Enterprise Useful resource Planning (ERP) programs are essential for a lot of corporations, centralizing core enterprise processes throughout numerous capabilities corresponding to finance, HR, provide chain, stock, service, and procurement. Nonetheless, legacy ERPs, primarily designed within the early 2000s, are struggling to fulfill the complicated calls for of contemporary companies. Rillet is a cutting-edge ERP answer, leveraging automation to streamline accounting workflows and get rid of the necessity for handbook information entry and spreadsheets. Remarkably, 93% of journal entries in Rillet have been processed with out human intervention, liberating finance groups to give attention to strategic, high-value work. The platform seamlessly integrates with present programs, effectively processing each unstructured and structured information whereas contemplating qualitative components. This functionality is especially worthwhile given the present scarcity of 340,000 accountants within the US and the truth that 75% of accountants are nearing retirement age. Rillet helps alleviate the rising burden on finance and accounting groups, who’re going through more and more heavy workloads.

AlleyWatch caught up with Rillet Founder and CEO Nicolas Kopp to study extra concerning the enterprise, the corporate’s strategic plans, latest spherical of funding, and far, way more…

Who had been your buyers and the way a lot did you elevate? $13.5M Seed from First Spherical Capital, Creandum, Susa Ventures, Field Group with participation from unimaginable particular person buyers together with Kevin Hartz (founding father of Eventbrite and Xoom), the previous Chief Accounting Officer of Fb and Stripe, and the Controller at Ramp.

Inform us concerning the product.

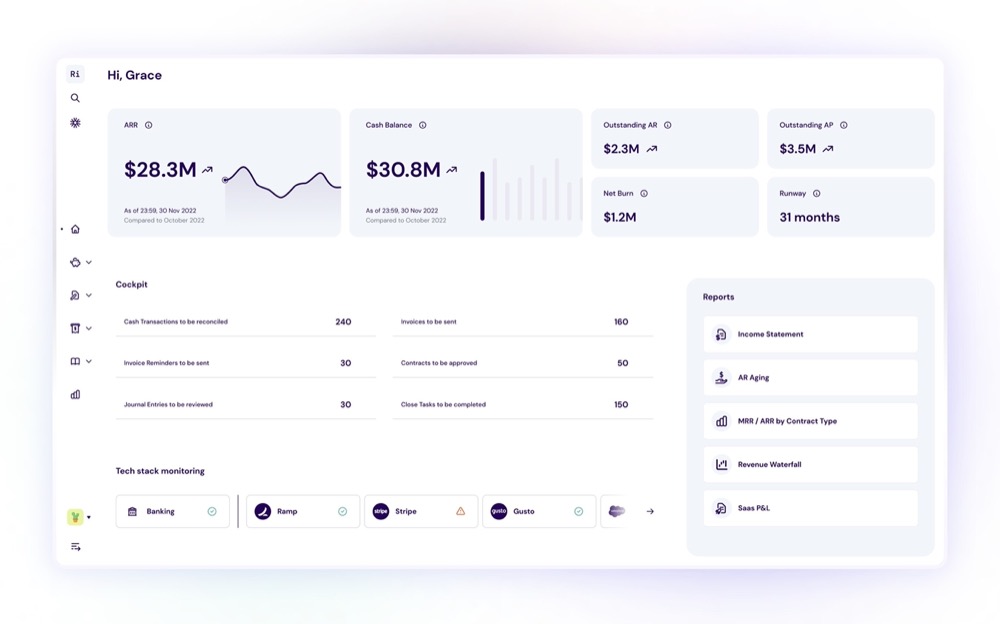

Rillet is the primary fashionable ERP that automates accounting for high-growth corporations. We pull in metadata out of your CRM, billing, AP, and payroll and routinely create invoices, payments, journal entries, deferred income schedules, pay as you go schedules, billing forecasts, and lots of extra.

What impressed the beginning of Rillet?

Private ache factors round reconciliation and the way lengthy it took each month to get financials in prior roles. At N26, our accounting and finance groups had been all the time struggling to maintain up with their financials and reviews. It was actually not a human drawback… it was actually a software program drawback.

How is Rillet completely different?

Constructed on fashionable infrastructure and AI-native vs. incumbents which might be 25+ years previous. We permit groups to shut their books in near real-time with our automations and provides entry to highly effective investor reporting.

What market does Rillet goal and the way huge is it?

We give attention to high-growth tech corporations to begin with. The speedy addressable market is $10B, and the broader ERP market is among the largest software program classes on this planet with $100B+.

What’s your corporation mannequin?

SaaS software program license.

How are you making ready for a possible financial slowdown?

We’re working to assist new trade verticals and geographies on our platform.

What was the funding course of like?

All up 3 weeks, we had been fortunate to have a spherical that was a number of occasions over-subscribed.

What components about your corporation led your buyers to put in writing the test?

Very robust buyer love (G2 evaluations of straight 5 stars and >75 NPS) and a big market.

What are the milestones you intend to realize within the subsequent six months?

Construct out extra product performance, particularly on worldwide assist and embedding AI throughout extra locations within the platform.

What recommendation are you able to provide corporations in New York that would not have a recent injection of capital within the financial institution?

Hold making your clients completely satisfied, give attention to environment friendly distribution, and good issues will observe.

The place do you see the corporate going now over the close to time period?

We’re persevering with to put money into our product to assist our clients and are constructing out our gross sales and partnership groups over the close to time period.

What’s your favourite summer time vacation spot in and across the metropolis?

Battery Park Metropolis.