- The bulls gapped up yesterday and offered off final within the day, creating a big outdoors down day. Yesterday was a sufficiently big bear shock that the chances favor a second leg down.

- The market has been above the shifting common for properly over 35 bars, and yesterday was an settlement that the market is just too costly.

- The shifting common displays the truthful value, and bulls are completely happy to purchase excessive and above the “truthful value” (shifting common) when momentum is driving the market up. Nevertheless, as soon as the second disappears, merchants will now not be keen to purchase excessive, and the market will start to go sideways as merchants resolve they need to purchase decrease.

- Finally, everybody desires to purchase on the shifting common, and the market usually will get a promote vacuum.

- Yesterday’s bear breakout bar is robust sufficient that the chances favor a second leg down. The market will in all probability take a look at the June thirtieth breakout level excessive and the 4,500 large spherical quantity.

- The bears need immediately to have sturdy follow-through promoting after yesterday’s bear breakout. Nevertheless, the bar is large, which suggests it’s climactic and should result in merchants shopping for the shut for a scalp. This is able to result in a short pullback and a second leg down.

- Total, yesterday was sufficient of a shock that the Bears will doubtless get a second leg down after any pullback.

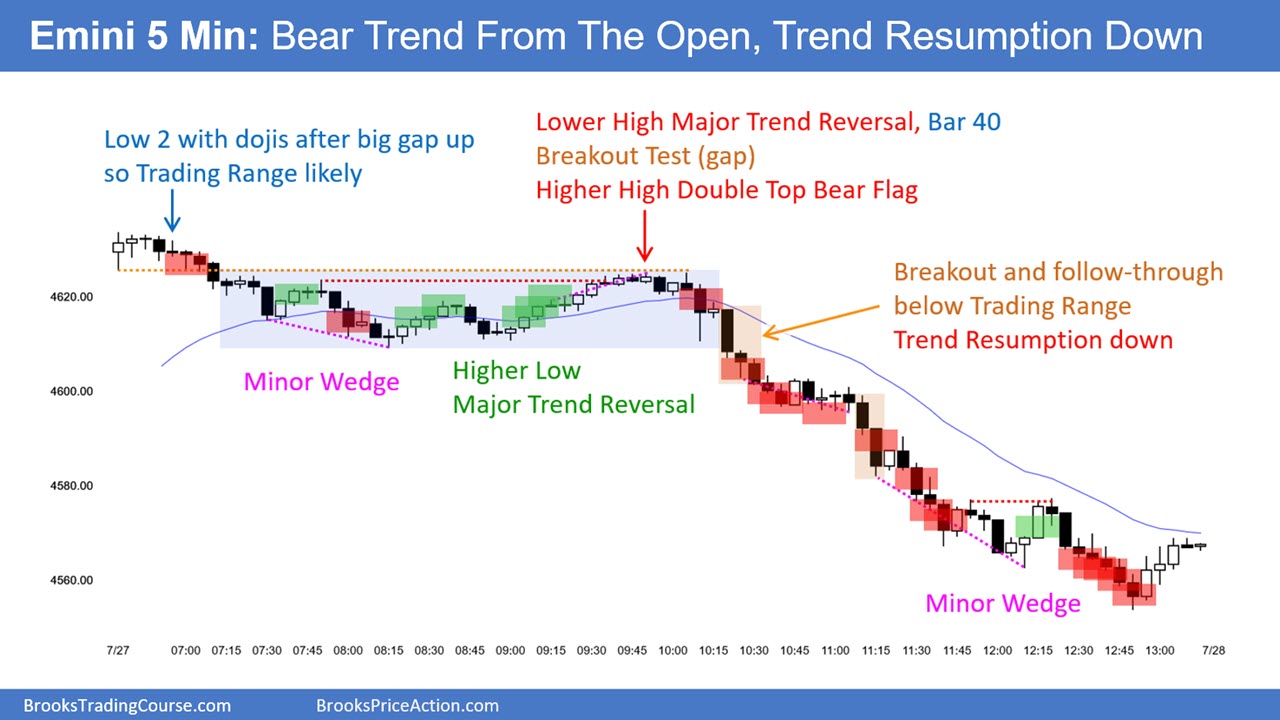

E-Mini 5-Minute Chart and What to Count on Immediately

- Yesterday’s selloff into the shut was climactic. There’s a 75% probability of sideways buying and selling lasting two hours, starting earlier than the tip of the second hour (bar 24).

- There’s a 50% probability of follow-through promoting and a 75% probability of sideways buying and selling, as talked about above.

- There’s solely a 25% probability that immediately can be one other sturdy small pullback bear pattern day.

- Merchants ought to count on the primary two hours of the day to have quite a lot of buying and selling vary value motion. This implies merchants ought to use warning and count on most breakouts to fail.

- Immediately is Friday, so weekly help and resistance is vital. The market is close to the open of the week is 4,575.25. This can in all probability be an vital magnet immediately as bears need the market to shut beneath it, making a bear bar on the weekly chart.

- Merchants ought to take note of the open of the day because the bears need follow-through after yesterday’s bear breakout, and the bulls need to forestall it.

- Lastly, immediately is Friday, which suggests there’s an elevated danger of a shock breakout up or down within the remaining hours of the day as merchants resolve on the shut of the weekly chart. Merchants must be open to any risk and should not deny the value motion in entrance of them.

Yesterday’s Emini setups

Listed below are a number of affordable stop-entry setups from yesterday. I present every purchase entry with a inexperienced rectangle and every promote entry with a purple rectangle. Patrons of each the Brooks Buying and selling Course and Encyclopedia of Chart Patterns have entry to a close to 4-year library of extra detailed explanations of swing commerce setups (see On-line Course/BTC Each day Setups). Encyclopedia members get present each day charts added to Encyclopedia.

My purpose with these charts is to current an At all times In perspective. If a dealer was making an attempt to be At all times In or practically At all times Ready all day, and he was not at the moment out there, these entries can be logical instances for him to enter. These, subsequently, are swing entries.

You will need to perceive that almost all swing setups don’t result in swing trades. As quickly as merchants are disenchanted, many exit. Those that exit desire to get out with a small revenue (scalp), however usually must exit with a small loss.

If the chance is just too large on your account, you need to await trades with much less danger or commerce another market just like the Micro Emini.