Be a part of Our Telegram channel to remain updated on breaking information protection

After crossing the $29.5k threshold on July 28 at 1:10 PM EST, Bitcoin has as soon as once more pulled again and is presently buying and selling across the $29.3k mark.

Bitcoin Worth Experiences Minor Uptick in Final 24 Hours

On Friday, July 28, Bitcoin started the day at round $29.2k, later escalating above $29.6k, which ignited optimistic predictions of a return to the $30k assist degree inside the crypto group.

Nevertheless, opposite to expectations, Bitcoin’s worth fell again to $29.2k.

Regardless of a slight 0.52% enhance in market cap and a 2% rise in buying and selling quantity, Bitcoin hasn’t regained its $30k degree.

CoinMarketcap buyers predict a possible drop to the $28k resistance line after the latest pullback.

Bitcoin Worth Evaluation

After shifting past its August 2022 highs and crossing the $31k threshold, Bitcoin has fallen in worth.

Bitcoin Candlestick Chart – 4-Hour Time Body

Bitcoin first rejected the $31k assist on July 14, dropping by 4% earlier than buying and selling sideways in an try to keep up a degree above $30k.

Crypto buyers feared dropping that degree on July 20 when the token fell to $29.6k for a day, which prompted bulls to take motion and bounce the token again to its $30k assist.

The intersection of 200 MA and 50 MA on July 22 led many to imagine {that a} golden cross had appeared, however Bitcoin misplaced its $30k assist on July 24 because the BTC worth dropped by 1%.

This lengthy purple candle led buyers to lose confidence, which created extra subsequent reds till Bitcoin dropped beneath $29k to achieve $28.8k earlier than rebounding.

Present tendencies present Bitcoin is attracting impartial sentiment.

Its RSI is within the center vary, and its MACD is optimistic. Whereas the latest motion of $275 million value of Bitcoin to exchanges by a whale is creating some concern, CryptoQuant mentioned that these whales are accumulating, which can sign an uptrend.

Why Bitcoin Rejected $30k Resistance?

Two causes are attributed to Bitcoins’ rejection of the $30k assist.

Federal Reserve’s Resumption of Curiosity Rake Hikes

Whereas the BTC market was bullish on June 14, when individuals believed that the Federal Reserve would pause on its rate of interest hikes, the Fed went the opposite means.

On July 26, the Federal Reserve elevated the federal funds charge by 1 / 4 of a p.c, bringing it from 5.25% to five.5%. That marked the Fed’s highest rate of interest within the final 22 years.

Merchants anticipated the speed to extend because the CME watch instrument confirmed the chance of an additional rate of interest hike to be 98.9%.

CNBC reported that Bitcoin’s worth fell sharply forward of that Fed assembly, and on July 24, Bitcoin misplaced its month-long $30k assist.

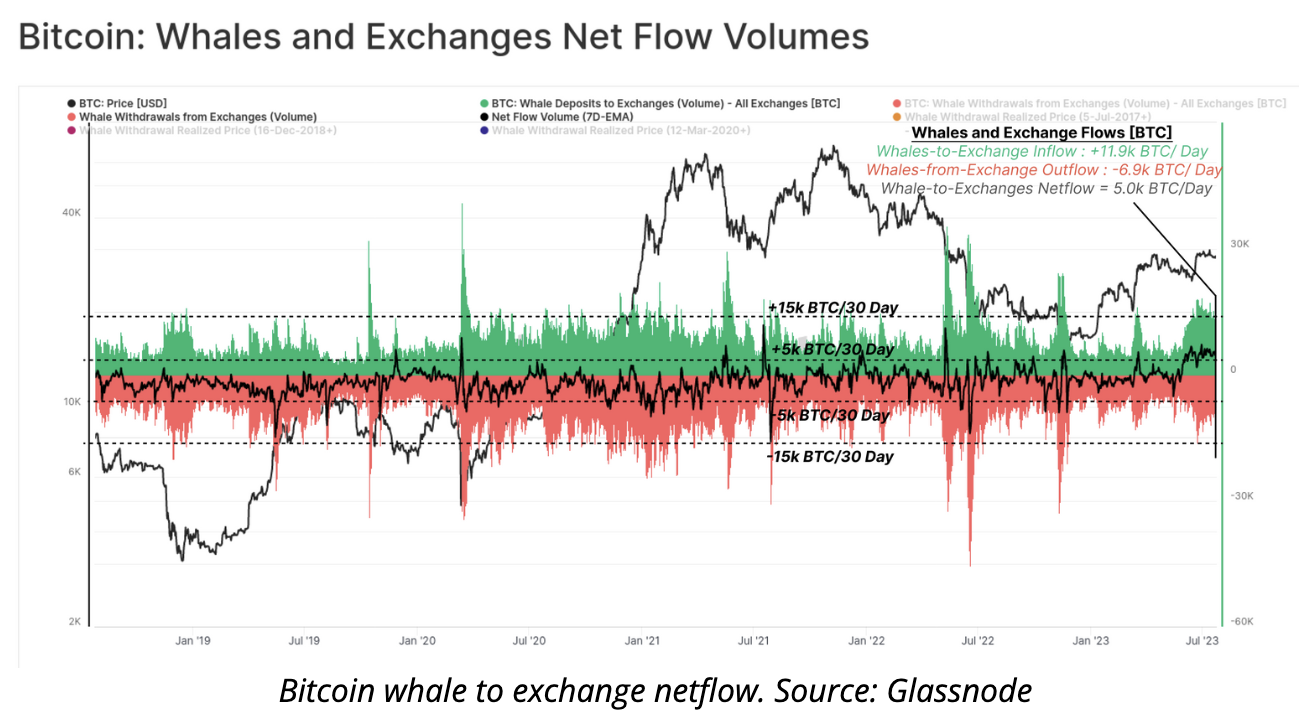

Whales Transferring Bitcoin to Exchanges

On July 24, Bitcoin whale alternate influx hit a 1-year excessive of over 40%, based on Cointelegraph.

The next optimistic alternate influx translated to promoting strain build-up round Bitcoin, resulting in BTC rejecting $30k assist the identical day.

Whereas these elements labored to push BTC down, some crypto consultants on Twitter recommend that the token is about to interrupt out.

Nevertheless, they haven’t disclosed whether or not it will be in a optimistic or damaging course.

$BTC Calm earlier than the storm… pic.twitter.com/fPWrGBPuTa

— Crypto Rover (@rovercrc) July 28, 2023

Evil Pepe a Higher Various

Evil Pepe Coin, a presale crypto modeled after Pepe Coin, may very well be a greater different funding.

Symbolizing the urge that pushes buyers to place cash into unstable property for features, Evil Pepe Coin (EVILPEPE) has raised greater than $1.97 million already. The arduous cap is ready to $1.99 million, which can possible be reached within the subsequent few hours.

Are you continue to making an attempt to resolve if you wish to ape into the #EvilPepeToken presale? #EvilPepe is aware of your intentions…

Time is actually working out ⏰ Solely simply over 500k remaining till the #Presale is bought out ☠️

Bear in mind he’s watching 🐸😈#Ethereum #ERC20 #ETH #memecoin pic.twitter.com/C5z3bfEQJE

— Evil Pepe (@evilpepe_token) July 28, 2023

Evil Pepe Coin’s simplicity because it faucets into Pepe Coin’s virality provides it a particular short-term upside.

Investing in now will permit early movers to make features from its upcoming DEX itemizing, which can possible pump EVILPEPE’s worth contemplating the excessive degree of curiosity it’s receiving through the presale.

Associated Articles

- Pepe Coin Worth Prediction after a Two-Week Tumble

- Worldcoin Worth Prediction for July twenty eighth

- How one can Purchase Bitcoin

Wall Road Memes – Subsequent Huge Crypto

- Early Entry Presale Reside Now

- Established Group of Shares & Crypto Merchants

- Featured on BeInCrypto, Bitcoinist, Yahoo Finance

- Rated Greatest Crypto to Purchase Now In Meme Coin Sector

- Group Behind OpenSea NFT Assortment – Wall St Bulls

- Tweets Replied to by Elon Musk

Be a part of Our Telegram channel to remain updated on breaking information protection