Yesterday was a kind of days when Jay Powell ought to have handed on its newest interview session. The message was obscure, and he didn’t appear to have many solutions at instances.

What is evident to me is that the Fed doesn’t know what comes subsequent, isn’t positive how lengthy charges could have to remain excessive and doesn’t even know if charges are tight sufficient to carry inflation again to focus on.

Inflation has come down rather a lot, and the labor market is exhibiting some indicators of slowing, however inflation at 3.5 to 4% is simply too excessive.

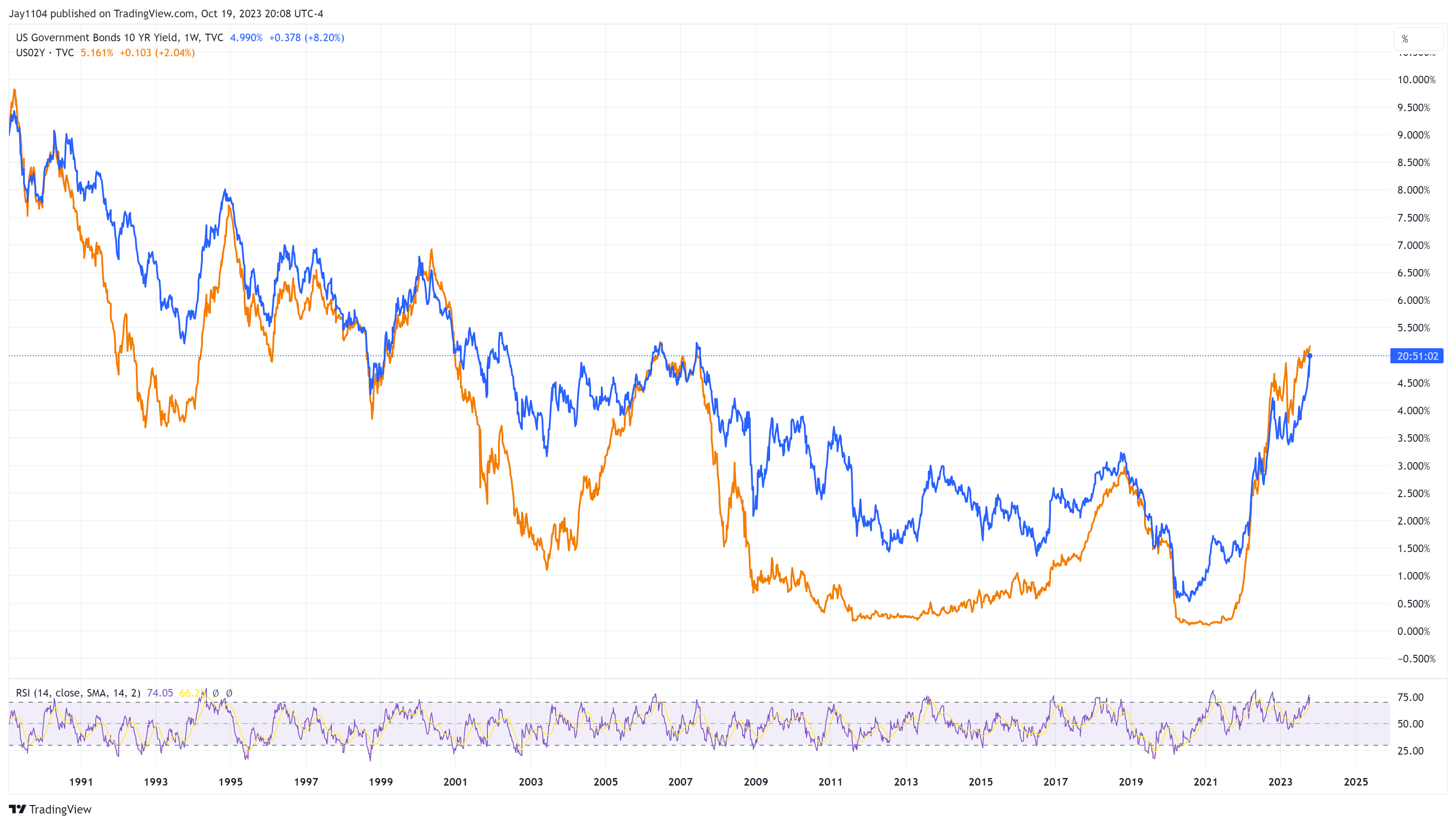

Yield Curve Steepens

The yield curve is now shortly steepening, rising to -17 bps. Some individuals suppose this can be a recession signal, however I don’t see it that manner. On this case, the is rising to the , not the 2-year, transferring away from the 10-year; it’s a massive distinction.

So long as the 2-year fee stays anchored across the 5% mark, I don’t suppose it’s a recession warning. As soon as the 2-year begins to fall, it’s a signal the market is beginning to anticipate fee cuts; that’s the recession warning. Proper now, we now have what appears to be a yield curve that is normalizing.

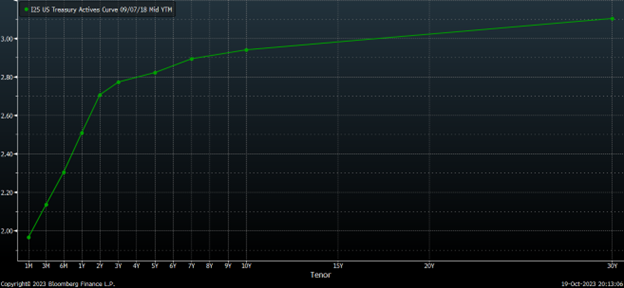

The chart beneath exhibits the yield curve in September 2018, which is what a normal-shaped yield curve ought to appear like.

Yield Curve

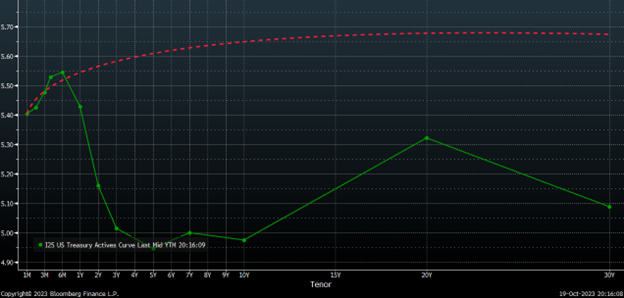

Which implies it may look extra like this as soon as full. Once more, that is what I believe is occurring. Solely time will inform.

New Yield Curve

S&P 500 Futures Eye 4,240

To date, the have fallen and given again a big chunk of the positive aspects from final week; I believe we are going to see the remainder of these positive aspects go away, and the futures fall again to that 4,240 stage for now.

Tesla Inventory Nosedives

Tesla (NASDAQ:) fell 9% and bought again to $220, and this is a crucial spot for the inventory, with help round $214; a breach of that stage wouldn’t be good.

Authentic Submit