Kwarkot

Co-produced with PendragonY.

As you’re employed arduous to construct up your property, there is no such thing as a scarcity of individuals providing you “alternatives” to speculate. Proudly owning actual property and renting it out is one asset class that has numerous proponents touting it. Weekly radio reveals, journal articles, and books all speak about how simple it’s to generate a formidable earnings stream by investing in numerous rental properties. You’ve got heard the adverts for “workshops” on how one can develop into independently rich by actual property. Whereas “get wealthy fast” is simply too on the nostril to be an efficient promoting line, there is no such thing as a scarcity of people that will primarily inform you that you’re going to get wealthy with actual property.

We frequently romanticize careers the place we solely see the outcomes. Folks dream of being a Hollywood star, an astronaut, a sports activities star, a health care provider, President, or a landlord. But these desires are inclined to give attention to the perceived advantages – wealth, fame, and the cool issue. We not often take into consideration the arduous work that goes into reaching lofty desires.

My very own expertise (and particularly that of my spouse) says that direct possession of actual property shouldn’t be solely not as simple as many declare, neither is it a “secure” funding. Being a landlord of any significant scale shouldn’t be a passive exercise. It is a full-time job, or two… or three. Sure, you may make some huge cash being a landlord, however it’s a profession. It takes a whole lot of time and work.

REITs (Actual Property Funding Trusts) supply a option to spend money on actual property and rental properties whereas offloading most of the issues that may come up from straight proudly owning actual property. The returns on REITs are sometimes not as spectacular as these from straight proudly owning actual property. I feel the discount in dangers, the rise in security, and simply the extra passive exercise of REIT investing is extra applicable for traders who aren’t searching for a second profession.

When in comparison with the quite a few teams that may promise to do the be just right for you and are fundraising with their “unique” alternatives, publicly traded REITs have robust aggressive benefits, are extra simply accessible, and have higher liquidity.

The Dangers of Direct Actual Property Possession

Scale is one space the place REITs will beat most different actual property funding choices. Few traders may have hundreds of thousands of {dollars} to purchase properties, whereas even small REITs simply have $100 million or extra. Bigger REITs sometimes have billions in properties.

This scale permits REITs to seize the very best properties in the very best places. With entry to cheaper debt and easy accessibility to fairness, REITs are capable of revenue from smaller spreads and acquire extra revenue than smaller rivals.

This scale additionally implies that the REIT can rent devoted managers for its properties. A person investor will handle them on their very own, rent a administration firm (the place they are going to be certainly one of many purchasers), and even rent a part-time supervisor. My spouse dietary supplements her earnings as a Realtor by managing a number of strip malls for shoppers.

Trash is one thing {that a} REIT investor by no means has to fret about. However if you’re the proprietor of actual property that’s getting used, then it would generate trash which needs to be collected and faraway from the property. Even when the tenants are chargeable for this, because the proprietor, the last word accountability is yours. So your time and generally fairly a little bit of problem can be required to make it possible for trash is being dealt with. As an example, within the strip malls my spouse manages, she has to watch that tenants are utilizing the dumpsters supplied and that the dumpsters have sufficient house (and are being emptied usually sufficient). On a number of events, she has needed to get dumpsters changed after they bought broken or simply worn out.

Tenants are one other issue that REIT traders by no means must take care of. However particular person traders should take care of tenants even when they only rent somebody to do all that work. It’s a indisputable fact that not all tenants are good tenants. Some can be late on hire. Some may even cease paying hire in any respect. And all tenants will ultimately must have one thing fastened. This can require your cash and sometimes your time. Scale steps in as a significant profit once more. In a portfolio of 5 properties, a emptiness in a single is a big deal able to utterly destroying any hope of optimistic returns. That is one thing that would simply occur simply by unhealthy luck, even in an excellent economic system. In a portfolio of 100+ properties, you’ll be able to count on 3-8% to be vacant at any given time, relying on the property kind and situations. Vacancies will mirror averages, not simply luck.

Lease assortment can also be much less of a priority for REIT traders. Whereas they might want to monitor the hire collected, they don’t have any involvement in really accumulating the hire. A person investor might want to make preparations to gather the hire. That is really one of many extra time-consuming duties my spouse has. She usually has to go to the property a number of occasions a month to gather the hire. Past that, she has needed to go to courtroom (at the very least annually) to gather hire from tenants which might be means behind on their hire or to get them evicted.

And we should not overlook points like snow removing, plumbing points, electrical issues, and storm harm. Proudly owning and managing rental properties shouldn’t be actually passive investing.

So, now that we have now checked out a number of the points that make direct actual property holding much less fascinating than what its proponents declare, how can we get the advantages of actual property whereas avoiding these pitfalls? Let’s check out a few examples.

Cohen & Steers High quality Revenue Realty Fund (RQI) – Yield 7.1%

In passive investing, the concept is to do the least quantity of labor attainable. When selecting a REIT, one has many choices that target numerous sectors. That requires the investor to watch which sectors are doing nicely and might be anticipated to do nicely sooner or later.

Diversification is a crucial tactic so as to add to the protection of the earnings movement. Or the investor should buy a closed-end fund, or CEF, and have professionals work out the combo of REITs to personal. On high of that, CEFs get leverage at a decrease price than most retail traders can get, together with skilled administration of that leverage.

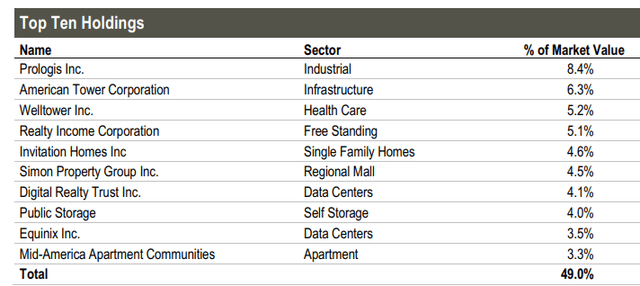

Cohen & Steers is certainly one of our favourite managers of CEFs (Closed-Finish Funds), and it has an excellent providing within the REIT house with RQI. RQI supplies leveraged publicity to the best high quality REITs: Supply.

RQI Factsheet Dec. 31, 2022

Most of those REITs use “triple web” leases. This implies the tenants of the REIT are liable for many property-level bills. Given the current run of excessive inflation, which means the tenants needed to cowl many of the will increase in prices attributable to inflation whereas the REIT bought bigger rents. Inflation will proceed to drive rents larger as leases renew.

Distributions have been absolutely coated between earnings and positive factors. And never solely has the distribution been absolutely coated in 2022, however RQI needed to situation a particular distribution as a result of it hadn’t met the minimal required distribution with its 8 cents month-to-month payout. That works out to be a beneficiant 7% yield.

Ares Business Actual Property Company (ACRE) – Yield 12.2%

One option to spend money on actual property is to personal it straight and hire it out. Another choice is to be a lender and personal mortgages. ACRE is a REIT that gives mortgages for industrial properties. As a substitute of accumulating hire, ACRE earnings from curiosity funds on the mortgage, with the choice to foreclose on the property if the borrower defaults.

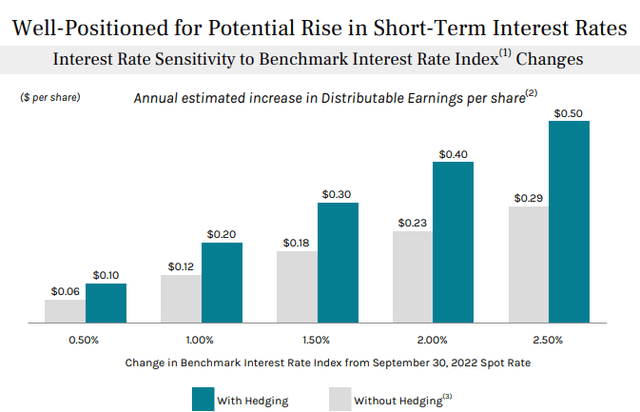

The most effective half is 98% of their loans are floating-rate loans. Widespread sense would say that in a time when rates of interest are rising, the earnings from floating-rate loans would enhance. And so ought to the share worth of corporations that made their cash from holding floating-rate loans.

But the share worth of ACRE during the last yr has been down about 16%, although their earnings is up. Mixed with hedges on their debt prices that do not expire until late 2023, the rates of interest for the final yr have elevated earnings and will proceed to take action till charges stabilize later this yr. Supply.

ACRE Q3 2022 Earnings Report

At 33 cents a share every quarter + 2 cents supplemental for the final 8 quarters, this works out to be a yield of 11.8%. That may be a very beneficiant earnings stream for a passive earnings. With earnings rising, there’s a robust risk of a dividend hike this yr.

ACRE studies earnings Wednesday morning, Feb. fifteenth.

Shutterstock

Conclusion

There are a thousand methods to earn a living on actual property and 1,000,000 methods to lose cash on actual property. If you’re searching for a profession, I want you the very best. Be significantly cautious of teams which might be attempting to boost capital from traders. There are investments like these that may work out, however they’re regularly larger threat than you may count on.

Publicly traded REITs present an avenue for retail traders to learn from actual property. They’ve scale, experience, and entry to capital. All present a aggressive benefit over most private funding choices.

For the investor, the liquidity of publicly traded corporations makes for a extra versatile funding choice. In distinction, direct possession of actual property can take many months and even years to exit. And private funding teams sometimes restrict your capacity to withdraw your capital. Even massive non-traded REITs like Blackstone’s BREIT can and can droop withdrawal requests.

RQI is a superb choice to achieve broad publicity to publicly traded fairness REITs. ACRE is an choice for investing in industrial mortgages and we count on will see earnings rising shortly on this rate of interest surroundings.

The Revenue Methodology goals to supply a rising stream of earnings as a way to take pleasure in your retirement doing what you like to do. Possibly you need to sip iced tea whereas watching the sundown out of your porch, take some dancing classes as a way to dance higher within the rain, take pleasure in a cruise, or journey the nation in an RV. This implies you want investments that you simply needn’t preserve every day.