NFP, USD, Yields and Gold Analysed

- A disappointing 114k jobs had been added to the financial system in July, lower than the 175k anticipated and prior 179k in June.

- Common hourly earnings proceed to ease however the unemployment fee rises to 4.3%

- USD continues to development decrease as do US treasuries whereas gold receives a lift

Advisable by Richard Snow

Get Your Free USD Forecast

US Labour Market Exhibits Indicators of Stress, Unemployment Rises to 4.3%

Non-farm payroll knowledge for July upset to the draw back as fewer hires had been achieved within the month of June. The unemployment fee shot as much as 4.3% after taking the studying above 4% simply final month. Economists polled by Reuters had a most expectation of 4.2%, including to the rapid shock issue and decline within the dollar.

Beforehand, the US job market has been hailed for its resilience, one thing that’s coming beneath menace within the second half of the 12 months as restrictive financial coverage seems to be having a stronger impact within the broader financial system.

Customise and filter dwell financial knowledge through our DailyFX financial calendar

Indicators forward of the July NFP quantity indicated that we could nicely see a decrease quantity. The employment sub-index of the ISM manufacturing survey revealed a pointy drop from 49.3 to 43.4. The general index, which gauges sentiment throughout the US manufacturing sector, slumped to 46.8 from 48.5 and an expectation of 48.8 – leading to sub 50 readings for 20 of the previous 21 months. Nevertheless, the ISM companies knowledge on Monday is prone to carry extra weight given the sector dominant make-up of the US financial system.

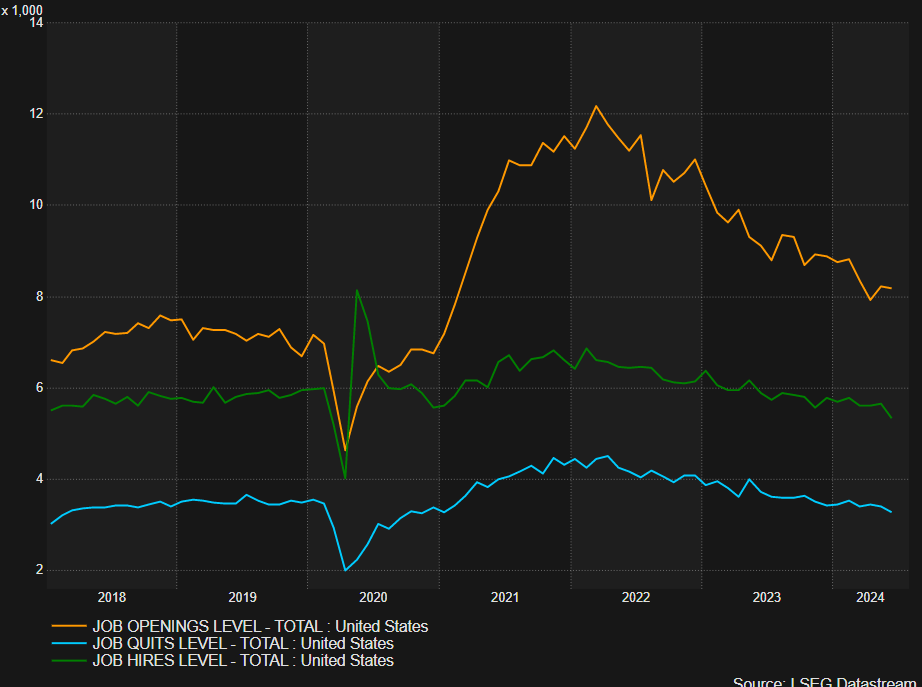

Further indicators of labour market weak spot has been constructing over a very long time, with job openings, job hires and the variety of folks voluntarily quitting their jobs declining in a gradual vogue.

Declining JOLTs Knowledge (Job hires, Job Quits, Job Openings)

Supply: LSEG Reuters, Datastream, ready by Richard Snow

What Does the Disappointing Jobs Knowledge Imply for the Fed?

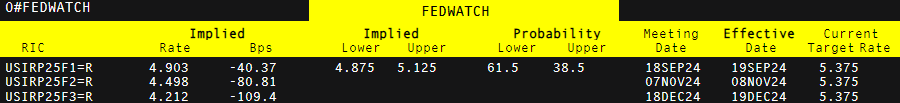

In the identical week because the FOMC assembly, the disappointing jobs knowledge feeds straight into the message communicated by Jerome Powell and the remainder of the committee that there’s a higher concentrate on the second a part of the twin mandate, the employment aspect.

This has led to hypothesis that subsequent month the Fed could even contemplate entrance loading the upcoming fee minimize cycle with a 50-basis level minimize to get the ball rolling. Markets at the moment assign an 80% probability to this end result, however such enthusiasm could also be priced decrease after the mud settles because the Fed will need to keep away from spooking the market.

Nonetheless, there’s now an expectation for 4 25-basis level cuts, or one 50 bps minimize and two 25 bps cuts, earlier than the top of the 12 months. This view contrasts the only fee minimize anticipated by the Fed in keeping with their most up-to-date dot plot in June.

Implied Market Possibilities of Future Fed Price Cuts

Supply: LSEG Reuters, ready by Richard Snow

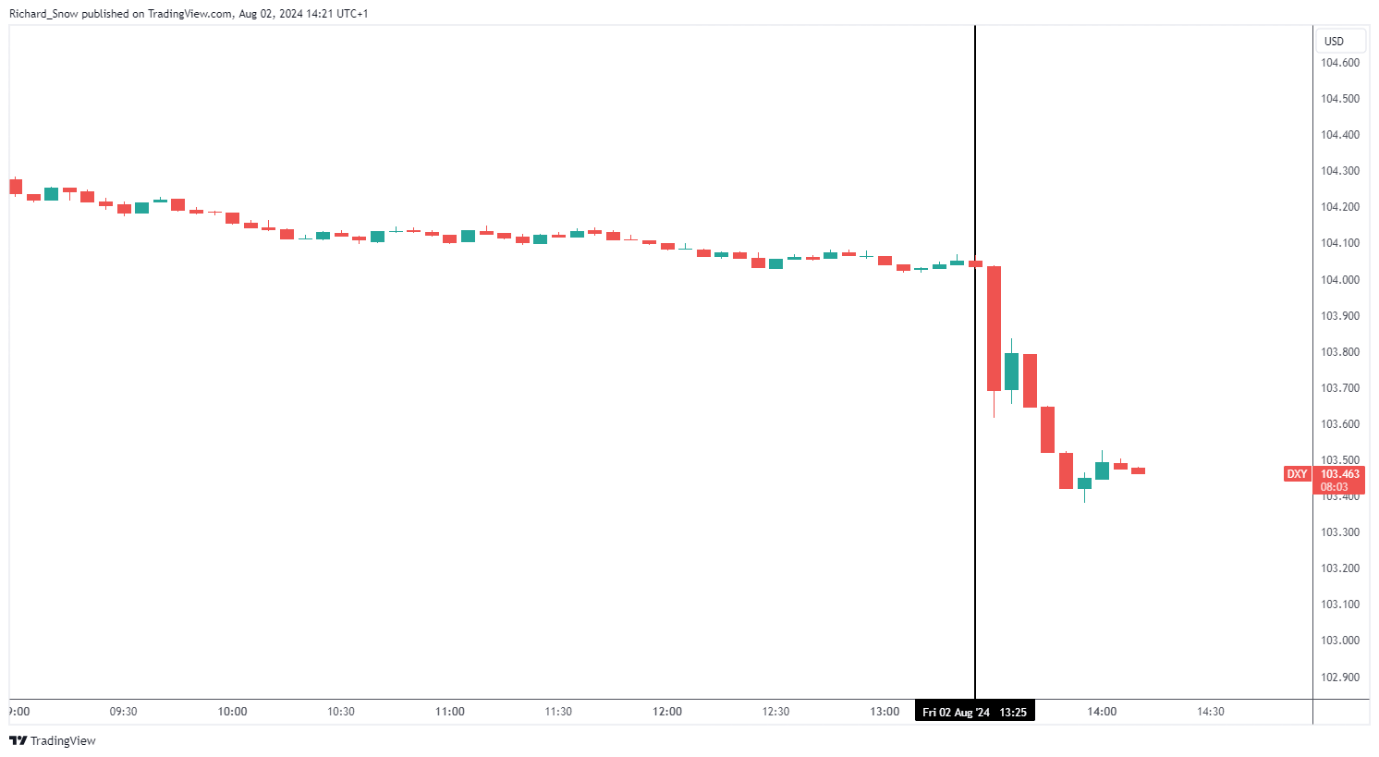

Market Response: USD, Yields and Gold

The US greenback has come beneath stress as inflation continued to point out indicators of easing in latest months and fee minimize expectations rose. The greenback eased decrease forward of the info however actually accelerated decrease within the moments after the discharge. With a number of fee cute probably coming into play earlier than the top of the 12 months, the trail of least resistance for the dollar is to the draw back, with potential, shorter-term help at 103.00.

US Greenback Index 5-Minute Chart

Supply: TradingView, ready by Richard Snow

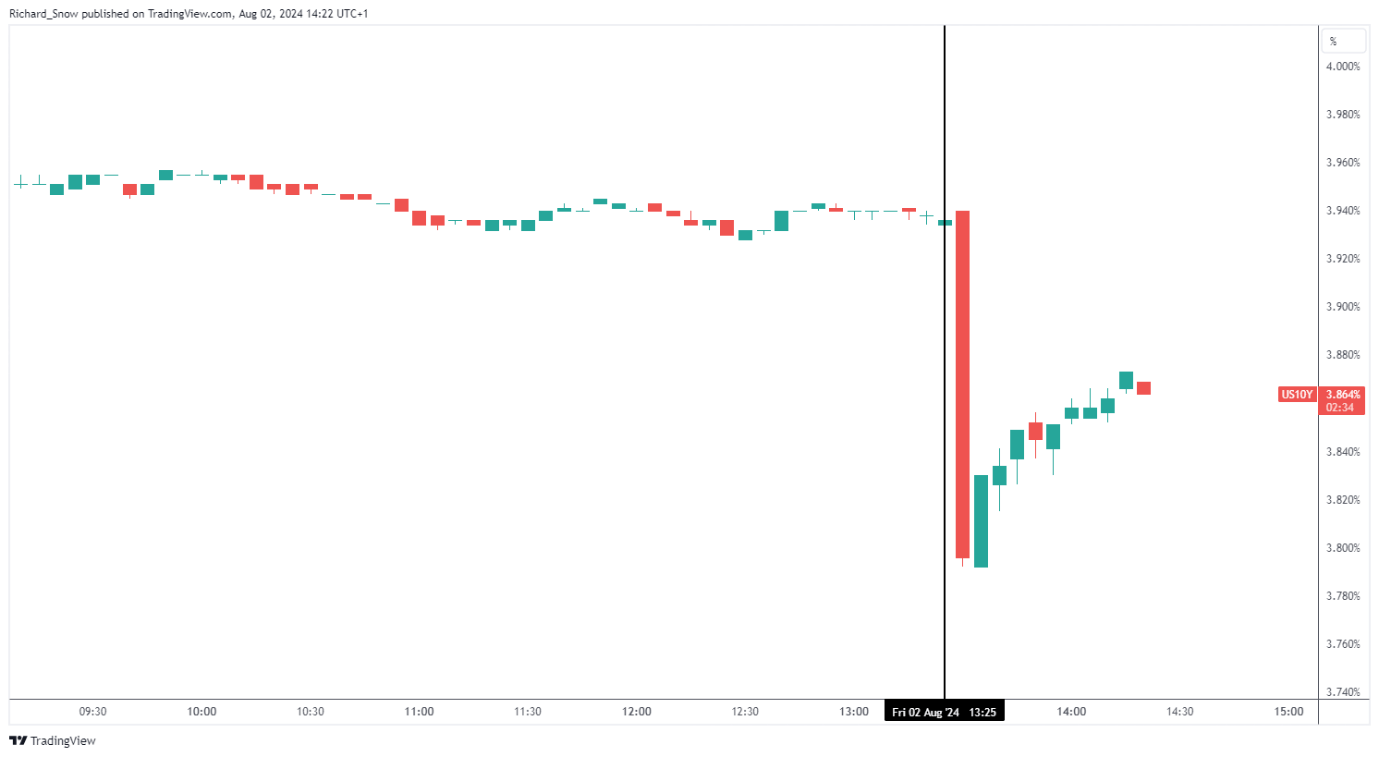

Unsurprisingly, US Treasury yields headed decrease too, with the 10-year now buying and selling comfortably beneath 4% and the 2-year slightly below the identical marker.

US Treasury Yield (10-Yr) 5-Minute Chart

Supply: TradingView, ready by Richard Snow

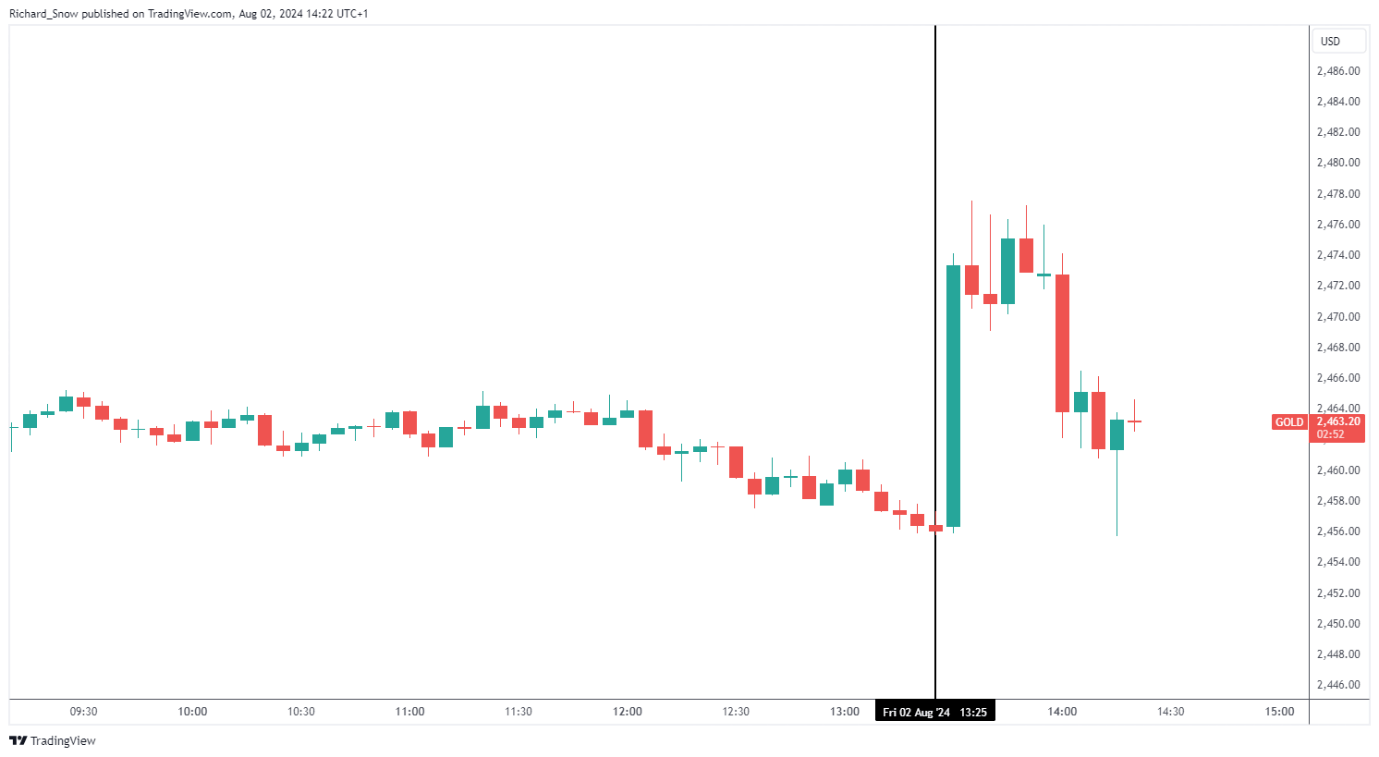

Gold shot greater within the rapid aftermath of the info launch however has recovered to ranges witnessed earlier than the announcement. Gold tends to maneuver inversely to US yields and so the bearish continuation in treasury yields supplies a launchpad for gold which can additionally profit from the elevated geopolitical uncertainty after Israel deliberate focused assaults in Lebanon and Iran.

Gold 5-Minute Chart

Supply: TradingView, ready by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and comply with Richard on Twitter: @RichardSnowFX