- September defies its weak popularity because the S&P 500 reveals outstanding power.

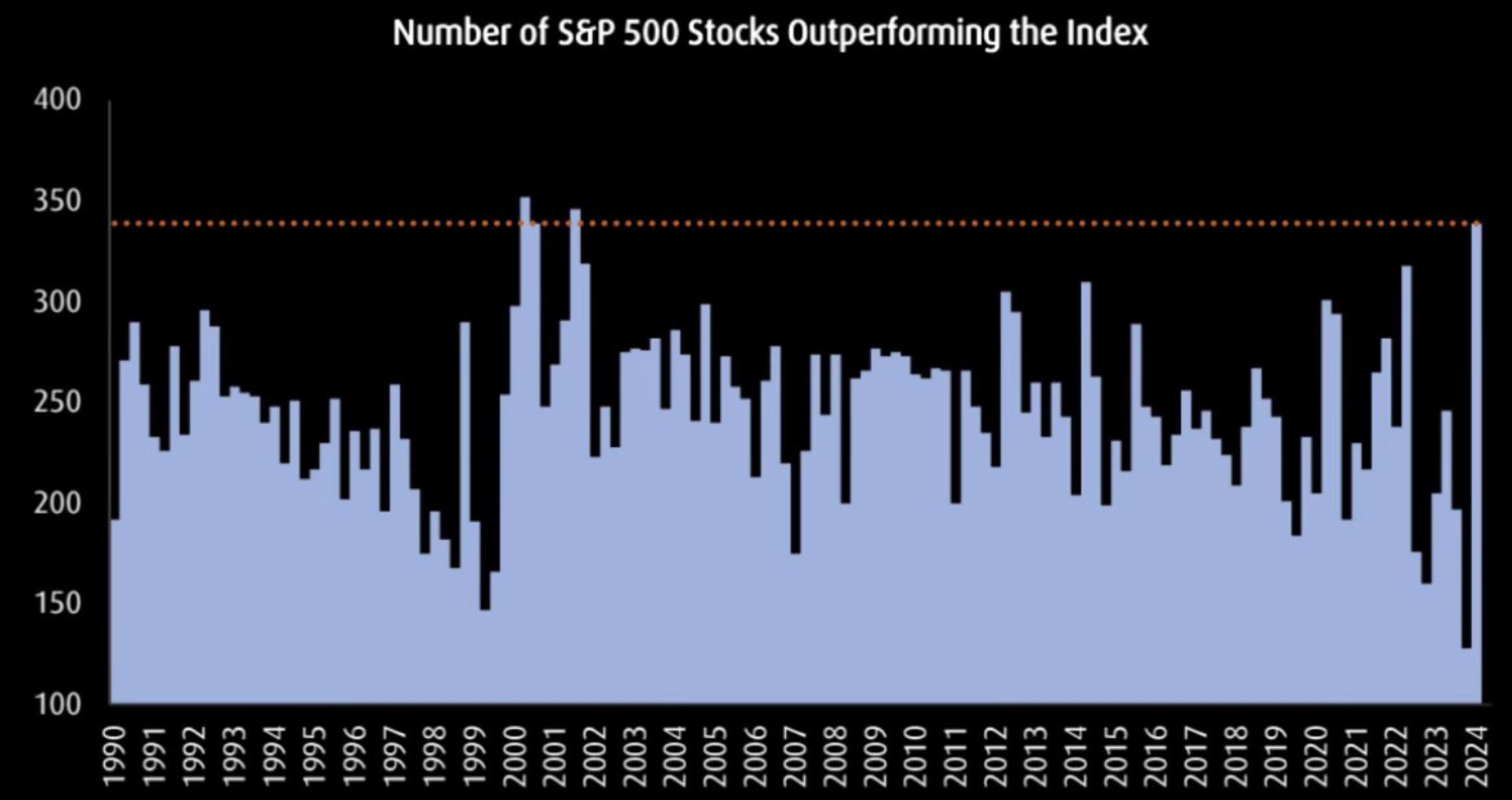

- A surge in outperforming shares highlights strong market breadth, the best since 2002.

- Beneath, we talk about 5 key charts that reveal sturdy momentum for the S&P 500 as 2024 enters its final quarter.

- In search of actionable commerce concepts to navigate the present market volatility? Unlock entry to InvestingPro’s AI-selected inventory winners for underneath $9 a month!

September has a popularity for being one of many worst-performing months for the . This 12 months, nonetheless, has bucked that development, with the index now on monitor to ship one of many strongest September performances in current reminiscence.

The variety of shares outperforming the S&P 500 has surged to its highest stage since 2002, underscoring the market’s outstanding power.

With bullish alerts rising throughout the board, let’s study 5 key charts that illustrate how the S&P 500 has defied historic tendencies this month and will maintain its momentum as we head towards the tip of 2024.

Chart 1: S&P 500 Continues Posting New All-Time Highs

The S&P 500 not too long ago achieved three new all-time highs in a single week, bringing its spectacular whole for 2024 to 42.

This chart illustrates the frequency of all-time highs for the S&P 500, showcasing its spectacular efficiency this 12 months towards the backdrop of September’s historic tendencies.

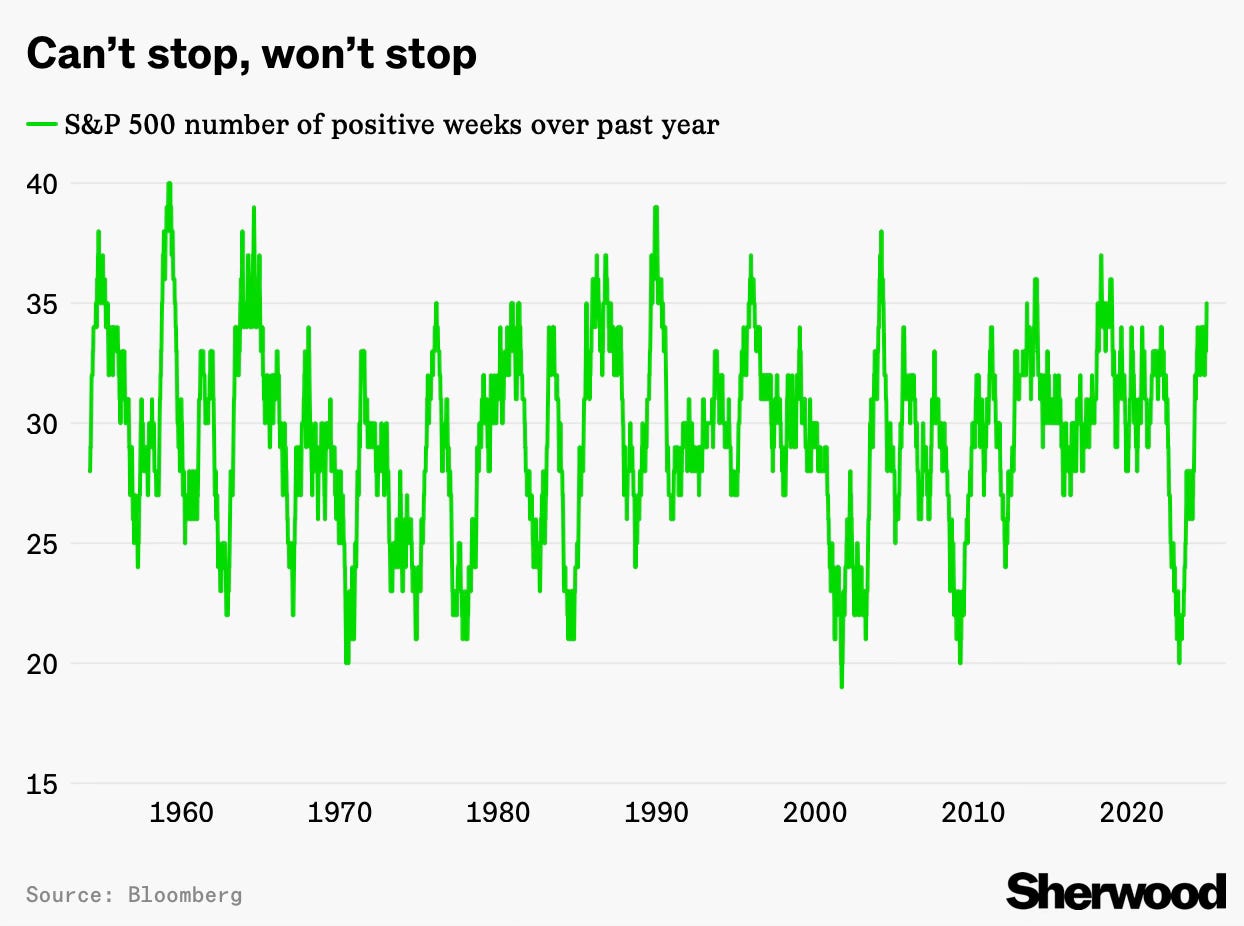

Chart 2: Variety of Constructive Weeks for the Yr

Over the previous 12 months, the index has proven outstanding resilience, with 35 weeks delivering constructive returns—a formidable 67% of the time. It is a clear indication that market momentum is powerful.

Chart 3: Variety of Shares Outperforming the Index

This graphic shows the proportion of shares outperforming the S&P 500, highlighting the best stage since 2002 and signaling sturdy market breadth.

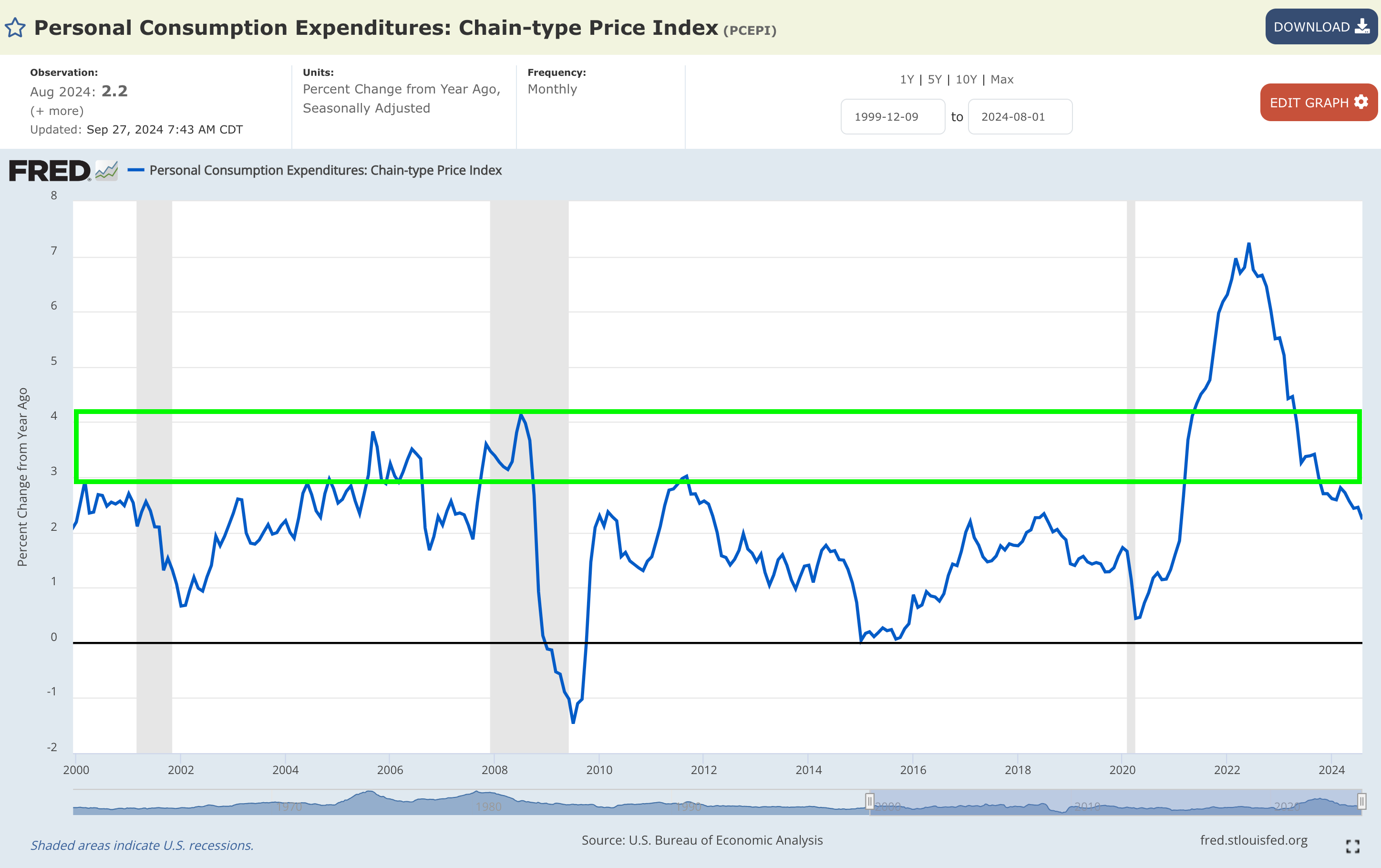

Chart 4: Disinflation Traits

On this chart, we monitor the year-on-year disinflation charge proven by the , exhibiting a modest decline from +2.45% to +2.23% whereas affirming the persistence of the disinflationary development.

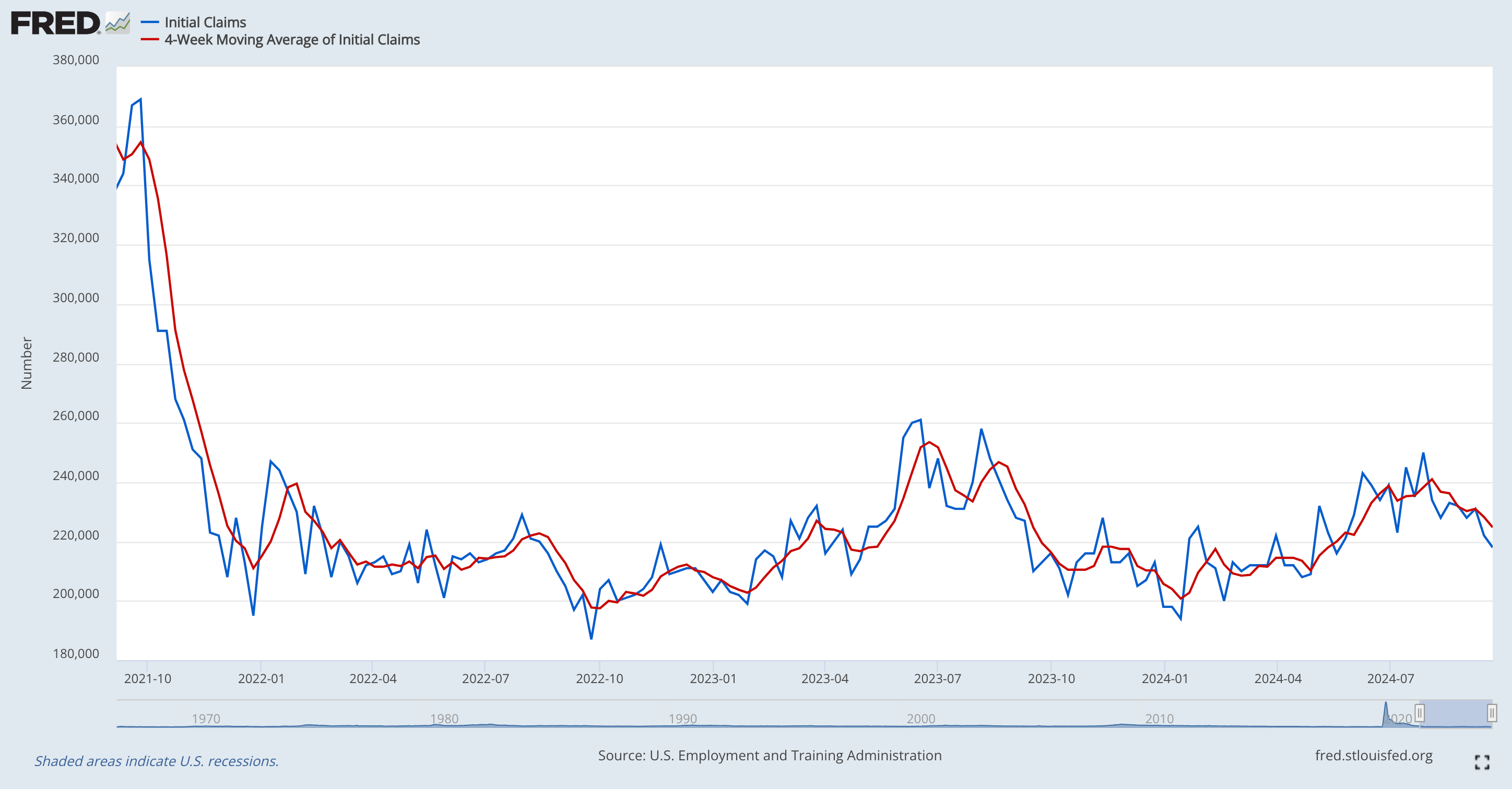

Chart 5: Labor Market Dynamics

This visible illustration of the information traces the labor market’s efficiency since September 2021, illustrating the short decline adopted by practically three years of sideways motion, dispelling fears of serious deterioration.

Backside Line

I need to draw your consideration to those graphs and information as a result of the present bullish development is undeniably sturdy.

This second presents a chance for every of you to mirror critically on the voices you’ve got listened to over the previous few months.

In the event you held a bearish view and selected to remain on the sidelines, contemplate who continues to affect your views in the marketplace at the moment.

If somebody has constantly been flawed and retains pushing the identical failed bearish narratives – ask your self: why ought to they nonetheless have your consideration?

***

Disclaimer: This text is written for informational functions solely. It’s not supposed to encourage the acquisition of belongings in any manner, nor does it represent a solicitation, provide, advice or suggestion to speculate. I want to remind you that each one belongings are evaluated from a number of views and are extremely dangerous, so any funding resolution and the related threat is on the investor’s personal threat. We additionally don’t present any funding advisory companies.