SeanPavonePhoto

Funding Thesis: Despite short-term pressures, SK Telecom may see longer-term upside on the premise of robust stability sheet metrics and income progress throughout the Media phase.

In a earlier article again in Might, I made the argument that whereas SK Telecom (NYSE:SKM) has seen spectacular progress because of 5G uptake, inflation may pose a priority as a result of greater prices of capital funding. Moreover, I additionally cautioned {that a} additional drop in equities might erode total positive factors.

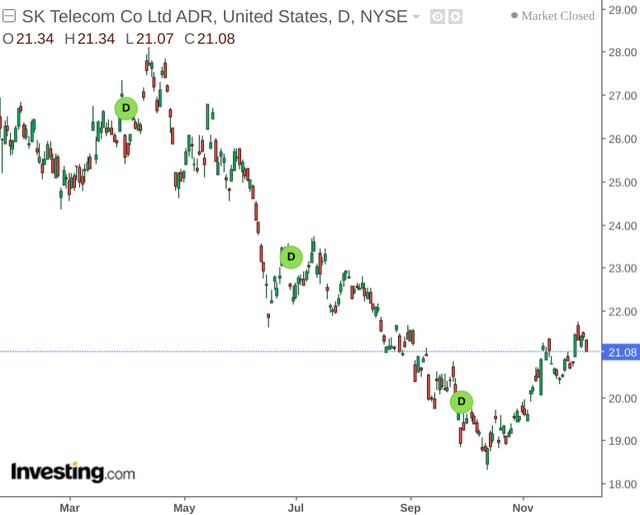

Since then, we’ve seen the inventory proceed to say no earlier than seeing a slight rebound up to now couple of months:

investing.com

The aim of this text is to evaluate whether or not SK Telecom may have the scope to rebound additional given the latest draw back.

Efficiency

My earlier article made the argument that in an inflationary atmosphere – SK Telecom might want to prioritise money circulation so as to deal with rising prices.

I beforehand remarked that given the corporate’s money to long-term borrowings and notes payable had elevated to above 30% for December 2021 and March 2022 – continued progress on this metric needs to be an encouraging signal.

We will see that for June and September 2022 – money and money equivalents grew whereas long-term borrowings and notes payable declined considerably, leading to a better money to long-term borrowings and notes payable ratio.

| (KRW bn) | 01/06/21 | 01/09/21 | 01/12/21 | 01/03/22 | 01/06/22 | 01/09/22 |

| Money and money equivalents | 211.9 | 315.7 | 407.7 | 436.7 | 649.4 | 583.6 |

| Lengthy-term borrowings and notes payable | 1376.6 | 1403.8 | 1255.1 | 1326.3 | 1245.2 | 852.4 |

| Money to long-term borrowings and notes payable ratio | 15.39% | 22.49% | 32.48% | 32.93% | 52.15% | 68.47% |

Supply: Figures sourced from SK Telecom Investor Briefing: 2022 Q1 Outcomes. Money to long-term borrowings and notes payable ratio calculated by creator.

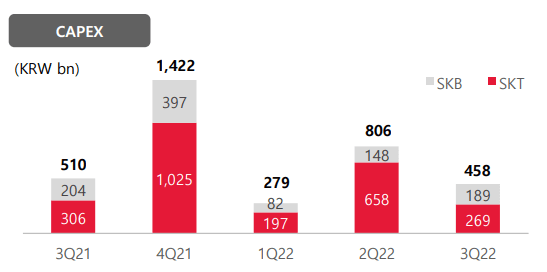

This has coincided with a decrease stage of capital expenditure as in comparison with final 12 months:

SK Telecom Investor Briefing 2022 Q3 Outcomes

On this regard, the truth that the corporate managed to extend its money relative to long-term borrowings is an encouraging signal – because it signifies that SK Telecom has extra liquidity to have the ability to deal with a possible drop in income and isn’t depending on long-term debt to maintain its enterprise.

When it comes to efficiency metrics, we are able to see that churn has maintained a charge of 0.8% over the previous 12 months. Furthermore, we are able to see that ARPU (or common income per person) has seen a slight decline from that of the identical quarter final 12 months. Moreover, 5G subscription progress continued to stay spectacular, up by 44% from that of final 12 months.

| Quarter | Month-to-month Churn | 5G subs | ARPU |

| 3Q20 | 0.9% | 4,263 | 30,051 |

| 3Q21 | 0.8% | 8,650 | 30,669 |

| 3Q22 | 0.8% | 12,468 | 30,633 |

Supply: Figures sourced from SK Telecom Investor Briefing 2022 Q3 Outcomes.

That stated, progress on a proportion foundation is down from 102% from 3Q20 to 3Q21 – which is anticipated as market demand begins to mature.

Moreover, whereas 5G subscriptions grew by 6.73% from 2Q22 to 3Q22, this was down from prior progress of 10.18% from 4Q21 to 1Q22.

On this regard, the money place for SK Telecom continues to stay robust, however modest income progress seems to have led the inventory decrease since Might.

Trying Ahead

Going ahead, except for the results of inflation probably limiting buyer demand – traders might proceed to be involved that the expansion the corporate has been seeing in 5G demand may ultimately stage off.

Whereas this can be a concern, I take the view that the corporate’s stability sheet efficiency is extremely encouraging, in that SK Telecom has decreased its long-term debt whereas persevering with to bolster its money reserves. Even when income progress stays modest within the quick to medium-term, continued enchancment in these metrics may imply additional potential upside for the inventory.

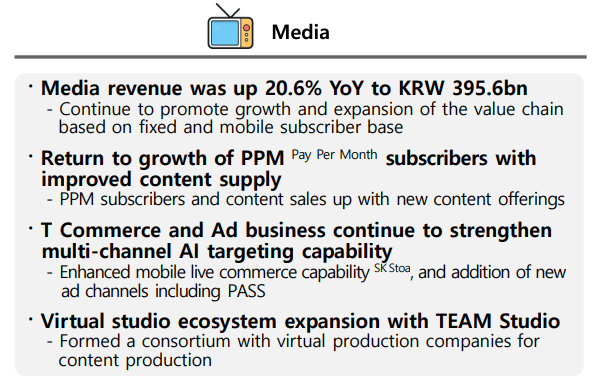

Furthermore, SK Telecom’s efficiency throughout the Media phase has been fairly spectacular – up by over 20% year-on-year.

SK Telecom Investor Briefing 2022 Q3 Outcomes

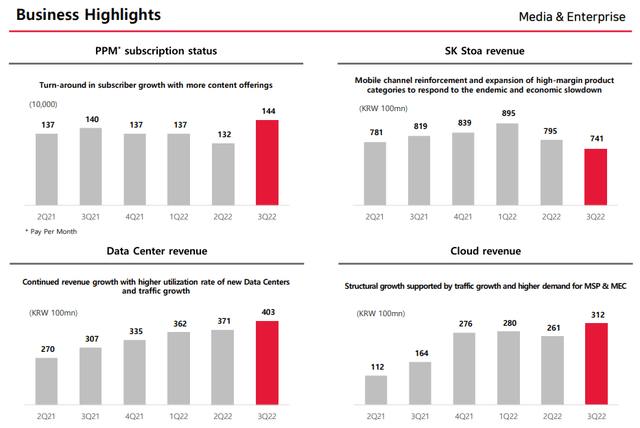

That is greater than the ten% progress that we noticed for year-on-year Q1 2022 outcomes, and we are able to see that progress in Information Heart and Cloud income has been lifting the phase total:

SK Telecom Investor Briefing 2022 Q3 Outcomes

Conclusion

To conclude, SK Telecom has continued to indicate robust stability sheet metrics and whereas traders may need some issues over modest income progress, progress throughout the Media phase continues to stay robust.

Whereas the inventory may see additional draw back if financial circumstances deteriorate considerably, I take the view that the inventory nonetheless has longer-term upside.