With simply 24 buying and selling days left in 2025 and the S&P 500 up about 14%, a robust yr for shares seems extremely probably. In case you are skeptical, contemplate that we’re popping out of among the best earnings seasons in years by the numbers, the fiscal stimulus from the One Large Stunning Invoice Act (OBBBA) that kicks in after New Yr’s is quick approaching, and the vacations are sometimes favorable for shares from a seasonal perspective.

In fact, yearly is completely different, however one component of the trail for shares this yr that’s fairly frequent is the truth that shares suffered a correction on the best way to sturdy good points. As you may see within the “It’s Not Over But, However 2025 Seems Like One other Yr of Large Features and a Giant Drawdown” chart, the S&P 500 skilled a drawdown of 18.9% this yr however is definitely up greater than 13% for the yr. This sample will not be unusual, because the chart illustrates. In truth, the common drawdown in a given calendar yr has been over 14% since 1980, whereas the S&P 500 has gained a median of 10.7% per yr throughout that point. Double-digit intra-year declines usually include double-digit annual good points, one of the crucial highly effective messages in investing. It’s straightforward to get scared out of the market when volatility arrives, so these traders who maintain this sample in thoughts must be extra assured holding on by the powerful occasions.

Volatility is sort of a toll that traders pay on the highway to enticing long-term returns. This yr presents us this highly effective lesson as soon as once more.

It’s Not Over But, However 2025 Seems Like One other Yr of Large Features and a Giant Drawdown

Supply: LPL Analysis, FactSet 11/25/25

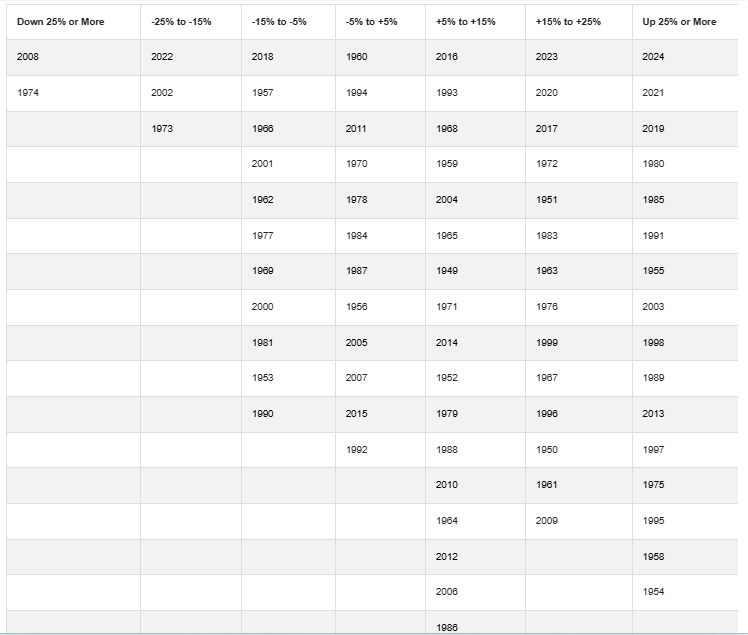

It’s additionally instructive to group annual returns and stack them, as we’ve performed within the “Optimistic Years Dominate Inventory Market Historical past” chart.

Optimistic Years Dominate Inventory Market Historical past

S&P 500 Efficiency (1950-2025)

*2025 worth achieve for the S&P 500 is yr so far by 11/24/25. Information collection: 1950-Current.

Supply: LPL Analysis, FactSet 11/25/25

Over 75 years for the S&P 500 (and its predecessor) and shares have solely been down 25% or extra twice — in 1974 and 2008. Solely 5 occasions whole has the index misplaced over 15% in a calendar yr. When these outliers — all related to skyrocketing inflation, recessions, monetary crises, or rate of interest shocks — are eliminated, the image that emerges is evident. Shares normally go up.

Traditionally, the S&P 500 has performed higher than a 5% loss in a calendar yr 79% of the time, with good points 75% of the time. Over all three-year rolling intervals by month since 1950, the S&P 500 was larger 85% of the time. Over 10 years, these odds go as much as 92%, and that’s excluding dividends, which makes these numbers even higher. Backside line, longer time frames than a yr produce even larger frequencies of good points, making staying the course one of the best method in most market environments.

***

Vital Disclosures

This materials is for common info solely and isn’t supposed to offer particular recommendation or suggestions for any particular person. There isn’t any assurance that the views or methods mentioned are appropriate for all traders. To find out which funding(s) could also be applicable for you, please seek the advice of your monetary skilled previous to investing.