While it is traditionally viewed as a B-grade economic indicator, the August consumer credit report from the Federal Reserve was another shocker especially after last month’s unexpected slow down in credit card debt, which we attributed to the surge in credit card rates and wondered if this implicit deleveraging would continue as the US economy slid into recession, or if US consumers are so desperate for liquidity they will max out their cards – without expecting to repay them – if it meant being able to pay for one more month of goods and services at record prices. We just got the answer when moments ago the Fed published the latest consumer credit data and it was a doozy.

Total consumer credit rose $32.2 billion, well above last month’s $26 billion and also above the $25 billion consensus estimate.

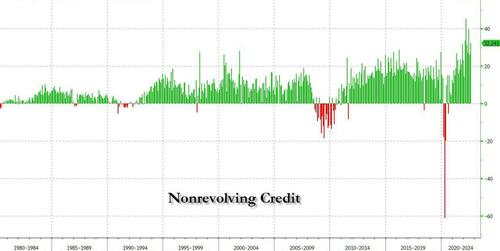

And while non-revolving credit (student and car loans) rose by a relatively pedestrian$15.1 billion…

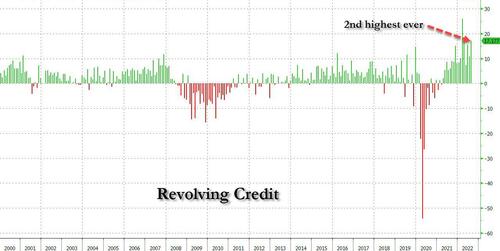

… the stunner again was revolving, or credit card debt, which soared from last month’s sharp drop, rising by the second highest on record at $17.2 billion (from $10.4 billion last month) and only lower than the highest print on record, March’s downward revised $25.9 billion…

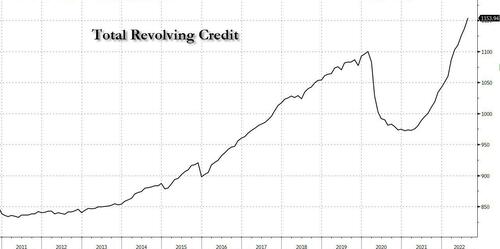

This sent total revolving consumer credit to new all time highs at just over $1.15 trillion, erasing all the post-covid credit card deleveraging just in time for those credit card APRs to hit record highs!

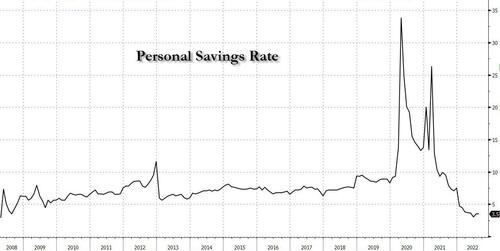

While this unprecedented rush to buy everything on credit at a time when there were no notable Hallmark holidays should not come as much of a surprise, after all we have repeatedly shown that for the middle class any “excess savings” – or any savings for that matter – are now gone, long gone (as the latest GDP revision confirmed) with the personal savings rate plunging to the lowest on record….

… what is shocking is that consumers are clearly ignoring the highest credit card APRs on record and rushing to charge anything they can find while they can, either because they simply can’t afford to buy anything with their disposable income courtesy of soaring inflation or because nobody has any plan of actually paying down their credit card.

The consequences of either of these alternatives is staggering, and suggests that the US economy is about to implode… but not before the midterms of course: the fake impression that all is well must be maintained until at least Nov 8. After that, however, we suggest you panic.