da-kuk/E+ via Getty Images

It’s been about 22 months since I walked away from Gentex Corporation (NASDAQ:GNTX), and since I sold, the shares have returned another 15% against a gain of ~44% for the S&P 500. A charitable read of this is that I walked away from a company that would go on to underperform the S&P 500. Since I’m seemingly in a permanent “glass half empty” frame of mind, my way of interpreting it is that I walked away too soon and missed out on some further upside. A small voice in my head might remind me that while I held the shares they outperformed the market, but I rarely pay attention to that part of myself.

Today I want to work out whether or not it makes sense to buy back in, since the shares have actually declined a fair bit over the past year. I’ll make that determination by looking at the financial history here, and by looking at the stock as a thing distinct from the underlying business. Also, although I sold my shares, I also sold put options on the business, and that trade worked out very well. For that reason, I absolutely need to write about my options trade.

It’s that time again. It’s the time when I offer up my “thesis statement” paragraph to readers who are interested in my perspective, but not at all interested in wading through my verbiage. I’ll come right to the point. I think Gentex stock remains very expensive, in spite of the fact that the business has just posted mediocre results. I’m also of the view that investments are relative to each other, and in a world where you can clip 2.9% from a government note, why would you buy a slow grower like this that’s currently yielding a much lower dividend? I made very good money on this name in the past, and would be willing to again, but for now I’m still avoiding the name.

Financial Snapshot

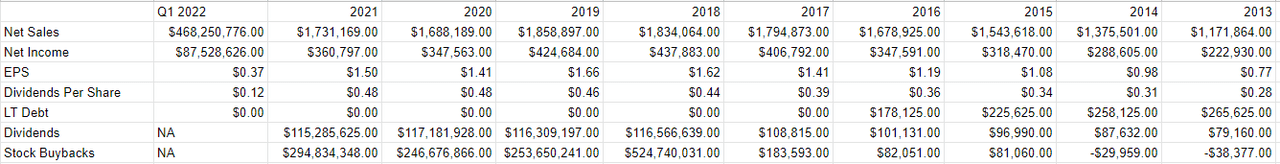

I’m just gonna come out with it. In my view, the financial performance in 2021 was mediocre. Sales in 2021 were barely (about 2.55%) higher, and net income was up by less than 4%, relative to 2020. Given that 2020 was no great shakes, that’s not a great accomplishment in my view. When compared to 2019, the most recent year looks even worse. Sales in 2021 were about 7% lower, and net income was down fully 15% relative to the pre-pandemic period.

Turning now to the quarter just announced this morning, it seems that things have gone in the wrong direction. Specifically, sales are down aboot 3.2% relative to 2021, and the first quarter of 2022 saw net income fully 22.85% lower than the year ago period. There’s not much to get excited about here in my view.

All that said, the balance sheet remains a positive standout, and is one of the strongest I’ve seen. This is evidenced by the fact that as of their latest reporting date, the company had cash on the books of $262.3 million, and total liabilities equaled only $193.4 million. Thus, I don’t think debt or interest expenses will crowd out dividend payments anytime soon. Speaking of the dividend…

Everything’s Relative

I’ve got a confession to make, dear readers. I have the capacity to be quite disagreeable. Please contain your shock. One of the many ways that this has manifested over the years is by the fact that I was always bothered by the argument that people were forced to buy stocks because government bonds offered such paltry returns. It always bothered me that investors with lower risk tolerances were driven into stocks because there’s no alternative (and also because we on Bay Street got paid more when we jammed clients into equities). That dynamic seems to be reversing itself in my view. Now that investors can collect 2.92% from 10-year treasury notes, how should they think about the dividend yield of a given stock?”

This is obviously a very complex question, with many variables, but I think a helpful first step in deciding what we’d be willing to pay for stocks would be to look at the cash flows between a 10-year Treasury note and a given stock. The stock may get a valuation “bonus” from potential growth, but I think it’s worthwhile working out how much of the current price is a function of that growth, and how much is a function of the cash investors can pocket.

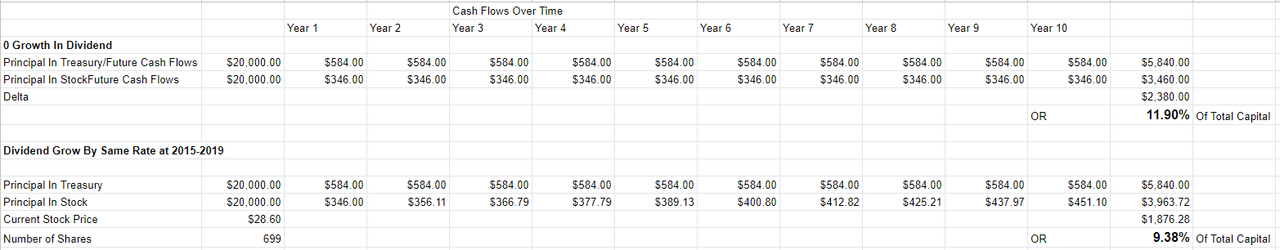

In aid of answering the first part of this question, I’ve created a simple spreadsheet that tries to start to tackle this question. It compares the cash flows from both the treasury and the stock over a 10-year period. It also compares the constant cash flows from the treasury to growing dividends on the equity. I assume the dividend will grow at the same rate for the next decade as it did for the period 2015-2019. This is obviously a very simple assumption, and won’t be perfect, obviously, but I think it will help offer some insight into the relative investment merits of each asset.

I’ve applied this tool to Gentex with the following starting rules, and have found the following:

-

The investor can invest $20,000 in either the treasury or they can invest that $20,000 to buy exactly 699 shares of Gentex.

-

In the scenario where Gentex does not raise its dividend over the next decade, the treasury investor finishes with an extra $2,380 in cash flows, or an extra 11.9% of the original investment.

-

In the scenario where Gentex raises its dividend at a rate of 3%, the treasury investor finishes with an extra $1,8760.28 or 9.38% of the original investment.

In my view, this analysis suggests that for an investor to be indifferent between Gentex stock, and a 10-year U.S. Treasury note, they’d need to assume two things. First, that the company will grow its dividend over the next decade at the rate that it did over the period 2015-2019. Second, that the shares will appreciate by ~9.5% from now to 2032. Alternatively, if the company does not raise the dividend, it’ll need to appreciate by just under 12% between now and 2032.

This tool doesn’t answer the question “stocks or bonds” definitively, obviously. It doesn’t talk about the risks associated with each investment, and there are obvious, and large, differences between the risks of the stock versus the U.S. government. That said, I think it’s a worthwhile first step. It helps quantify the relative merits of each, which goes a long way to answering the question in my view.

Lastly, I should say that some variables are a wash. Inflation, for instance, will impact $1 received from a dividend identically as will impact $1 received from Uncle Sam. There are potentially significant tax differences for Americans, though. Dividends are taxed differently, so you may want to factor your own relationship with the Internal Revenue Service into this analysis. Or, this analysis may be relevant to tax sheltered assets.

In closing, I think this tool helps to quantify the differences between stocks and government bonds at the moment. I’d suggest that in general, stocks are more risky, and are paying investors less in the terms of cash flows. Thus, investors are now reliant on price appreciation stemming from either earnings growth or multiple expansion. In my view, this is a pretty heavy lift. In spite of that, I’d be comfortable buying the shares at the right price.

Gentex dividend v 10 Year Treasuries (Author calculations based on public sources)

Gentex Finanacials (Gentex investor relations)

The Stock

Some of you who follow me regularly for some reason know what time it is. It’s the point in the article where I turn even more sour, because I start writing about risk-adjusted returns, and how a stock with a well-covered dividend can be a terrible investment at the wrong price. Even if a company grows profits nicely, which is not the situation here, the investment can still be a terrible one if the shares are too richly priced. This is because this business, like all businesses, is an organisation that takes a bunch of inputs, adds value to them, and then sells them for a profit. That’s all a business is in the final analysis. The stock, on the other hand, is a proxy whose changing prices reflect more about the mood of the crowd than anything to do with the business. In my view, stock price changes are much more about the expectations of a company’s future, and the whims of the crowd than anything to do with the business. This is why I look at stocks as things apart from the underlying business.

If you were hoping that I would stop blathering about this, and move on to my next point, you’d be wrong, dear reader. I want to drive home the importance of looking at the stock as a thing distinct from the business by using Gentex itself as an example. The company only released quarterly results this morning, so there’s no history to be guided by yet, so I’ll look at the period between the release of their latest annual results through to yesterday. The company released annual results on February 23rd. If you bought this stock that day, you’re down about 3.3% since then. If you waited until April 7th to pick a date totally at random, you’re up about 4% since. Obviously, not much changed at the firm over this short span of time to warrant a 7% variance in returns. The differences in return came down entirely to the price paid. The investors who bought virtually identical shares more cheaply did better than those who bought the shares at a higher price. This is why I try to avoid overpaying for stocks.

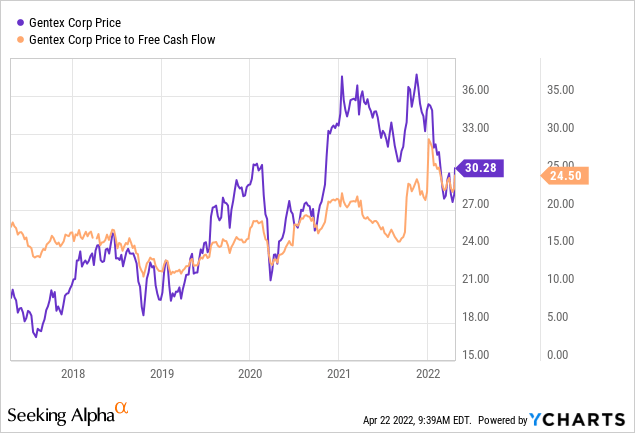

If you’re one of the masochists who reads my stuff often, you know that I measure the cheapness of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I look at the ratio of price to some measure of economic value like sales, earnings, free cash flow, and the like. Ideally, I want to see a stock trading at a discount to both its own history and the overall market. In my previous missive, one of the reasons I walked away was because the shares had hit a price to free cash ratio of 15.27. This was 24% more expensive than the price that excited me initially. In spite of the rather large drawdown in price over the past year, things are even more expensive now, per the following:

Source: YCharts

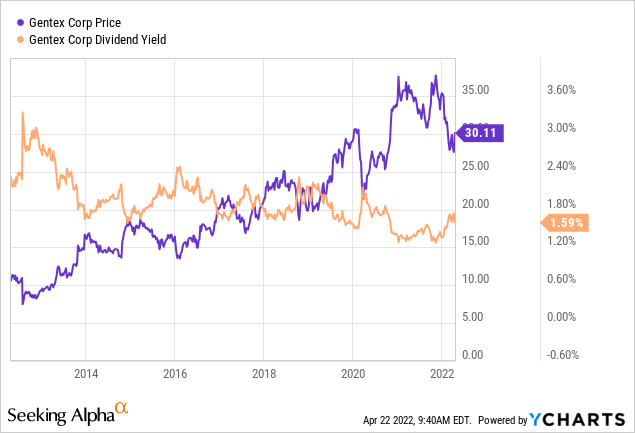

At the same time that shares are priced near record valuations, investors are getting near low dividend yields. I don’t know aboot you, dear reader, but I don’t like paying more and getting less.

Source: YCharts

In addition to simple ratios, I want to try to understand what the market is currently “assuming” about the future of this company. In order to do this, I turn to the work of Professor Stephen Penman and his book “Accounting for Value.” In this book, Penman walks investors through how they can apply the magic of high school algebra to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in the said formula. Applying this approach to Gentex at the moment suggests the market is assuming that this company will grow at a rate of about 4.5% over the long term. This is quite optimistic in my view, especially in light of the fact that net income continues to slide lower. Given all of this, I’m taking my chips off the table here.

Options Reduce Risk, Enhance Returns

While I took profits in June of 2020, I sold 10 December Gentex puts with a strike of $20 for $0.70 each, and these expired worhthless, and that enhanced my returns nicely. I point this out in order to brag most importantly, but also to demonstrate yet again how short put options offer the opportunity to enhance returns while decreasing risk. Had the shares fallen, I would have been obliged to buy at a great price of $19.30. Since the shares remained above this strike price, these puts expired worthless, which was also a great outcome.

While I like to try to repeat success when I can, I can’t do it in this case because the premia on offer for reasonable strike prices is non-existent. For instance, I’d be willing to sell the December Gentex put with a strike of $20, but the bid on these is currently zero. Thus, I must simply wait for the shares to drop further in price before considering buying back in.

Conclusion

I think the shares of Gentex remain expensive, in spite of the fact that the company has just posted mediocre results. This is particularly troubling in light of the fact that an investor can now clip 2.9% on a “sleep at night” trade. I made good money on this stock in the past, and I’d be happy to buy back in at the right price. The problem is that we’re not near that price today.