nicoletaionescu/iStock by way of Getty Pictures

Intro

As buyers, we could come throughout a enterprise that we’re extraordinarily impressed with. It might be because of the firm’s distinguished place in its business, its spectacular monitor document of development and excessive returns on invested capital, or the sturdy management group that shares your values. Alternatively, you might even see substantial development potential within the enterprise.

Nonetheless, it is important for clever buyers to not turn out to be so infatuated with a enterprise that they disregard its value. Whereas it is attainable to find these distinctive companies, it is necessary to notice that others could have already discovered them, and the inventory value could have already been inflated to a degree the place the anticipated return might not be passable.

This state of affairs isn’t uncommon, which is why it is important to stay affected person and look forward to a high-quality enterprise to be obtainable at a beautiful value. The next article will study Rollins, Inc. (NYSE:ROL), a enterprise that meets this description. Regardless of being an business chief, having a confirmed monitor document of development and profitability, making astute acquisitions, and offering glorious customer support, ROL inventory is at present overpriced.

Enterprise Mannequin

Rollins, Inc. and its subsidiaries function by delivering pest and wildlife management companies to each residential and industrial purchasers within the US and globally. Their vary of pest management companies is geared toward safeguarding residential properties towards frequent pests like rodents, bugs, and wildlife.

In addition they present office pest management options for patrons in numerous sectors comparable to healthcare, foodservice, and logistics. Together with conventional and baiting termite safety, they provide extra companies as properly. The corporate caters to purchasers instantly and likewise operates by way of its franchisee operations.

Established in 1948, ROL has a wealthy historical past and has established a repute for delivering distinctive customer support. In the present day the Atlanta firm employs over 16,000 individuals in 70 nations.

Efficiency

ROL’s distinctive efficiency over the past decade is attributed to its spectacular income development. The corporate has recorded a outstanding income development fee of over 100% up to now ten years. It’s price mentioning that the corporate has not skilled any decline in income in any yr throughout this era.

Information by Inventory Evaluation

ROL additionally boasts a outstanding monitor document of manufacturing free money stream development. The corporate has witnessed a major surge in its free money stream, rising by 202% over the previous decade. As well as, this development has been constant, with simply two years of decline throughout this era.

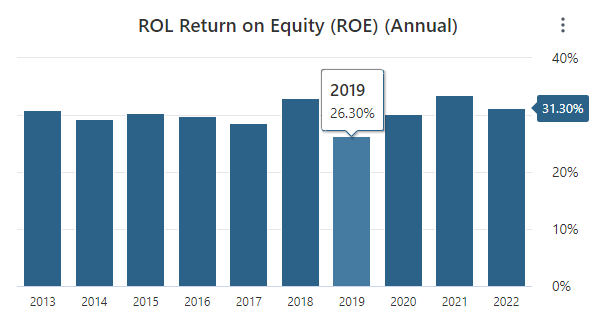

ROL has demonstrated a powerful monitor document of profitability. Over the previous decade, the corporate has attained a mean return on fairness of barely above 30%, and not one of the years recorded lower than 26%. These elevated ranges of ROE are indicative of the corporate’s environment friendly administration group and skill to allocate assets to maximise income.

Information by Inventory Evaluation

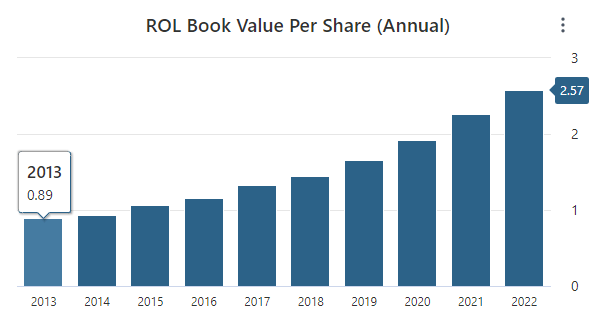

Concerning ROL’s steadiness sheet, the corporate’s outstanding development is obvious in its guide worth. The corporate has grown its guide worth yearly over the previous decade, recording an general development of 188%. Rising guide worth is essential for firms because it signifies that the worth of their belongings is rising relative to their liabilities. This, in flip, may end up in a rise within the firm’s internet price, which after all is favorable for shareholders.

Information by Inventory Evaluation

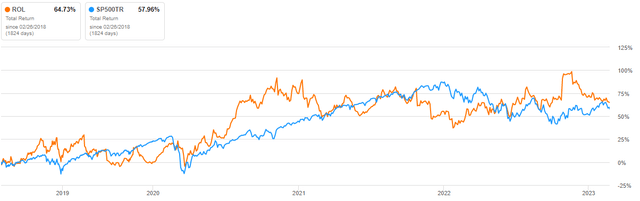

ROL’s monetary outcomes are superior in nearly each metric, it is clear this can be a well-run enterprise. Sadly, the corporate’s inventory hasn’t been in a position to considerably outperform the S&P 500’s whole return as it has been about even over the previous 5 years. Because of this, buyers are questioning what the corporate can do sooner or later to reverse this pattern.

Information by In search of Alpha

Outlook

ROL’s enterprise stays sturdy because it recorded document income of $2.7B final yr which represents 11% development yr over yr. The entire firm’s working segments grew by double digits with residential service income rising 10%, industrial income development was additionally 10% and termite and ancillary income development was 15%. This excessive stage of development exhibits that the battle between people and bugs and rodents rages on!

ROL’s success may be attributed to their aggressive edge within the business, and one in all their greatest benefits is their giant working platform. This enables them to supply top-notch customer support, promote extra merchandise, and get monetary savings.

In instance of that is their proprietary Department Working Assist System (*BOSS) which helps with monitoring companies, processing funds, and managing service routes for technicians. This reduces prices and improves buyer satisfaction by making certain fast and well timed service, which after all ends in the superior monetary efficiency that buyers love.

The corporate’s sturdy working efficiency permits it to aggressively spend money on future development. Final yr, ROL invested $119M to make 31 acquisitions and administration expects to proceed this pattern sooner or later. Acquisitions are a big a part of ROL’s development technique as they’ve revamped 100 of them over the previous three years.

The corporate’s technique for acquisitions focuses on worthwhile companies with sturdy management that might profit from extra development capital and enhance revenue margins by discovering value and income synergies. The corporate’s dedication to this acquisition strategy is obvious from its excessive return on invested capital. This technique has strengthened itself through the years, because the fly wheel retains spinning.

As well as, ROL revamped $100M price debt repayments which places the enterprise in an excellent higher monetary place. ROL additionally elevated its dividend for the second yr in a row which can not appear all that spectacular however take into account the corporate has grown its dividend by nearly 300% over the past 10 years.

Valuation

to find out the intrinsic worth of ROL, we’ll conduct each comparative and discounted money stream (“DCF”) analyses. To start out, we’ll carry out a comparative evaluation by analyzing the best, lowest, and median price-to-earnings ratios that the market has paid for ROL over the past 5 years. Moreover, we’ll take into account the sector median P/E ratio, which is 20.23. Lastly, we’ll multiply these ratios by ROL’s consensus 2023 EPS estimate of $0.83 per share.

| State of affairs | P/E | Subsequent Yr Earnings Estimate | Intrinsic Worth Estimate | % Change |

| Bear Case | 40.8 | $0.83 | $33.86 | -3.58% |

| 5Y Median P/E | 56.4 | $0.83 | $46.81 | 33.29% |

| Bull Case | 87.66 | $0.83 | $72.76 | 107.17% |

| Sector Median Valuation | 20.23 | $0.83 | $16.79 | -52.19% |

After conducting a comparative evaluation, there are a number of attainable situations that might unfold for ROL. If the market is bullish and applies the 87.66 a number of, which was noticed in 2020, to the typical analyst earnings estimate for subsequent yr, buyers may probably understand a major return of over 100% ought to these estimates come to fruition. Conversely, if the market values ROL on the bearish P/E ratio noticed in January 2022, buyers may endure a slightly insignificant 3.5% loss.

In response to the 5-year median P/E ratio, the bottom case is essentially the most possible state of affairs for ROL and is due to this fact thought-about essentially the most vital. If this state of affairs involves fruition, it may result in a return of 33.29% for buyers.

The final state of affairs to contemplate is that if the market values ROL on the sector median a number of. This state of affairs is noteworthy because it suggests a possible lack of 52.19% and divulges that ROL trades at 2x the sector median a number of. Although the remainder of the situations point out that there’s vital upside for ROL with little or no draw back, it is arduous to imagine that an organization buying and selling at 2x the sector median may be thought-about low-cost.

Turning to the discounted money stream evaluation of ROL, we’ll begin by calculating the typical free money flows for the final 5 years, which quantities to $326M. Then we’ll implement a development fee of seven% for the upcoming ten years, adhering to the rule of 72, which states {that a} development fee of seven% will double the preliminary worth in ten years.

We’ll use rule of 72 to information our DCF evaluation as a result of it may be difficult to create exact projections at no cost money stream development charges that stretch a number of years into the longer term. Nonetheless, I’m assured that ROL has the aptitude to double its free money stream within the subsequent ten years based mostly on its development document and aggressive benefits inside the business.

After the tenth yr, we’ll assume a development fee of two.5% to seek out the terminal worth. In an effort to low cost the money flows, we’ll apply a ten% low cost fee, that is based mostly on my private anticipated fee of return. Primarily based on these parameters, the DCF evaluation signifies an intrinsic worth of $12.57, indicating a possible lack of 64.22% for buyers.

Creator’s Work

You probably have issues a few 7% development fee for ROL over the following decade being overly conservative, it is essential to notice that even when the corporate grows at a fee of 20% yearly throughout the identical interval, its intrinsic worth based mostly on this DCF evaluation would nonetheless fall in need of its present inventory value. This suggests that ROL’s present market value has zero margin of security.

Takeaway

ROL is a top-tier pest management firm with a monitor document of sturdy efficiency, due to its business management, operational excellence, and sensible acquisitions. With greater than 70 years of expertise within the business, ROL is without doubt one of the most acknowledged and revered names within the pest management enterprise.

The corporate’s repute is constructed on a dedication to superior customer support which is extensively thought-about probably the greatest within the business. The result’s a loyal buyer base that has contributed to constant income and free money stream development and persistently excessive returns on fairness.

ROL is actually a enterprise that the majority buyers ought to like to personal. Sadly, the standard of the corporate isn’t secret because the inventory is at present overpriced, buying and selling at a P/E ratio that’s greater than twice sector median. Thus, buyers trying to spend money on ROL ought to train warning and look forward to a extra cheap entry level, because the inventory’s present value might not be justified by its underlying fundamentals.

Please let me know your ideas on ROL within the feedback part under.

Thanks for studying!