The weekly candlestick fashioned was an inside bull doji, forming an breakout mode. The bulls need a breakout above, whereas the bears need a breakout under the within bar. For now, odds barely favor the present sideways-to-down pullback to be minor and a minimum of a small retest of the July 27 excessive after the present pullback.

Emini futures

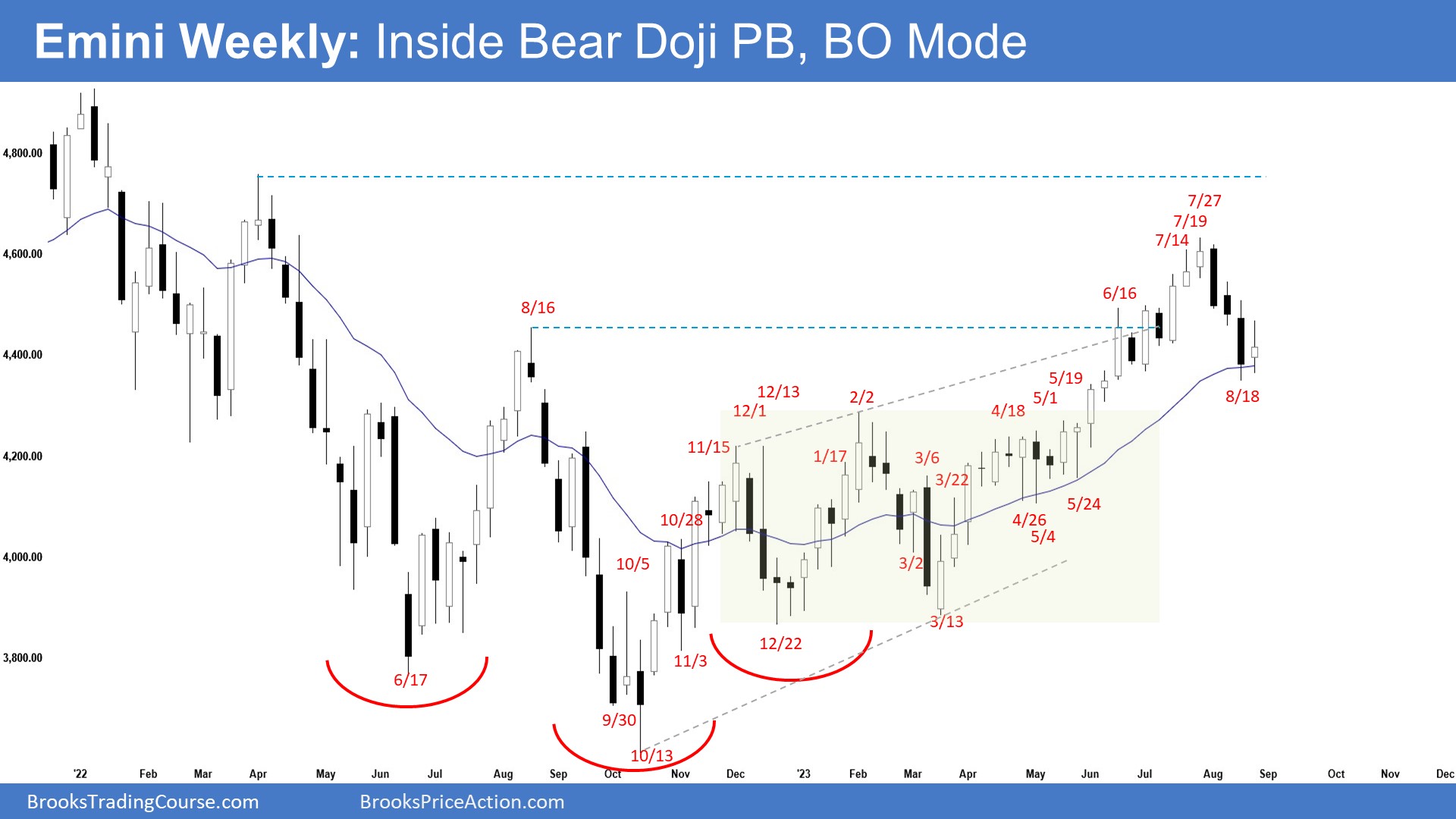

The Weekly S&P 500 Emini chart

- This week’s Emini candlestick was an inside bull doji, closing above the 20-week exponential transferring common.

- Final week, we mentioned that the percentages barely favor a minimum of a small second leg sideways to down after a small pullback and merchants will see if the bears can proceed to create consecutive bear bars or will the pullback stalls sideways across the 20-week EMA.

- This week traded greater earlier within the week however reversed to shut within the decrease half with a protracted tail above.

- The bears obtained a bigger pullback from a climactic transfer and examined the 20-week exponential transferring common.

- They might want to proceed creating consecutive robust bear bars buying and selling far under the 20-week exponential transferring common (EMA) to persuade merchants {that a} reversal down might be underway.

- Beforehand, the bulls obtained a robust pattern up (since March) in a good bull channel. That will increase the percentages of a minimum of a second leg sideways to up after the present pullback.

- They need a measured transfer utilizing the peak of the 6-month buying and selling vary which is able to take them to the March 2022 excessive space.

- The transfer up had lasted a very long time (4 months) and was climactic. The market wanted to commerce sideways to all the way down to work off the overbought situation. The minor pullback has begun.

- The bulls need the pullback to be shallow and weak (with overlapping bars, doji(s) and bull bars) and for the 20-week EMA to behave as help.

- Since this week’s candlestick was an inside bull doji, the market is in breakout mode.

- The bulls need a breakout above, whereas the bears need a breakout under the within bar.

- Generally, the candlestick after an inside bar is one other inside bar, through which case, it’s going to kind an ii (inside-inside) sample which is a breakout mode sample.

- Merchants will see if the bears can proceed to create a breakout under the 20-week EMA or will the pullback stall sideways across the present ranges.

- If subsequent week’s candlestick is a robust bull bar breaking above the within bar and shutting close to its excessive, it may result in a retest of the July 27 excessive.

- In a robust pattern, the market can resume the transfer from a pullback even and not using a robust sign bar.

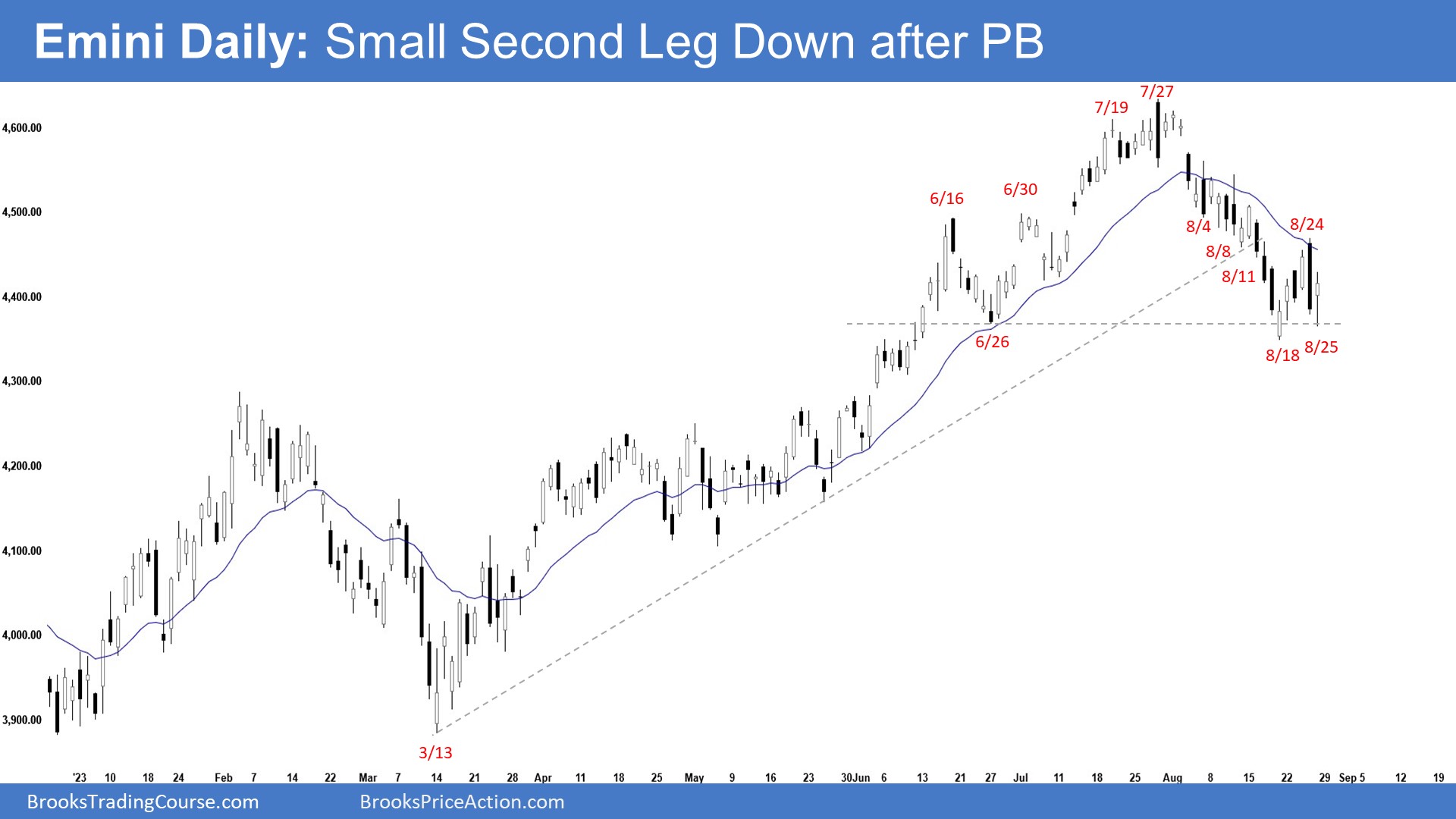

The Day by day S&P 500 Emini chart

- The Emini traded greater earlier within the week. Thursday gapped greater however reversed into an enormous exterior bear bar. Friday traded decrease however reversed right into a bull bar closing within the higher half of its vary.

- Final week, we mentioned that the market might commerce barely greater early this week. Nonetheless, due to the tight bear channel down, odds barely favor a minimum of a small second leg sideways to down after a pullback (bounce).

- Beforehand, the bears obtained a reversal from a climactic transfer, a wedge sample (Dec 13, Feb 2, and Jul 27), and a small wedge (Jun 30, Jun 19, and July 27).

- They need a minimum of a small second leg sideways to down after a pullback.

- They obtained that on Thursday however didn’t get follow-through promoting on Friday.

- A pullback would normally final a minimum of TBTL (Ten Bars, Two Legs). To this point, the minimal requirement has been fulfilled.

- They might want to proceed creating robust bear bars closing close to their lows to extend the percentages of a reversal down.

- If the market trades greater, they need a reversal down from a double-top bear flag with the August 24 excessive.

- The bulls hope that Thursday and Friday had been the small second leg sideways to all the way down to retest the pullback excessive (Aug 18).

- They need a reversal up from a double backside bull flag (Jun 22) and the next low main pattern reversal (Aug 25).

- The transfer up for the reason that March 13 low is in a good bull channel which suggests robust bulls.

- Odds favor a minimum of a small retest of the prior leg’s excessive excessive (Jul 27) after the present pullback.

- Since Friday was a bull bar closing within the higher half of its vary, it’s a purchase sign bar for Monday.

- If the bulls can create sustained follow-through shopping for early subsequent week, breaking far above the August 24 excessive, it’s going to improve the percentages of the retest of July 27 excessive.

- Merchants will see if the bulls can create follow-through shopping for or will the bears be capable of create a bigger second leg sideways to down.