Bitcoin bulls have had a torrid week. Trying on the value motion within the each day chart, not solely is the coin down roughly 7% after breaching $70,000 early this week, however cracks are starting to type. General, optimistic merchants preserve that the uptrend stays, contemplating the sharp enlargement between July 14 and 21. Nonetheless, since then, costs have been uneven and principally shifting decrease, signaling the potential presence of bears.

Extra Ache For Bitcoin Holders?

In gentle of this unstable value motion, one analyst is cautious of what lies forward, even predicting that Bitcoin may, in spite of everything, proceed dropping within the classes to come back. Taking to X, the analyst shared buying and selling information, which means that bears are in management, at the least for now.

Particularly, the analyst famous that the weekly clusters of liquidation quantity have been growing, coinciding with the latest value drop over the previous buying and selling day. With this sign printing, the analyst is satisfied that bears may proceed pushing the coin decrease at the least within the subsequent week.

Whereas this prints out, the online taker quantity throughout main perpetual exchanges stays adverse. The web taker quantity, which on-chain analysts use to gauge market sentiment, fluctuates relying on market valuation.

When the online taker quantity sinks into adverse territory, it suggests that almost all merchants are taking quick positions. In keeping with the analyst, costs may recuperate solely when this studying turns inexperienced, permitting bulls to take cost of the market.

Trying on the Bitcoin each day chart, patrons have help at across the $63,000 stage. Nonetheless, a stage increased, the zone between $60,000–a spherical quantity–and $63,000 shall be vital.

If bulls maintain this stage, stopping sellers from pushing costs decrease, the chances of Bitcoin recovering shall be excessive. Any enlargement above $70,000 can be essential and in alignment with the bullish development established within the third week of July.

Establishments Accumulating: Spot ETF Issuers Management Practically 300,000 BTC

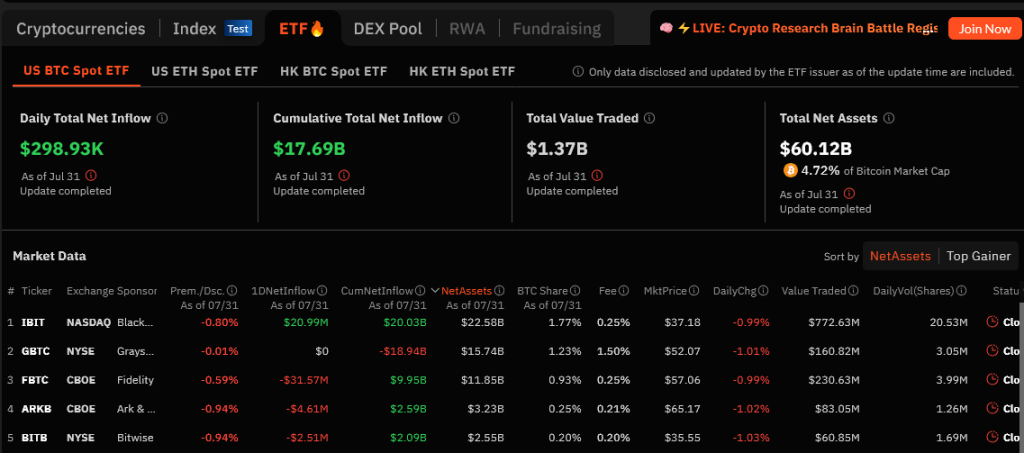

Regardless of the present weak spot, establishments are eager to get publicity to Bitcoin. For the reason that approval of spot Bitcoin ETFs in the USA, Ecoinometrics information exhibits that main issuers like Constancy and BlackRock have amassed almost 300,000 BTC.

On August 1, Soso Worth information revealed that each one spot Bitcoin ETFs maintain over $60 billion price of BTC. On July 31 alone, BlackRock bought almost $21 million price of BTC.

Even so, there have been main outflows from different issuers, primarily Constancy. That establishments are doubling down, accumulating the coin is overly bullish for Bitcoin, particularly in the long run.

Function picture from Canva, chart from TradingView