Galeanu Mihai

Fears of contagion following Silicon Valley Financial institution’s failure in March have led to a selloff within the BDC and monetary sectors, for my part, for no good purpose.

This selloff has diminished the worth of a variety of well-managed and numerous BDCs, together with Stellus Capital Funding Company (NYSE:SCM), which primarily invests in First Liens.

Stellus Capital Funding additionally continues to cowl its dividend with internet funding earnings and lately elevated its month-to-month dividend by 43%, so I imagine passive earnings traders ought to think about SCM on the decline because the inventory now pays a well-covered 11.5% dividend yield.

Effectively-Diversified Funding Portfolio

Stellus Capital gives earnings traders with a diversified and secure funding portfolio. The BDC’s portfolio is primarily composed of extremely rated First Liens (94%), nearly all of that are floating charge (the floating charge proportion was reported as 97% on the finish of the BDC’s fourth quarter).

Moreover, the BDC invests in non-First Liens sometimes, with Second Liens accounting for roughly 6% of investments.

Stellus Capital, in distinction to different enterprise growth firms, owns virtually no Unsecured Debt and Fairness, making the BDC, for my part, significantly appropriate for passive earnings traders involved in regards to the impression of a possible recession on portfolio and credit score efficiency.

Debt Portfolio (Stellus Capital Funding Corp)

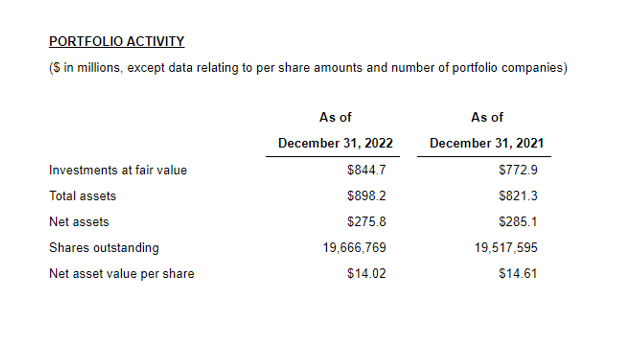

Stellus Capital’s portfolio was valued at $844.7 million as of December 31, 2022, representing 9% YoY progress. The portfolio contained 85 investments in whole, up from 73 on the finish of 2021.

Portfolio Exercise (Stellus Capital Funding Corp)

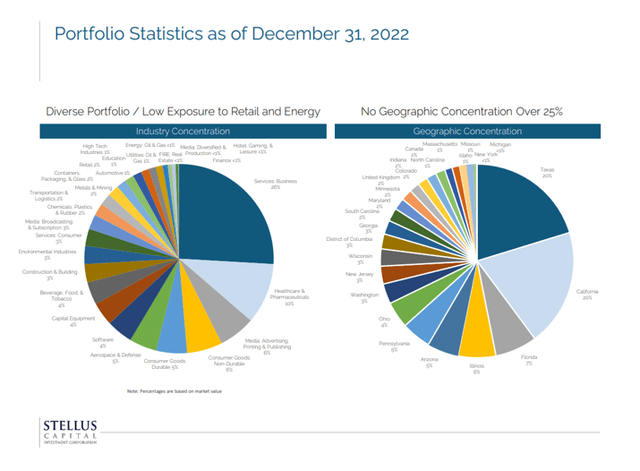

Stellus Capital’s portfolio is well-diversified, and the BDC focuses on industries which might be much less weak to financial downturns, resembling enterprise providers, healthcare, and prescription drugs. See the diversification chart under for extra info.

Portfolio Statistics (Stellus Capital Funding Corp)

Dividend Protection

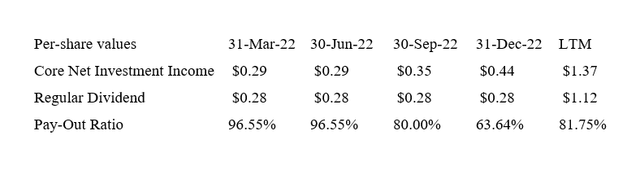

There are enterprise growth firms with higher dividend protection than Stellus Capital, Hercules Capital, Inc. (HTGC) being a very good instance, however the BDC’s internet funding earnings gives sufficient help for the dividend payout to be sustained.

The dividend payout ratio in 2022 was solely 82%, and the pay-out metrics improved steadily within the second half of 2022 because the BDC benefited from increased internet curiosity earnings from its floating charge debt portfolio.

Stellus Capital presently pays a quarterly dividend of $0.40 per share, paid month-to-month in pops of $0.1333 per share. In 1Q-23, the BDC elevated its dividend by 43% YoY. Proper now, the ahead dividend yield is 11.5%.

Dividend Protection (Writer Created Desk Utilizing BDC Info)

Get An 11.5% Yield And Pay Solely Internet Asset Worth For SCM

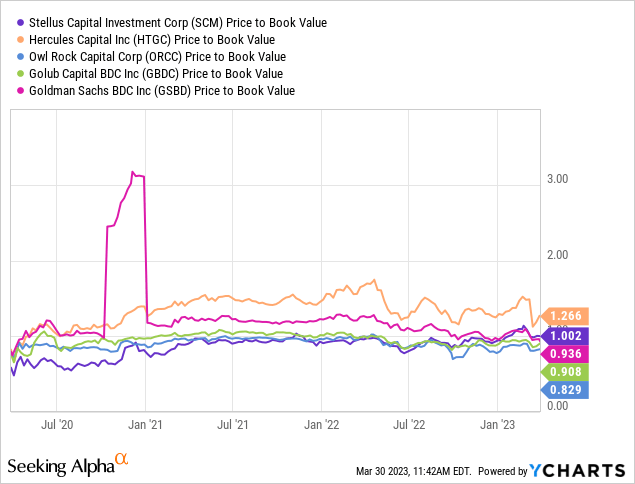

I am within the temper for a discount, so I am including Stellus Capital Funding’s 11.5% yield on the dip, primarily as a result of the inventory is virtually out there at internet asset worth.

Stellus Capital’s internet asset worth as of 31 December 2022 was $14.02, representing a 0.2% low cost to internet asset worth for passive earnings traders.

Stellus Capital offered at a premium to NAV simply earlier than the March drop, which is why I imagine passive earnings traders ought to seize the chance to buy Stellus Capital inventory. Given the portfolio’s top quality and deal with security, I imagine traders can get a really strong, long-term dividend yield right here.

Within the aftermath of the SVB failure in March, many different enterprise growth firms have begun to commerce at both decrease premium multiples or increased reductions to the web asset worth.

On condition that SCM’s portfolio is closely weighted within the most secure sorts of debt and that the BDC lately elevated its dividend by an eye-popping 43%, I imagine the inventory is an effective purchase for yield-seeking traders. SCM traded at the next low cost to NAV final 12 months, however this was earlier than the central financial institution obtained severe about elevating rates of interest.

As a result of 97% of the BDC’s property are invested in floating charge debt, the central financial institution’s ongoing push to boost rates of interest could lead to increased internet funding earnings and a greater dividend protection ratio sooner or later. These are all explanation why I imagine SCM deserves the next NAV valuation.

Why Stellus Capital Might See A Decrease Valuation

Given the backdrop of Stellus Capital’s worth decline within the aftermath of the Silicon Valley Financial institution fallout, it’s potential that traders will proceed to promote shares and purchase safer investments, particularly if new financial institution runs agitate the U.S. banking system.

Nevertheless, a bigger low cost to internet asset worth would trigger me to double down on Stellus Capital’s inventory relatively than promote it. Given Stellus Capital’s aggressive strategy to floating-rate debt, a adverse for the corporate could be if present banking system issues lead to rate of interest cuts, stopping SCM from realizing its incremental earnings upside.

My Conclusion

Stellus Capital is a well-managed enterprise growth firm with a portfolio closely weighted in extremely rated first liens, and the BDC earns its dividend by means of internet funding earnings.

For my part, the dividend payout ratio is an important criterion for figuring out whether or not or not a BDC is price buying. Stellus Capital is a BDC that persistently earns its dividend by means of NII.

Stellus Capital gives all the pieces I search for in a well-managed BDC, which is why I imagine its 11.5% dividend yield remains to be a very good purchase for passive earnings traders.