IGphotography

Seritage Quarterly Replace:

Seritage Development Properties (NYSE:SRG) filed its 10-Ok on April 1 after a brief delay. There have been no main surprises within the submitting. Importantly, the corporate had no further impairments of actual property belongings and added about $32 million in positive factors on sale of actual property. These two knowledge factors are vital to validate the worth of the portfolio.

The one actual detrimental I noticed was a continued loss from fairness in unconsolidated associates, principally JV’s the corporate is attempting to exit. Backing that out, the corporate had constructive NOI, though there was an working money burn that administration can solely achieve this a lot to attenuate.

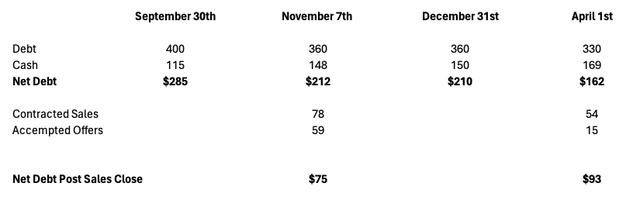

The corporate gave a pleasant overview of the remaining portfolio and gross sales course of. The contracts/accepted gives from November are enjoying out slowly, and it appears some gross sales have damaged or been diminished. Nonetheless, as demonstrated by the desk under that highlights the adjustments from the tip of Q3, the timing of the Q3 report versus the tip of This autumn and the time of the This autumn report, the delays and adjustments of worth are de minimus within the grand scheme of issues.

Seritage Debt Profile (Creator’s Calculations Based mostly on Firm Filings)

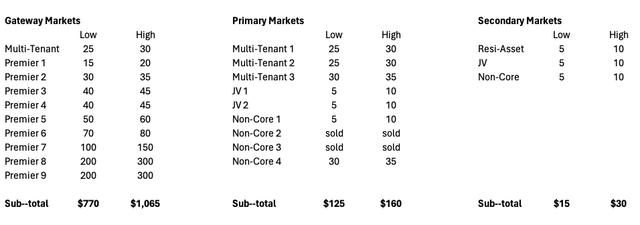

Extra vital, in my thoughts, the corporate has not modified its anticipated worth ranges for the remaining properties. I refer everybody to my final article on the corporate to see how the under numbers have modified (or not for that matter) from final quarter’s estimates.

Seritage Asset Values by Property and Market (Creator’s Calculations Based mostly on Firm Filings)

Valuation:

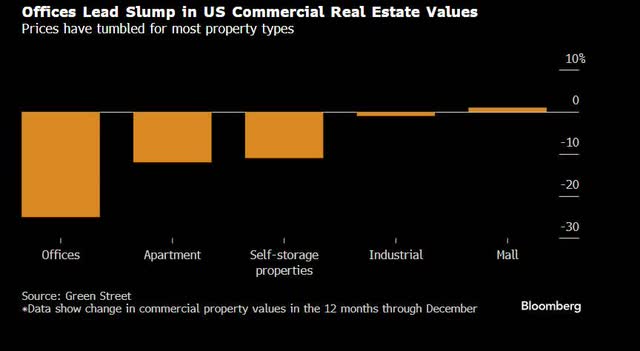

Whereas rates of interest, excessive debt ranges, tight lending surroundings, and total jitters about future use are hobbling the backdrop for actual property transactions stinks proper now, my views of the embedded worth right here stays unchanged. Actual property is a neighborhood enterprise that’s additional damaged down by asset kind. Whereas many have thought of the mall a dying asset class, malls have been the one actual property kind to realize in worth final yr, even beating out industrial/warehouse.

2023 Efficiency of US Actual Property Sectors (Bloomberg)

Furthermore, as evidenced by Blackstone shopping for AIR Communities yesterday, good belongings in good markets will discover consumers.

I proceed to consider that promoting the first and secondary market belongings can pay down many of the internet debt. Proceeds from the gross sales of the Gateway Markets will create fairness worth. I proceed to consider this inventory is value a spread of about $14 to $20/share, with out even contemplating any worth of any tax belongings.

High quality of Administration:

I proceed to assume administration, notably CEO Andrea Olshan, is doing a terrific job right here. Andrea is working a decent ship and getting truthful values for the properties beneath her care. I’d like to see her ready to redevelop the belongings like Dallas and San Diego, which might require creativity, monetary acumen, group, and simply plain realizing the procuring heart trade. Andrea has the entire above in spades. I believe she’s a uniquely certified and gifted govt who may create a variety of worth with these belongings beneath the suitable construction.

Threat:

The dangers right here proceed to be basic actual property market values and Andrea sticking round. Tight lending and viscous markets will delay asset gross sales and maybe finally harm values.

Andrea exhibits no indicators of strolling away right here. I’ve full religion in her integrity as an individual and an govt. Nonetheless, no govt is chained to any firm. If one other incredible alternative got here alongside that rewarded her higher for her time and skills (that are appreciable), I would not blame her for taking it.

Conclusion:

This inventory has reacted nicely since my final SRG article on the dangerous actual property transaction surroundings. It seems like the corporate is being barely affected by the transaction slowdown, however nothing horrific within the scheme of belongings value near $1 billion. I believe Seritage Development Properties has restricted draw back and good upside. It is only a matter of time and yield.