Emini every day chart

- The will doubtless get a second leg down after final Thursday’s (July twenty seventh) exterior down bar. The skin down bar is just not sufficient to show the market right into a bear development, however it’s sufficient of a shock to make the market go sideways for the following a number of bars.

- The market has held above the shifting common (blue line) for over 40 bars. This means that the bull channel is powerful and can restrict the draw back.

- Merchants are glad to purchase above the shifting common when the momentum up is powerful. Nonetheless, merchants will likely be much less prepared to purchase far above the shifting common as soon as the market goes sideways. The second common displays the honest value, and shopping for above it’s paying a premium. One will solely pay a premium in the event that they thought the market could be larger in a brief time period.

- The bears will in all probability get their second leg down within the subsequent day or two. The July twenty seventh bear breakout was sufficient of a shock that the market will doubtless get a second leg down.

- Total, the market will in all probability get a second leg down, check under the July twenty seventh low and attain the shifting common. Even when the market goes above the July twenty seventh excessive first, sellers are in all probability not far above.

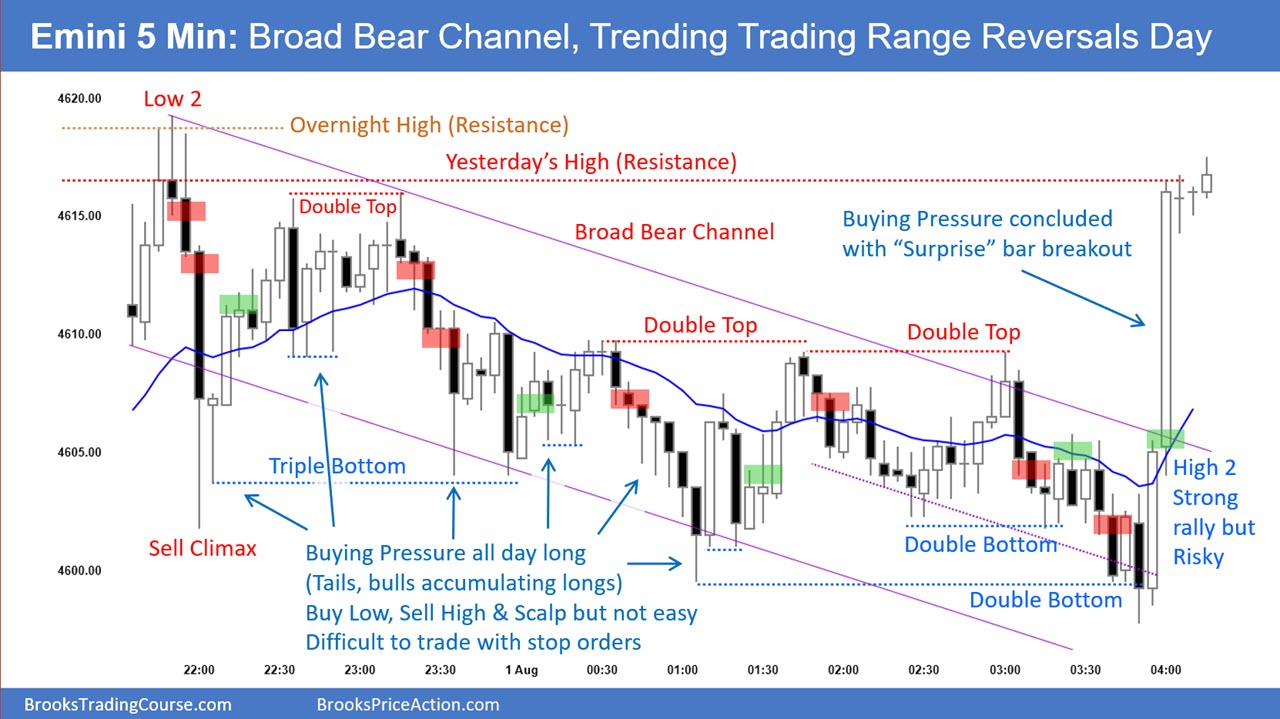

Emini 5-minute chart and what to anticipate right this moment

- Emini is down 16 factors within the in a single day Globex session.

- The in a single day Globex market offered off and is testing yesterday’s lows.

- The bulls desire a double backside with yesterday’s lows and a reversal up.

- The bears are hopeful that the in a single day selloff begins a second leg down following final Thursday’s massive exterior down bar on the every day chart.

- Merchants ought to assume that right this moment can have a number of buying and selling vary value motion on the open. Most merchants ought to think about not buying and selling for the primary 6-12 bars. By ready on the open, a dealer positive factors certainty in regards to the day’s construction.

- On the open, merchants ought to keep in mind that solely three doable outcomes exist. A development from the open, a buying and selling vary open (breakout mode open), or a gap reversal. Out of the three, a buying and selling vary open is almost definitely.

- Most merchants ought to try to catch the opening swing that usually begins earlier than the tip of the second hour.

- It’s common for the opening swing to start following a double prime/backside or a wedge prime/backside. Because of this a dealer can typically be affected person on the open, anticipate one of many patterns talked about above to develop, and search for a reputable cease entry to try to catch the opening swing.

- Lastly, merchants needs to be ready for a doable bear development day because the bears will try to get a second leg down and check the July twenty seventh excessive on the every day chart.

Yesterday’s Emini setups

Listed here are a number of cheap stop-entry setups from yesterday. I present every purchase entry with a inexperienced rectangle and every promote entry with a pink rectangle. Patrons of each the Brooks Buying and selling Course and Encyclopedia of Chart Patterns have entry to a close to 4-year library of extra detailed explanations of swing commerce setups (see On-line Course/BTC Every day Setups). Encyclopedia members get present every day charts added to Encyclopedia.

My objective with these charts is to current an All the time In perspective. If a dealer was making an attempt to be All the time In or almost All the time Able all day, and he was not at the moment out there, these entries could be logical instances for him to enter. These, subsequently, are swing entries.

You will need to perceive that the majority swing setups don’t result in swing trades. As quickly as merchants are disenchanted, many exit. Those that exit choose to get out with a small revenue (scalp), however typically must exit with a small loss.

If the danger is simply too huge on your account, you must anticipate trades with much less threat or commerce another market just like the Micro Emini.