I’m a agency believer in long-term pondering and sustaining an optimistic outlook on the longer term. If I’m being understated, I’d say I naturally see “the glass half full.” Given the selection, I would be a lifelong permabull somewhat than a permabear.

Staying optimistic may be robust, even with a long-term perspective. We inevitably face many years peppered with recessions, three or 4 bear markets, some deeper crashes, monetary and geopolitical crises, wars, political upheavals, and people utterly surprising occasions that catch us without warning.

However here is the important thing: I’m conscious these challenges may happen within the brief time period, but I stay bullish on the over the long term.

If you consider it, we’re all permabulls in a way. Our historical past as a species is a mixture of important moments, setbacks, and conflicts, but we rise every morning with a resolve to enhance our circumstances. If you look carefully, you’ll discover our collective story brimming with dedication, progress, innovation, and development.

I might pull up a chart of the S&P 500 to point out its enduring upward development, however in the present day, let’s discover present investor sentiment utilizing information from the American Affiliation of Particular person Buyers (AAII).

Final week’s stall within the S&P 500 (-0.93% on the time of writing) coincided with a dip in sentiment. In accordance with the AAII survey, solely 37.7% of respondents felt bullish this week, down from 45.5% the earlier week and over 50% a month prior. Bullish sentiment is at the moment at its lowest in six months.

As anticipated, the decline in bullish sentiment translated to elevated bearishness, with 29.9% of traders expressing damaging sentiment—up 9.3% over the previous two weeks from a latest low of 20.6%.

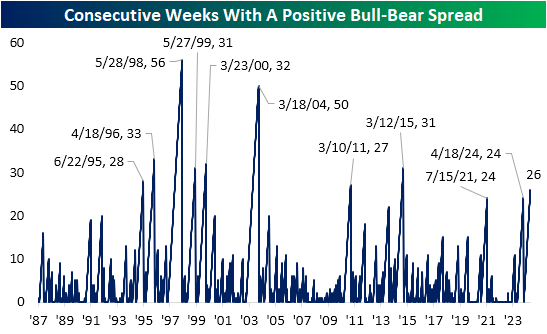

However let’s take a look at the information as an entire: Bullish sentiment nonetheless outpaces bearish by 7.8%. This might sound minor, nevertheless it is not when you think about we have seen 26 consecutive weeks of prevailing constructive sentiment.

This string marks a traditionally lengthy interval, surpassing the 24-week collection in July 2021 and April 2024. It’s the longest since 2015, and since then, sentiment has been markedly bullish for greater than six months solely seven different instances.

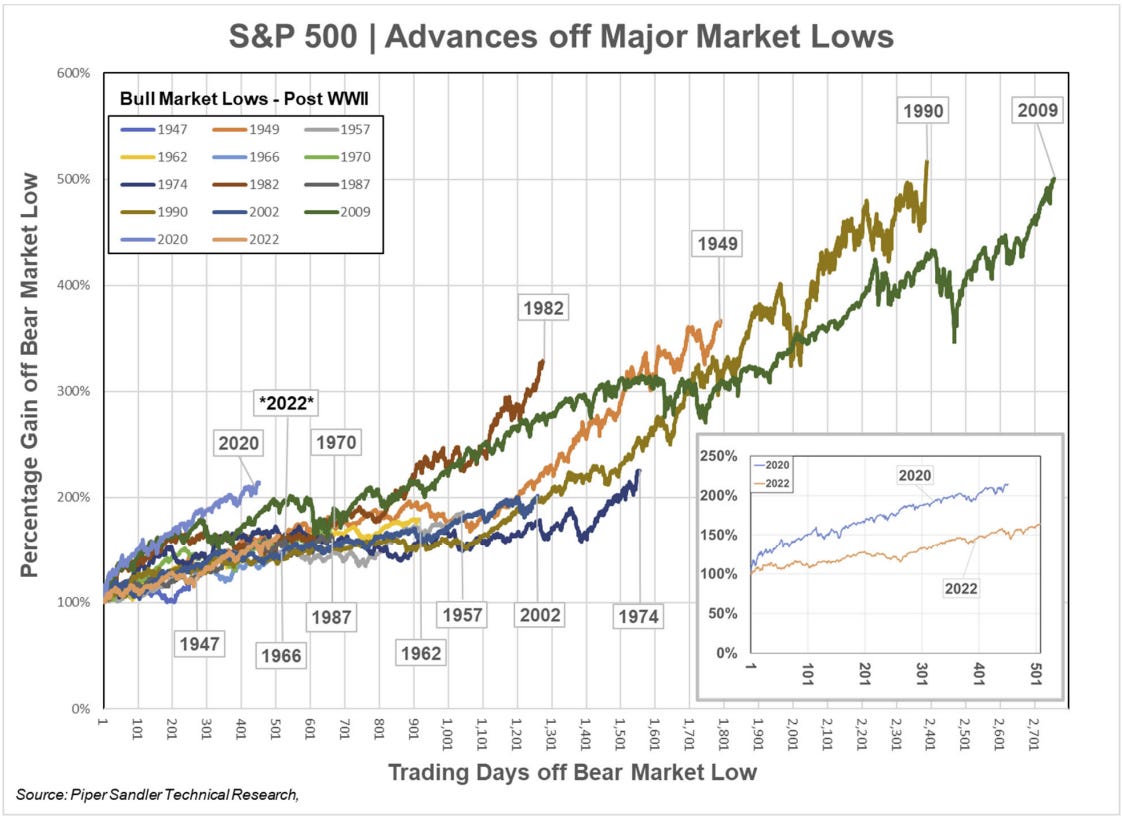

Furthermore, we’re within the third 12 months of a bull market following the October 2022 lows. Traditionally, uptrends from market lows final about 1,147 days on common. We’re at the moment solely at day 507, not even midway via.

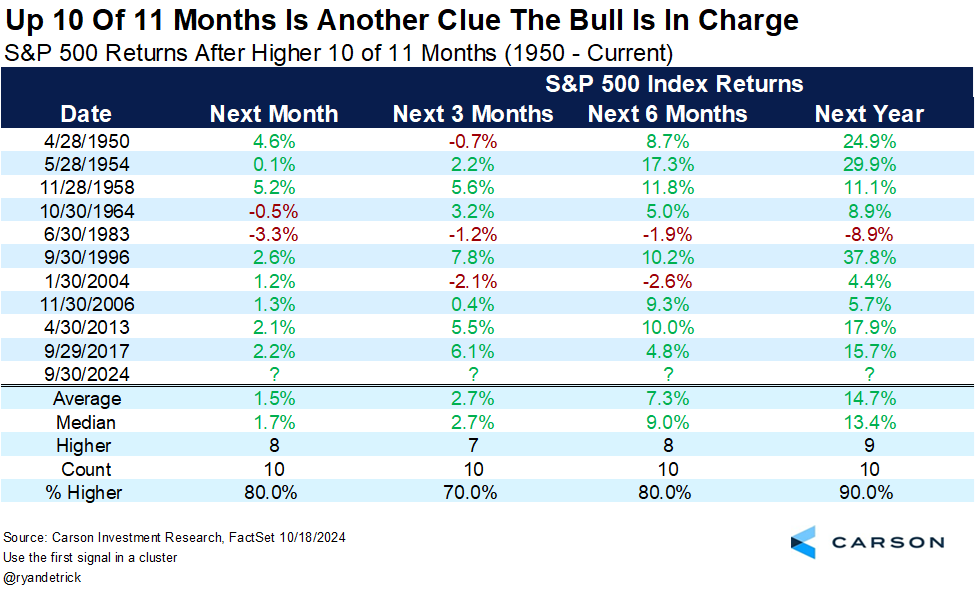

The sturdy observe document of a bullish market extending as much as 10 months suggests this might proceed over the following 6 to 12 months.

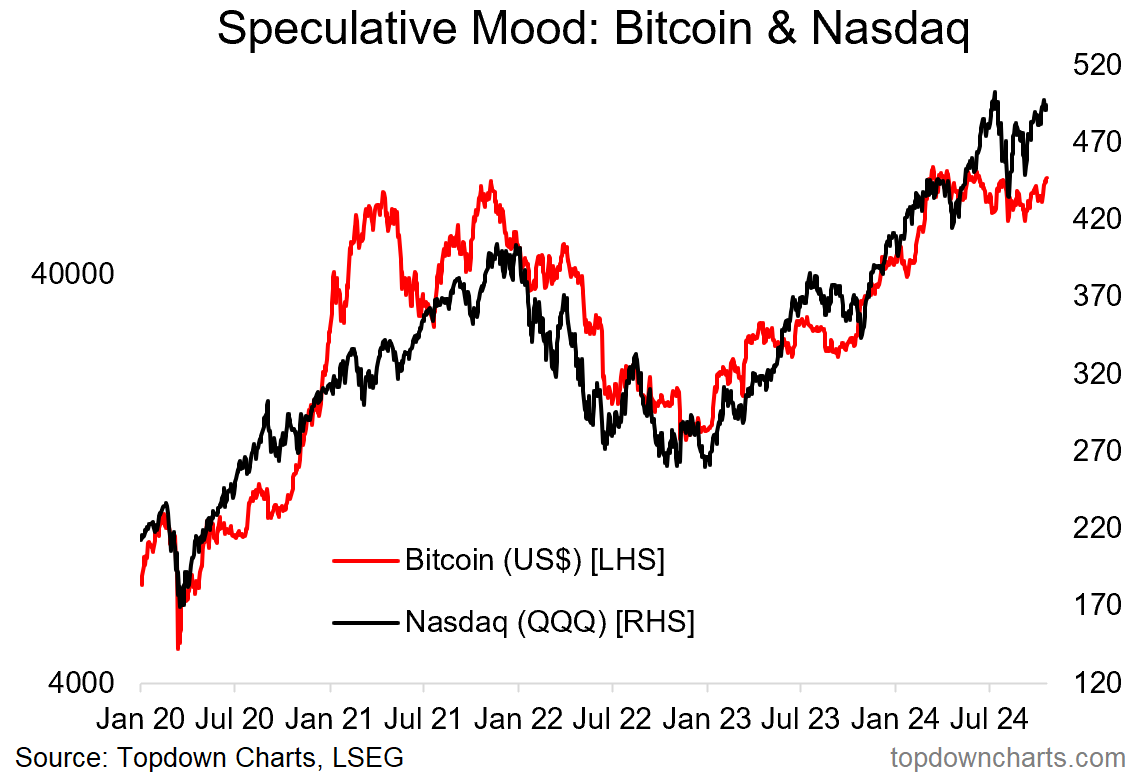

Once we shift focus to , which regularly mirrors ‘s actions, we observe a big constructive sentiment shift. Optimism might stem from potential election outcomes, an absence of unhealthy information, or anticipated charge cuts.

This sentiment is probably going lifting Bitcoin’s traits alongside, after what many described as a lateral market part for the cryptocurrency.

Till subsequent time!

***

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, counsel or suggestion to speculate as such it’s not supposed to incentivize the acquisition of belongings in any manner. I want to remind you that any kind of asset, is evaluated from a number of views and is extremely dangerous and due to this fact, any funding determination and the related danger stays with the investor.