Solana (SOL) has managed to shake off current value dips, rekindling bullish optimism amongst buyers. This resurgence comes on the heels of a decided effort by sellers to flip the altcoin’s trajectory bearish, following a value rejection on the vital $29 resistance stage.

Nonetheless, SOL’s retreat from this resistance proved to be a strategic transfer because it discovered assist within the bullish order block (OB) at $22, setting the stage for a renewed uptrend.

SOL’s journey from the formidable $29 value mark to the bullish order block at $22 was pivotal. A current value evaluation has underscored the significance of this OB as a key stage for the altcoin’s potential reversal of fortunes.

With a long-term perspective in thoughts, Solana’s means to rally from this OB demonstrates the resolve of patrons to reclaim management. This restoration has not solely bolstered sentiment but additionally signified the strategic significance of this value juncture in steering the pattern.

BTC’s Affect On SOL’s Trajectory

One notable issue underpinning Solana’s present narrative is the position of Bitcoin (BTC), the flagship cryptocurrency. As SOL seeks to flip the $25.3 resistance stage right into a supportive base for additional good points, its success might very nicely depend upon the continued bullish advance of Bitcoin.

The interaction between these two outstanding cryptocurrencies stays a major facet to watch, as BTC’s trajectory usually influences the broader altcoin market sentiment.

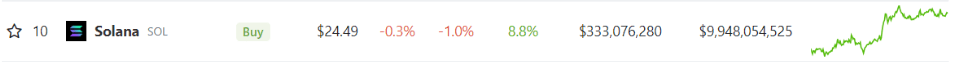

At current, Solana stands at a value of $24.50, as per CoinGecko information. Regardless of a slight decline of 1.0% during the last 24 hours, the altcoin has showcased a commendable seven-day rally of 8.8%, indicative of its capability to rebound from adversities.

Solana weekend value motion. Supply: Coingecko

Nonetheless, a notable problem emerges as SOL inches nearer to the $25.7 mark. The upcoming provide stress at this stage might probably stall the upward momentum, prompting a sideways pattern and resulting in a consolidation section.

Solana: Clearing The Path Ahead

Ought to the SOL value encounter intensified provide stress across the $25.7 threshold, a definite chance is the emergence of a slender value vary throughout buying and selling classes.

This consolidation section, whereas seemingly a brief lull, might serve a significant objective. By trimming away weaker positions, this era might pave the best way for a definitive directional motion.

Solana market cap nearing the $10 billion stage. Chart: TradingView.com

The shedding of much less sturdy positions would ideally set the stage for a extra sustainable bullish advance, because the altcoin continues its journey to reclaim misplaced floor.

Because the altcoin navigates potential consolidation, buyers are watching carefully, anticipating the emergence of a clearer path ahead on this dynamic crypto panorama.

(This web site’s content material shouldn’t be construed as funding recommendation. Investing includes danger. Whenever you make investments, your capital is topic to danger).

Featured picture from Ana Silva/Getty Pictures