Delmaine Donson

RumbleON, Inc. (NASDAQ:RMBL) plans to supply new options and a brand new company web site in 2023, which can enhance buyer expertise and FCF progress. Moreover, I consider that model constructing methods and direct response channels might additionally improve powersports items offered. I do consider that there are specific dangers from the entire quantity of debt, and I dislike the warrants issued lately. With that, I believe that RMBL might commerce a bit extra expensively.

RumbleOn

RumbleOn is a technology-based platform revolutionizing the shopper expertise within the powersports trade. Headquartered within the Dallas Metroplex, it stands out for being the primary and the biggest platform of its type to go public within the nation.

Supply: 10-k

Its aim is to make powersports automobiles extra accessible to extra folks throughout the nation. With a wide array, nice worth and high quality, transparency, and a simple, frictionless transaction, RumbleOn seeks to present an expertise unmatched within the trade. The checklist of manufacturers supplied seems fairly overwhelming.

Supply: 10-k

Double Digit Enhance In Income In Unit Gross sales, And Optimistic FCF Expectations For 2024 And 2025

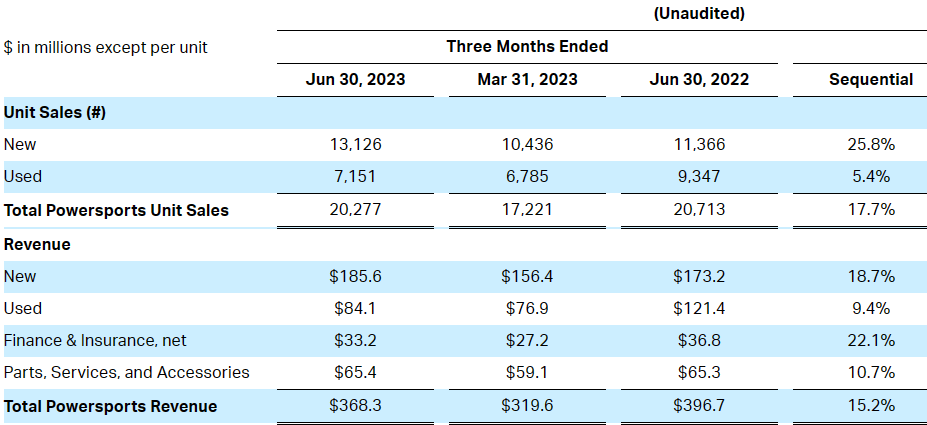

I consider that the latest quarterly outcomes are a superb motive to conduct in depth due diligence on the inventory. Within the three months ended June 30, 2023, the corporate reported a complete of 20k powersports items offered, near 17.7% greater than that within the quarter ended March 31, 2033. Moreover, quarterly income additionally elevated shut to fifteen% to round $368 million.

Supply: 10-Q

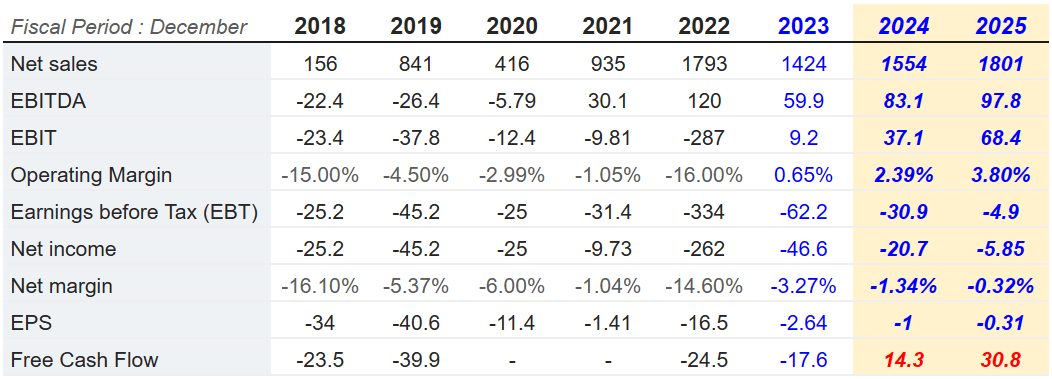

I additionally consider that RumbleOn is interesting as a result of after reporting detrimental internet revenue for a few years, for the primary time, analysts anticipate optimistic figures in 2024 and 2025. In my opinion, if administration actually reviews optimistic EPS and rising FCF, many extra traders might take a look at RumbleOn. The demand for the inventory might push the worth up.

Market analysts anticipate 2025 internet gross sales to face at near $1.801 billion, with 2025 EBITDA of about $97 million, 2025 EBIT price $68 million, and 2025 internet revenue of about -$6 million. Free money stream would stand at near $30 million, which represents considerably extra FCF than that in 2024.

Supply: Market Screener

Stable Stability Sheet

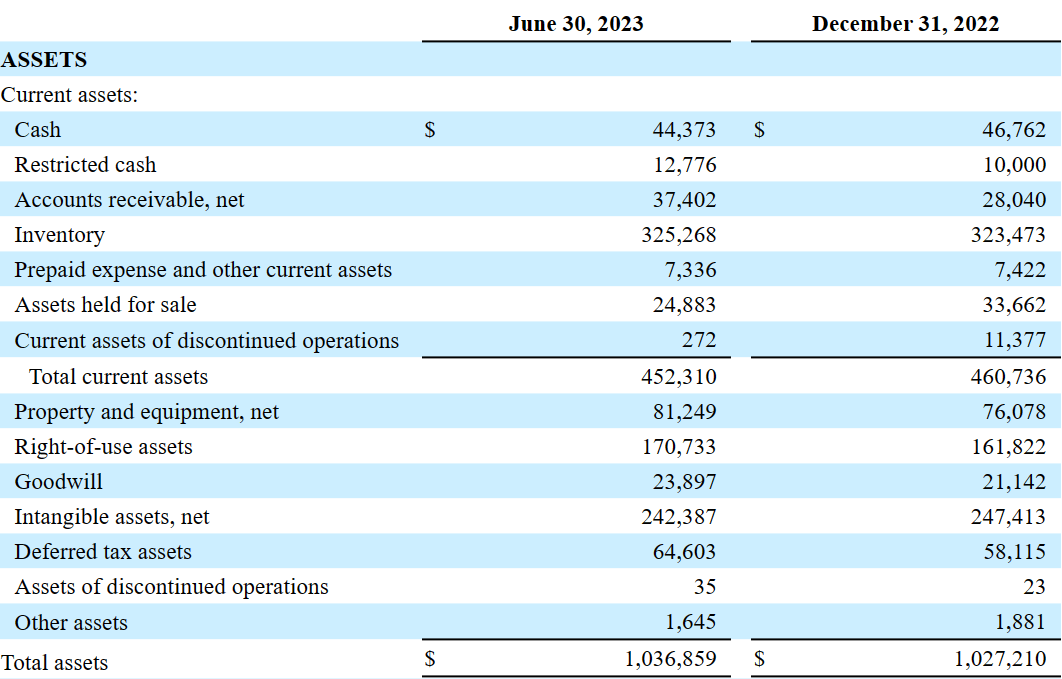

Within the final quarterly report, RumbleOn reported extra property than that in 2022. Money in hand didn’t enhance, nonetheless administration reported will increase in goodwill, stock, intangible property, and right-of-use property.

As of June 30, 2023, RumbleOn reported money price $44 million, restricted money of about $12 million, and accounts receivable near $37 million. Moreover, with stock of about $325 million and pay as you go bills and different present property price $7 million, whole present property have been equal to $452 million. The present ratio is bigger than one, so I didn’t actually detect any liquidity drawback.

Moreover, with property and tools price $81 million and right-of-use property of about $170 million, goodwill stands at $23 million, with intangible property near $242 million. Lastly, with deferred tax property price $64 million, whole property are equal to $1.036 billion, greater than 1x the entire quantity of present property. I consider that the steadiness sheet stands in a helpful place.

Supply: 10-Q

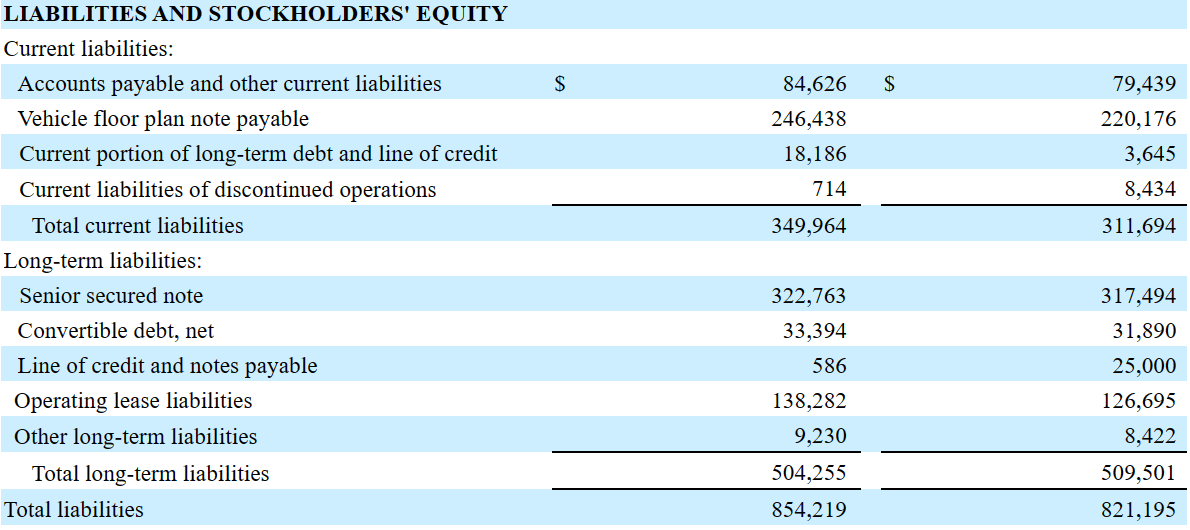

The checklist of liabilities contains accounts payable and different present liabilities price $84 million, car flooring plan notice payable of $246 million, and present portion of long-term debt and line of credit score price $18 million. RumbleOn additionally reported a senior secured notice price $322 million, with convertible debt near $33 million, working lease liabilities of about $138 million, and whole liabilities price $854 million.

Supply: 10-Q

Contemplating the entire quantity of senior secured notes, convertible debt, and contours of credit score, I’d perceive that sure traders are afraid of the entire quantity of debt. If we assume ahead EBITDA of $83 million, the online debt/EBITDA seems bigger than 3x. In my opinion, additional discount within the whole quantity of debt or FCF progress might result in enhancements within the inventory valuation.

FCF Catalyst: Shorter Gross sales Occasions, Model Constructing Methods, And Direct Response Channels

With each retail and wholesale gross sales channels, RumbleOn seeks to maximise profitability by means of greater gross sales quantity and shorter gross sales instances. As well as, it hopes to extend used car gross sales utilizing model constructing methods and direct response channels. The principle components that have an effect on used car gross sales are the amount offered and the common value. Therefore, I’d anticipate that pricing methods and economies of scale can also improve future FCF margins.

Spectacular Market Alternative Of Shut To $100 Billion

RumbleOn seeks to capitalize on the powersports market, which might, in accordance with estimates of administration, be price near $100 billion. Contemplating present internet gross sales and internet gross sales progress, I consider that there’s vital room for enchancment. On this regard, I’d suggest taking a look on the traces under from the final annual report.

From our view, powersports contains bikes, side-by-sides, ATV, UTV, snowmobile, and private watercraft together with associated components and elements. When you add within the largely unaccounted for however vital peer-to-peer market in used powersports, which RumbleOn believes represents as much as 70% of used powersports transactions, the entire addressable powersports market is probably going in extra of $100 billion. Supply: 10-k

Additional Stock Optimization, Knowledge, And New Retail Places Would Speed up FCF Development

In my opinion, if RumbleOn continues so as to add new franchises to the checklist of retail places, and sufficient high-quality used automobiles are acquired, we may even see additional internet gross sales progress. On this regard, it’s price noting that RumbleOn seems to be utilizing knowledge evaluation to carry out sure duties, which can deliver additional effectivity. Within the final quarterly report, administration famous its efforts as regards to knowledge evaluation and its Omnichannel platform.

RumbleOn leverages expertise and knowledge to streamline operations, enhance profitability, and drive lifetime engagements with our prospects by providing a best-in-class buyer expertise with unmatched Omnichannel capabilities. Our Omnichannel platform presents shoppers the quickest, best, and most clear transactions obtainable in powersports. Supply: 10-Q

The New Company Web site For The Yr 2023 Will Most Probably Speed up Transaction Closings

In line with administration, in 2023, RumbleOn plans so as to add new options and a brand new company web site, which can supply new functionalities to customers. For my part, if customers have higher entry to the stock, the variety of transactions might enhance. Consequently, we may even see bigger internet gross sales progress and FCF progress.

With this aim in thoughts, we intend to launch our new company web site below the RumbleOn model throughout the first half of 2023 and our all new RideNow-branded web site later within the second quarter of 2023. Our RideNow web site may have unmatched options for our prospects, permitting them to see all stock in a single place and it’ll have the flexibility to push stock to particular person seller web sites, leading to a greater on-line presence and buyer expertise. Supply: 10-Q

Money Movement Expectations

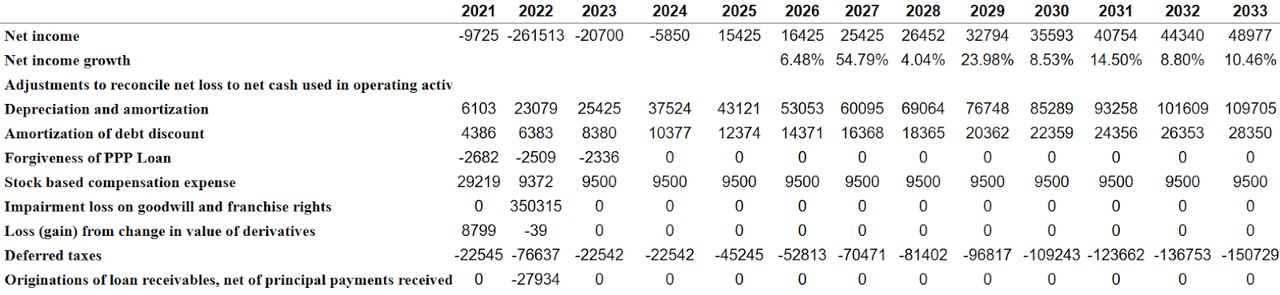

With the earlier assumptions and after contemplating earlier monetary figures, my monetary mannequin contains 2033 internet revenue near $49 million, with depreciation and amortization price $109.55 million, amortization of debt low cost of $28.5 million, no forgiveness of ppp loans, and 2033 inventory based mostly compensation expense of about $9.55 million. Moreover, I additionally included deferred taxes near -$151 million, however no originations of mortgage receivables.

Supply: Money Movement Assertion Forecasts

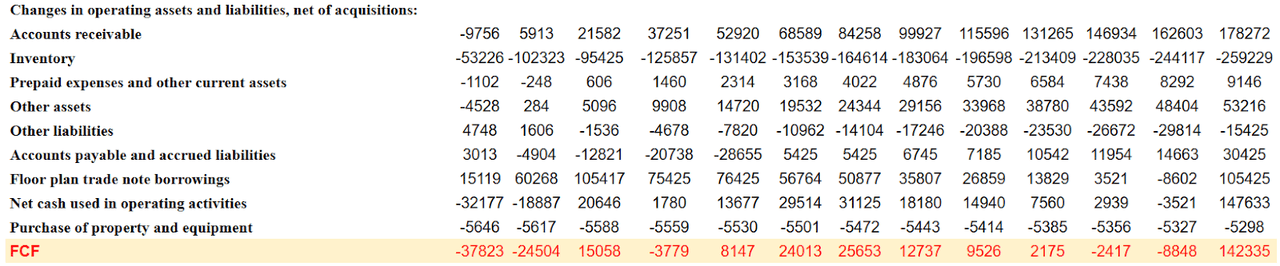

On the subject of modifications in working property and liabilities, I foresee modifications in 2033 accounts receivable price $178 million, 2033 modifications in stock of about -$260 million, and modifications in accounts payable and accrued liabilities price $30 million. Lastly, with modifications in flooring plan commerce notice borrowings of about $105 million, internet money utilized in working actions would stand at near $147 million. If we additionally embrace buy of property and tools near -$6 million, 2033 FCF could be $142 million.

Supply: Money Movement Assertion Forecasts

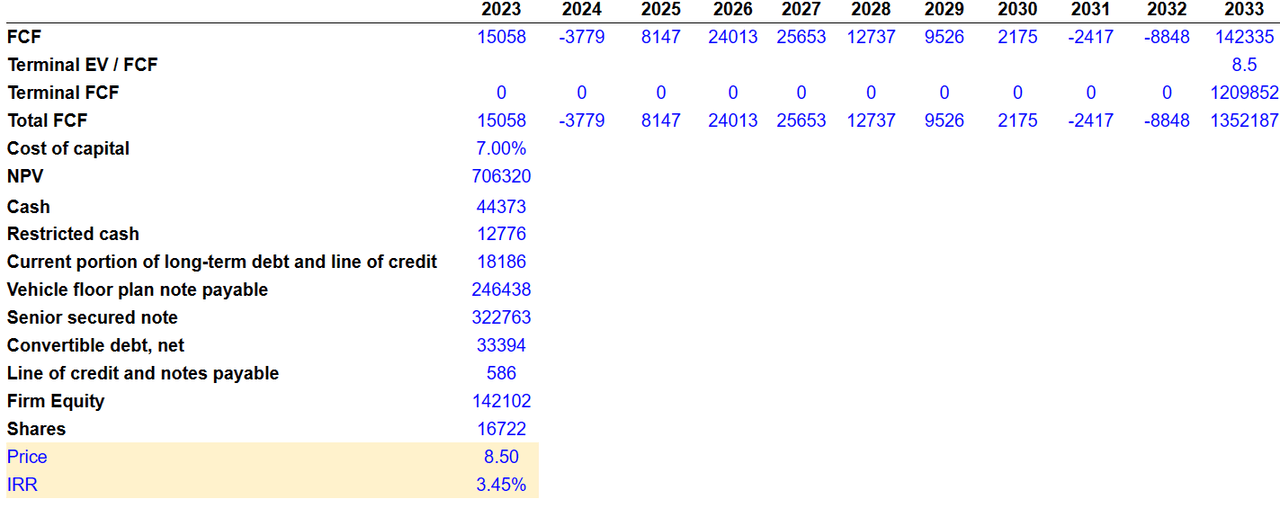

If we assume a terminal EV/ FCF shut to eight.55x and value of capital of seven.055%, the implied NPV of future FCFs could be $706 million. Now, including money of about $44 million and restricted money near $12 million, and subtracting present portion of long-term debt and line of credit score price $18 million, car flooring plan notice payable near $246 million, senior secured notice of $322 million, and convertible debt price $33 million, fairness could be $142 million. The implied truthful value would stand at about $8.55, and the forecasted inner price of return could be 3.455%. With this in thoughts, I believe it is a purchase for conservative traders. I don’t consider the corporate is a purchase in case you search extra vital IRR than 4%-5%.

Supply: DCF Mannequin

Competitors And Aggressive Benefits Of RumbleOn

From my standpoint, RumbleOn faces rivals that embrace conventional franchised dealerships, impartial used car sellers, on-line and cellular gross sales platforms, and personal events.

Competitors is targeted on offering an distinctive buyer expertise, making certain high quality stock, having a wide array of merchandise, and setting aggressive costs. RumbleOn excels by offering a complete platform that enables prospects to get pleasure from a buying expertise on-line, in retailer, or by means of the cellular app. Its pleasant shopping for course of and the number of fashions obtainable give it a bonus in sourcing and gross sales.

Threat

In my opinion, the corporate has considerably elevated its indebtedness because of the RideNow and Freedom transactions. This reduces the pliability to answer modifications in enterprise and financial situations, resultantly rising curiosity expense. Excessive debt ranges can even restrict the funds obtainable for working capital and different company functions, creating aggressive disadvantages.

As well as, the corporate is uncovered to variable rate of interest threat on its flooring plan payables and different debt devices, which might negatively have an effect on its profitability. The powersports trade is delicate to basic financial modifications and different components that will have an effect on the demand for services, which might have an adversarial affect on the corporate’s enterprise and outcomes. Inflation, modifications in gasoline costs, and rates of interest can even affect an organization’s monetary efficiency. Will increase in labor prices and different bills have additionally been a priority. I’d additionally perceive if sure traders are a bit involved concerning the inventory warrants issued lately. Consequently, I consider that shareholders might endure fairness dilution and inventory value declines.

In reference to offering the debt financing for the RideNow Transaction, the Firm issued the Warrants at an train value of $33.00 per share. The train value was adjusted throughout the third quarter to $31.50 and the expiration date was prolonged to July 25, 2023. Supply: 10-Q

Conclusion

RumbleOn is an organization with a powerful enterprise mannequin and a technique centered on offering an distinctive buyer expertise within the powersports trade. Moreover, the brand new company web site and in depth use of knowledge might deliver additional effectivity and FCF margin progress. With that, I do consider that RumbleOn might commerce at greater value marks, however there are specific monetary dangers that might have an effect on future efficiency, and traders might should take a cautious take a look at future internet debt/EBITDA ranges.