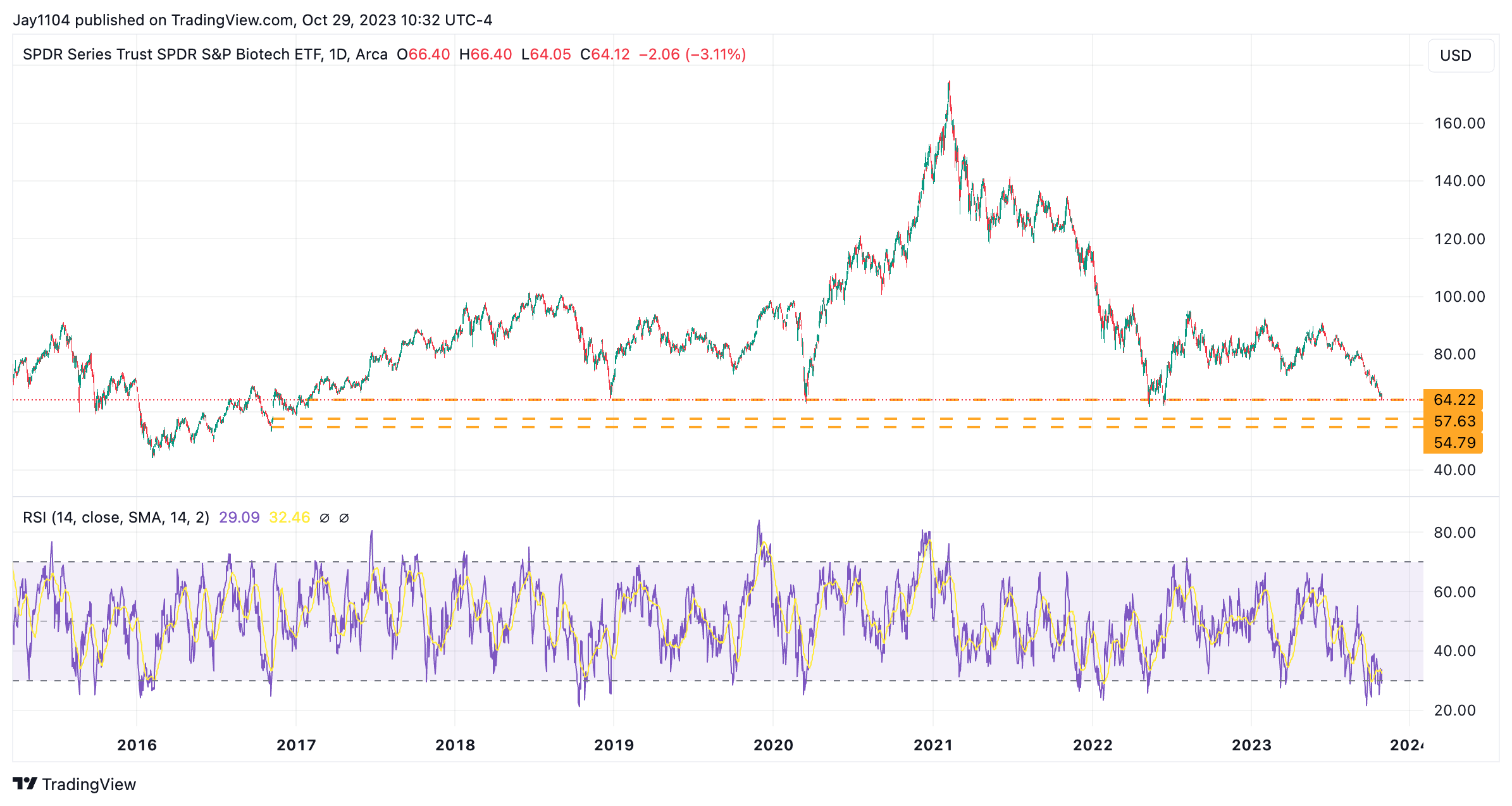

Biotech Sector Might Proceed Decrease

For the biotech ETF () has fallen again to ranges seen in 2017, 2018, 2020, and 2022. The unhappy factor for this group is that it is probably not completed falling, both.

If the XBI ought to break assist round $64, the following degree of assist comes at hole fills from 2016 at $54 and $57.

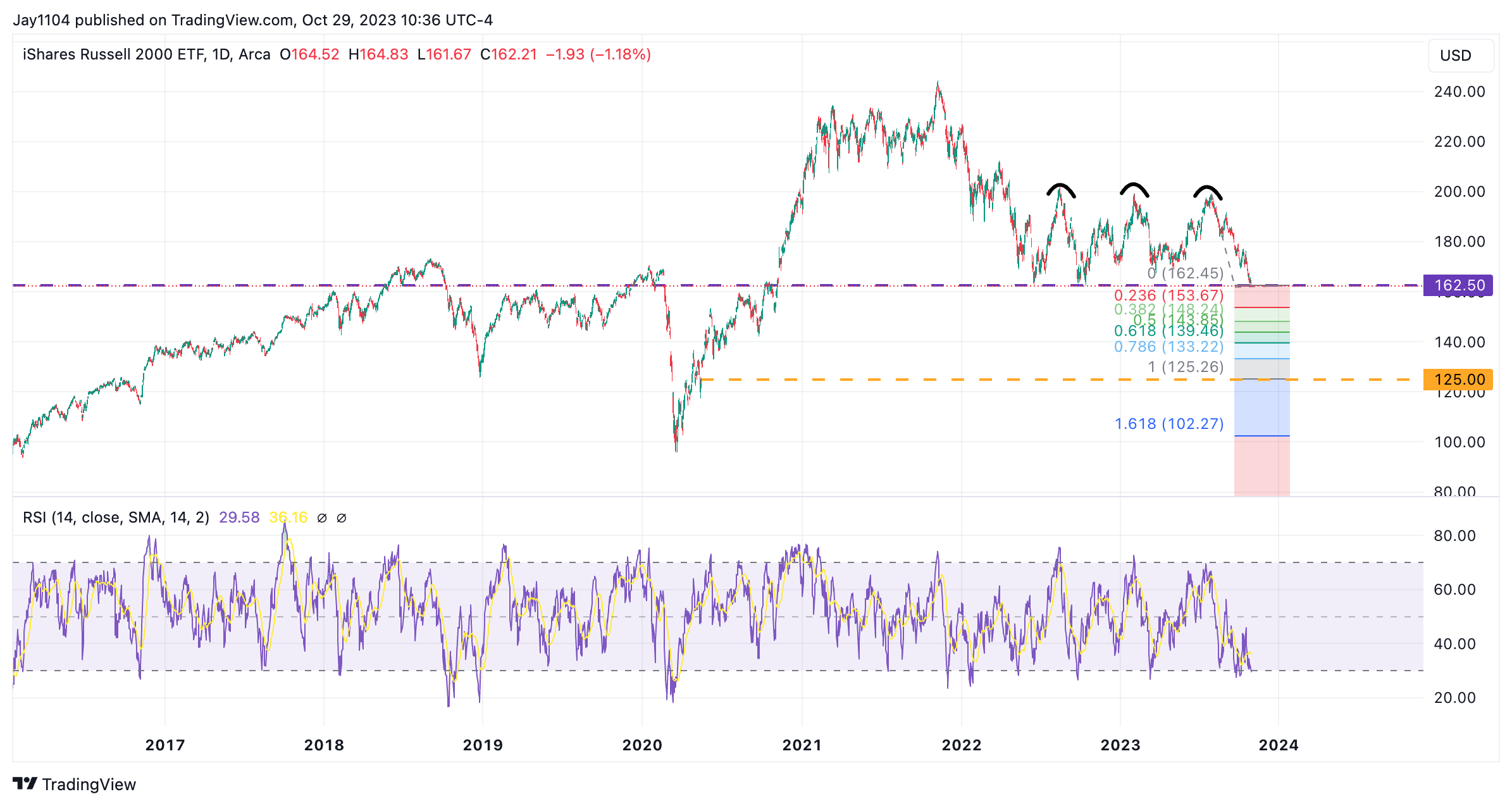

Russell 2000 (IWM) Again to Its 2022 Lows

When biotech underperforms, small-cap underperforms, which has the () again to its 2022 lows.

You may see how ominous the triple high within the IWM appears to be like and what a break of the neckline at $162.50 may imply for the IWM, with gaps to fill down round $127.

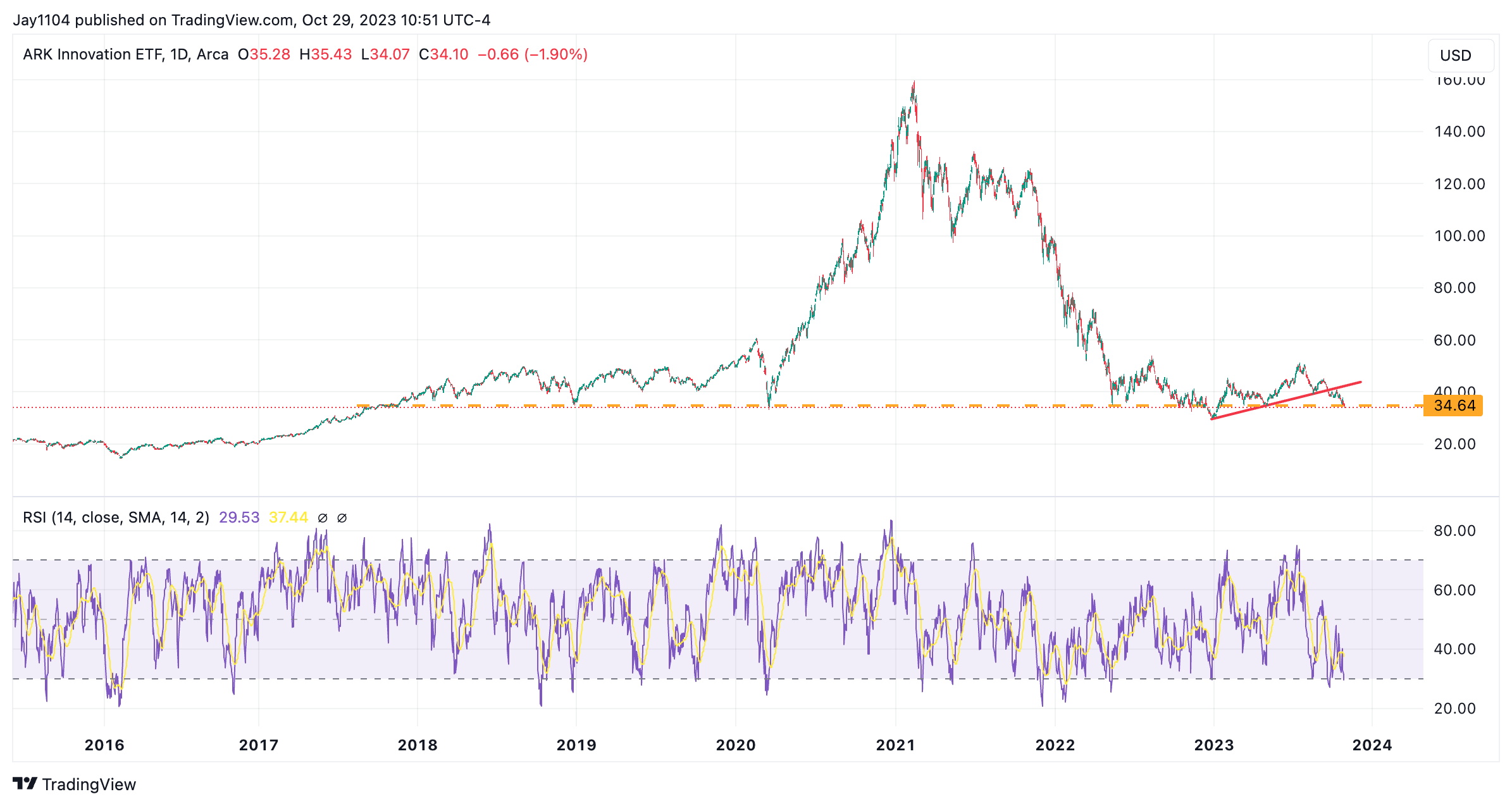

ARKK Innovation ETF Trades Close to 2017 Low

That is extra broadly an indication of long-duration progress property doing poorly, which can also be why the ETF is buying and selling again close to its low and a degree seen again in 2017.

Magnificent 7 Shares Begin to Worth in Excessive Charges

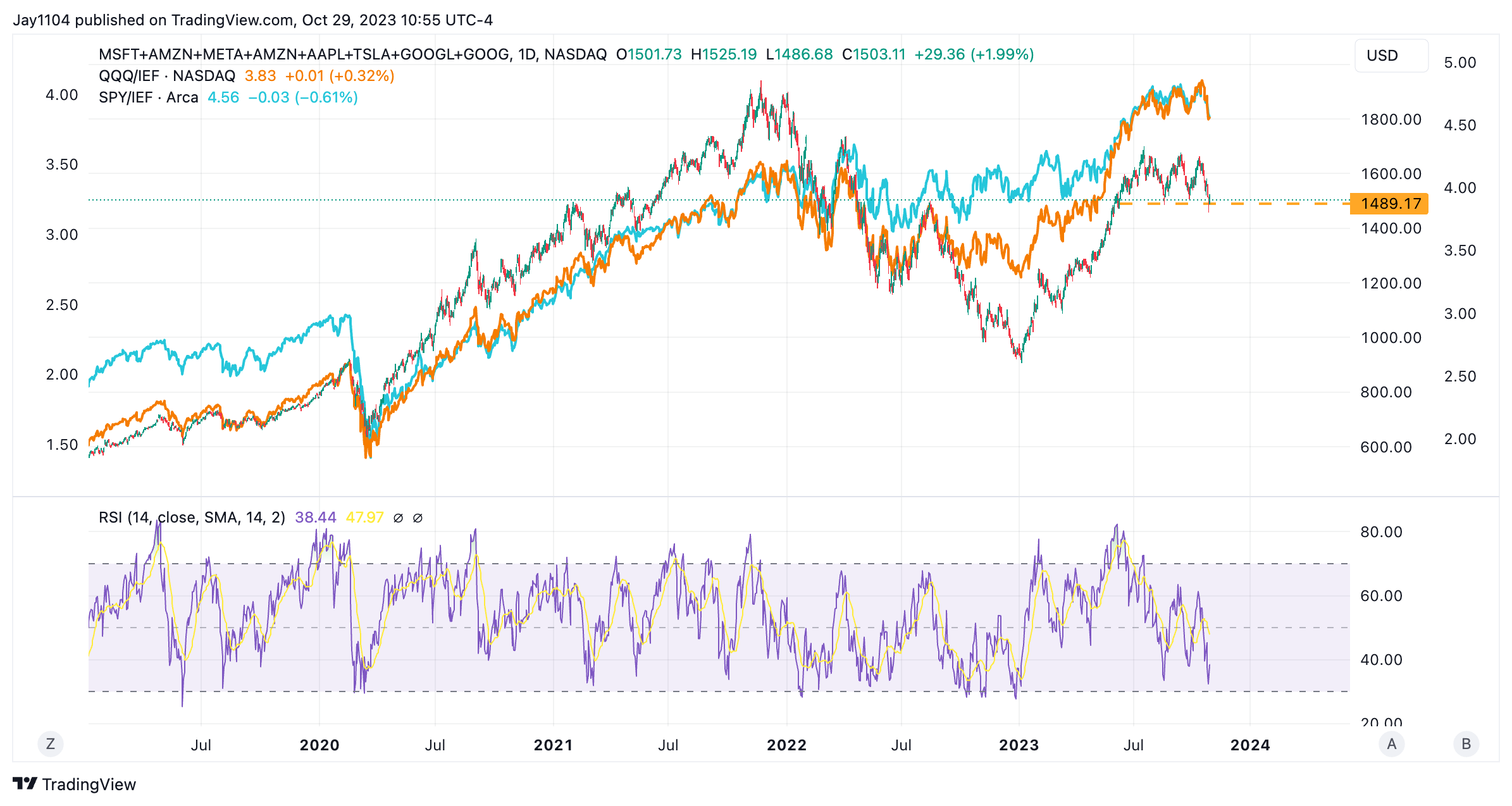

That is most likely why the Magazine 7, when added into one entity, has the identical look because the SPY to IEF and the to IEF ratio. They’re telling us the identical factor.

Shares are repricing for the next fee world, and the upper charges go, the extra shares might want to reprice.

So, if you’re attempting to grasp when shares will cease falling, flip your consideration to the macro knowledge, bonds, and the greenback. They may let you know when shares have completed falling earlier than shares will let you know when they’re completed falling.

THIS WEEK’S FREE YOUTUBE VIDEO:

Authentic Put up