spooh

The NXG Cushing Midstream Power Fund (NYSE:SRV) is a closed-end fund that focuses on investing in midstream vitality corporations and grasp restricted partnerships. This fund has turn out to be one of the crucial widespread funds on this class in current years resulting from having a considerably increased yield than most of its peer funds. Its shares yield a whopping 12.56% on the present worth, which simply locations it effectively above the yield supplied by the opposite funds within the sector. That is clearly seen right here:

|

Fund Identify |

Morningstar Classification |

Present Yield |

|

NXG Cushing Midstream Power Fund |

Fairness-MLP |

12.56% |

|

ClearBridge Power Midstream Alternative Fund (EMO) |

Fairness-MLP |

6.67% |

|

Kayne Anderson Power Infrastructure (KYN) |

Fairness-MLP |

8.38% |

|

Neuberger Berman Power Infrastructure and Earnings Fund (NML) |

Fairness-MLP |

8.73% |

|

Tortoise Pipeline & Power Fund (TTP) |

Fairness-MLP |

6.67% |

Many traders who’re attracted to the midstream sector within the first place are fascinated about receiving a really excessive yield from the cash that they park into these corporations. As such, a fund with a better yield is prone to be extra engaging than one with a decrease yield. The truth that the NXG Cushing Midstream Power Fund at present provides the very best yield within the sector (by a substantial margin) thus makes it fairly straightforward to see why this fund is pretty engaging to many potential shareholders. Nevertheless, as I’ve talked about in varied earlier articles, any time a fund has an outsized yield relative to its friends, it’s a signal that it may not be capable to maintain the distribution. That is very a lot the case right here, which implies that we have to pay particular consideration to the fund’s funds.

As common readers would possibly keep in mind, we beforehand mentioned the NXG Cushing Midstream Power Fund in the course of Could of this 12 months. On the time, we had some considerations in regards to the fund’s skill to maintain its distribution, however it didn’t seem {that a} reduce is imminent. The midstream sector as an entire has been fairly robust since that article was printed, so that’s most likely nonetheless the case in the present day. As well as, the power within the midstream sector would lead us to imagine that this fund has delivered a good efficiency because the publication date of my earlier article on it.

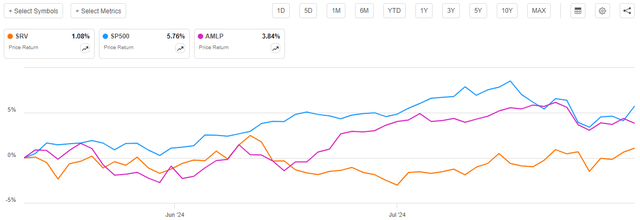

Nevertheless, this fund’s efficiency since mid-Could has not been significantly spectacular. Its share worth is barely up 1.08%:

Searching for Alpha

As we will see, the NXG Cushing Midstream Power Fund considerably underperformed each the S&P 500 Index (SP500) and the Alerian MLP Index (AMLP) because the date that my earlier article on this fund was printed. Of the 2, the underperformance versus the Alerian MLP Index is especially disheartening as a result of this fund particularly focuses on investing in the identical sorts of corporations as could be included in that index. Grasp restricted partnerships traditionally underperform the S&P 500 Index, so the truth that this fund didn’t preserve tempo shouldn’t be particularly stunning.

Nevertheless, the above chart doesn’t inform the entire story. As I said in my earlier article on this fund:

A easy take a look at a closed-end fund’s worth efficiency doesn’t essentially present an correct image of how traders within the fund did throughout a given interval. It is because these funds are inclined to pay out all of their web funding earnings to the shareholders, moderately than counting on the capital appreciation of their share worth to offer a return. That is the explanation why the yields of those funds are usually a lot increased than the yield of index funds or most different market belongings.

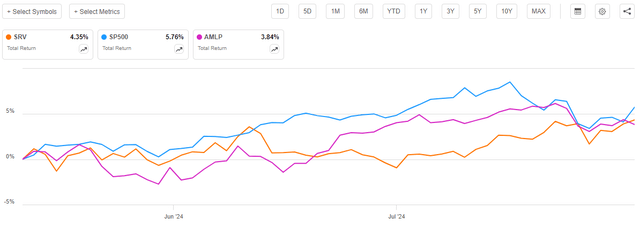

After we embody the distributions that had been paid out by the NXG Cushing Midstream Power Fund in addition to the index funds into the value efficiency chart since Could 13, 2024, we get this different chart:

Searching for Alpha

This actually seems considerably higher for traders. The NXG Cushing Midstream Power Fund managed to ship a greater complete return over the previous two-and-a-half months than the Alerian MLP Index. The fund did, nonetheless, nonetheless underperform the S&P 500 Index, however that’s to be anticipated. The efficiency of most grasp restricted partnerships is beneath that of the S&P 500 Index over most intervals of time, however that is no less than partially as a result of business collapses that occurred in 2015 and 2020. The NXG Cushing Midstream Power Fund and the Alerian MLP Index each outperformed the S&P 500 Index on a complete return foundation over the previous three years:

Searching for Alpha

Sadly, it appears unlikely that both the NXG Cushing Midstream Power Fund or the Alerian MLP Index will proceed to ship efficiency that beats the S&P 500 Index going ahead. There is no such thing as a actual driver of natural progress proper now, and people grasp restricted partnerships which have delivered robust progress over the previous three years have executed it via acquisitions. Nevertheless, given the yields of most grasp restricted partnerships, they don’t want a lot progress with a view to ship a complete return that’s in step with the ten% common annual enhance within the S&P 500 Index. Thus, we will most likely no less than anticipate to become profitable with a fund like this.

About The Fund

In accordance with the fund’s web site, the NXG Cushing Midstream Power Fund has the first goal of offering its traders with a really excessive degree of complete return. This makes plenty of sense given the technique description that the fund supplies on its web site:

The Fund’s funding goal is to acquire a excessive after-tax complete return from a mixture of capital appreciation and present revenue. The Fund seeks to attain its funding goal by investing, underneath regular circumstances, no less than 80% of its web belongings, plus any borrowings for funding functions, in midstream vitality investments.

The technique description from the web site is in no way clear on this, however based mostly on the fund’s present holdings, the time period “midstream vitality investments” means frequent fairness securities issued by midstream corporations. In accordance with the fund’s most up-to-date semi-annual report, the fund was holding the next asset allocation on Could 31, 2024:

|

Asset Sort |

% of Web Belongings |

|

Frequent Inventory |

88.5% |

|

MLP Investments and Associated Corporations |

40.6% |

|

Most popular Inventory |

2.9% |

|

Cash Market Funds |

1.1% |

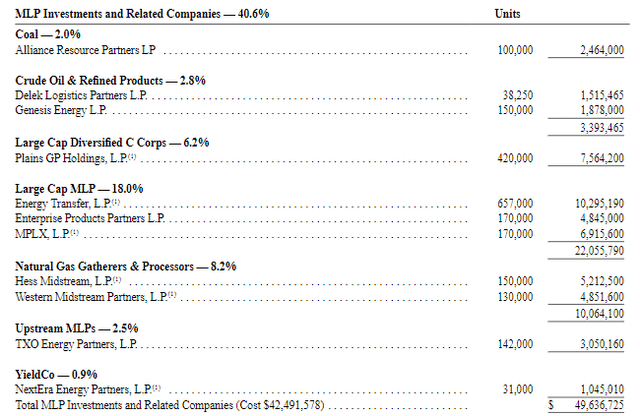

The “MLP Investments” class consists solely of frequent fairness models issued by varied grasp restricted partnerships. Here’s a full record from the semi-annual report:

Fund Semi-Annual Report

We will see that the fund has grasp restricted partnership holdings in just a few totally different classes. There are crude oil and refined merchandise pipeline operators, large pipeline partnerships that function all several types of hydrocarbon pipelines, pure gasoline gathering and processing corporations, an upstream exploration and manufacturing firm, a coal producer, and a renewable vitality partnership. These securities are all of the frequent fairness models issued by these corporations, not the popular or debt securities from these grasp restricted partnerships which have such securities.

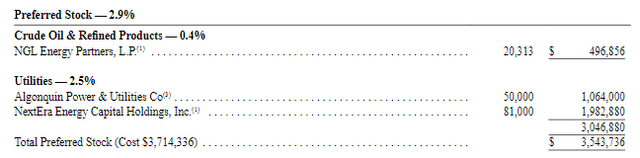

The one securities held on this fund that aren’t frequent shares or frequent fairness partnership models are the two.9% of web belongings invested in most well-liked inventory and the 1.1% invested in idle money. There are solely three most well-liked inventory points held by this fund:

Fund Semi-Annual Report

We see right here that the fund is barely holding a really small place in the popular inventory concern of NGL Power Companions, which is a midstream pipeline firm that principally operates within the state of New Mexico. It has a a lot bigger place in the popular inventory problems with two massive electrical utilities. In contrast to many different funds which may embody most well-liked inventory, there aren’t any banks or different monetary corporations included within the fund. That is smart given the fund’s vitality sector theme.

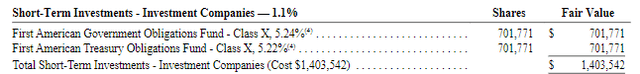

The NXG Cushing Midstream Power Fund makes use of two totally different cash market funds to handle its money holdings:

Fund Semi-Annual Report

Because the screenshot reveals, the fund’s money is evenly cut up between the First American Authorities Obligations Fund (FGXXX) and the First American Treasury Obligations Fund (FXFXX). The one distinction between the 2 is that the First American Authorities Obligations Fund consists of company securities that commerce within the cash market. The First American Treasury Obligations Fund is solely invested in U.S. Treasury securities and secured repos backed by U.S. Treasuries.

It’s unclear why the fund is utilizing two cash market funds for money administration functions. Normally, authorities cash market funds have barely increased yields than Treasury-only cash market funds. This isn’t the case with these two funds:

|

Fund Identify |

Present Yield |

|

First American Authorities Obligations Fund |

5.25% |

|

First American Treasury Obligations Fund |

5.25% |

Nevertheless, in lots of circumstances, the curiosity obtained from U.S. Treasury securities is exempt from state revenue tax. The curiosity obtained from company cash market securities is taxed by state governments. Thus, Treasury-only cash market funds will often have a better after-tax yield for these people who reside in a state that has an revenue tax. As these two funds have the identical present yield, it’s unclear what benefit the fund really derives from splitting its cash between the 2 of them. Because the yields are the identical, it will make extra sense for it to easily have all of its cash within the Treasury-only fund as a result of potential for decrease taxation.

As is the case with most midstream funds, the NXG Cushing Midstream Power Fund solely has a really small variety of holdings. The semi-annual report lists 41 holdings, not together with the 2 cash market funds. CEF Join states that the fund had 46 positions as of June 30, 2024, however it’s unclear the place that quantity got here from. The very fact sheet dated June 30, 2024, doesn’t state what number of positions the fund had on that date, neither does the web site. The fund didn’t launch a holdings report for the month of June. In any case, it’s nonetheless very clear that the NXG Cushing Midstream Power Fund doesn’t have an particularly massive variety of holdings.

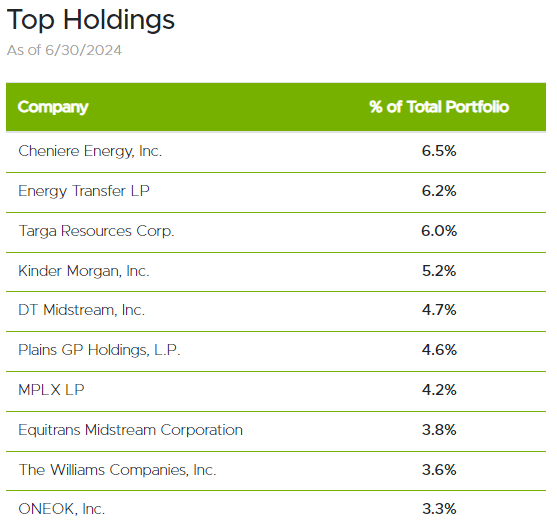

The fund’s web site lists the next as the biggest positions within the fund as of June 30, 2024:

NXG Cushing

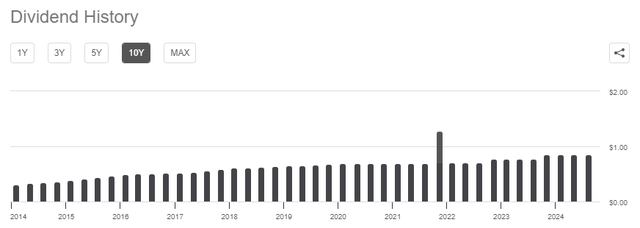

There have been two important adjustments to the biggest positions within the fund because the final time that we mentioned it. Which means that Western Midstream (WES) and Hess Midstream (HESM) had been each faraway from their former positions among the many fund’s largest positions. Of their place, we’ve got DT Midstream (DTM) and MPLX (MPLX). It’s onerous to complain in regards to the addition of MPLX to the biggest positions within the fund. As subscribers to Power Earnings in Dividends are effectively conscious, this has been among the finest corporations within the midstream sector for a number of years now. The corporate’s money move was nearly fully unaffected by the pandemic lockdowns that induced many different corporations within the sector to chop their distributions again in 2020, and that is fairly evident by the truth that MPLX has step by step grown its distribution over the previous ten years:

Searching for Alpha

This is among the few midstream corporations that has by no means reduce its payout, regardless of the troubles that the sector went via over the previous decade. The corporate’s market efficiency, when measured on a complete return foundation, has additionally outperformed the Alerian MLP Index over the previous ten years:

Searching for Alpha

Thus, we can not complain in regards to the fund including this firm to its largest positions.

I’ll admit that I’m much less enamored with DT Midstream than I’m with MPLX. Nevertheless, that is principally as a result of DT Midstream has, previously, traded at extremely excessive valuations relative to its money move and dividends. The value is a little more cheap now, though the corporate’s 3.90% present yield is pretty low in comparison with most different midstream corporations.

One other factor that we seen is that the fund’s frequent inventory weighting has elevated considerably since our earlier dialogue. As talked about earlier, the NXG Cushing Midstream Power Fund has 88.5% of its web belongings invested in frequent inventory. Within the earlier article, which used figures from the fund’s annual report, confirmed that the fund had 78.5% of its belongings invested in frequent inventory as of November 30, 2023. Apparently, the fund’s weighting in the direction of midstream partnerships remained comparatively steady from the top of November till the top of Could. Its most well-liked inventory and cash market fund weightings decreased over the interval, which partially explains how this fund managed to fund the substantial enhance in its frequent inventory allocation. Nevertheless, neither a kind of positions was massive sufficient to fund a ten% of web belongings enhance within the fund’s frequent inventory allocation. Thus, it appears possible that this fund borrowed some cash sooner or later throughout the interval to make use of to fund further investments.

Leverage

As is the case with most closed-end funds, the NXG Cushing Midstream Power Fund employs leverage as a technique of boosting the efficient yield and complete return that it earns from the belongings in its portfolio. I defined how this works in my earlier article on this fund:

Briefly, the fund is borrowing cash and utilizing that borrowed cash to buy the frequent fairness of midstream corporations. So long as the bought belongings have a better complete return than the rate of interest that the fund must pay on the borrowed monies, the technique works fairly effectively to spice up the efficient yield of the portfolio. As this fund is able to borrowing cash at institutional charges, that are significantly decrease than retail charges, this can normally be the case. It’s price noting that this technique is way much less efficient at boosting the efficient portfolio return in the present day than it was three years in the past. That is just because borrowing cash is significantly dearer in the present day than it was once.

Nevertheless, using debt on this vogue is a double-edged sword. It is because leverage boosts each positive aspects and losses. As such, we wish to be sure that the fund shouldn’t be utilizing an excessive amount of leverage as a result of that may expose us to an extreme quantity of threat. I typically don’t wish to see a fund’s leverage exceed a 3rd as a proportion of its belongings for that reason.

As of the time of writing, the NXG Cushing Midstream Power Fund has leveraged belongings comprising 29.23% of its portfolio. This represents a rise over the 25.86% leverage that the fund had the final time that we mentioned it. This fund had 14.07% leverage again on November 15, 2023, so we see a considerable enhance within the fund’s borrowings since that date. This isn’t sudden, given the feedback that I made within the earlier part in regards to the fund’s allocation to frequent inventory growing dramatically since late November 2023.

The leverage ratio of the NXG Cushing Midstream Power Fund stays beneath the one-third of belongings degree that we typically take into account to be acceptable for a fund like this. Nevertheless, it’s a bit above what a few of its friends possess:

|

Fund Identify |

Leverage Ratio |

|

NXG Cushing Midstream Power Fund |

29.23% |

|

ClearBridge Power Midstream Alternative Fund |

29.34% |

|

Kayne Anderson Power Infrastructure |

22.27% |

|

Neuberger Berman Power Infrastructure and Earnings Fund |

17.45% |

|

Tortoise Pipeline & Power Fund |

16.20% |

(all figures from CEF Knowledge)

As we will see, the NXG Cushing Midstream Power Fund is extra extremely leveraged than all however considered one of its friends. This is likely to be regarding contemplating that a few of these funds have had some issues with leverage previously. In any case, leverage mainly induced these funds to wipe themselves out in 2015 and 2020 when the sector collapsed. Whereas the sector is now a lot stronger than it has ever been, there may be nonetheless the concern that such an occasion might occur once more. That’s the reason most of those funds have decrease ranges of leverage than they used to. This fund clearly doesn’t, and as such it might be riskier than a few of its friends within the occasion of a sudden near-term correction.

Distribution Evaluation

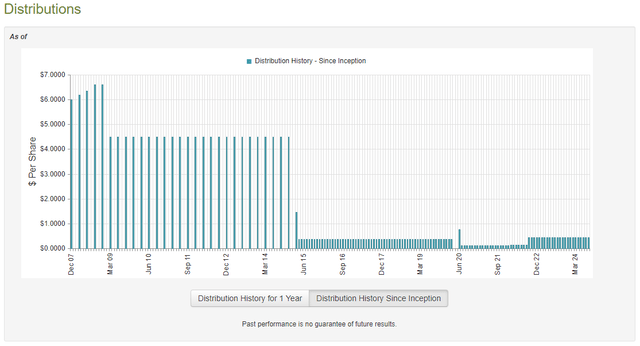

The first goal of the NXG Cushing Midstream Power Fund is to offer its traders with a excessive degree of complete return. Nevertheless, midstream corporations typically present a big proportion of their complete returns to their traders within the type of dividends and distributions. This fund will go that cash via to its traders and thus present a big proportion of its complete returns within the type of distributions. To that finish, the NXG Cushing Midstream Power Fund pays a month-to-month distribution of $0.45 per share ($5.40 per share yearly), which supplies it a 12.56% yield on the present worth.

Sadly, the NXG Cushing Midstream Power Fund has not been particularly per respect to its distributions through the years:

CEF Join

From my earlier article on this fund:

We will see that the fund has made just a few cuts through the years, notably in response to grease worth collapses in 2015 and 2020. Whereas these occasions didn’t influence the money flows of most midstream corporations, they did trigger their share and unit costs to break down. That resulted in losses for this fund. As well as, some midstream corporations slashed their distributions in response to the market turning in opposition to their fairness with a view to cut back debt and turn out to be financially impartial of the market. That diminished the fund’s revenue. As such, it is smart that the fund would slash its personal distribution because it wanted to keep away from destroying its web asset worth an excessive amount of.

Allow us to take a look at how effectively this fund is overlaying its distribution in the present day. In any case, as talked about within the introduction, its present yield is effectively above most of its friends, which is an indication that the market believes that the distribution is probably not sustainable.

As of the time of writing, the latest monetary report that’s accessible for the NXG Cushing Midstream Power Fund is the semi-annual report for the six-month interval ending on Could 31, 2024. A hyperlink to this doc was supplied earlier on this article. It is a a lot newer report than the one which was accessible the final time that we mentioned this fund, which is good as a result of it ought to be capable to present us with an replace on the fund’s monetary state of affairs and distribution protection.

For the six-month interval that ended on Could 31, 2024, the NXG Cushing Midstream Power Fund obtained $5,164,012 in dividends and distributions together with $173,259 in curiosity from the belongings in its portfolio. Nevertheless, a few of this revenue got here from grasp restricted partnerships, so it’s thought of to be a return of capital versus funding revenue. We subtract out the return of capital to reach at a complete funding revenue of $2,766,994 for the interval. The fund paid its bills out of this quantity, which left it with $342,678 accessible for shareholders. That was not adequate to cowl the $7,540,636 that the fund paid out to its shareholders in distributions over the interval.

Thankfully, the fund was in a position to make up the distinction via capital positive aspects. For the six-month interval ending on Could 31, 2024, the fund reported web realized positive aspects of $7,346,357 together with web unrealized positive aspects of $14,096,864. That was greater than adequate to cowl the distributions and nonetheless depart the fund with a considerable quantity of extra returns. In reality, the web realized positive aspects plus web funding revenue had been adequate to totally cowl the distribution. That is very good to see, and it’s a clear signal that this fund shouldn’t be over-distributing.

General, we should always not want to fret about this fund’s skill to maintain its distribution.

Valuation

Shares of the NXG Cushing Midstream Power Fund are at present buying and selling at a 0.77% premium on web asset worth. It is a pretty small premium, and it’s barely higher than the 0.81% premium that the shares have had on common over the previous month. Nevertheless, it does nonetheless imply that anybody buying the shares is barely overpaying for the precise belongings represented by the shares.

It is likely to be price paying a small premium given the fund’s excessive yield and the truth that it may possibly apparently maintain it. Nevertheless, I’d nonetheless want to get the shares at a reduction. The truth that the premium is so small would possibly imply that this can be a risk sooner or later.

Conclusion

In conclusion, the NXG Cushing Midstream Power Fund is among the hottest midstream closed-end funds for an excellent motive. The fund boasts a really excessive distribution yield, and it seems in a position to maintain it. The fund has been growing its leverage, although, which is likely to be a dangerous proposition given the volatility that oil costs can exhibit. The truth that it’s promoting for a premium is one other draw back right here, however no less than it’s a small one.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please concentrate on the dangers related to these shares.