Market Overview: S&P 500 Emini Futures

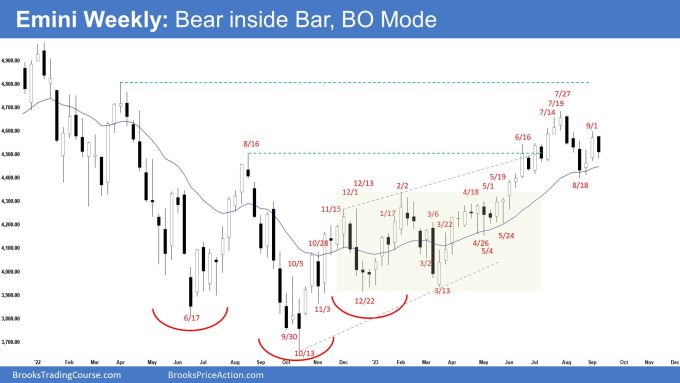

The weekly chart fashioned an Bear Inside Bar which suggests the market is in breakout mode. The bears desire a breakout beneath whereas the bulls desire a breakout above the within bar. The primary breakout from an inside bar can fail 50% of the time. Generally, the candlestick after an inside bar is one other inside bar, forming an ii (inside inside) which is a breakout mode sample.

S&P500 Emini Futures

S&P 500 Emini Weekly Chart

- This week’s Emini candlestick was an inside bear bar with a distinguished tail beneath.

- Final week, we stated that odds barely favor the market to commerce no less than just a little increased and sure nonetheless At all times In Lengthy.

- The market traded sideways to down for the week and closed within the decrease half.

- Beforehand, the bulls bought a robust development up (since March) in a decent bull channel.

- That will increase the chances of no less than a second leg sideways to up after a pullback. The second leg sideways to up should still be underway.

- They hope that this week was merely a pullback and desire a breakout above the bear contained in the bar.

- The bulls desire a retest of the July 27 excessive adopted by a robust breakout above.

- The subsequent targets for the bulls are the March 2022 excessive space and the all-time excessive.

- If the market trades decrease, they need a reversal up from across the 20-week exponential transferring common or from a double-bottom bull flag with the August 18 low.

- Beforehand, the bears bought a pullback from a climactic transfer and examined the 20-week exponential transferring common.

- They need one other leg down from a decrease excessive main development reversal.

- They might want to create follow-through promoting buying and selling far beneath the 20-week exponential transferring common to extend the chances of a deeper pullback.

- Since this week’s candlestick was an inside bar, the market is in breakout mode. The bulls desire a breakout above whereas the bears desire a breakout beneath the within bar.

- As a result of it’s a bear bar closing within the decrease half, the market could first escape beneath the within bar.

- The primary breakout from an inside bar can fail 50% of the time.

- Generally, the candlestick after an inside bar is one other inside bar, forming an ii (inside inside) which is a breakout mode sample.

- Whereas the Emini might nonetheless commerce just a little decrease, odds barely favor the market to nonetheless be At all times In Lengthy.

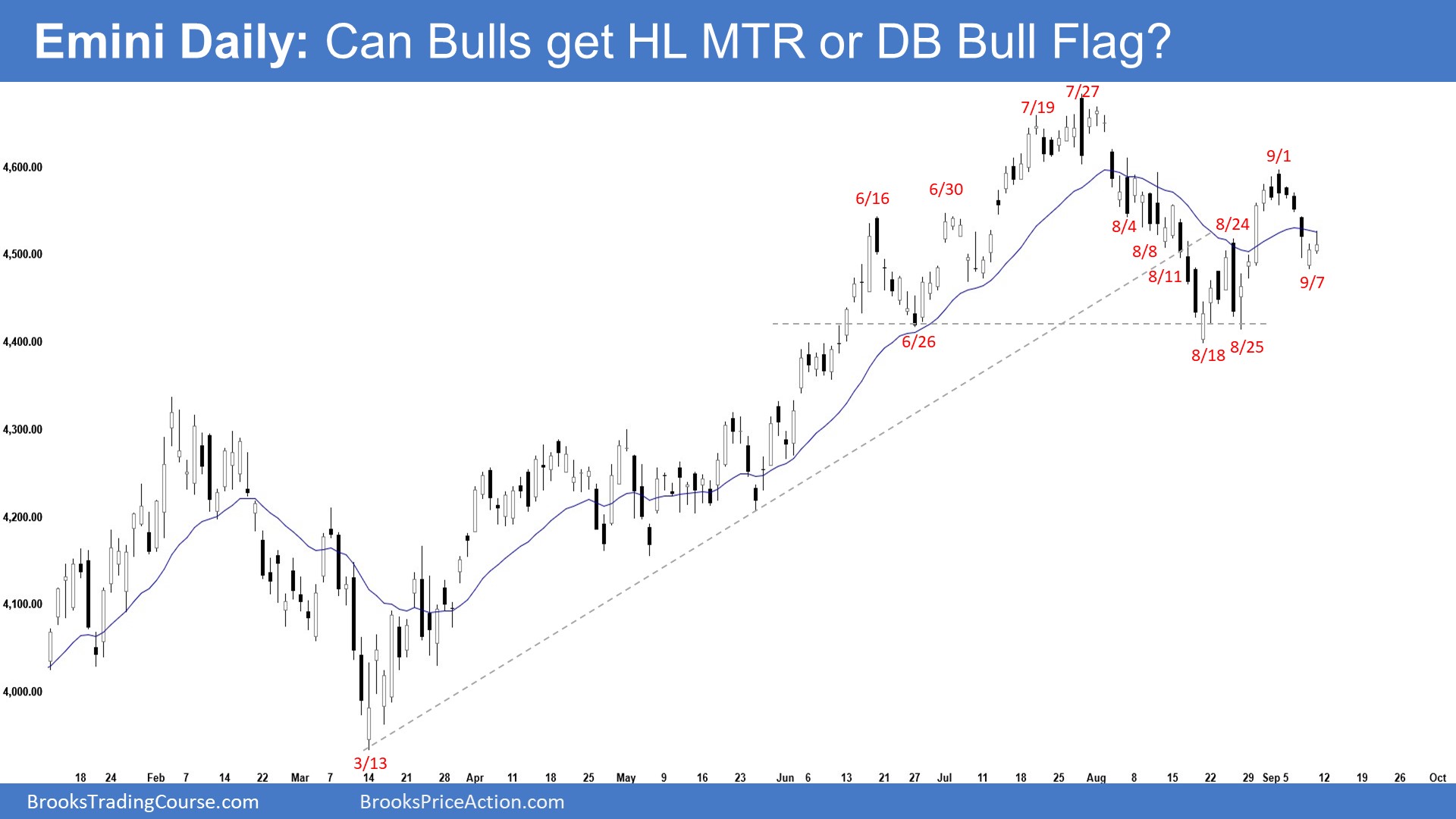

S&P 500 Emini Every day Chart

- The Emini traded sideways to down earlier within the week. Thursday gapped down however reversed right into a bull bar with some follow-through shopping for on Friday albeit weaker.

- Beforehand, we stated that odds favor no less than a small retest of the prior leg’s excessive excessive (Jul 27) after the present pullback.

- The bears bought a reversal from a climactic transfer and a wedge sample (Dec 13, Feb 2, and Jul 27).

- They need a second leg sideways to down from a decrease excessive main development reversal. It’s at present underway.

- They hope that Thursday and Friday have been merely a small pullback and wish one other robust leg down testing the August 18 low.

- They might want to proceed creating robust bear bars closing close to their lows, buying and selling far beneath the August 18 low to extend the chances of a reversal down.

- The bulls desire a reversal up from a better low main development reversal adopted by a retest of the July 27 excessive and a robust breakout above.

- If the market trades decrease, they need a reversal up from a double-bottom bull flag with the August 18 low.

- A pullback from a development would normally final no less than TBTL (Ten Bars, Two Legs). The present pullback which began from July 27 has fulfilled the minimal requirement.

- Since Friday was a bull bar doji closing within the decrease half of its vary, it’s a promote sign bar for Monday.

- Merchants will see if the bears can create follow-through promoting or will the market commerce barely decrease however discover patrons close to the August 18 low space.

- For now, whereas the Emini might nonetheless commerce just a little decrease, odds barely favor the market to nonetheless be At all times In Lengthy.