Market Overview: S&P 500 Emini Futures

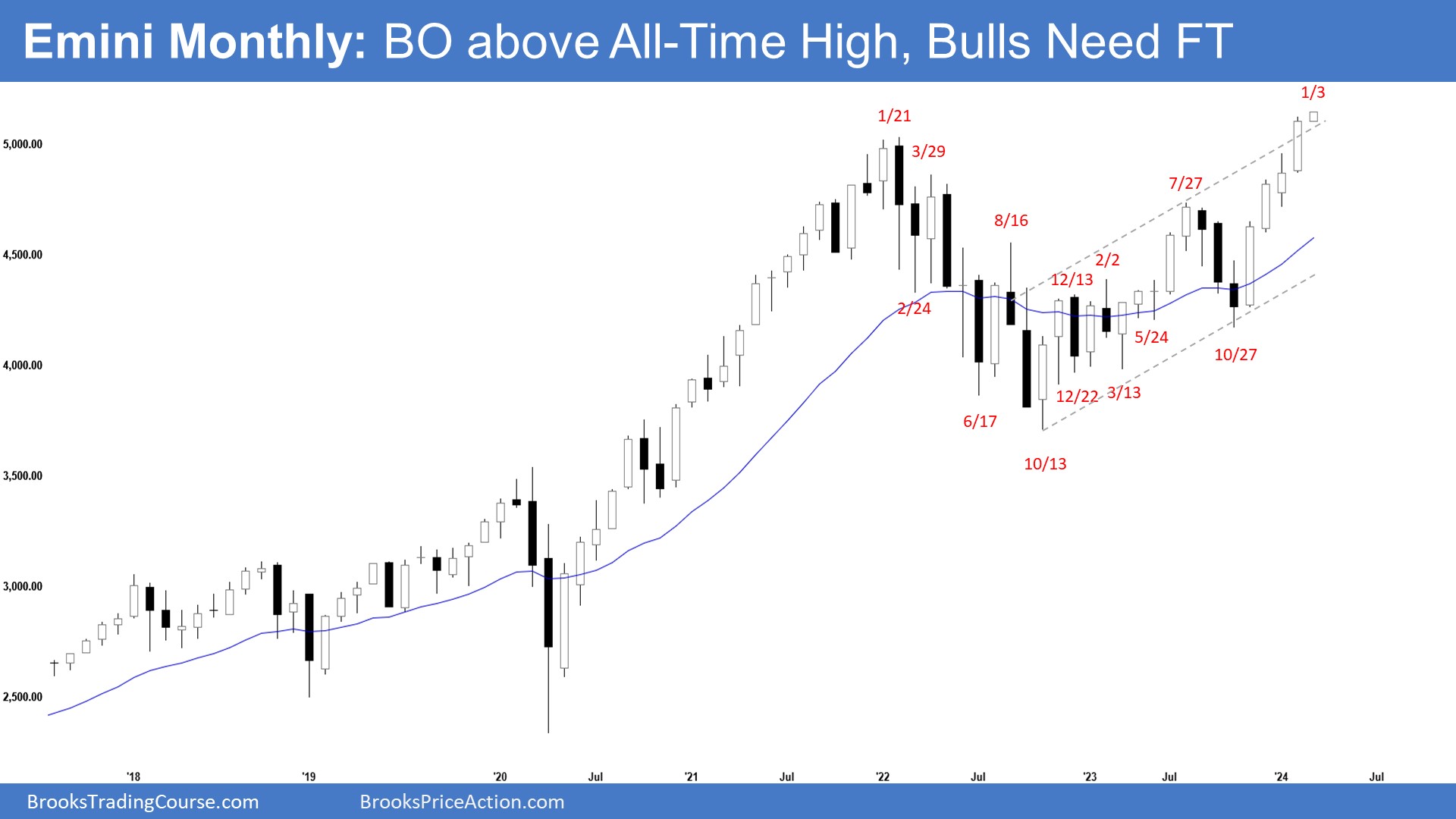

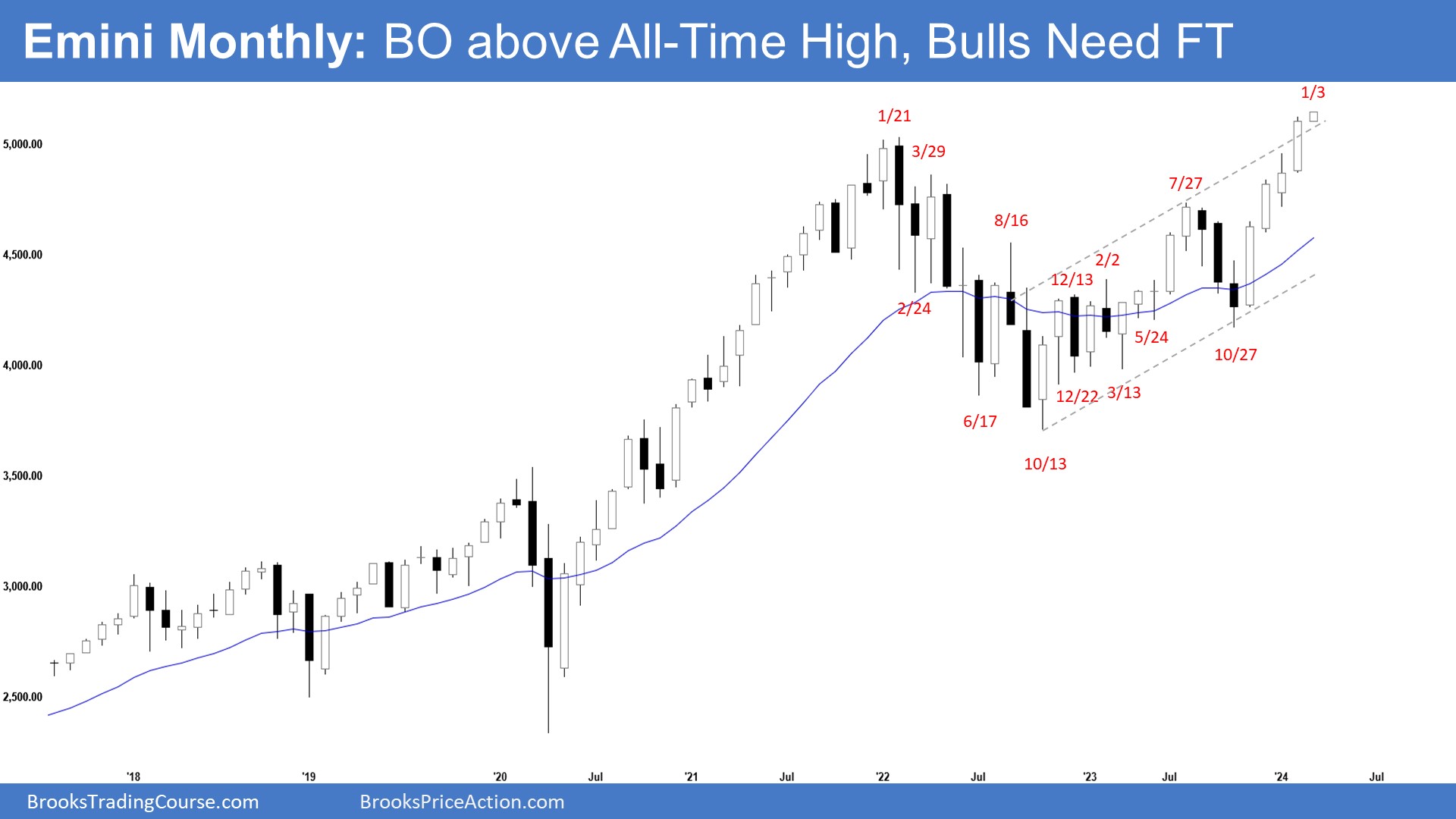

The month-to-month chart shaped an Emini breakout above the prior all-time excessive. The bulls might want to create a follow-through bull bar in March to substantiate the breakout even whether it is only a bull doji. The bears will want a robust promote sign bar or a micro double high earlier than merchants can be keen to promote extra aggressively.

S&P 500 Emini Futures

- The February month-to-month Emini candlestick was one other consecutive huge bull bar closing above the all-time excessive.

- Final month, we mentioned that the percentages barely favor February to commerce not less than a little bit larger. Nevertheless, the rally has additionally lasted a very long time and is barely climactic and a minor pullback can start inside a couple of months earlier than the market resumes larger.

- The bulls need a breakout above the all-time excessive and obtained it in February.

- They might want to create a follow-through bull bar in March to substantiate the breakout even whether it is only a bull doji.

- If the market trades decrease, they need it to be sideways with overlapping candlesticks.

- The bears see the present rally as a retest of the January 2022 all-time excessive and need a reversal from the next excessive main development reversal.

- In addition they see a big wedge sample (Dec 2, July 27, and Mar 1).

- Due to the robust rally within the final 4 months, they are going to want a robust promote sign bar or a micro double high earlier than merchants could be keen to promote extra aggressively. Thus far, there isn’t any robust sign bar but.

- Since February closed close to its excessive, it’s a purchase sign bar for March.

- For now, odds barely favor March to commerce not less than a little bit larger.

- The market stays At all times In Lengthy and the bull development stays intact (larger highs, larger lows).

- The rally has lasted a very long time and is barely climactic. Merchants are in search of indicators of a pullback. There are none but.

- Till the bears can create a robust promote sign bar, odds proceed to favor the market to commerce sideways to up.

S&P 500 Emini Weekly Chart

S&P 500 Emini Weekly Chart

S&P 500 Emini Weekly Chart

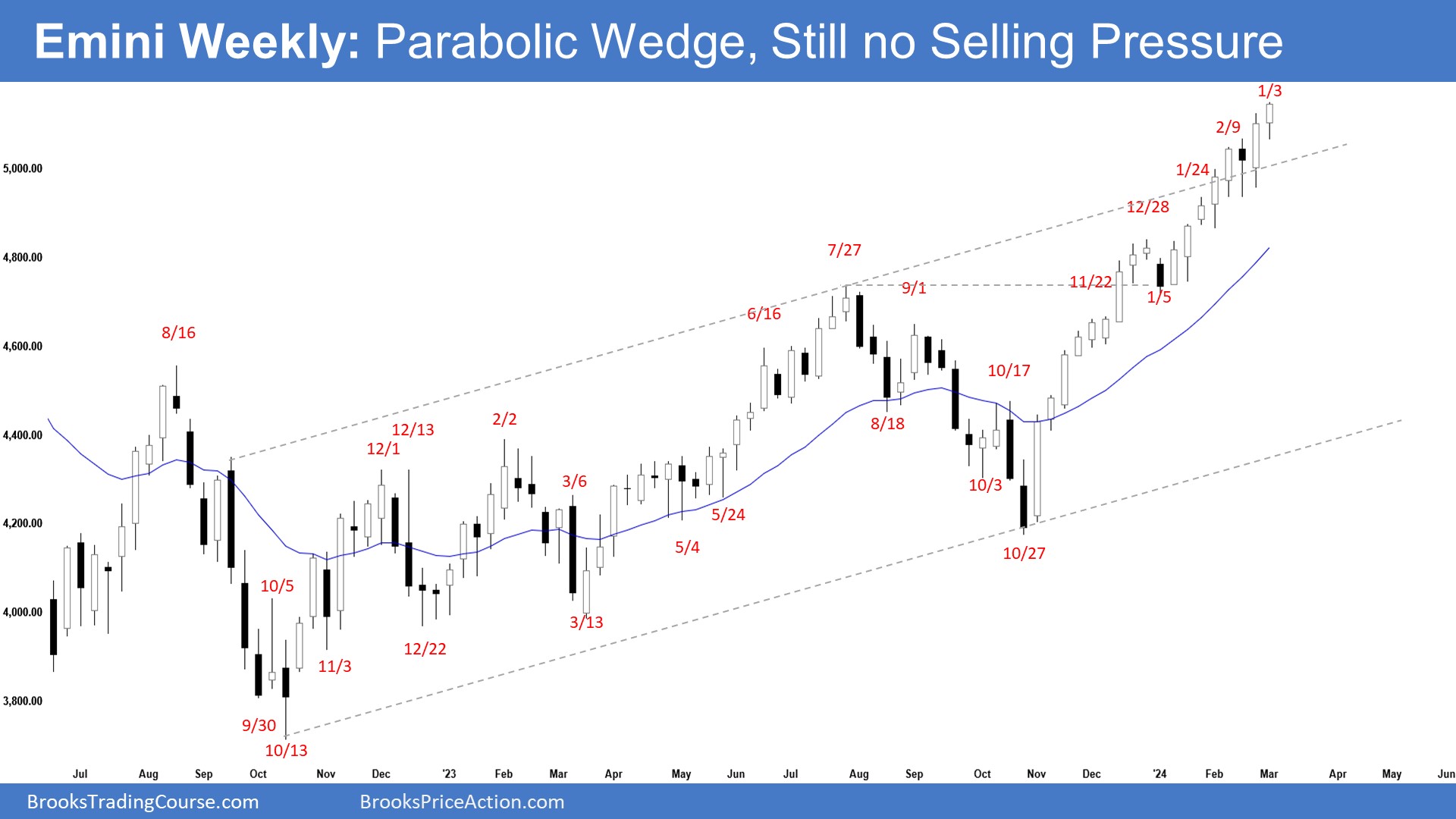

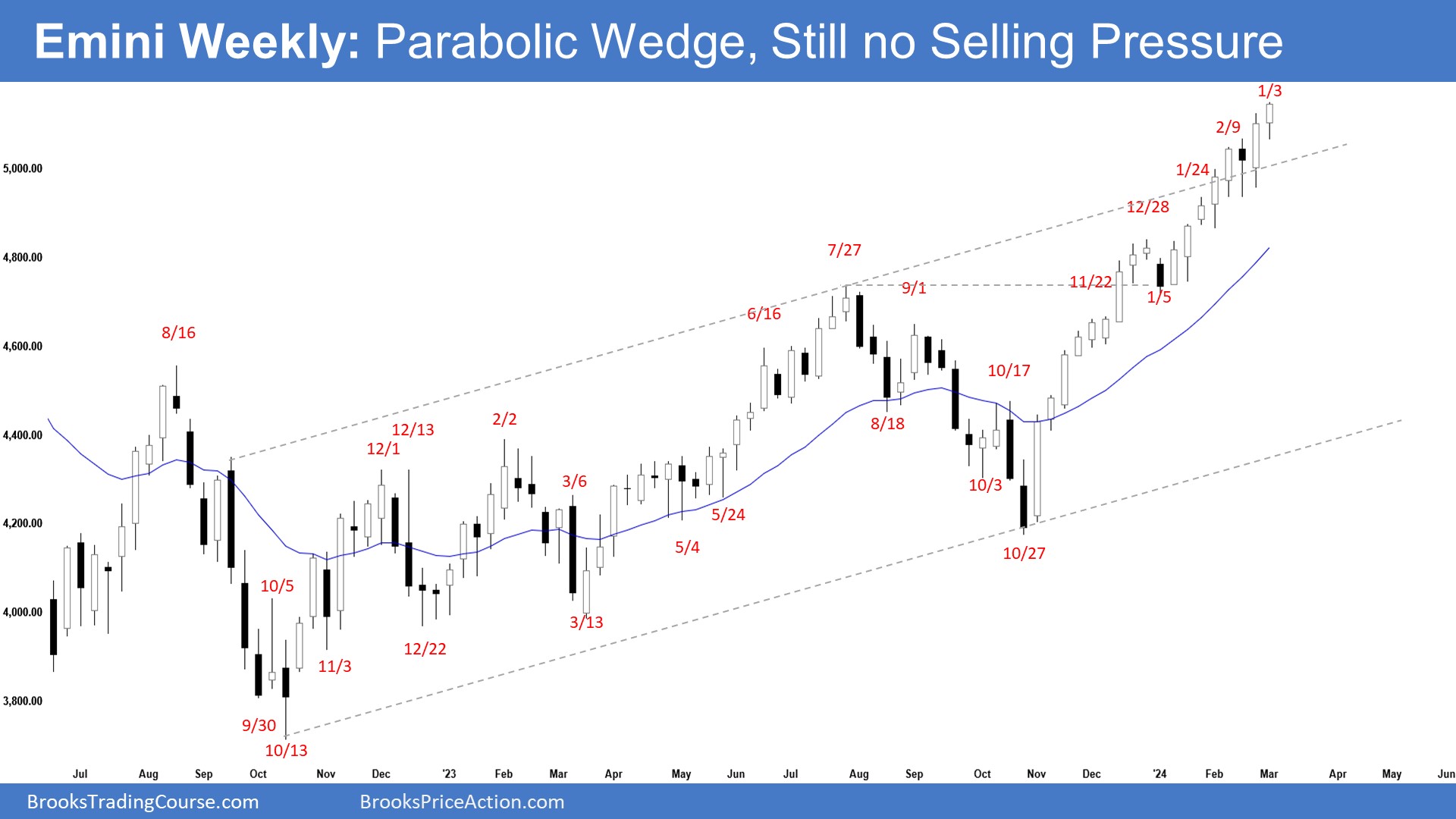

- This week’s Emini candlestick was a bull bar closing close to its excessive.

- Final week, we mentioned that whereas the market continues to be At all times In Lengthy, the rally has lasted a very long time and is barely climactic. Merchants will see if we begin to get extra promoting stress or will the bulls proceed to create follow-through shopping for.

- This week traded sideways to down earlier within the week however reversed larger by the top of the week. The bears are nonetheless not capable of create any promoting stress.

- The bulls have a good bull channel. Meaning robust bulls.

- They need a robust breakout into a brand new all-time excessive territory, hoping that it’s going to result in many months of sideways to up buying and selling.

- They might want to proceed to create sustained follow-through shopping for above the prior all-time excessive.

- We might also see some profit-taking exercise as soon as the market begins to stall.

- If a pullback begins, the bulls need it to be sideways and shallow, stuffed with bull bars, doji(s) and overlapping candlesticks.

- The bears hope that the robust rally is just a buy-vacuum take a look at of the prior all-time excessive.

- They need a reversal from the next excessive main development reversal and a big wedge sample (Feb 2, July 27, and Mar 1). They need a failed breakout above the all-time excessive and the development channel line.

- In addition they see a parabolic wedge within the third leg up since October (Nov 22, Dec 28, and Mar 1) and an embedded wedge (Jan 24, Feb 9, and Mar 1).

- They hope to get a TBTL (Ten Bars, Two Legs) pullback of not less than 5-to-10%. They need not less than a take a look at of the 20-week EMA.

- The issue with the bear’s case is that the rally may be very robust. They would wish to create a couple of robust bear bars to point that they’re not less than quickly again in management. Thus far, they haven’t but been ready to take action.

- Since this week’s candlestick is a bull bar closing close to its excessive, it’s a purchase sign bar for subsequent week.

- The market continues to be At all times In Lengthy and odds barely favor the market to commerce not less than a little bit larger.

- The rally has lasted a very long time and is barely climactic. Merchants are in search of indicators of a minor pullback however there are none nonetheless.

- The bears proceed to fail creating any promoting stress.

- Till the bears can create robust bear bars, merchants is not going to be keen to promote aggressively.

- Typically, a euphoric market (as it’s now) can proceed larger right into a blow-off high (parabolic climax).

- Merchants will see if the bulls proceed to create extra follow-through shopping for.