Yesterday’s market was a bit risky, although not stunning. We primarily noticed sideways buying and selling for many of the day till about 2 PM, once we skilled a major downdraft.

Nonetheless, that was reversed into the shut with a fairly sizable purchase imbalance. In line with Monetary Juice, the had a $2.3 billion purchase imbalance going into the ultimate minutes, serving to raise shares on the shut.

The larger story yesterday, although, is the 1-day index. We mentioned it when it was at a low of simply 11. yesterday, it closed at 15.70—a 42% improve—implying that at present, we’ll possible see a few 1% transfer within the S&P 500. Usually, when the roles report comes out, volatility on the VIX will get crushed and the S&P 500 strikes decrease.

After that volatility reset, common buying and selling ought to resume. The VIX 1-day index will possible open sharply decrease at present. So, we could possibly be in a situation the place we see an preliminary knee-jerk response larger whatever the job report end result.

FX Market’s Response Stays Key

I believe the FX and charges markets will most likely supply the very best total view of how the market responds—not essentially the fairness market. We’ve seen some flattening on the minus unfold. It had been round 60-65 foundation factors, however now it’s again right down to about 30 foundation factors. That will probably be one thing to look at at present to see if the steepening continues after the report.

As for the , we’ve mentioned the way it seems to be prefer it’s in a bull flag sample within the quick time period since mid-December. Proper now, it’s on the decrease finish of the vary. If the bull flag goes to carry, we want a scorching jobs report at present. In any other case, we might see the break under 4.40% and probably head towards 4.15%.

That’s not what I’ve been anticipating, however it’s potential. We’ll should see how the numbers are available. It’s additionally unclear how the benchmark revisions will weigh into the information.

The counsel 170,000 new jobs, in comparison with 256,000 final month. The unemployment price is anticipated to stay unchanged, whereas common hourly earnings are forecasted to remain at 0.3% month over month and fall to three.8% 12 months over 12 months from 3.9%.

The NFIB launched its jobs report yesterday, displaying that precise compensation modifications rose 4 factors to 33%. Whereas this isn’t a one-to-one indicator with wages within the BLS report, it’s fascinating. Moreover, S&P International’s PMI report beforehand famous compensation pressures. Additionally, the identical report, which got here out on February fifth, within the first line of the report states:

“Stronger job creation regardless of slowdown in output development at begin of 2025” and “Job creation hits 31-month excessive“.

So, anecdotal proof means that at present’s quantity could possibly be substantial. We’ll should see the way it performs out. Earlier than wrapping up, I wished to spotlight that TradingView now contains BTIC Whole Return Index futures.

Anybody can now entry this information utilizing the image AST1, which supplies the generic contract for the present month. You’ll find different months via the dropdown. yesterday, fairness financing prices for the present contract completed round 54, they usually haven’t recovered from the numerous decline following the December Fed assembly firstly of the 12 months. Apparently, we’re on the low finish of the vary since mid-September.

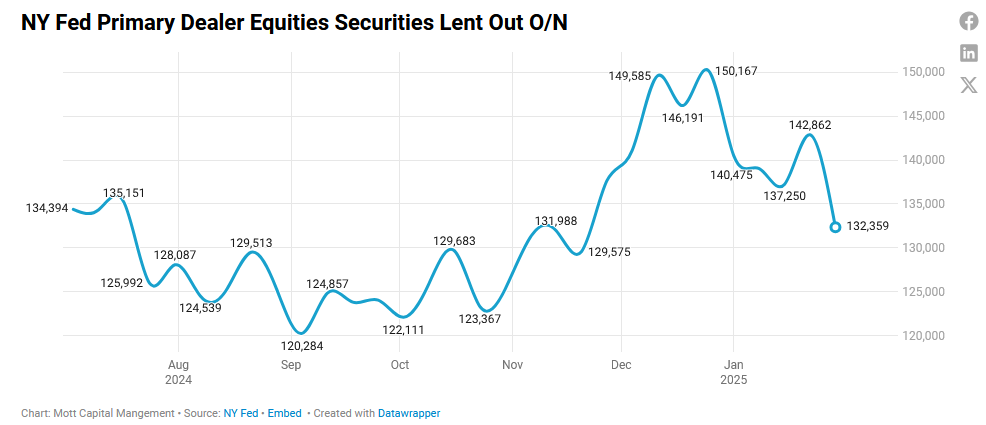

We additionally obtained the New York Fed Major Seller Report, which confirmed that in a single day, repo exercise for equities dropped from $142.8 billion to $132.3 billion. This aligns with the broader theme we’ve mentioned: Demand for leverage hasn’t reemerged, which possible explains why the fairness market has been buying and selling sideways for the previous few weeks.

Authentic Submit