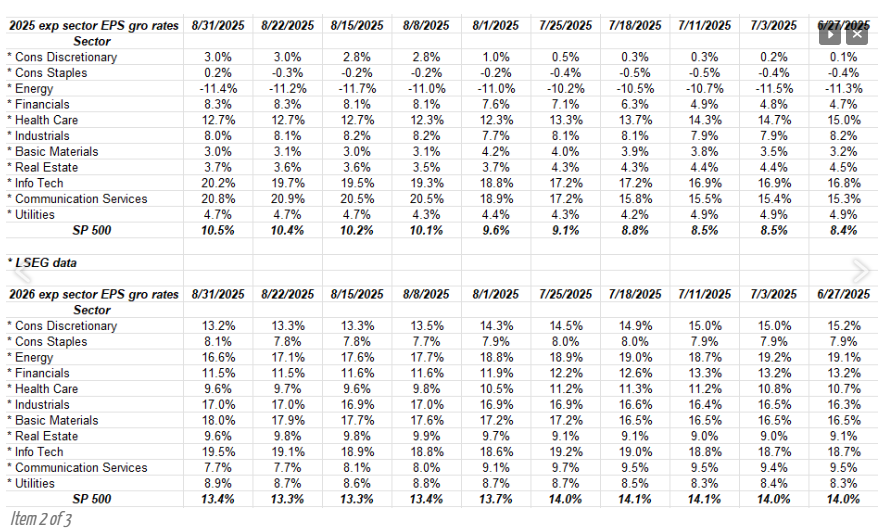

Fairly arduous to imagine, given what we have been going through in early April ’25 with “Liberation Day” however the estimated SP 500 EPS development has risen from 8% in late June ’25 to 10% by late August ’25.

Doesn’t look like quite a bit however it’s a much bigger transfer than you’d suppose in 8 weeks time.

Charges of Change

Since late June ’25 all three SP 500 EPS estimates for calendar ’25, ’26 and ’27 have moved greater, and never by a bit bit.

The “charges of change” are all bettering throughout most time collection.

It’s much more uncommon to see the ahead years like ’26 and ’27 transferring greater at the moment: the traditional sample is to be seeing slight revisions decrease.

Ahead 4-quarter estimates:

- 8/31/25: $283.34 (finish of month is Sunday, in order that date is getting used)

- 8/22/25: $283.03

- 8/15/25: $282.02

- 8/8/25: $282.57

- 8/01/25: $281.15

- 7/25/25: $281.37

- 7/18/25: $280.83

- 7/11/25: $280.60

- 7/03/25: $279.92

- 6/27/25: $269.60

On this weekly development of the forward4-quarter estimate, there was just one week – the final week of July to the primary week of August – that the sequential FFQE truly declined from the earlier week’s estimate.

(Bear in mind, the ahead 4-quarter estimate covers the interval from Q3 ’25 via Q2’26, so sure it’s a number one indicator for SP 500 earnings, whereas the overwhelming majority of the info is backward trying.)

Wanting Ahead to the Sector

Know-how and communication providers are driving all the expansion (or most of it anyway) within the SP 500: take a look at the change in anticipated calendar ’25 EPS development charges for know-how and communication providers since June 27 ’25.

Subsequent 12 months – 2026 – is the underside half of the above desk, and it’s nonetheless fairly steady.

Abstract / Conclusion

Haven’t executed a weekly replace shortly, regardless that the numbers have been up to date each week.

It’s arduous to explain how robust this quarter’s outcomes have been: the SP 500 EPS “upside shock” remains to be elevated at 7.8%. What’s possibly extra attention-grabbing is that the SP 500 income upside shock is 2.5%, which is effectively above 2023’s and 2024 numbers, regardless that the SP 500 returned 25% every of these years.

Makes you marvel if there’s a disconnect with the labor market weak point that appears to be talked about a lot. Granted, DOGE layoffs, immigration losses and AI job reductions will matter, however solely immigration appears to be in full-force proper now.

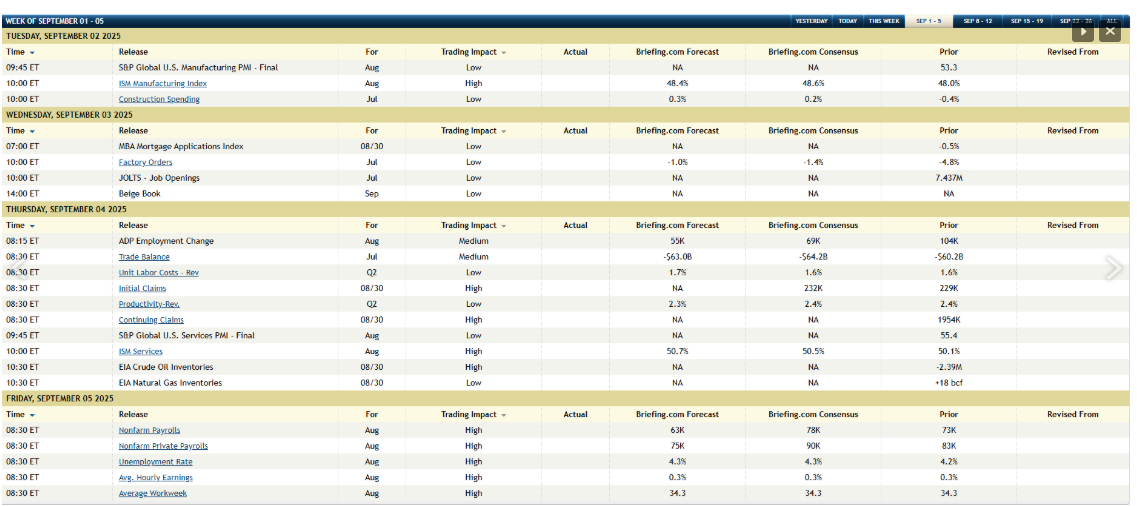

Subsequent week, the August nonfarm payroll report is predicted to point out job development lower than 100k for each the general and personal sector payroll development.

Right here’s the financial calendar for the week of 9/1/25:

It appears like we’re in uncharted waters with such robust Q2 ’25 GDP revisions and SP 500 earnings development and but speaking about Fed decreasing the fed funds charge, regardless that the three month, 1-year, 2-year, and yields are at the moment beneath the fed funds charge of 4.375% and have been for some time.

Thanks for studying.

***

Disclaimer: None of that is recommendation or a suggestion, however solely an opinion. Previous efficiency isn’t any assure of future outcomes. Readers ought to gauge their very own consolation with portfolio volatility and alter accordingly.