Market Overview: S&P 500 Emini Futures

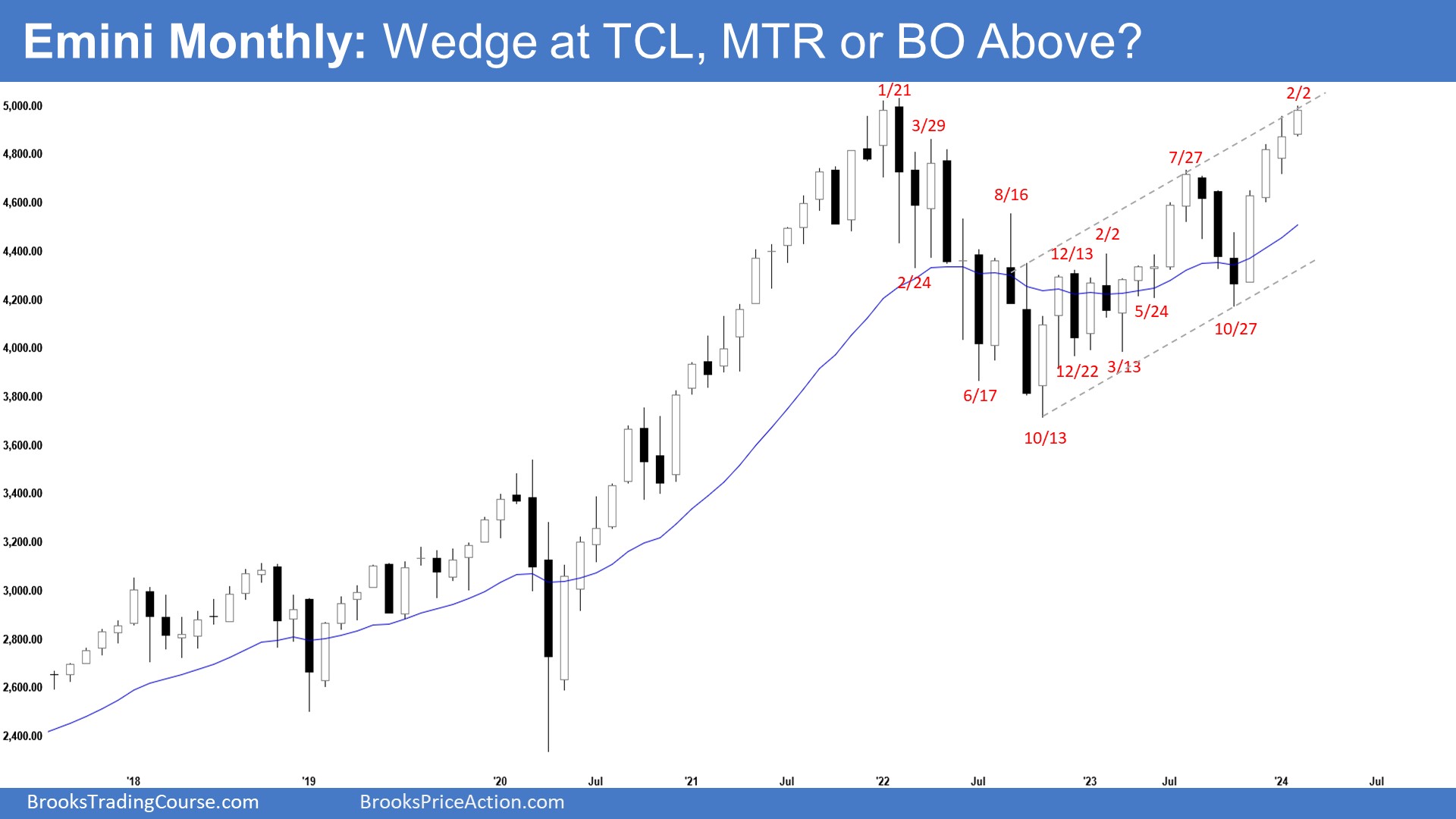

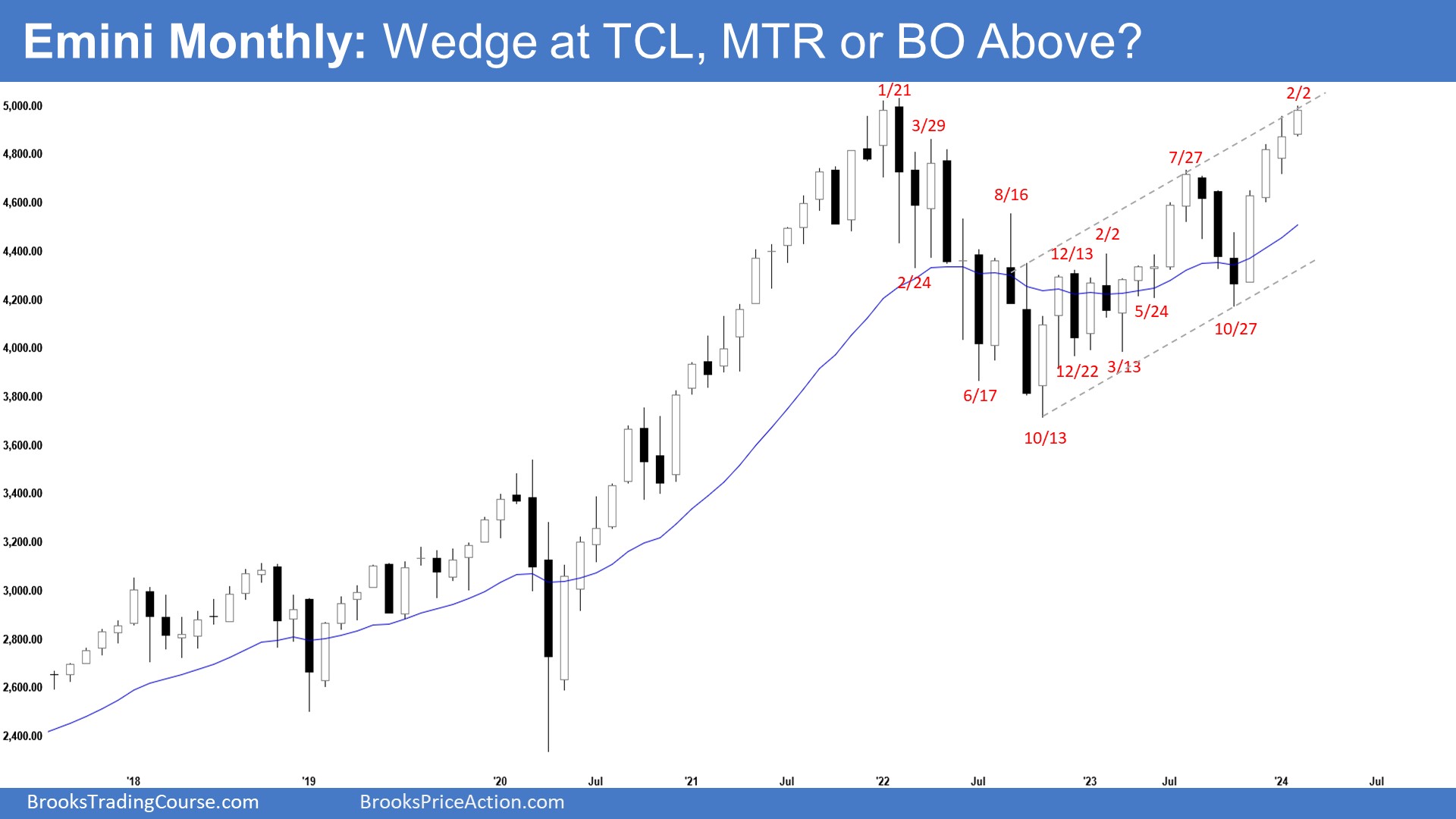

The month-to-month chart is forming an check all-time excessive. The bulls hope that the market will attain the all-time excessive and escape above. The bears need a reversal from a decrease excessive main development reversal or a double high and a big wedge sample (Dec 2, July 27, and Feb 2) forming on the development channel line space.

S&P 500 Emini Futures

S&P 500 Emini Futures-Month-to-month Chart

S&P 500 Emini Futures-Month-to-month Chart

S&P 500 Emini Futures-Month-to-month Chart

- The January month-to-month Emini candlestick was one other consecutive bull bar with a distinguished tail above.

- Final month, we stated that the chances barely favor January to commerce not less than somewhat larger. The all-time excessive is shut sufficient and might be examined in January.

- January traded larger however didn’t attain the all-time excessive.

- Beforehand, the bulls managed to create a decent bull channel from March to July.

- That will increase the chances of not less than a small second leg sideways to up after the July to October pullback. The second leg up is at the moment underway.

- February has traded above the January excessive. The bulls hope that the market will attain the all-time excessive and escape above.

- The bears see the present rally as a retest of the January 2022 all-time excessive and need a reversal from a decrease excessive main development reversal or a double high.

- In addition they see a big wedge sample (Dec 2, July 27, and Feb 2) forming on the development channel line space.

- Due to the robust rally within the final 3 months, they are going to want a powerful sign bar or a micro double high earlier than merchants can be prepared to promote extra aggressively.

- If February stalls across the January excessive space or barely above, it might kind a micro double high.

- Since January closed above the center of its vary, it’s a purchase sign bar albeit weaker.

- For now, odds barely favor February to commerce not less than somewhat larger which it has performed.

- The market stays At all times In Lengthy and the bull development stays intact (larger highs, larger lows).

- Nevertheless, the rally has additionally lasted a very long time and is barely climactic.

- A minor pullback can start inside just a few months earlier than the market resumes larger.

S&P 500 Emini-Weekly Chart

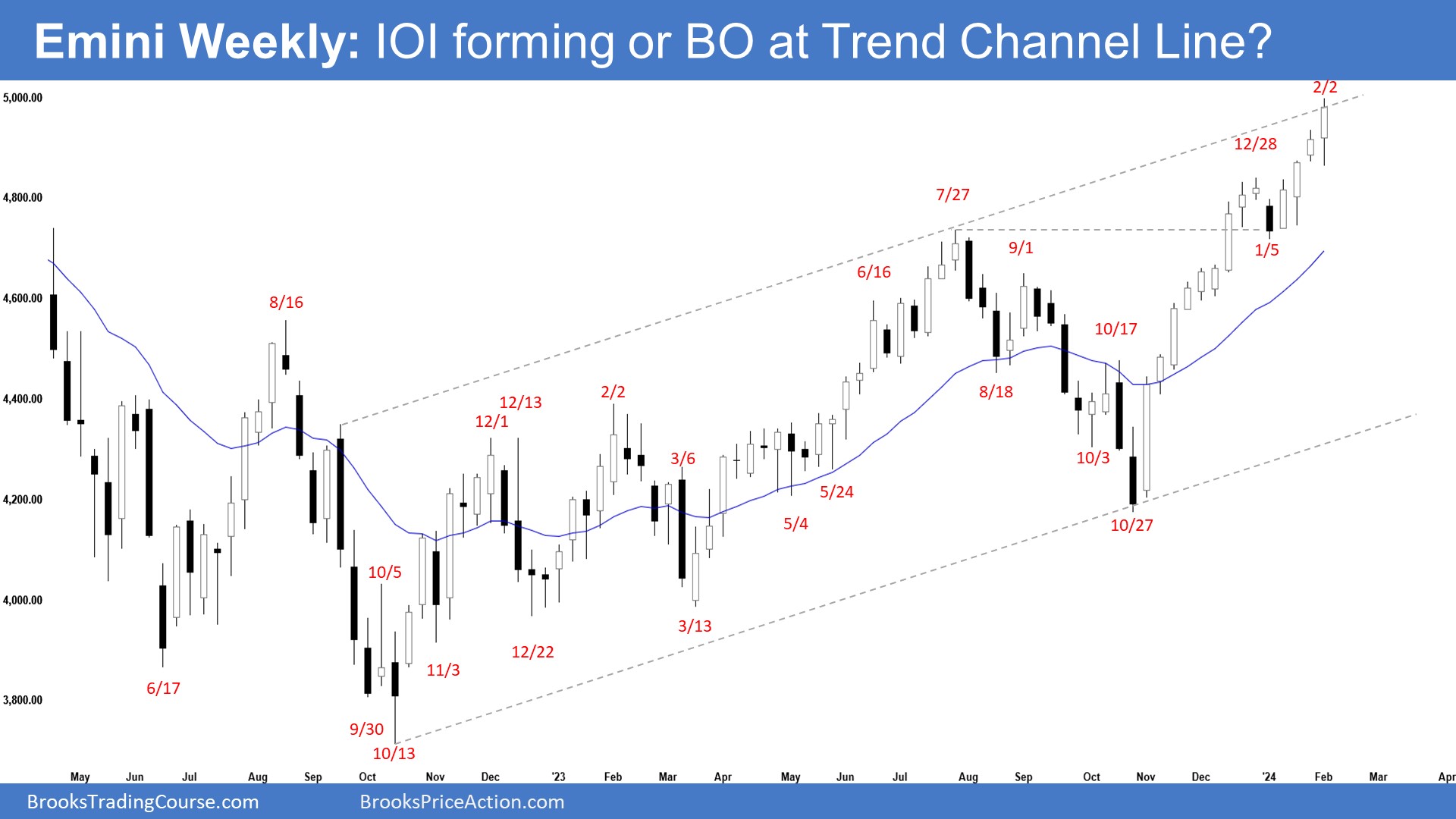

- This week’s Emini candlestick was an outdoor bull bar closing close to its excessive with a protracted tail beneath.

- Final week, we stated that the chances barely favor the market to nonetheless be At all times In Lengthy. Merchants will see if the bull can create one other follow-through bull bar and resume the transfer larger.

- The bulls proceed to get follow-through shopping for above the December 28 excessive.

- The transfer up since October is in a decent bull channel. Which means robust bulls.

- The subsequent goal for the bulls is the all-time excessive. They need a powerful breakout into a brand new all-time excessive territory, hoping that it’ll result in many months of sideways to up buying and selling.

- Swing bulls would proceed to carry their lengthy place established at decrease costs believing any pullback more likely to be minor and the market has transitioned right into a bull channel part.

- The bears hope that the robust rally is just a buy-vacuum check of what they consider to be a 38-month buying and selling vary excessive.

- They need a reversal from a decrease excessive main development reversal (with the all-time excessive) and a big wedge sample (Feb 2, July 27, and Feb 2) from across the development channel line space.

- They hope to get not less than a TBTL (Ten Bars, Two Legs) pullback.

- The issue with the bear’s case is that the rally could be very robust. The one bear bar within the rally had no follow-through promoting.

- They would want a powerful reversal bar, a micro double high or an inexpensive sign bar for a Low 2 setup earlier than they’d suppose to promote aggressively.

- The bears hope subsequent week will kind an inside bear bar, forming an ioi (inside-outside-inside) adopted by a breakout beneath, starting the TBTL pullback part.

- If the market trades larger, the bears need the Emini to stall across the development channel line space or the all-time excessive space.

- Since this week’s candlestick is an outdoor bull closing close to its excessive, it’s a purchase sign bar for subsequent week.

- Generally the candlestick after an outdoor bar is an inside bar, forming an ioi (inside-outside-inside) sample, a breakout mode sample.

- Whereas the market continues to be At all times In Lengthy, the rally has lasted a very long time and is barely climactic.

- Merchants count on a minor pullback (even when it lasts for weeks) and are on the lookout for indicators of this.

- Merchants will see if the bull can create one other follow-through bull bar and resume the transfer larger. Or will the market stall across the development channel line space?