I Wayan Suarnaya/iStock via Getty Images

Today, I continue the series of updates on emerging markets-focused exchange-traded funds with the article on the iShares MSCI Indonesia ETF (NYSEARCA:EIDO).

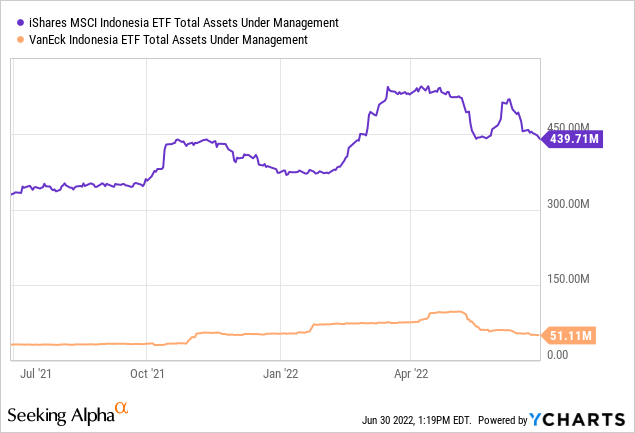

Tracking the MSCI Indonesia IMI 25/50 Index, EIDO offers targeted exposure to the country’s equity universe principally via large-caps, though with a few smaller-size companies also present. In the current version, it is long 90 equities, with the top five accounting for almost 48% of the net assets. Financials dominate the portfolio completely, sporting a weight of close to 43%, followed by communication (12.9%) and consumer staples (11.5%). It underweights utilities (1.2%) and IT (0.65%). In terms of AUM, EIDO is way ahead of its peer the VanEck Vectors Indonesia Index ETF (IDX). Both have expense ratios of 57 bps. IDX is also a bit different regarding sector exposure, with lower allocation to financials but a larger share of net assets parked in materials.

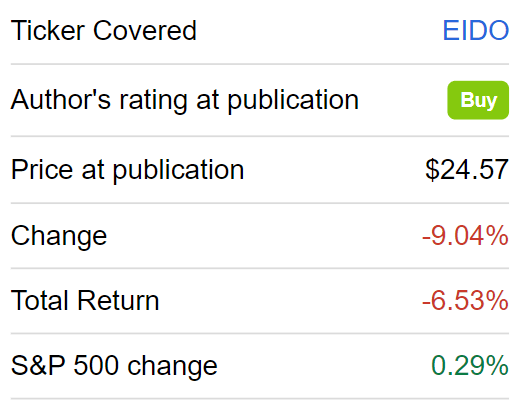

Since my bullish piece was published on January 15, 2021, EIDO has surprised to the downside, delivering a negative total return of 6.5%, while the S&P 500 has risen by a few basis points.

Seeking Alpha

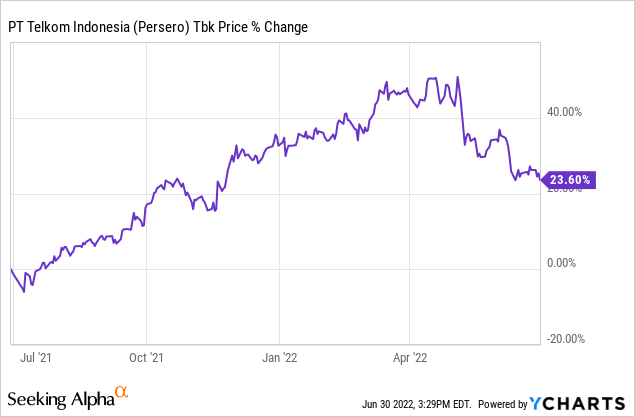

The key reason for the fund performing softer than expected is the FX pressure. I am of the opinion that the elevated U.S. inflation stemming from supply/demand imbalances and lately worsened by the energy crisis was the key culprit for the bullish thesis not materializing in 2021-2022 to date. That is to say, the USD has been appreciating consistently, bolstered by the inflation-fighting Fed, while the Indonesian central bank has been dovish, decidedly keeping the 7-day reverse repo rate steady, which has taken its toll on the rupiah. And even though a few EIDO holdings like Bank Central Asia (OTCPK:PBCRF) (IDX ticker BBCA) and Telekomunikasi Indonesia (TLK) (IDX ticker TLKM) were delivering robust performance, with the former having an ~21% one-year price return in Jakarta and the latter delivering a 28.6% return (~23.6% in New York), the ETF still failed to beat the iShares Core S&P 500 ETF (IVV).

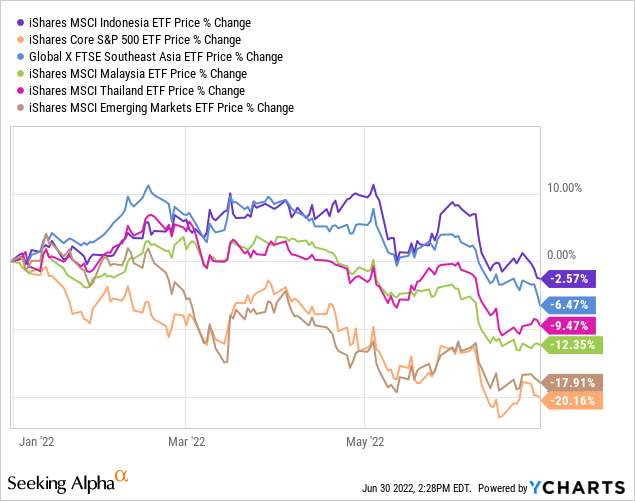

However, it should not go unnoticed that this year, the fund has fared far better compared to the U.S. bellwether ETF despite the rupiah losing around 4.6% vs. the USD while also beating the EM cohort (EEM), and its peers the iShares MSCI Malaysia (EWM), iShares MSCI Thailand Capped ETF (THD), and Global X FTSE Southeast Asia ETF (ASEA).

That said, with the FX effect stripped off, the EIDO holdings have actually demonstrated a fairly decent performance despite the global equity markets reeling, mostly due to the favorable macro backdrop in the country discussed below.

However, even though macro factors look comparatively robust, I would opt for a Hold rating due to the rupiah risk.

The macro picture: interest rate increases postponed, spelling trouble for the rupiah

First and foremost, the bargaining chip of Indonesia bulls is that the country has been among a few emerging markets that escaped the debilitating effects of global inflation, with the core figure standing at 2.6%, perfectly within the target range, with the palm oil export ban and subsidies successful in taming prices. This allowed the central bank to keep the 7-day reverse repo rate at 3.5% again this June, while the outlook for 2022 GDP growth was maintained within the 4.5-5.3% range. We also see that Indonesian consumers see a rosier future ahead, with the consumer confidence index as reported by the OECD touching 101.6 in May, pointing to the fact households’ consumption should continue growing, which is certainly good news for EIDO heavy in financials, consumer defensive & cyclical names.

It should be noted that its ASEAN-5 peers (Thailand, the Philippines, Vietnam, and Malaysia) will likely be suffering from rampant inflation neither in 2022 nor in 2023. At least, according to the April World Economic Outlook, the IMF anticipates consumer prices in the region to increase by just 3.5% in 2022 and then 3.2% in 2023. For Indonesia, a 3.3% growth is forecast for both years.

Meanwhile, EM locomotives like India and Brazil will more likely see 6.1% and 8.2% rates, respectively, with necessary monetary policy adjustments already proceeding vigorously. To bring a bit more color, the Euro area is forecast to endure a 5.3% increase in consumer prices in 2022 followed by 2.3% in 2023, with the U.S. suffering from even higher inflation this year, of 7.7%, and then 2.2% in 2023.

In this context, Indonesia’s case fairly stands out.

To rewind, the country’s previous hiking cycle ended in July 2019 with the 7-day RRR at 6%; since then, the central bank had been reducing it steadily, first to prop up the economic expansion amid the trade war-induced global slowdown risks and then the pandemic, before the rate plateaued at the current level of 3.5% in 2021. That is to say, Bank Indonesia does not want to risk derailing the economic growth by boosting rates too early and too fast to keep the ailing rupiah afloat, which will certainly take its toll on the EIDO returns in the short term.

However, I believe there is a possibility that the policymaker will resume the hikes in the third or fourth quarter to follow the Fed’s suit (and the suit of its ASEAN peers like the Philippines) and to cut down on the risk of the national currency plunging to the levels that would harm its economy, creating the imported inflation problem.

Additionally, there may also be one surprising contributor – coal. Amid the global energy crisis, this previously shunned fossil fuel is now in high demand. And Indonesian exports in January-May looked rather strong. Should this trend continue, this may contribute to the rupiah’s appreciation.

Nevertheless, it is questionable whether, for example, a 25 bps hike will be enough to boost the IDR given how aggressively the Fed is acting, with a similar increase in July in the cards. So my point here is that there is no short-term bullish case for the rupiah at this juncture.

Final thoughts

As long as its economic expansion remains fully on track, even a bit stronger compared to the ASEAN-5 group, the EIDO investors should, in theory, enjoy robust gains, partly due to the fact the ETF is heavy in financials (close to 43%), principally major banks like Bank Central Asia, the fund’s largest (17.6%) investment at the moment, which capitalize on periods of healthy economic expansion.

The Indonesia ETF has surprised to the downside since my previous note due to the rather soft performance of the IDR, even though its key holdings were performing comparatively steadily. Now, given the outlook for the currency is somewhat clouded, even though the 7-day RRR will almost certainly move higher in the coming quarters, EIDO is a suboptimal tactical choice. Of course, the global recession risk should also not be ignored.

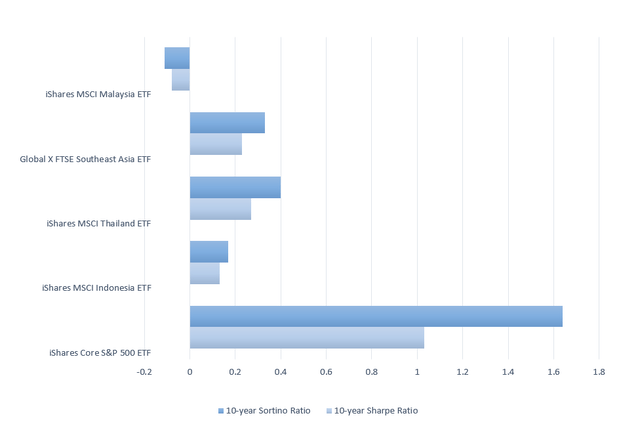

Among other disadvantages of this investment vehicle worth keeping in mind are poor historical risk-adjusted returns. For example, the ten-year Sharpe and Sortino ratios are barely comparable with the U.S. bellwether ETF as well as with key peers. Only EWM did worse.

Created by the author using data from Portfolio Visualizer

From a dividend standpoint, EIDO does not offer a yield high enough (2.2% at the moment), at least for my taste. Its TTM dividend growth rate of 58.85% with the most recent semi-annual distribution factored in is simply gargantuan, but I believe it is unsustainable. The 3- and 5-year CAGRs are in single digits.

Another risk is that though the ETF shows a Price/Earnings ratio of 16.45x, its main holding is priced at a premium; in Jakarta, Bank Central Asia is trading with a P/E of 27.5x and P/B of 4.6x.

In sum, considering the short-term rupiah risk, I downgrade it to a Hold.