An outdated adage says traders ought to “Promote Might And Go Away.”

The historic evaluation suggests summer time months of the market are usually the weakest of the yr. The mathematical statistics show this as $10,000 invested out there from November to April vastly outperformed the quantity invested from Might by way of October.

Curiously, the max drawdowns are considerably bigger through the “Promote In Might” durations. Earlier essential dates of main market declines occurred in October 1929, 1987, and 2008.

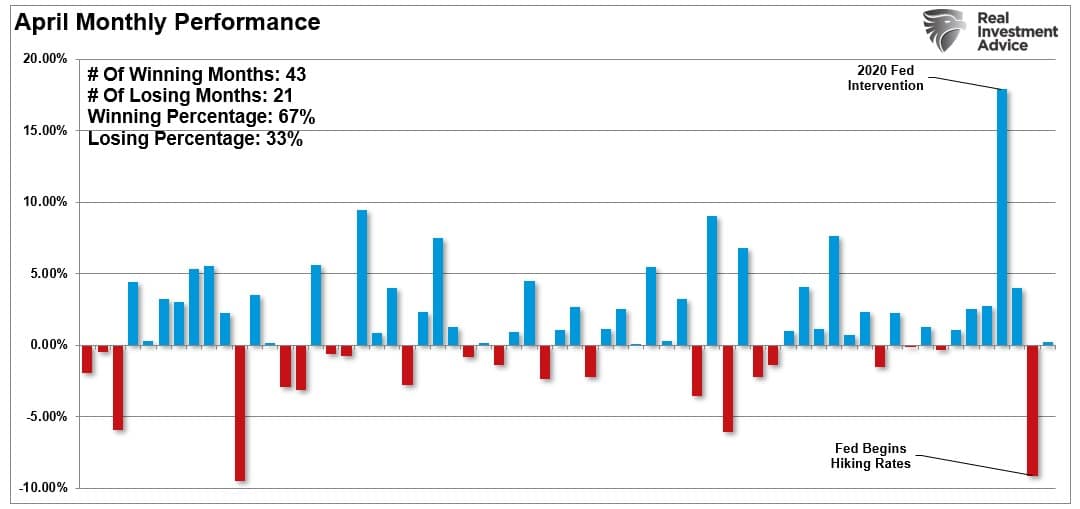

Nevertheless, not each summer time works out poorly. Traditionally, there are a lot of durations the place “Promote In Might” didn’t work and markets rose. 2020 and 2021 had been examples the place large Federal Reserve interventions pushed costs greater in April and subsequent summer time months. Nevertheless, 2022 was the other as April declined sharply because the Fed started an aggressive rate of interest climbing marketing campaign the previous month.

As the tip of April approaches, will 2023 be one other yr the place the “Promote In Might” technique works? Whereas nobody is aware of the reply, historic statistics, present financial indicators, and technical measures recommend some warning is warranted.

A Reversal Of Liquidity

Earlier than we focus on the place we’re presently, a fast evaluation of the earlier evaluation is required for context.

We that the correction following the robust January rally had seemingly began in February.

“Over the following few weeks, the ‘ache commerce’ is probably going decrease because the correction continues. If the bulls win this battle, these essential assist ranges will maintain. If not, we are going to seemingly start a extra profound decline as bearish fundamentals take over.”

The bears did certainly acquire management, and markets slid into mid-March. We then penned

“Nevertheless, with these purchase alerts in place, traders ought to modestly enhance fairness publicity, because the seemingly path for inventory costs is greater over the following two weeks to 2 months. As proven, the more than likely goal for the S&P 500 is 4200 earlier than severe resistance is encountered and an inexpensive degree to take income and once more scale back danger.”

Whereas the market didn’t rally to 4200, it received shut and peaked with an intraday excessive of 4168.

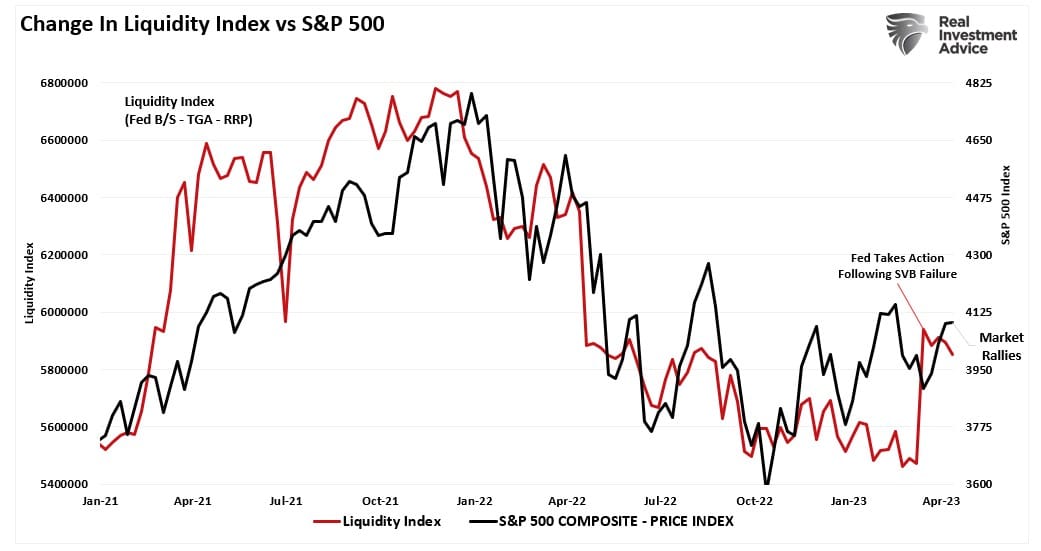

One other assist for that rally got here from the Fed’s bailout of the banks following the Silicon Valley Financial institution failure. As mentioned in , these loans to the banks weren’t technically QE. Nevertheless, from the market’s perspective, the Fed’s stability sheet enhance was “the ringing of Pavlov’s bell.”

“One other approach to take a look at that is by way of the liquidity measure of the Fed’s stability sheet, much less the Treasury basic account, much less the Fed’s reserve program. That mixed measure has a good correlation with adjustments out there.”

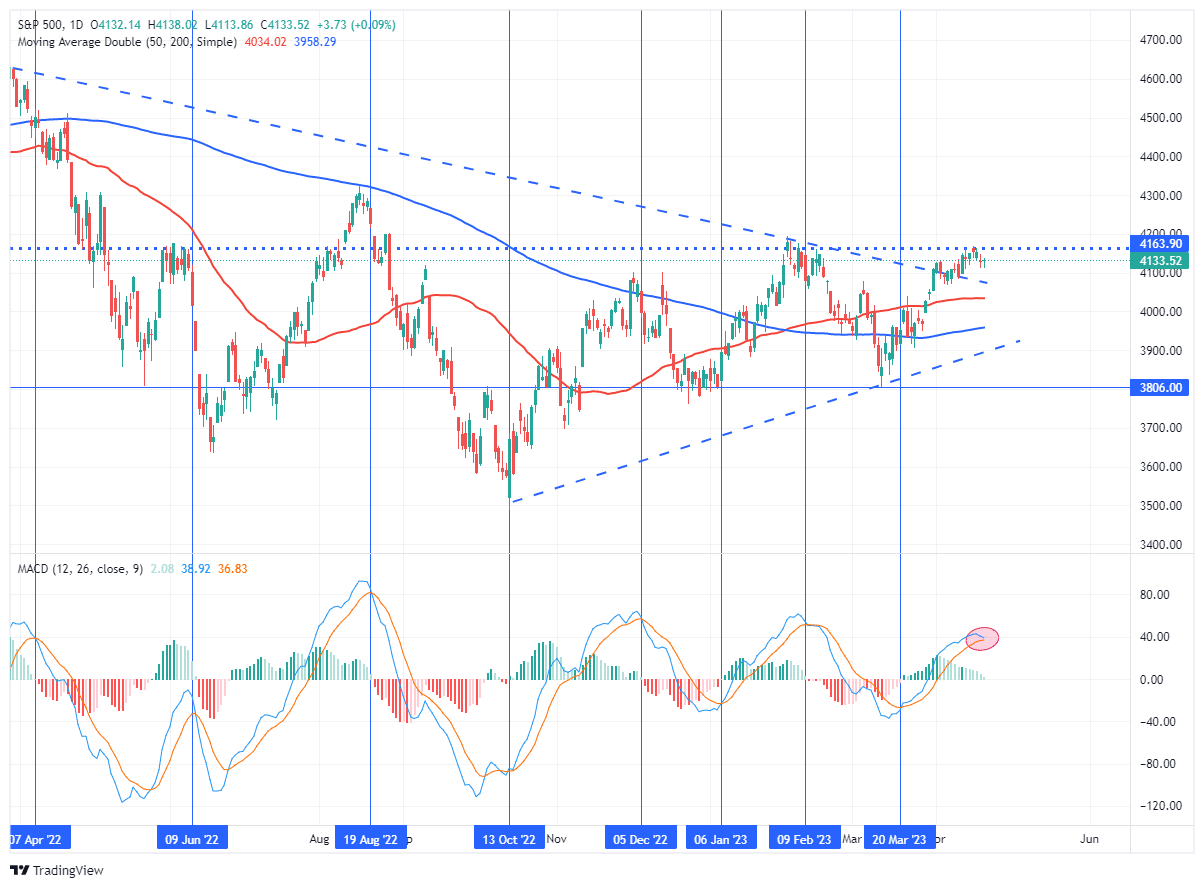

The chart beneath has been annotated and up to date since that report. Not surprisingly, given the historic correlation between the liquidity index and the , the market rallied in response to the liquidity enhance. As we strategy the “Promote Might” interval, that liquidity index is declining and can seemingly fall additional because the Treasury and the Authorities wrestle over the upcoming debt ceiling.

As famous, it isn’t simply the reversal of liquidity that implies that promoting Might could also be prudent, but additionally the technical and financial indications.

Indicators Recommend Warning

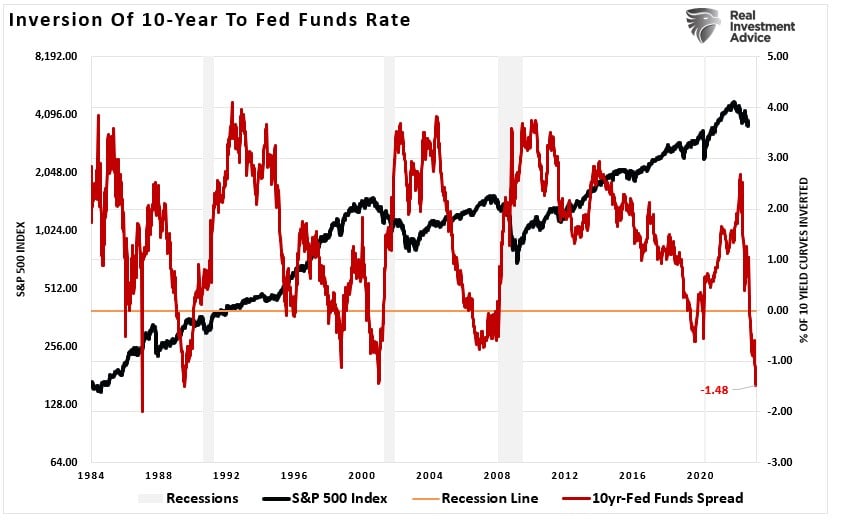

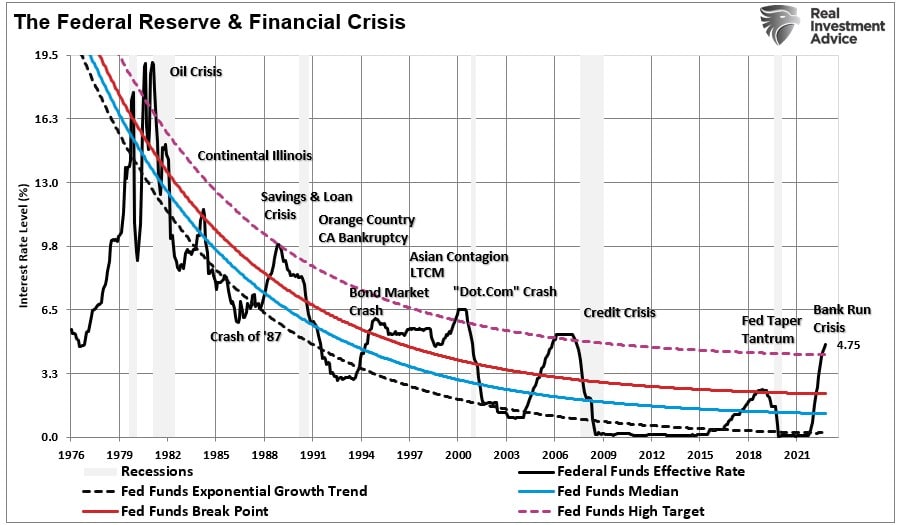

Within the newest Bull Bear Report, I mentioned that many indicators are undoubtedly regarding and recommend an “official” financial recession is probably going. The inversion of the Fed Funds fee to the Treasury is essentially the most inverted since 1986 (roughly 10 months earlier than the 1987 market crash.)

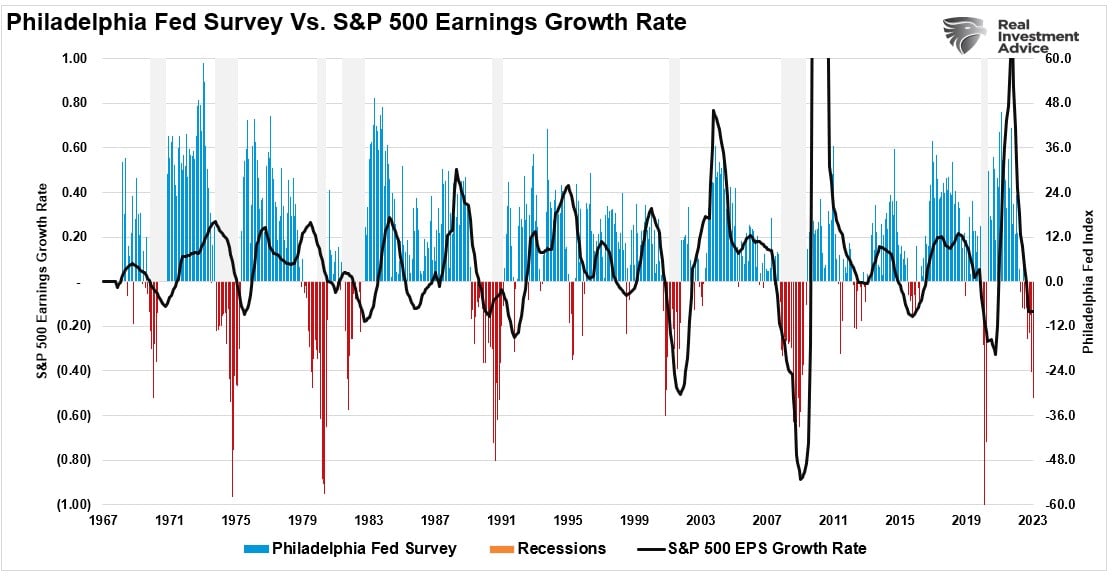

Moreover, the newest launch of the confirmed a pointy plunge in sentiment, suggesting a extra pronounced correction than earnings presently signify. Traditionally, such deep readings of the “Philly Fed” index had been related to more durable, not softer, financial recessions.

Nevertheless, within the brief time period, it’s the technical value motion that we pay the closest consideration to. Such is as a result of the value motion represents the psychology of the market. These technical indicators had been the first drivers behind lowering publicity to the markets in February and rising once more in March. The vertical traces signify every “purchase” and “promote” sign during the last yr.

Whereas these alerts will not be timing indicators to “be all in or out” of the market, they’ve constantly supplied good alerts to extend and scale back publicity to fairness danger accordingly. These indicators recommend that traders could also be nicely served to “Promote Might” and return later.

The Fed Set To Hike Charges

Whereas the technical indications could also be sufficient warning on their very own to scale back danger heading into Might, it’s price remembering the is about to hike charges once more on the fifth. With every fee hike, we’re getting nearer to the Federal Reserve breaking one thing economically or financially. Such has repeatedly been the case all through historical past, and given the aggressiveness of the speed climbing marketing campaign during the last yr, a unfavourable end result could be unsurprising.

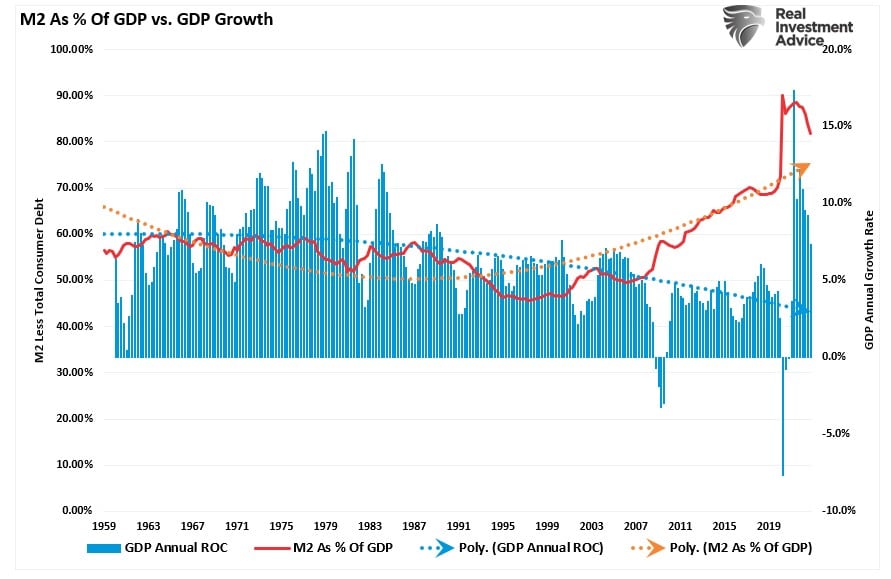

To this point, the markets have weathered the speed enhance significantly better than anticipated. Nevertheless, most of these fee hikes haven’t labored by way of the financial system. Moreover, the economic system has remained buoyed by the huge enhance in cash provide, which nonetheless helps financial exercise. However that assist can also be fading because the final vestiges of pandemic assist packages finish.

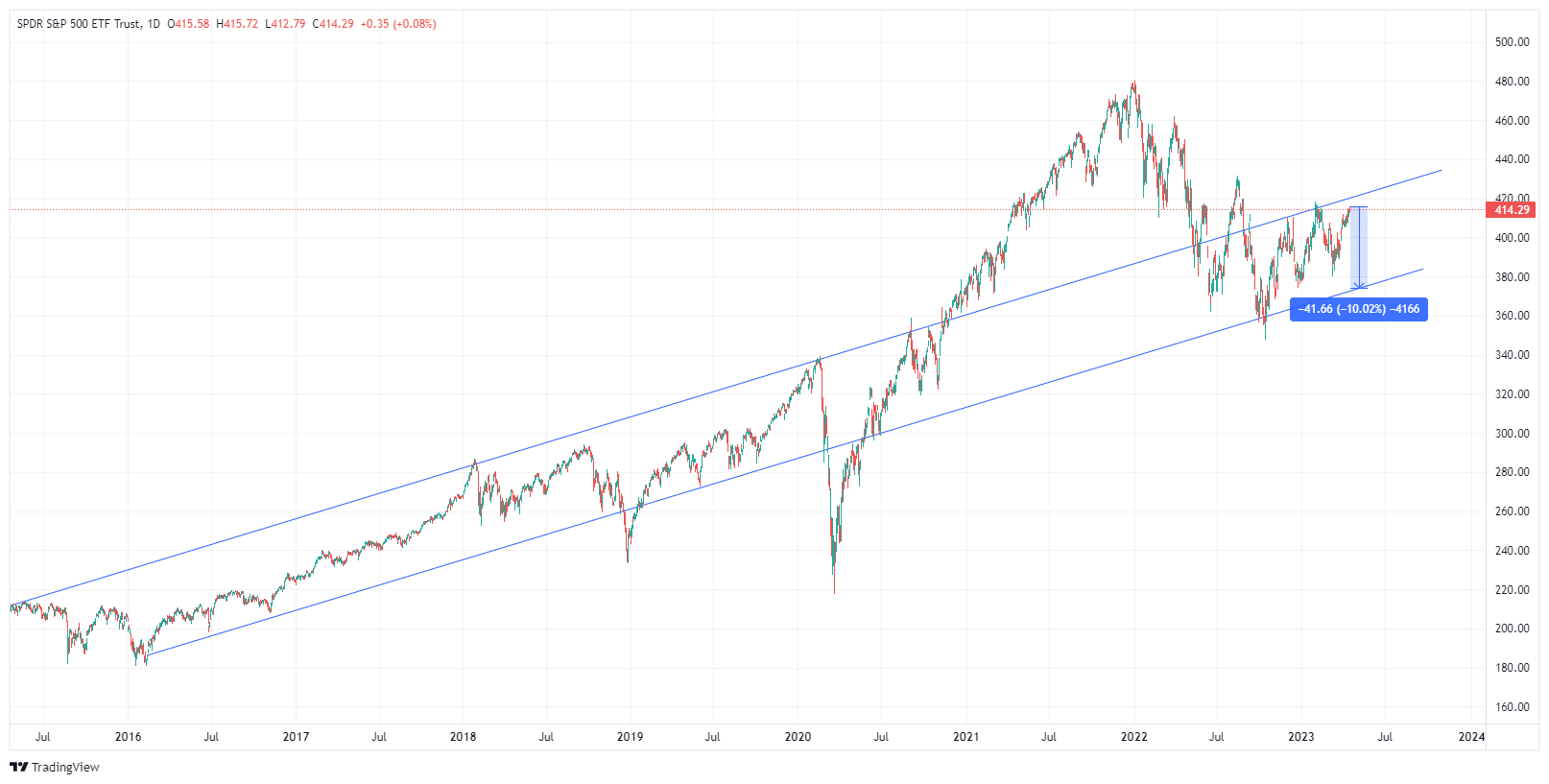

As we enter the historically weak summer time months, we should be aware that the market’s bullish pattern stays intact. Nevertheless, as I concluded this previous weekend:

“A correction ought to be acknowledged and anticipated. A ten% decline would result in one other retracement to the lows of the bullish pattern channel, as famous above. If that assist holds, that will be a logical place so as to add publicity to danger property from a purely technical perspective.”

For these causes, we have now raised money and lowered fairness danger in portfolios as we head into the seasonally weak summer time months. May we be incorrect to “promote Might” and go away till later? It’s actually potential, and if such is certainly the case, we are going to add publicity accordingly when wanted.

Nevertheless, being cautious heading into the summer time could pay additional dividends.