EUR/USD, PRICE FORECAST:

MOST READ: Oil Newest – US Crude Attempting to Nudge Increased After One other Week of Heavy Losses

The Euro continues to carry the excessive floor towards the Dollar following Tuesday’s explosive transfer to the upside. EURUSD is at the moment buying and selling between two key ranges with assist supplied across the 1.0840 deal with and resistance on the 1.0900 mark.

Beneficial by Zain Vawda

Get Your Free High Buying and selling Alternatives Forecast

US DATA WEAKENS

Macroeconomic knowledge from the US continued its lower than spectacular prints this week with each preliminary jobless claims and Industrial Manufacturing coming in worse than anticipated. Preliminary jobless claims rose to 231k for the week ended November 11, whereas industrial manufacturing contracted by 0.6% for the month of November. The info continued to weigh on the US Greenback and hindering any try at a sustained restoration.

EURO AREA DATA

Euro Space last inflation knowledge was launched this morning with no surprises or changes to the preliminary quantity. Regardless of positives mirrored in falling inflation, ECB Member Holzmann refuses to decide to fee cuts or name an finish to fee hikes. Holzmann acknowledged that the ECB won’t minimize rates of interest in Q2 of 2024, a story that continues to achieve traction each within the EU and the US. This in my view nonetheless stays a bit untimely given all of the adjustments we’ve got seen throughout the course of 2023. A key space of focus for the ECB has been wage progress which the Central Financial institution wish to monitor within the first half of 2024 which appears to be like like it could be cooling as nicely. We’d solely see ECB members decide to calling the tip of the speed hike cycle throughout Q1 or Q2 of 2024 with the Central Financial institution hoping for no additional shocks to inflation.

Supply: EuroStat

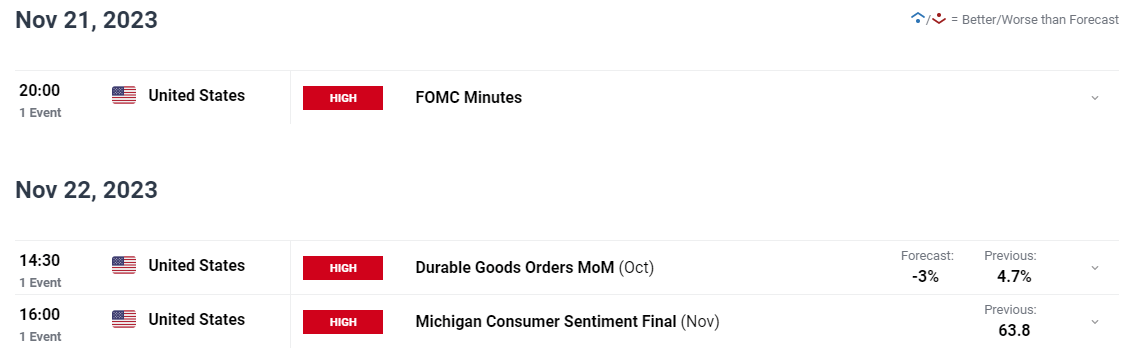

LOOKING AHEAD TO NEXT WEEK

EURUSD could stay caught within the vary between 1.0800-1.0900 with out a catalyst to maintain the Euro advance towards the Dollar going. Subsequent week we do have the Fed Assembly Minutes which if it does backup the market narrative that the Fed are completed with fee hikes might assist spur EURUSD above the 1.0900 resistance hurdle.

Beneficial by Zain Vawda

Easy methods to Commerce EUR/USD

On the Euro facet we’ve got PMI knowledge which is unlikely to indicate any main change because the financial system within the Euro Space continues to limp alongside. Because the clouds darken on the Euro Space it does appear as if This autumn may even see detrimental GDP progress with a possible restoration trying extra possible within the second half of 2024. Let’s hope the information can at the very least spark some type of volatility subsequent week to maintain merchants engaged even when the medium-term outlook stays murky.

For all market-moving financial releases and occasions, see the DailyFX Calendar

TECHNICAL OUTLOOK AND FINAL THOUGHTS

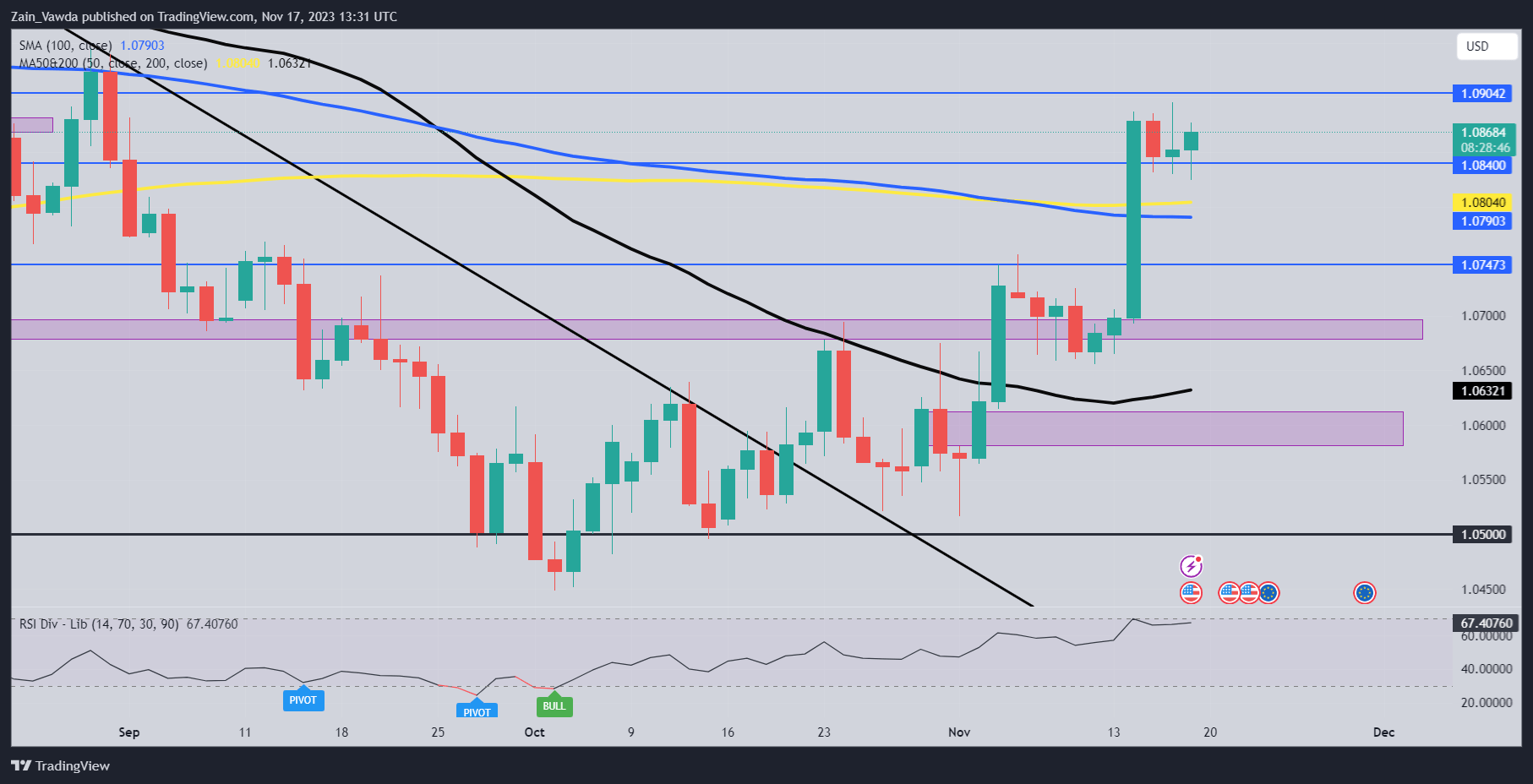

EURUSD and the technical image is fascinating in gentle of the amount and restoration of the Euro this week. In fact, many of the restoration will be laid on the toes of the US Greenback following a slowdown in US inflation. Following the large candle we had on Tuesday we do seem like in a consolidative mode proper now between the 1.0800 and 1.0900 handles.

The 1.0800 has numerous confluences and will serve to offer assist ought to a beak of the speedy assist resting at 1.0840. A break decrease will convey the 1.0750 assist degree into focus, however this may occasionally additionally hinge on the USD outlook subsequent week because the DXY appears to be driving the worth motion in EURUSD.

EUR/USD Day by day Chart – November 17, 2023

Supply: TradingView

IG CLIENT SENTIMENT DATA

IGCSshows retail merchants are at the moment Internet-Brief on EURUSD, with 57% of merchants at the moment holding SHORT positions.

To Get the Full IG Consumer Sentiment Breakdown in addition to Ideas, Please Obtain the Information Under

| Change in | Longs | Shorts | OI |

| Day by day | -10% | 9% | 1% |

| Weekly | -38% | 48% | -4% |

Written by: Zain Vawda, Market Author for DailyFX.com

Contact and observe Zain on Twitter: @zvawda