onurdongel

With the goal of offering memorable merchandise, Solo Manufacturers (NYSE:DTC) operates premium genuine way of life manufacturers. Because of its high-quality merchandise, the corporate has loved buyer loyalty through the years. Within the final yr, the corporate has entered into three acquisitions, Our Kayak, Surf Ventures, and Chubbies, that are anticipated to strengthen the present enterprise mannequin.

The corporate is operated by a visionary founder, who based its core enterprise, Solo Range, in 2011 to carry the household collectively open air. With time, on account of its worthwhile operations, the corporate has expanded its footprints in numerous segments.

At present, Solo model markets its merchandise by means of its quickly rising DTC platform and has been centered on delivering modern and high-performance merchandise to achieve a broad neighborhood of shoppers.

Solo manufacturers manufacture sturdy and easy-to-use merchandise similar to Signature 360º Airflow Design™ and OruPlast™, which give clients a memorable expertise and drive buyer loyalty.

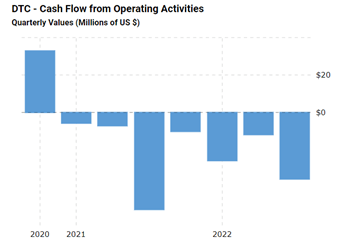

Money movement from operations (macrotrends.internet )

Though the corporate appears to be rising, money movement from operations remains to be unfavourable, which can carry substantial considerations concerning the enterprise mannequin. Regardless of posting income, final yr’s money movement had been unfavourable; As the corporate has been engaged in an costly acquisition, it’d require to depend upon exterior sources to fund its loss-making inner operations and acquisitions; which could result in deteriorating funding returns.

I imagine it’s higher to attend till the corporate turns worthwhile and efficiently expands its different phase; holding the inventory at such a degree the place the corporate has been making enormous losses can carry substantial threat. My present view on the inventory is bearish.

Historic efficiency

Since its IPO in 2021, the corporate’s gross sales have elevated considerably, primarily attributed to elevated advertising and marketing initiatives, hype in outside product gross sales, and partially as a result of acquisitions. Because of quickly rising demand, the corporate turned worthwhile after final yr’s loss. Within the final yr, the corporate has seen income improve from $133 million in 2020 to about $403 million by 2021, leading to a internet revenue of over $10 million (offset by internet revenue attributed to controlling members previous to the reorganization transaction). However regardless of worthwhile operations, the money movement turned considerably unfavourable on account of elevated stock ranges.

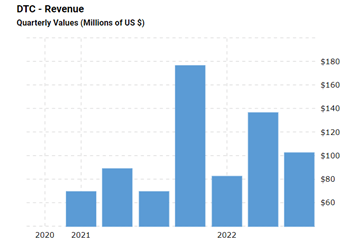

Quarterly income (macrotrend.internet )

Over the previous few quarters, income appears to be rising (fluctuations are partially attributed to seasonality), however such income progress is attributed to larger advertising and marketing spending, which is exerting vital strain on the corporate’s margins; due to this fact, it’s higher to attend till the enterprise efficiency turns optimistic.

Energy within the enterprise mannequin

Administration’s goal to maintain the whole lot easy, sustainable, and simple has performed a much bigger function within the firm’s success. Though the corporate has expanded into numerous segments, it has managed its product high quality. Such a profitable growth is likely to be attributed to a data-driven product improvement course of and an modern strategy totally different from its opponents.

The corporate has been centered on bringing modern merchandise as per the shopper necessities and desires; such a customer-centric strategy may drive vital income within the upcoming years. Additionally, not too long ago developed analysis and improvement services may help perceive clients’ wants higher, which might additional strengthen the enterprise mannequin.

Evidently administration has rigorously centered on each phase of the enterprise, from advertising and marketing initiatives to product improvement, displaying that the administration is owner-oriented and dealing laborious to strengthen its aggressive benefit.

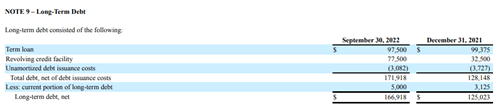

Debt (quarterly report )

It’s appreciated that debt ranges are average, which reduces the chance. Nonetheless, buyers should think about that if administration could not flip enterprise operations worthwhile, the corporate should depend upon exterior sources similar to debt and fairness providing to fund its operation, which might put vital strain on the corporate’s monetary place.

Threat Elements

Though over time, the corporate has expanded by means of numerous segments, over 90% of the entire income comes from Solo Range; such a excessive focus of gross sales may carry a considerable threat of competitors; if the competitors got here up with many modern merchandise, the income may see a major drop.

Additionally, the speedy progress within the final yr could cause a requirement surge in leisure and outside merchandise; Subsequently, such progress could not maintain for an extended time.

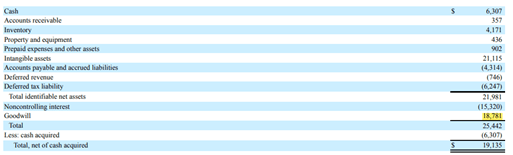

Kayak acquisition transaction (annual report )

The above talked about image displays the transaction of Our Kayak acquisition; primarily based on the numerous goodwill era, it appears that evidently the administration has entered into an costly acquisition (when the trade was booming). Such a capital allocation determination may carry a considerable price to the corporate leading to subdued shareholder returns. Additionally, the corporate has paid such an costly worth in its different two acquisitions as nicely; any deterioration within the enterprise efficiency of these acquired firms may carry appreciable goodwill impairment prices.

Latest improvement

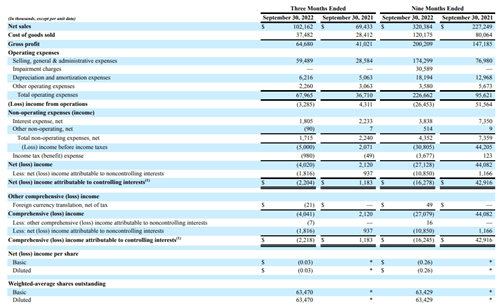

quarterly outcomes (quarterly report )

Within the latest quarter, income has elevated considerably from $69 million in the identical quarter final yr to about $102 million now; however on account of larger spending on advertising and marketing, the online income turned unfavourable. Additionally, on account of elevated stock ranges, the money movement from operations turned unfavourable, and in consequence, the corporate needed to depend on debt to maintain its operations.

Stock ranges have elevated considerably, reaching about $65 million, and the money reserves have depleted; due to this fact, it appears that evidently because the enterprise has been shedding cash constantly, it should depend upon exterior sourcing to maintain its operations which can ultimately have an effect on the enterprise worth.

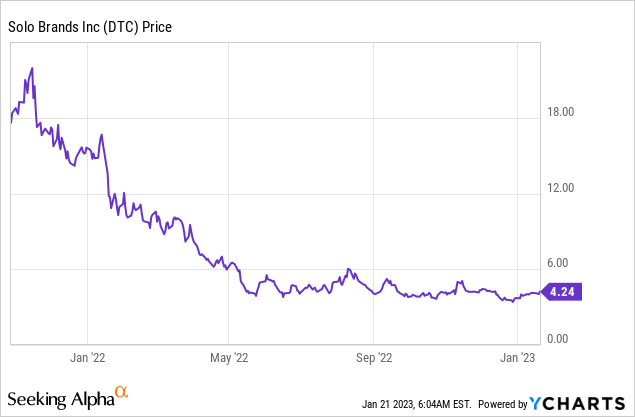

share worth (YCharts )

At present, the corporate has been buying and selling for almost $405 million. Since its IPO, the inventory has misplaced over 76% of its worth; after dropping from $18.36 per share in 2021, the inventory has reached $4.24 per share now. I imagine, on account of its loss-making enterprise operations, the corporate should take substantial debt, and because the market cap has contracted, the corporate should dilute its vital stake to boost capital.

Subsequently, it’s higher to avoid such a loss-making enterprise which might carry substantial threat; I assign a promote ranking to the inventory.