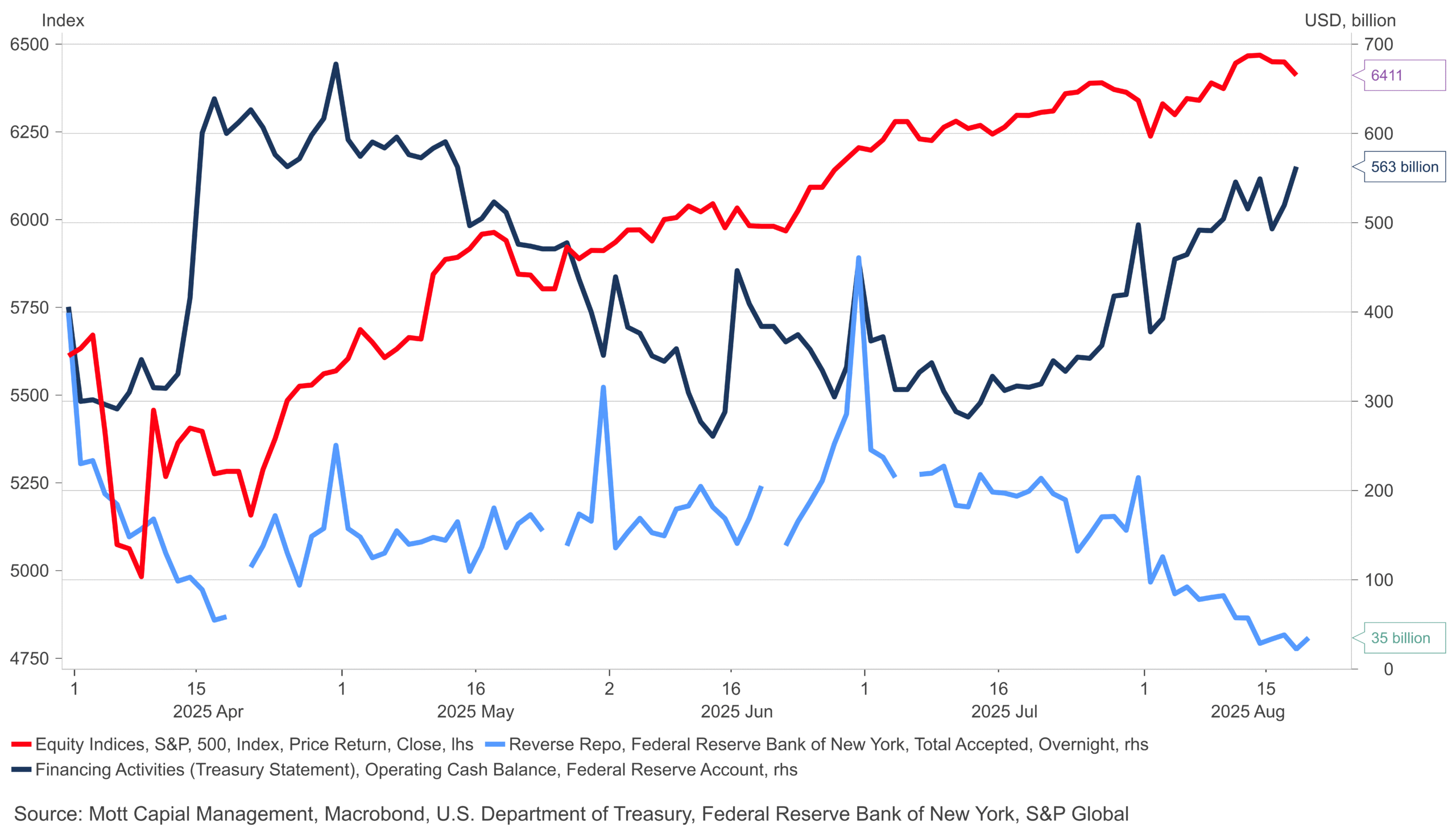

Shares had a unstable session, broadly ending decrease. The sharp morning sell-off on Wednesday was surprising, although the rebound was not. The actual take a look at comes at present with $44 billion in Treasury settlements and the reverse repo facility now depleted, which might set off a repeat of Tuesday’s poor efficiency.

The TGA climbed on Tuesday to $563 billion, up from about $520 billion the day earlier than. If at present brings one other decline like we noticed within the , it would doubtless replicate the influence of Treasury settlements and the depletion of the repo facility.

For now, the is holding help on the uptrend. Even when that breaks, the important thing stage to observe is 6,200. A break there might ship us again into the 5,900s, and that’s when considerations would develop.

The unfold between the and the continues to say no, now barely holding above its lowest stage since August 2022. As soon as the two.65% unfold breaks, there may be little in the best way of help, apart from minor ranges at 2.37% and a couple of.10%. The strongest help sits at 1.94%.

With the unfold narrowing, demand is weakening, as seen within the 5-year cross-currency foundation swap, which has turn into much less destructive at –13.5 bps. The commerce seems to be swapping out of {dollars} and again into yen, as the price of acquiring yen has eased. This implies new carry trades are unlikely to be initiated, and if the unfold continues to maneuver towards zero, the chance of an unwind in present carry trades will improve.

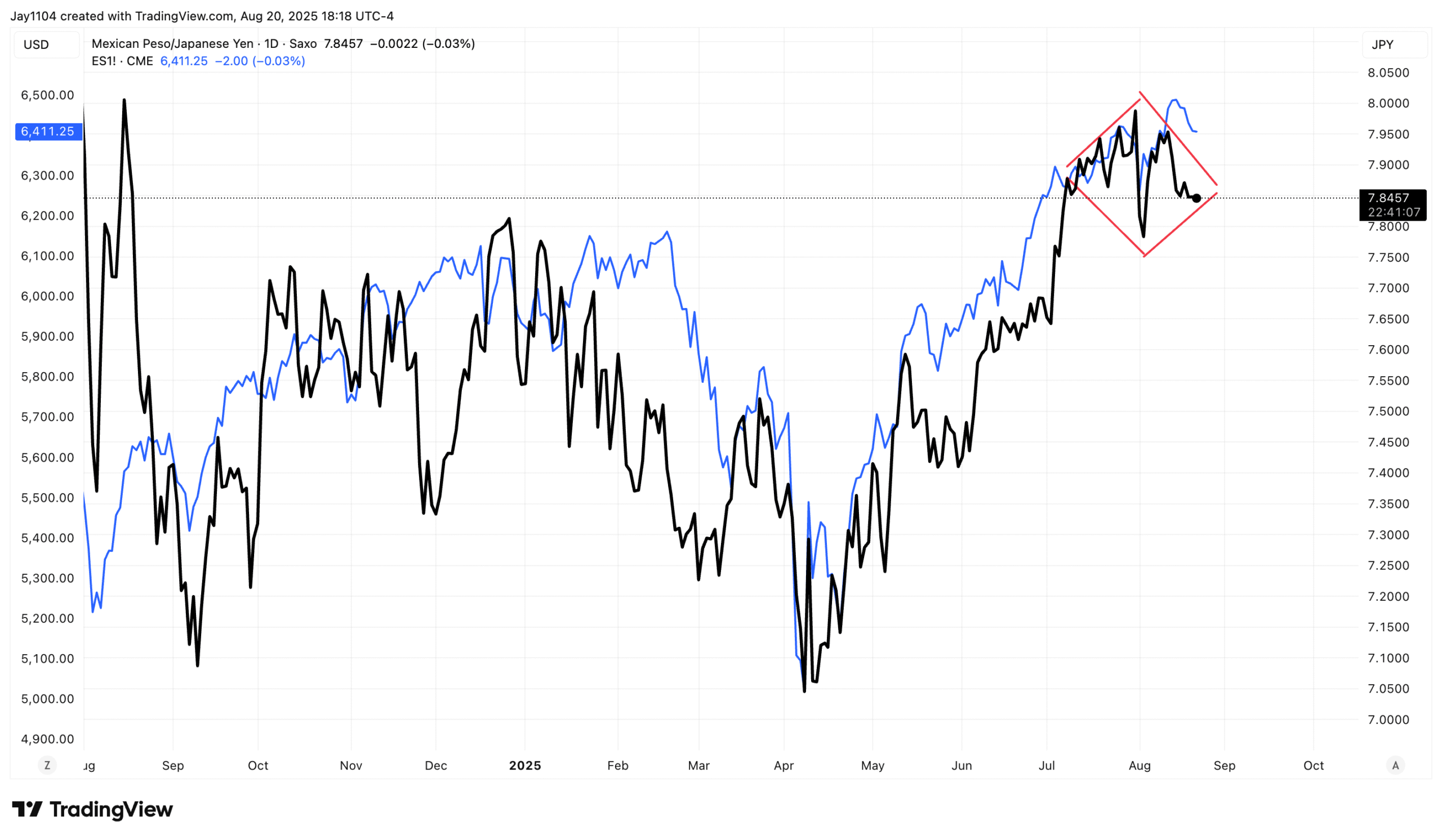

In essence, this isn’t only a US greenback concern—it’s taking place elsewhere too, comparable to within the . Extra curiously, this FX pair has not too long ago been buying and selling in keeping with the S&P 500. We noticed this dynamic in the summertime of 2024, and it has been monitoring the index pretty carefully once more for a while.

This relationship turns into clearer when considered within the context of the autumn of final 12 months. Extra importantly, if the MXN/JPY is topping out, a break decrease would doubtless coincide with—or replicate—a broader risk-off transfer, given how carefully the pair has been buying and selling with the S&P 500.

Unique Put up