Key Takeaways

- Michael Saylor has proposed a Bitcoin reserve plan to the SEC aiming to create as much as $81 trillion in wealth for the US Treasury.

- The SEC’s Crypto Job Pressure is working in direction of a regulatory framework balancing innovation and investor safety.

Share this text

At the moment, it was launched that this previous Friday, Michael Saylor offered his proposal to the SEC’s Crypto Job Pressure, outlining a strategic Bitcoin reserve plan that might generate between $16 trillion and $81 trillion in wealth for the US Treasury.

🚨NEW: @saylor met with the @SECGov #crypto process power on Friday. pic.twitter.com/KkLfb5Mf2Q

— Eleanor Terrett (@EleanorTerrett) February 24, 2025

The proposal goals to deal with the nationwide debt, which presently stands at $36.2 trillion, comprising $28.9 trillion in public debt and $7.3 trillion in intergovernmental debt as of February 5, 2025.

The plan is a part of Saylor’s “Digital Belongings Framework,” launched on X on December 20, 2024.

A strategic digital asset coverage can strengthen the US greenback, neutralize the nationwide debt, and place America as the worldwide chief within the Twenty first-century digital economic system—empowering tens of millions of companies, driving development, and creating trillions in worth. https://t.co/7n7jQqPkf1

— Michael Saylor⚡️ (@saylor) December 20, 2024

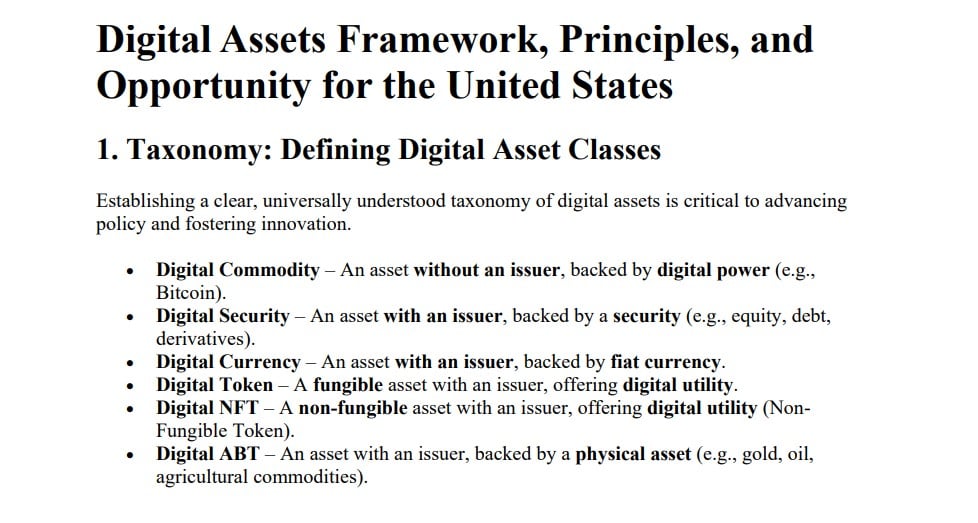

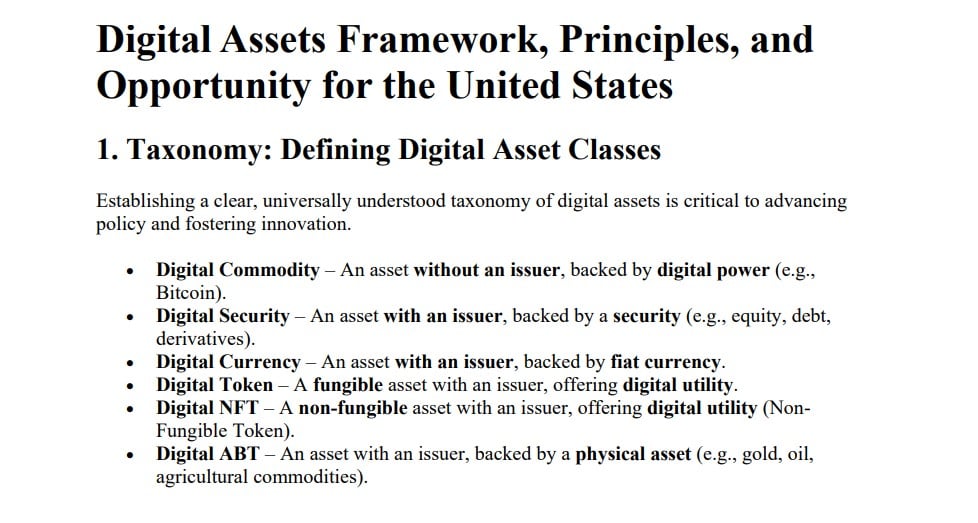

This Framework seeks to supply regulatory readability by categorizing digital property into six courses: Digital Commodities, Digital Securities, Digital Currencies, Digital Tokens, Digital NFTs, and Digital ABTs.

Beneath the framework, Bitcoin is assessed as a Digital Commodity, representing decentralized property not tied to an issuer.

Different classes embody tokenized fairness or debt (Digital Securities), stablecoins pegged to fiat (Digital Currencies), fungible utility tokens (Digital Tokens), distinctive digital artwork or mental property representations (Digital NFTs), and tokens tied to bodily commodities (Digital ABTs).

To streamline the issuance course of, Saylor proposes capping issuance compliance prices at 1% of property underneath administration and annual upkeep prices at 10 foundation factors.

The SEC established its Crypto Job Pressure in January, acknowledging the constraints of its earlier enforcement-focused strategy, which had created uncertainty within the business.

The duty power goals to develop a regulatory framework that balances innovation with investor safety by stakeholder engagement.

Final Thursday, Michael Saylor proposed that the US authorities ought to purchase 20% of Bitcoin’s whole circulation to keep up a dominant standing within the international digital economic system and guarantee financial empowerment.

Share this text