We appear to be seeing just a little little bit of rotation within the allocation to US indices. It is a quite unusual factor to see in 2023: in spite of everything, the US30 is up 2.94% YTD, in comparison with 15.47% for the US500 and 36.57% within the case of the Nasdaq.

But when we take a look at the efficiency since 16/06 – the final relative excessive of the US indices (with very excessive volumes on these crimson inside candles on the money market) – issues are completely different. Sure, the NDQ is underperforming: the number of the SP500 and the ”worth” shares within the DJ are at the moment permitting it not to take action badly.

US500, USA100, US30 relative efficiency, 16/06 – at the moment, 30 minutes

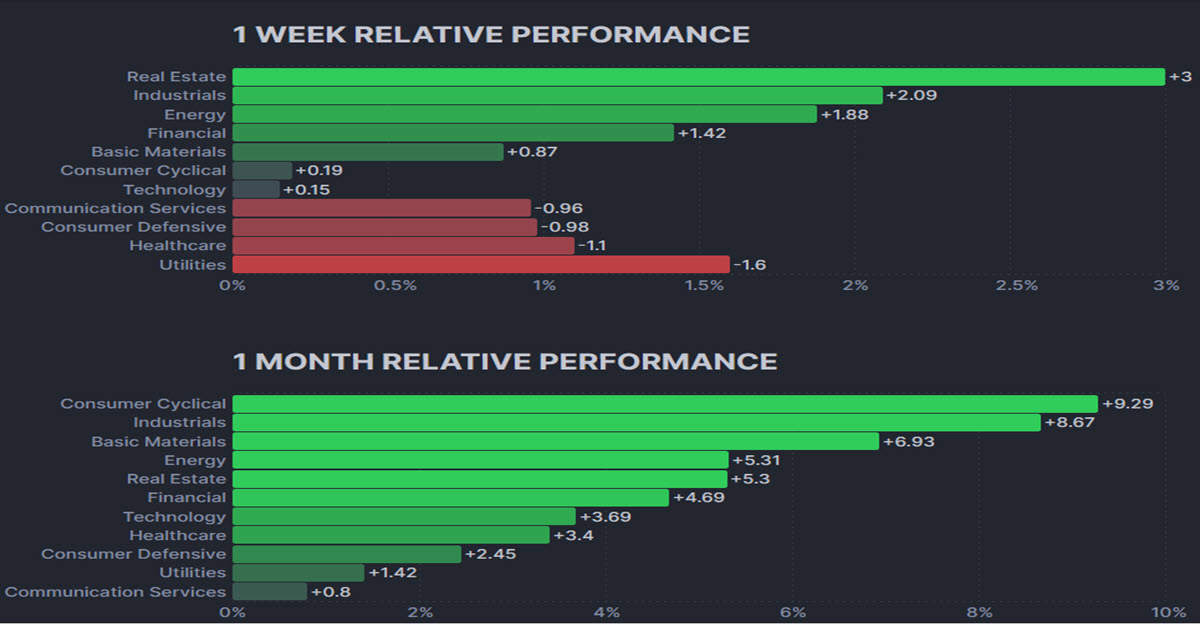

It’s fairly regular to see rotation from one sector to a different when the market is already in a mature progress part: the cash within the palms of portfolio managers just isn’t infinite and tends for use typically in its near-fullness, in order to not lose return potentialities. At a sure level, one takes revenue on what has completed greatest and repositions oneself – possibly solely tactically – in sectors that appear just a little cheaper. So within the final week and month we’re seeing the return of sectors similar to industrial, vitality, financials and primary supplies. Even actual property, regardless of its poor outlook and the way costly it’s, with PE and FWD PE second solely to know-how.

US Sectors, Weekly and Month-to-month efficiency

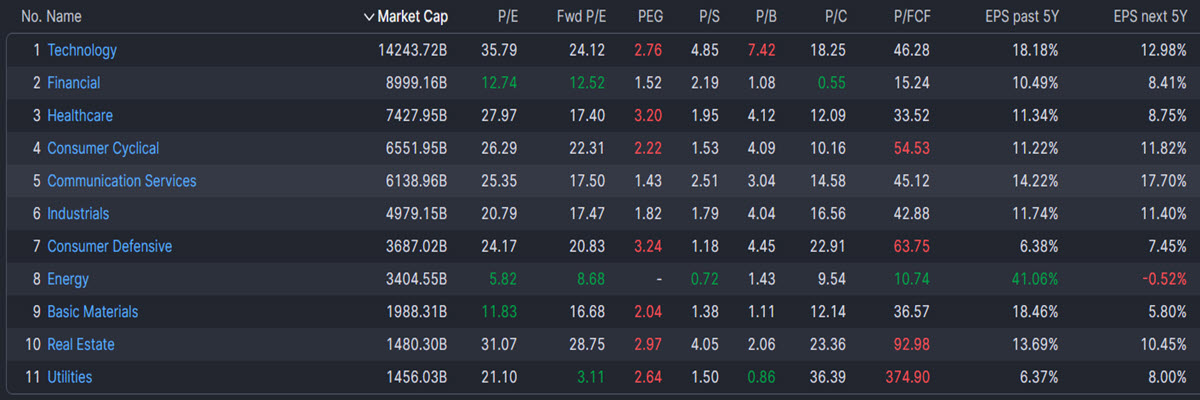

Briefly, this will likely imply that for probably the most utilized and meticulous merchants, there are at the moment potentialities in inventory selecting: scanning the market past the index that teams all the things collectively and discovering particular person names which have fallen behind within the rally of current months. To do that we will rely not solely on value but additionally on sure elementary ratios, such nearly as good future prospects (e.g. one other EPS anticipated within the subsequent 5 years) or a low value relative to earnings (PE) or present gross sales (PS): within the first case communication providers would stand out; if we give attention to the opposite two, we’d maybe need to focus our consideration on Vitality, Financials and even Industrial.

US Sectors, some elementary ratios

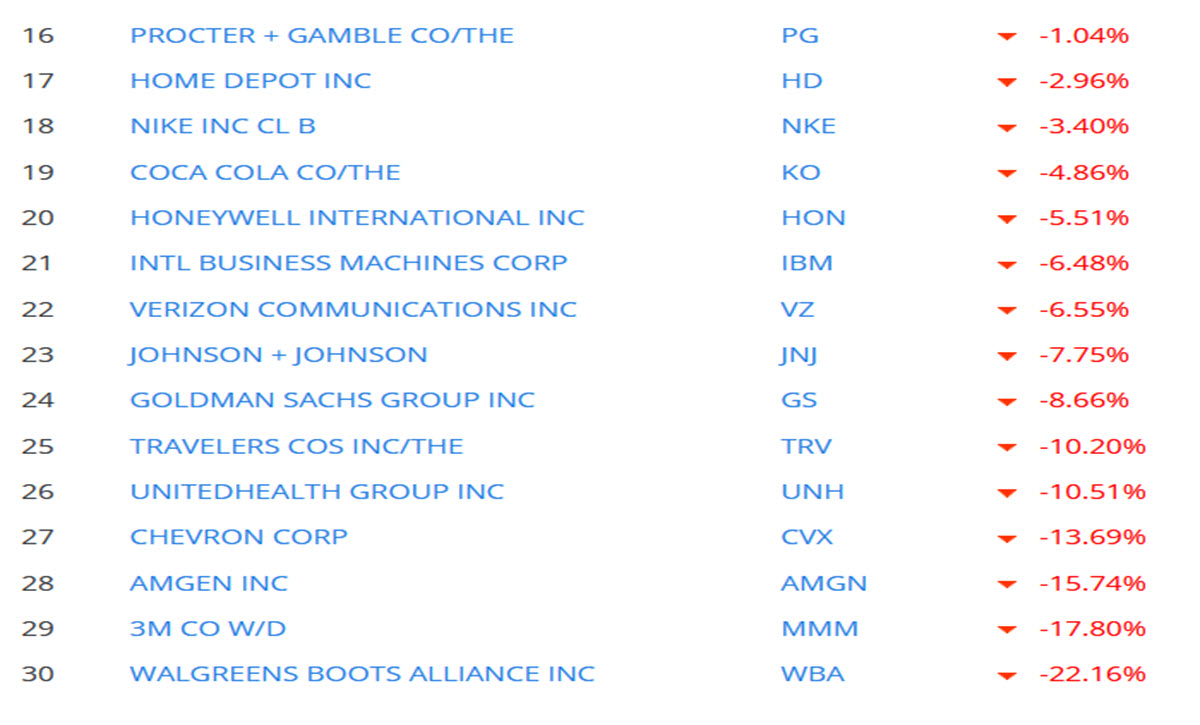

In any case, there are a lot of names, even massive and well-known ones, which have fallen behind and will supply an fascinating future relative return: beneath are the businesses in adverse YTD of the DJ.

DJ30, shares adverse YTD

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is offered as a common advertising and marketing communication for data functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication accommodates, or needs to be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency just isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.