Market Overview: S&P 500 Emini Futures

The bulls want follow-through shopping for to extend the chances of retesting the all-time excessive. If the market trades greater, the bears desire a double prime bear flag with the December 26 excessive or a decrease excessive main pattern reversal.

S&P 500 Emini Futures

The Weekly S&P 500 Emini Chart

- This week’s Emini candlestick was an enormous bull bar closing close to its excessive.

- Final week, we stated that the market should commerce barely decrease in direction of the October/November lows or the bull pattern line space. Merchants would see if the bears may create a follow-through bear bar or if the market would commerce barely decrease however shut with a protracted tail beneath or a bull physique as a substitute.

- The market opened decrease however reversed to shut as an enormous bull bar.

- The bears obtained a two-legged pullback from a big wedge (Mar 21, Jul 16, and Dec 6), an embedded wedge (Aug 30, Oct 17, and Dec 6) and a micro wedge (Nov 22, Nov 29, and Dec 6).

- They wished a robust second leg sideways to down however weren’t in a position to create a follow-through bear bar buying and selling beneath the 20-week EMA. The bears should not but as sturdy as they hoped to be.

- If the market trades greater, they need a double prime bear flag with the December 26 excessive or a decrease excessive main pattern reversal.

- They need to create consecutive bear bars closing close to their lows to persuade merchants that they’re again in management.

- The bulls see the market as being in a broad bull channel and need the market to proceed sideways to up for months.

- They see the present transfer as a two-legged pullback and need the market to renew greater from a double backside bull flag (Nov 4 and Jan 13).

- They hope the pullback can have poor follow-through promoting. To this point, that is the case.

- They need the 20-week EMA, the October/November lows, or the bull pattern line to behave as help.

- Since this week’s candlestick is an enormous bull bar closing close to its excessive, it’s a purchase sign bar for subsequent week.

- As a result of the weekly candlestick closed close to its excessive, the market might hole up on Tuesday. Small gaps often shut early.

- The market might commerce at the very least a bit greater.

- Merchants will see if the bulls can create a follow-through bull bar. In the event that they do, the chances of a retest of the all-time excessive will enhance.

- Or will the market commerce barely greater however shut with a protracted tail or a bear physique as a substitute?

- The bears have to do extra and create sustained follow-through promoting to persuade merchants that they’re again in management. They haven’t but been in a position to take action.

- If the pullback stays sideways and shallow (overlapping candlesticks, with bull bars, doji(s), and candlesticks with lengthy tails beneath), the chances of a bull pattern resumption will enhance after that.

- For now, odds barely favor the pullback to be minor and never result in a reversal.

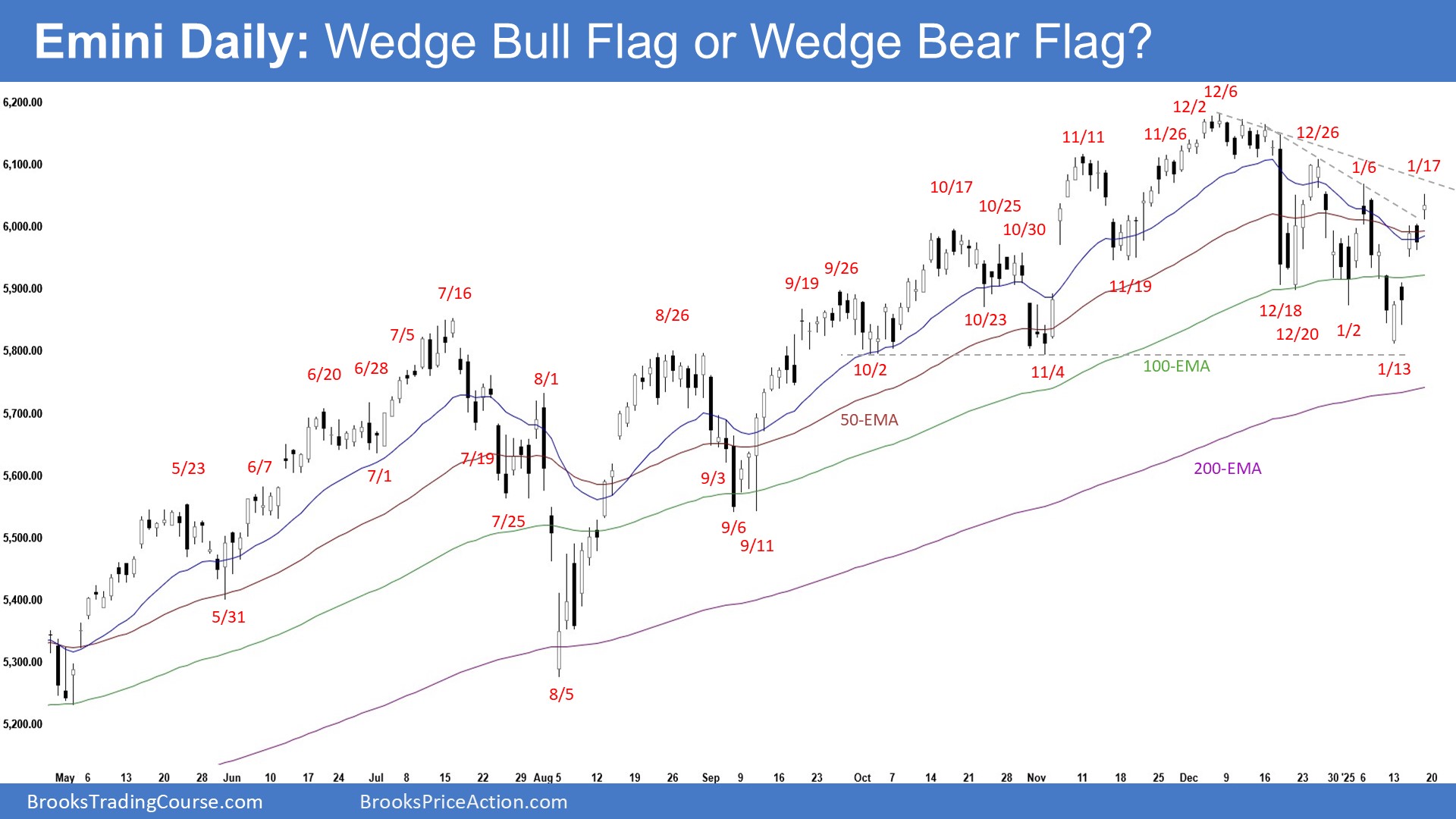

The Day by day S&P 500 Emini Chart

- The market opened decrease on Monday however closed as a bull bar. The market then traded sideways to up for the remainder of the week. Friday gapped up and closed as a bull doji with outstanding tails.

- Final week, we stated that the market should commerce at the very least a bit decrease. Merchants would see if the bears may create follow-through promoting or if the bulls would be capable of create a reversal from a wedge bull flag as a substitute.

- The bears weren’t in a position to create sustained follow-through promoting this week.

- They obtained a reversal from a big wedge sample (Mar 21, Jul 16, and Dec 6) and an embedded wedge (Aug 30, Oct 17, and Dec 6).

- They need a TBTL (ten bars, two legs) pullback. The pullback has fulfilled the minimal necessities.

- They need one other sturdy leg down to check the October/November lows and the 200-day EMA from a wedge bear flag (Dec 26, Jan 6, and Jan 17).

- They need the 20-day EMA or the bear pattern line to behave as resistance.

- If the market trades greater, they need a decrease excessive main pattern reversal and a double prime.

- The bulls see the market buying and selling in a broad bull channel and need the transfer to proceed for months. They need an limitless pullback bull pattern.

- They need a retest of the all-time excessive (Dec 6) from a wedge bull flag (Dec 20, Jan 2, and Jan 13) and a double backside bull flag (Nov 4 and Jan 13).

- They need the October/November lows or the 200-day EMA to behave as help.

- To this point, the market has transitioned right into a buying and selling vary.

- The bears have to create follow-through promoting buying and selling far beneath the 200-day EMA to indicate that they’re again in management. To this point, they haven’t but been in a position to do this.

- For now, the market might commerce barely greater early subsequent week.

- Merchants will see if the bulls can create follow-through shopping for breaking far above January 6 or December 26 excessive.

- Or will the market commerce barely greater however stall, forming a decrease excessive main pattern reversal as a substitute?

- For now, odds barely favor the pullback to be minor and never result in a reversal.