AsiaVision

A current Wall Avenue Journal article mentioned how retail merchants that made hundreds of thousands throughout the pandemic buying and selling the market at the moment are largely worn out.

“Newbie dealer Omar Ghias says he amassed roughly $1.5 million as shares surged throughout the early a part of the pandemic, gripped by a speculative fervor that cascaded throughout all markets.

As his positive aspects swelled, so did his spending on every thing from sports activities betting and bars to luxurious automobiles. He says he additionally borrowed closely to amplify his positions.

When the social gathering ended, his fortune evaporated due to some wrong-way bets and his extreme spending. To assist himself, he says he now works at a deli in Las Vegas that pays him roughly $14 an hour plus suggestions and sells space timeshares. He says he now not has any cash invested available in the market.

‘I’m ranging from zero,’ stated Mr. Ghias, who’s 25.”

His story just isn’t a one-off occasion. Through the pandemic lockdowns in 2020 and 2021, scores of Individuals turned to inventory market playing to switch sports activities betting because the financial system was shuttered.

Between “stimulus checks,” swelling financial institution accounts, no job to go to, and a free inventory buying and selling app on each cellphone, retail merchants poured into the market chasing every thing from cryptocurrencies to bankrupt corporations.

If all this sounds acquainted, it ought to.

In June 2020, I wrote an article in regards to the speculative behaviors of retail merchants resembling what we noticed in 1999 and 2007. To wit:

“Is it 1999 or 2007? Retail buyers flood the market as hypothesis grows rampant with a palpable exuberance and perception of no draw back threat. What may go fallacious?

Do you bear in mind this industrial?”

“The Etrade industrial aired throughout Tremendous Bowl XLI in 2007. The next 12 months, the monetary disaster set in, markets plunged, and buyers misplaced 50%, or extra, of their wealth.

Nevertheless, this wasn’t the primary time it occurred.

The identical factor occurred in late 1999. This industrial was aired 2 months shy of the start of the “Dot.com” bust as buyers as soon as once more believed “investing was as straightforward as 1-2-3.”

In fact, on the time, retail merchants have been consumed by greed and the “worry of lacking out.” Nevertheless, as we concluded on the time:

“I get it. In case you are one in every of our youthful readers, who’ve by no means been by way of an precise “bear market,” I wouldn’t imagine what I’m telling you both.

Nevertheless, after dwelling by way of the Crash of ’87, managing cash by way of 2000 and 2008, and navigating the “Nice Crash of 2020,” I can let you know the indicators are all there.“

A Change Of Psychology

We warned a number of occasions in numerous articles that the actions of retail merchants would result in very poor outcomes. One such be aware was that Gen Z’ers have been taking up debt to take a position.

“Younger buyers are taking up private debt to spend money on shares. I’ve not personally witnessed such a factor since late 1999. At the moment, ‘day merchants’ tapped bank cards and residential fairness loans to leverage their funding portfolios.

For anybody who has lived by way of two ‘actual’ bear markets, the imagery of individuals attempting to ‘daytrade’ their option to riches is acquainted. The current surge in ‘Meme’ shares like AMC and GameStop because the ‘retail dealer sticks it to Wall Avenue just isn’t new.“

However once more, retail merchants felt indestructible on the time because the market superior virtually every day, and the extra threat you took, the extra success you had.

Nevertheless, as is at all times the case, “threat” and “reward” aren’t mutually unique, and taking up leverage to take a position finally results in poor outcomes. As I concluded in August of 2021:

“Investing is a sport of ‘threat.’ It’s usually said that the extra ‘threat’ you are taking, the extra money you can also make. Nevertheless, the precise definition of threat is ‘how a lot you’ll lose when one thing goes fallacious.’

Following the ‘Dot.com crash,’ many people discovered the perils of ‘threat’ and ‘leverage.’”

Because the WSJ famous, Mr. Ghias borrowed closely to amplify his positions.

The consequence was not sudden.

Nevertheless, importantly, Mr. Ghias just isn’t alone, and the downturn available in the market final 12 months has many retail merchants altering their psychology. To wit:

“Now a few of these so-called retail buyers are backing away from the markets after the worst 12 months for shares since 2008. Others are paring their positions or shifting their cash to extra conservative holdings, resembling bonds or money.”

Given the influence of retail merchants on the markets in 2020 and 2021, their retreat from the market may additionally pose an extra headwind. Nevertheless, most significantly, many of the cash utilized by retail merchants to spice up the markets got here from the pandemic-related stimulus. As one other WSJ article notes, that’s now largely gone.

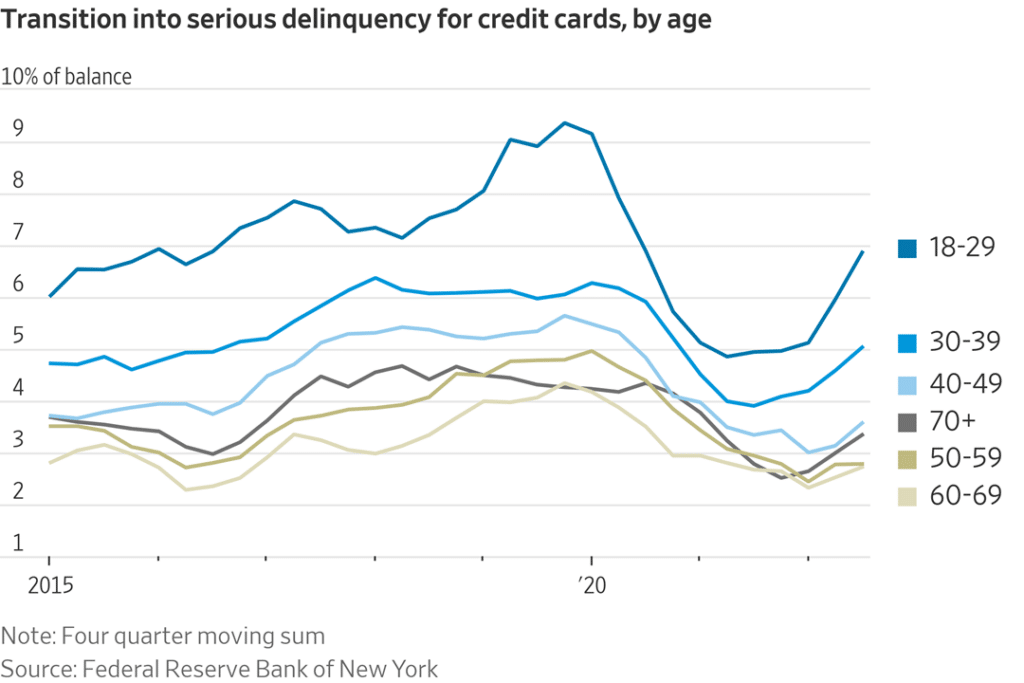

In fact, that lack of capital is now additionally catching up with the flexibility to repay the elevated bank card debt taken on by the youthful era to fund their life-style. As Jeff Sparshott of WSJ notes:

“In 2020 and into 2021, a mixture of presidency pandemic stimulus and lowered spending, for instance on eating places and journey, fattened Individuals’ wallets. This money helped Individuals make it by way of a interval of excessive inflation final 12 months, however the forces that had acted to spice up financial savings reversed course as pandemic aid unwound and costs soared. Right now, some persons are having to chop again on their spending or add to their credit-card balances. Many have needed to faucet their financial savings to remain afloat, say economists.”

In fact, all of it is a operate of the extremely dangerous recommendation dished out on social media that retail merchants consumed with out query.

Don’t Be Bearish

In Might 2022, I wrote an article for the Epoch Occasions titled “The Inevitable Finish Of Dangerous Recommendation.” which mentioned a WSJ article on the rise of a “new era of monetary media stars.”

“Because the U.S. retreated amid the pandemic to its couches, hundreds of thousands of would-be inventory pickers—some flush with stimulus money—fired up social media and messaging apps and dove headlong into the world of retail investing.

Many of those influencers don’t have any formal coaching as monetary advisers and no background in skilled investing, main them to choose shares based mostly on the whims of common opinion or to dispense money-losing recommendation.”

Based on the article, you wanted to be relatable, promote the dream, and never be bearish.

The issue with the “don’t be bearish” bias ought to be evident. Solely listening to one-half of the story makes buyers “blindsided” by the opposite half.

“We all know that day buying and selling doesn’t produce long-term wealth for the overwhelming majority of people that do it, however these influencers are preying on that a part of the human mind that has fewer inhibitions, that thinks: ‘I would be the exception.’ That results in hypothesis and other forms of very high-risk conduct.” – Ted Klontz, Professor Of Behavioral Finance, Creighton College.

The demand by Gen Z’ers for “don’t be bearish” commentary is why they ignored the identical indicators that negatively impacted each Millennials and Boomers beforehand.

Whereas social media stars “acquired wealthy” for his or her free “don’t be bearish” investing recommendation, it’s price noting their “riches” didn’t come from their investing ability. As an alternative, it got here from their ability in producing merchandise and advertisements. Such just isn’t a lot totally different than how Wall Avenue makes its cash.

Expertise tends to be a brutal instructor, however it’s only by way of expertise that we learn to construct wealth efficiently over the long run.

As Ray Dalio as soon as quipped:

“The largest mistake buyers make is to imagine that what occurred within the current previous is prone to persist. They assume that one thing that was a superb funding within the current previous remains to be a superb funding. Sometimes, excessive previous returns merely suggest that an asset has turn out to be dearer and is a poorer, not higher, funding.”

Such is why each nice investor in historical past, in numerous kinds, has one primary investing rule in frequent:

“Don’t lose cash.”

The reason being easy: you’re out of the sport in case you lose capital.

Many younger buyers have gained a lot expertise by giving most of their cash to these with expertise.

It is among the oldest tales on Wall Avenue.

So, whereas Millennials have been fast to dismiss the “Boomers” within the monetary markets for “not getting it.”

There was a extra easy fact.

We did “get it.”

We have now been round lengthy sufficient to understand how these items ultimately finish.

If solely somebody may have warned them.

Unique Put up

Editor’s Word: The abstract bullets for this text have been chosen by In search of Alpha editors.