ISM Companies PMI Studying Drops however the Outlook Stays Optimistic

The providers sector is the biggest by far and contributes probably the most to whole US GDP. As such, it supplies an important sign of the general well being of the US economic system. The PMI report aggregates opinions of the businesses’ buying managers who typically see shifts in tendencies earlier than they filter into the broader economic system.

The composite measure declined from 54.5 to an anticipated 53.6 in what continues to be being considered a optimistic final result. Figures over 50 point out sector growth whereas something beneath 50 signifies a contraction.

Customise and filter dwell financial knowledge by way of our DailyFX financial calendar

One notable subcategory is the ‘new orders’ knowledge which revealed a pointy drop in September from 57.5 to 51.8. Nevertheless, the drop stays above 50 and continues to be considered in a optimistic mild however must be monitored in subsequent month’s print. Enterprise exercise/manufacturing alternatively was seen growing, whereas costs remained flat month on month and employment dropped. This week is essential for labour market statistics with the JOLTS report revealing {that a} vital variety of jobs stay out there and ADP employment dissatisfied for September. Hold a watch out for tomorrow’s preliminary jobless claims and Friday’s NFP report.

Learn how to arrange and commerce round information releases within the devoted information beneath:

Advisable by Richard Snow

Buying and selling Foreign exchange Information: The Technique

Market Response:

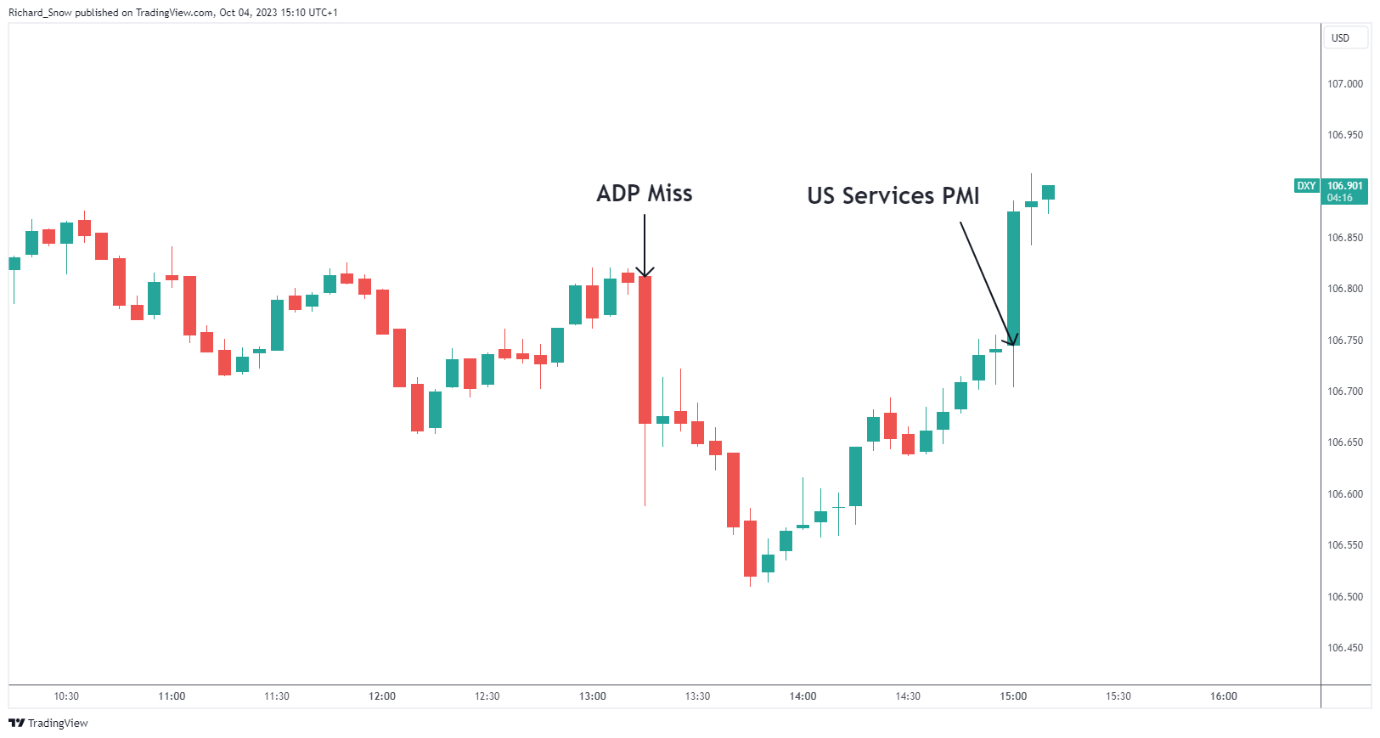

The US greenback (DXY) dipped after the ADP miss however recovered intra-day after the general optimistic providers report. A robust providers sector suggests the economic system is powerful – necessitating tighter monetary circumstances for longer. US yields additionally famous a slight transfer to the upside after the discharge.

US Greenback Basket (DXY) 5-minute chart

Supply: TradingView, ready by Richard Snow

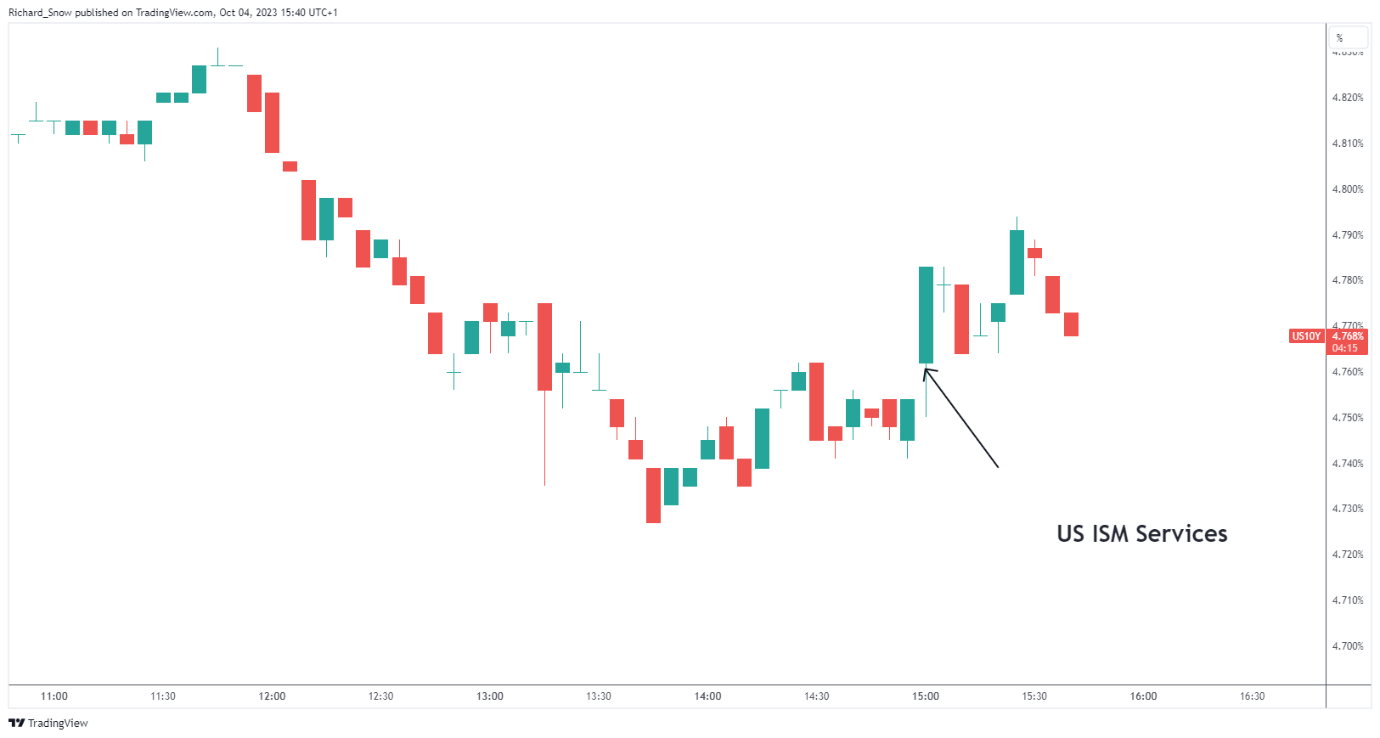

The ten-Yr US Treasury notice witnessed a marginal transfer increased in a buying and selling session that broadly noticed yields ease on the day.

US 10-Yr Treasury Yield

Supply: TradingView, ready by Richard Snow

We have now launched This fall forecasts for main traded property. Discover out the place the US greenback is headed by claiming the information beneath:

Advisable by Richard Snow

Get Your Free USD Forecast

— Written by Richard Snow for DailyFX.com

Contact and observe Richard on Twitter: @RichardSnowFX