bob_bosewell/iStock through Getty Photographs

Written by Nick Ackerman, co-produced by Stanford Chemist.

The final time we touched on Cohen & Steers Complete Return Realty Fund (NYSE:RFI), we additionally took a have a look at Cohen & Steers High quality Earnings Realty Fund (RQI). These funds are fairly related by way of their strategy by way of investing in largely fairness actual property funding belief (“REIT”) securities but in addition embody a sleeve of most popular and fixed-income devices. In actual fact, for RFI and RQI, the funds mirror one another precisely at present, with 81% listed as invested in widespread inventory and 19% in most popular and fixed-income.

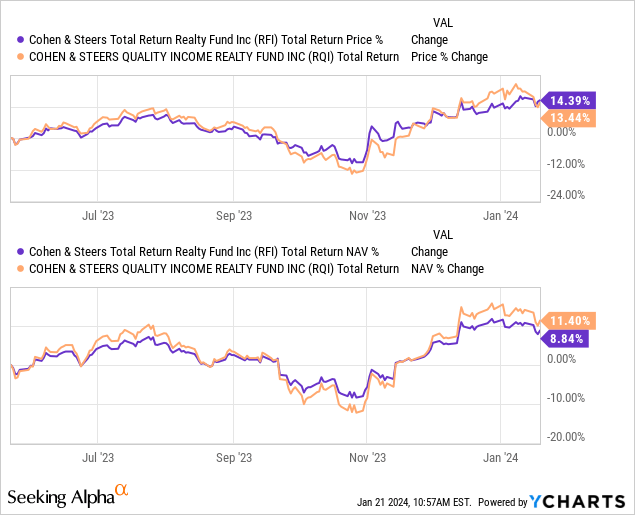

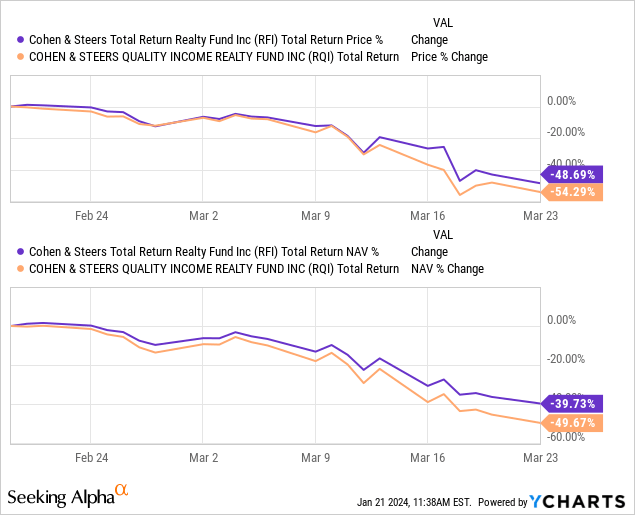

The most important distinction between the 2 is that RQI additionally incorporates leverage into its technique whereas RFI stays non-leveraged. Since that earlier replace in Could 2023, RFI barely outperformed RQI on a complete share worth foundation. Nevertheless, this was reversed on a complete NAV return foundation. This means that whereas RQI’s portfolio carried out higher – it wasn’t truly mirrored out there worth.

Ycharts

That is the place reductions/premiums can play a job in altering the end result of the outcomes. For each of those funds, we noticed the precise market costs outperform their underlying portfolios. Extra particularly, RFI’s premium would have expanded whereas RQI’s low cost narrowed however not as considerably.

I would nonetheless lean towards RQI because the extra enticing play immediately, however RFI continues to be pretty enticing for these buyers who need to keep away from including any leverage in any respect.

RFI Fundamentals

- 1-Yr Z-score: 0.62

- Premium: 2.66%

- Distribution Yield: 8.02%

- Expense Ratio: 0.96%

- Leverage: N/A

- Managed Property: $317.32 million

- Construction: Perpetual

RFI’s funding goal is “to realize a excessive complete return.” They will try to realize this “via funding in actual property securities. Actual property securities embody widespread shares, most popular shares and different fairness securities of any market capitalization issued by actual property firms, together with actual property funding ruts (REITs) and related REIT-like entities.”

With no leverage by way of borrowings, that is one much less shifting half we’ve to fret about for this fund. That retains the fund’s complete expense ratio decrease, however funds that do make use of borrowings are ideally incomes these prices again via higher efficiency. That is not at all times the case, however that is the concept.

Efficiency – Pretty Enticing At Truthful Worth

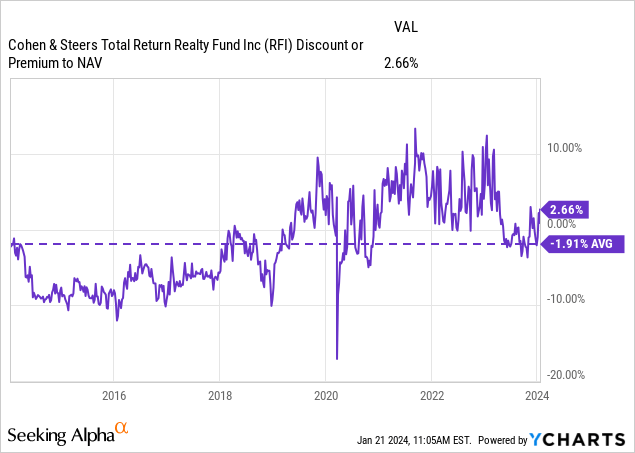

RFI continues to commerce at a slight premium immediately, however the present valuation is across the regular premium stage that the fund tends to commerce at. A minimum of over the past 3 and 5-year durations.

Over the longer-term decade historical past, the fund will be seen as buying and selling at a reasonably deep low cost previous to round 2018. Throughout 2018, the fund flirted with a premium, and whereas it was pretty short-lived – presumably influenced by the This autumn 2018 broader market correction – it did not take lengthy for that premium to return as soon as once more. Now, it has largely stayed at a premium that is been fairly sticky for 5 years or so.

Ycharts

That mentioned, a reasonably valued CEF can nonetheless be enticing, given the present financial circumstances one may anticipate. I am personally anticipating REITs to be a greater place to place capital to work going ahead. The principle catalyst for lifting REITs greater can be the anticipated fee cuts. We do not know precisely when or how aggressive cuts will probably be, however we’re trying on the Fed projecting 3 cuts this yr with extra in 2025.

That might return extra investor curiosity again to the REIT house in a seek for revenue. We already noticed a swift rebound within the house when risk-free Treasury Charges began to fall. Equally, preferreds can even get a elevate as their yields would additionally begin to turn into extra enticing.

Decrease charges from the Fed would additionally imply that REIT’s personal leverage prices that they make the most of would additionally ease off, offering some probably higher progress going ahead. That is one thing to think about while you spend money on a leveraged fund reminiscent of RQI. If there’s a restoration, it’s possible that RQI may proceed to outperform, however that does imply taking over greater dangers and probably larger volatility.

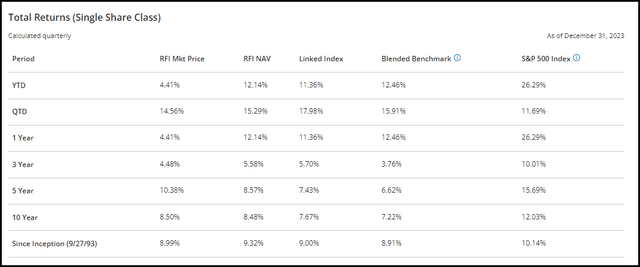

RFI traditionally has delivered quite enticing complete returns on an annualized foundation. They’ve overwhelmed each their Blended and Linked Indexes on a complete NAV return foundation or acme shut on a 3, 5, 10 and since inception interval. The inception of the fund was going again towards the tip of 1993 – so we’re a fund with fairly the observe report.

This information is as of December 31, 2023, which means we’re trying basically at 2023’s efficiency when a YTD and 1-year interval.

RFI Annualized Efficiency (Cohen & Steers)

The place we see a giant underperformance in 2023 was on a market worth foundation, and that is as a result of RFI’s share worth got here in at a warmer premium of round 6% to start out off the yr. At one level in the course of the yr, it spiked to double-digits, however that was a reasonably quick time period.

RFI Vs. RQI Efficiency

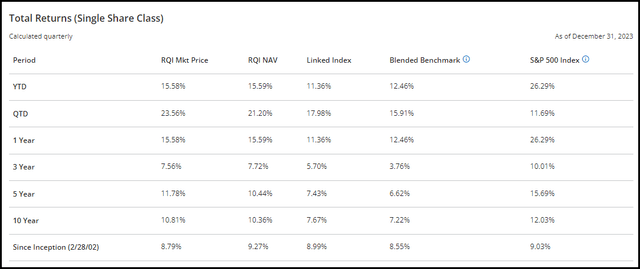

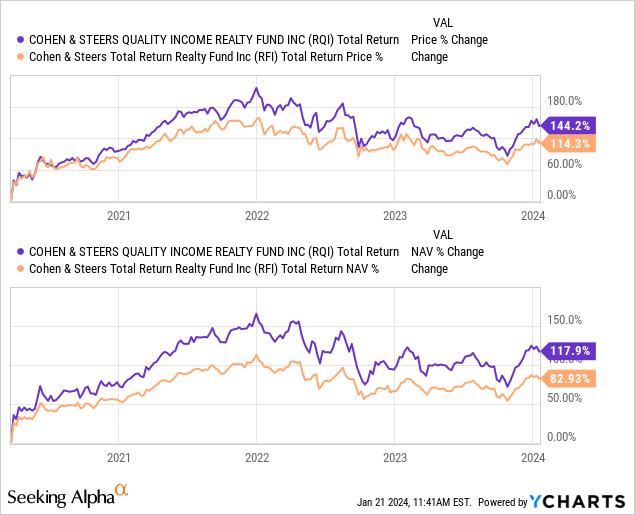

For curiosity’s sake, here’s a have a look at RQI’s annualized efficiency as nicely. In addition to the inception interval attributable to RQI coming to the market a lot later in 2002, RQI’s leverage has resulted in optimistic outcomes via this era.

RQI Annualized Efficiency (Cohen & Steers)

Nevertheless, this was after a significant restoration for the sector, and if we return to Covid, we will see that RQI did underperform. The beneath measures the interval from February 19, 2020, to March 23, 2020.

Ycharts

Personally, I used to be shopping for in the course of the Covid crash, so the deeper losses right here have been welcomed to purchase even cheaper. Clearly, I am an aggressive investor. On this situation, I used to be fortunate sufficient that it labored out because the restoration from the Covid low labored out.

Ycharts

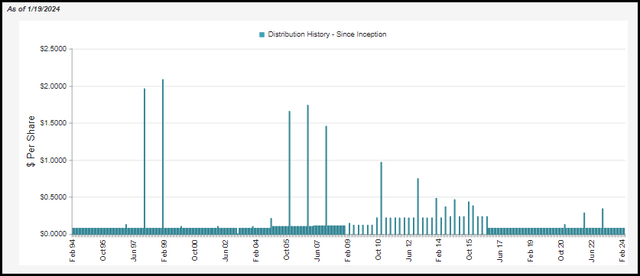

Distribution – Regular Month-to-month Distribution

RFI has been paying a reasonably regular month-to-month distribution for plenty of years now. It additionally launched with a month-to-month distribution – however just like its sister funds – they minimize the distribution in the course of the International Monetary Disaster. When doing that minimize, they went to a quarterly distribution for a time period till switching again to a month-to-month schedule, the place the identical payout of $0.08 is immediately.

RFI Distribution Historical past (CEFConnect)

The fund’s present distribution fee comes to eight.02%. On account of that little bit of premium pricing, the NAV fee is available in a contact greater at 8.23%

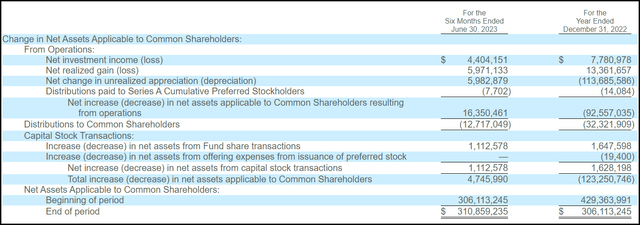

The fund, just like its sister funds, would require capital features to cowl their payout. This is not something too distinctive within the CEF house, particularly funds like RFI, that are primarily equity-focused funds.

Of their final semi-annual report, we will see that internet funding revenue protection got here in at round 34.6%. NII was on the rise relative to final yr, too, which is a optimistic signal. To assist contribute to the fund’s capital features potential, the fund additionally writes choices contracts and participates in ahead international foreign money change contracts and international foreign money transactions. As of the newest report, these transactions didn’t have a significant optimistic or unfavourable affect on the fund.

RFI Semi-Annual Report (Cohen & Steers)

On a per-share foundation, NII for 2022 was $0.30, and for the six-month interval, we noticed $0.17 – or an annualized determine of $0.34. The per-share determine generally is a higher indicator on this case due to RFI’s premium. Because of the premium, the fund can situation shares via an at-the-market providing or via their DRIP. On account of having extra capital to take a position, NII would naturally rise, however the per-share determine nonetheless reinforces that it was a optimistic for the fund.

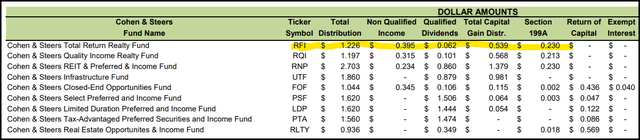

We do not have the 2023 figures simply but, however trying again on the tax classifications of the distribution from 2022, we will see how the distribution was damaged up.

RFI Distribution Classification (Cohen & Steers)

Primarily, it was a good portion of capital features, however non-qualified revenue contributed to a significant portion as nicely. That places it in a state of affairs the place an argument might be made for a tax-sheltered account or a taxable account.

RFI’s Portfolio

The turnover for the fund was pretty low at simply 9% primarily based on the final six-month report. That put it on tempo to be much less lively than in 2022, after we noticed a turnover of 28%. That itself was a slowing tempo of adjustments in comparison with 2021’s 38% and 2020’s comparatively lively yr of 53%.

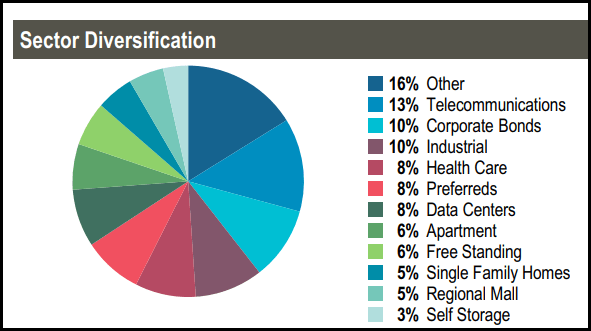

With that being mentioned, we have seen some pretty small portfolio gyrations by way of sector weighting. The newest breakdown beneath is as of the final factsheet for the interval ended December 31, 2023.

RFI Sector Allocation (Cohen & Steers)

When in comparison with our prior replace, the “different” class has grown right here to turn into the biggest. This was beforehand at a ten% allocation, which then pushed down the commercial sector weighting to 10% now from the highest sector weighting of 12% beforehand. That wasn’t a considerable change in itself and is one thing that might merely occur from values shifting round.

This was a very unstable interval because it was trying on the information as of the tip of March 2023. Which means we noticed the banking disaster, the October lows and the fast November/December restoration on this interval. For such a robust yr for the broader market, that was primarily pushed by the Magnificent 7. REITs ended up doing okay, but it surely was a way more unstable yr for the house as rates of interest ended up having a extra significant affect on the house.

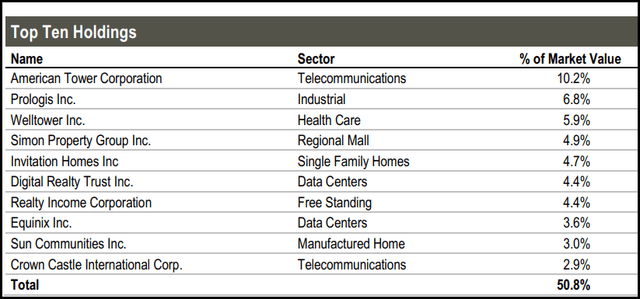

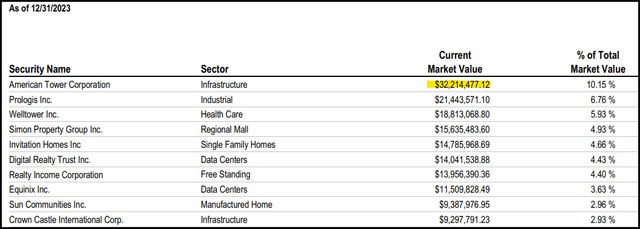

In complete, the fund listed 163 complete holdings. Nevertheless, just like RQI, this fund holds a heavy focus throughout the high ten – with the highest 5 even comprising a quite materials allocation by itself because of the fund’s largest holding, American Tower Corp. (AMT). It is a weighty 10.2% weight for the fund, which was lifted from the prior 5.7% breakdown it was beforehand.

RFI High Ten Holdings (Cohen & Steers)

Different holdings that made the highest ten listing beforehand have been Prologis (PLD), which was the fund’s largest holding, Welltower (WELL), Simon Property (SPG), Invitation Houses Inc (INVH), Digital Realty Belief (DLR), Realty Earnings (O) and Equinix (EQIX).

That solely leaves Solar Communities Inc. (SUI) and Crown Citadel (CCI). Relaxation assured that these two names have been holdings within the fund at the moment, in accordance with that quarterly N-PORT submitting; they only weren’t as giant of holdings at the moment.

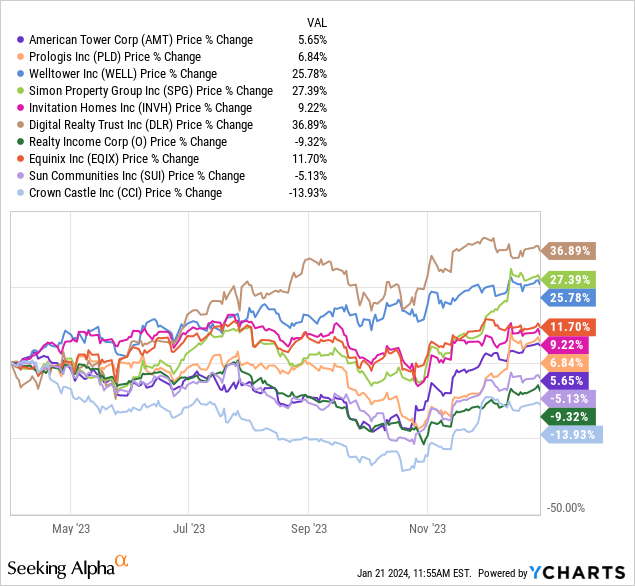

From the tip of March to the tip of December 2023, DLR carried out one of the best by a large margin. SPG and WELL had some sturdy performances as nicely. In actual fact, it was AMT that got here in on the backside half, but it surely nonetheless noticed its weighting climb materials.

Ycharts

In fact, one of many contributing components is that the managers have been including shares to see that kind of change. This appeared to occur steadily all year long as nicely. First, within the March N-PORT, we noticed 86,483 shares being held. The semi-annual report listed 92,635 shares, and the interval ending September N-PORT confirmed a whopping 149,224 shares being held.

As of the final full holdings listing, they’d a present market worth of $32,214,477.12. From there, we will merely take the final closing worth of the yr on December 29, 2023, and see that shares closed at $215.88 per share for AMT. That calculates out to the identical 149,224 shares that the fund continues to be holding.

RFI Tope Ten Holdings (Cohen & Steers)

Conclusion

RFI is a non-leveraged fund that holds primarily fairness REIT holdings. Nevertheless, the fund additionally incorporates a sleeve of most popular and fixed-income devices. That makes it an curiosity rate-sensitive fund, however with charges trying to come down within the subsequent yr or two, that places RFI in a probably sturdy place. Ideally, I would need to see the fund buying and selling at a reduction to really feel like I used to be getting a ‘whole lot,’ however even choosing up a long-term place at a good worth may end up in sturdy outcomes sooner or later.

For buyers prepared to step up the danger profile, its leveraged sister fund RQI can also be a consideration. There, buyers are getting a little bit of a reduction, however with leverage comes greater volatility and probably decrease returns if issues flip bitter.