Viorika

SoFi (NASDAQ:SOFI) submitted a robust earnings sheet for its fourth-quarter yesterday and the non-public finance firm additionally offered a formidable EBITDA outlook for the present 12 months. The report despatched shares of SoFi up by 13% yesterday, however I consider the firm’s upside potential will not be wherever close to being exhausted. What was particularly sturdy within the fourth-quarter was SoFi’s buyer acquisition which pushed the agency’s complete buyer depend above 5M at quarter-end for the primary time ever. I consider the chance profile is very favorable for shares of SoFi and a resumption of pupil mortgage repayments may very well be the catalyst that traders have been ready for!

Robust buyer acquisition

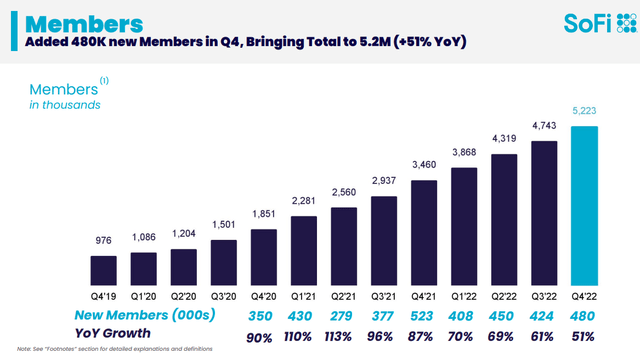

What I like the most effective about SoFi is the power with which the corporate presents itself on the shopper acquisition entrance. The private finance firm acquired 480 thousand new members simply within the fourth-quarter, which introduced the shopper complete on the finish of the quarter to five.22 million. I beforehand estimated that SoFi would finish the 12 months with 5.0-5.2M clients in its ecosystem, a determine that SoFi barely beat.

Though SoFi’s acquisition progress slowed from 87% in This autumn’21 to 51% in This autumn’22, the corporate’s accomplishments concerning buyer acquisition are nothing however spectacular: within the fourth-quarter, SoFi signed on 480 thousand new members — the equal of including 160 thousand new clients on common each month — which was the second-biggest addition of recent clients ever. Solely in This autumn’21 did SoFi purchase extra clients (523 thousand) than within the final quarter.

Supply: SoFi

Member progress is beginning to translate into EBITDA progress

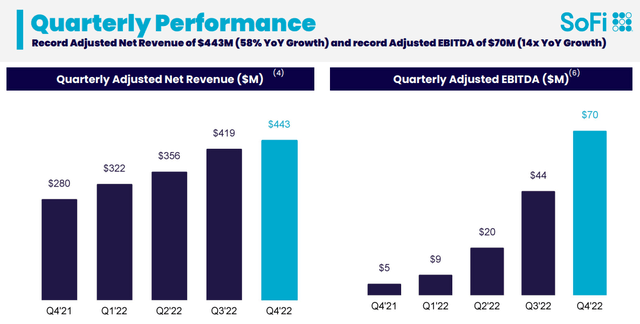

SoFi generated $443M in adjusted revenues within the fourth-quarter, exhibiting 58% 12 months over progress, with progress mainly being pushed by sturdy member acquisition and a continuing enlargement of obtainable monetary and lending merchandise on the SoFi platform. The private finance firm additionally noticed a big enchancment concerning its adjusted EBITDA, which totaled $70M and which represented a 14-fold improve over the year-earlier adjusted EBITDA stage.

Supply: SoFi

Robust progress outlook for FY 2023

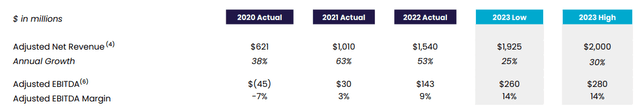

SoFi guided for complete revenues of $1.925B to $2.0B in FY 2023 which represents a 12 months over 12 months progress price of 27% on a mid-point foundation. Adjusted EBITDA, a key metric for SoFi that adjusts for depreciation, amortization and share-based bills, is predicted to fall into a variety of $260-280M which means a 12 months over 12 months progress price of 89%. The outlook is spectacular and means that the non-public finance firm will proceed to have the ability to translate member progress to adjusted EBITDA progress. Moreover, SoFi’s EBITDA margins are bettering and anticipated to additional broaden: the FinTech now expects to develop its adjusted EBITDA margin from 9% in FY 2022 to 14% in FY 2023.

Supply: SoFi

I beforehand estimated in “SoFi Applied sciences: Robust Blow” that due to the anticipated resumption of pupil mortgage repayments in FY 2023, SoFi might see solely $150M in adjusted EBITDA, a determine that’s a lot too low.

SoFi’s outlook for FY 2023 offers traders (and me) a robust motive to reevaluate the corporate’s progress potential. The reboot of the coed mortgage origination enterprise is ready to be a potent catalyst for SoFi and the corporate is planning with the beginning of pupil mortgage repayments this 12 months. In November, the Biden administration prolonged the Federal Pupil Mortgage Cost Moratorium from December 2022 to June 2023.

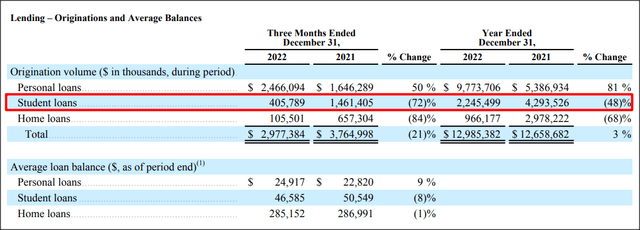

Because of a number of delays regarding the restart of pupil mortgage repayments in FY 2022, SoFi skilled a serious down-turn in its pupil mortgage origination enterprise. In consequence, mortgage originations slumped to $2.25B, exhibiting a 48% lower in comparison with FY 2021. The tip of the moratorium this 12 months might reinvigorate SoFi’s origination enterprise as debtors resume making curiosity funds.

Supply: SoFi

SoFi’s valuation

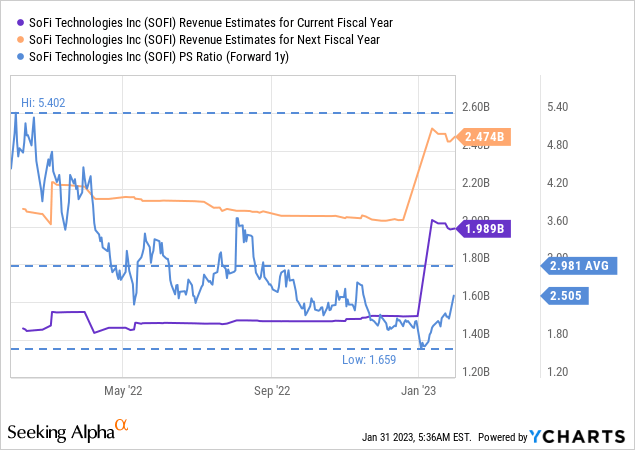

SoFi is predicted to generate revenues of $2.0B in FY 2023 which represents the highest finish of SoFi’s just lately communicated steerage. For subsequent 12 months, FY 2024, analysts anticipate $2.5B in revenues, implying yet one more 12 months of sturdy progress for the non-public finance firm. SoFi is presently valued at a P/S ratio of two.5 X, under its 1-year common P/S ratio of three.0 X. Contemplating that SoFi traded at a gross sales multiplier issue of greater than 5.0 X within the final 12 months, I consider SoFi positively has potential to revalue to the upside… so long as the corporate experiences sturdy buyer acquisition charges and increasing EBITDA margins.

Dangers with SoFi

The most important danger with SoFi is that acquisition charges will proceed to gradual. Though SoFi is more likely to nonetheless add a big absolute variety of new members to its ecosystem within the coming quarters, SoFi’s acquisition and high line progress charges are set to average going ahead. What I additionally think about to be a danger for SoFi is an surprising extension of the Federal Pupil Mortgage Cost Moratorium which might forestall a reboot of SoFi’s pupil mortgage origination enterprise and certain lead to a down-grade of SoFi’s EBITDA steerage.

Remaining ideas

SoFi submitted a unbelievable earnings report for the fourth-quarter that included sturdy buyer acquisition charges and a formidable outlook for FY 2023… each of which display that SoFi has much more fuel within the tank. What can be spectacular is that SoFi has been in a position to translate member progress to adjusted EBITDA progress which resulted in 14 X issue improve in adjusted EBITDA in This autumn’22 in comparison with the year-earlier interval. I consider traders underestimate SoFi’s progress potential and the inventory can additional revalue to the upside!