Silver Speaking Factors:

Advisable by James Stanley

Get Your Free High Buying and selling Alternatives Forecast

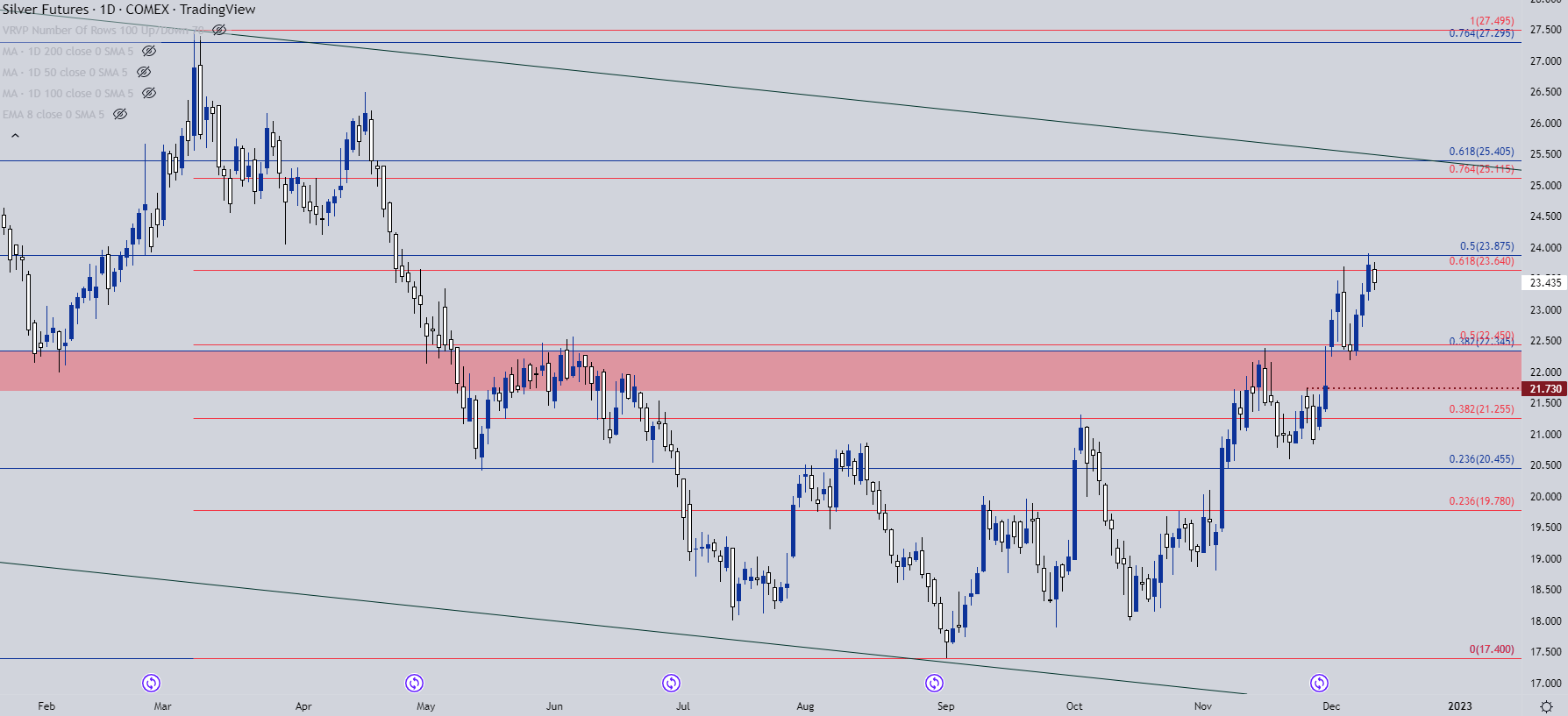

Silver costs set a recent seven-month-high on Friday, discovering resistance at a key Fibonacci stage that plots on the worth of 23.88. That is the 50% mark of the 2020-2022 sell-off and there’s additionally some prior worth motion reference, as this similar stage had helped to set a swing low a few years in the past.

I had regarded into Silver costs final week, highlighting a long-term zone of assist that ended up serving to to carve out final week’s lows. This runs from the 21.73 space as much as round 22.35, and this was an space of assist by means of 2021 commerce till coming in as resistance in Could after which once more in November, simply earlier than costs staged a breakout to the recent seven-month-highs that printed final week.

Silver Weekly Worth Chart

Chart ready by James Stanley; Silver on Tradingview

From the each day, we are able to see that assist pullback that confirmed up final week, with the lows carving out across the 38.2% Fibonacci retracement of the identical main transfer from which the 50% marker set the highs. There’s some further reference right here, as effectively, taken from the Fibonacci retracement protecting the 2022 main transfer, from the excessive set in March down the identical September low that was serving to to set the prior retracement.

This highlights one other stage of resistance that’s at-play, taken from round 23.64 and collectively, with the 23.88 stage, this creates a resistance zone that consumers should take care of if the breakout is to proceed. However, a latest higher-high mixed with final week’s higher-low retains the door open for bulls.

Advisable by James Stanley

Traits of Profitable Merchants

Silver Each day Chart

Chart ready by James Stanley; Silver on Tradingview

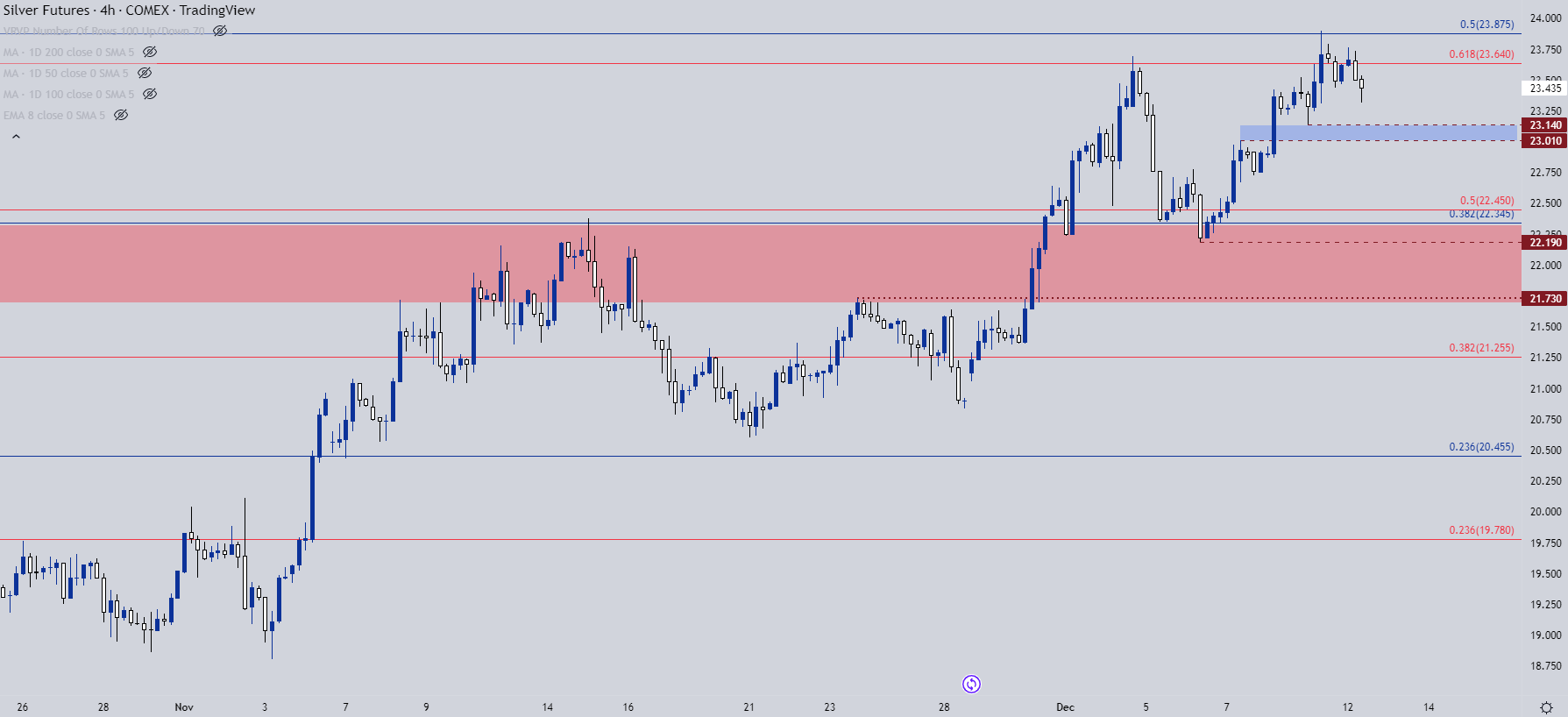

Silver Shorter-Time period

Silver carries bullish potential given the latest higher-high to go together with a higher-low, however the large query is the place that subsequent higher-low may seem.

Final week’s swing-low is at 22.19, so consumers might want to step-in to supply assist above that worth. From latest worth motion, there’s some potential for such across the 23 deal with, operating as much as round 23.14 which was final Friday’s swing-low simply earlier than the push as much as Fibonacci resistance.

Advisable by James Stanley

The Fundamentals of Development Buying and selling

Silver 4-Hour Chart

Chart ready by James Stanley; Silver on Tradingview

— Written by James Stanley, Senior Strategist, DailyFX.com & Head of DailyFX Training

Contact and observe James on Twitter: @JStanleyFX