Japanese traders are very innovative when it comes to developing ways to read a forex chart.

First, they developed the traditional Japanese candlesticks. Nowadays, this has been a mainstay for most traders. This is because it allows traders to identify price action quite easily. Traders can identify where price has opened, where the highs and lows are and where price has closed. All this information is essential for price action traders.

Then, they developed the Heiken Ashi Candlesticks. Heiken Ashi in Japanese translates to “average bars”. The Heiken Ashi Candlesticks is a candlestick which is averaged out in order to allow traders to easily identify trend direction.

As if the charting methods mentioned above are not good enough, they have also developed the Renko Bars. This method of charting allows traders to focus more on the direction of price and takes away the focus from the time element of each candle.

Traders who can easily identify the direction of price can identify fresh trends much better. This in turn allows traders to take trades at the beginning of a trend and ride it out until the end of a trend. This allows traders to earn the most profit out of each trade.

Renko Turtle Channel Forex Trading Strategy is a trend following strategy which makes use of the Renko bars.

Renko Color Bars

The Renko Bars or Renko Chart is a type of charting developed by the Japanese. The word “Renko” is thought to have been derived from the Japanese word “renga”, which means bricks. This is because Renko bars have the resemblance of bricks.

While most charting method employ the concept of time when plotting a chart, the Renko Chart removes the concept of time from the chart. Instead it plots a box like bar every time price moves by a preset distance. This allows traders to focus more on price movements and identify fresh trend more easily.

Renko Color Bars is a modified version of the Renko Chart. It provides traders with an option to remove the time aspect of the bars or not. Traders who are more accustomed to the usual Japanese Candlesticks may adapt to this type of Renko bars more easily.

The Turtle Trading Channel

The Turtle Trading Channel is a technical indicator which was designed by Dennis Gartman and Bill Eckhart.

It is a trend following indicator which identifies trend direction and plots two lines opposite from the direction of the trend. These lines can be used to identify trend reversals, as well as a stop loss placement basis. The first line is a dotted line. This line moves closer to price action. Aggressive traders can opt to use this as a stop loss placement in order to tighten their stop loss. The second line is a solid line. This line changes color depending on the direction of the trend. A dodger blue line would indicate a bullish trend, while a red line would indicate a bearish trend. Traders can use the shifting of the lines or the changing of the color of the solid line as a trend reversal signal.

Moving Average Convergence and Divergence

The Moving Average Convergence and Divergence (MACD) is a staple technical among many traders. It is an oscillator type of technical indicator which is based on moving averages.

The MACD is computed by subtracting the difference between two moving average lines. The difference between the two moving average lines is then plotted in a separate window. Then, another line which is derived from the main MACD line is then plotted on the same window. This line is called the signal line. This line is basically a moving average of the MACD line.

Trend reversal signals are generated based on the crossing over of the two lines. If the MACD line is above the signal line, the trend is bullish. If the signal line is above the MACD line, the trend is bearish.

In this version of the MACD, the difference between the two moving average lines is plotted as a histogram rather than as the MACD line. The signal line on the other hand is plotted as a dotted line.

Trading Strategy

This trading strategy is a trend reversal trading strategy based on the confluence between the Renko Color Bars, the Turtle Trading Channel indicator, and the MACD.

First, the Renko Color Bars should change color indicating a probable shift in trend direction.

Then, the solid line of the Turtle Trading Channel indicator should shift and change color indicating a trend reversal.

The MACD should also confirm the trend reversal. This is based on the crossing of the MACD histogram bars over zero, which is the midline.

Confluences between these three signals warrant a valid trade setup.

However, instead of taking market orders, we will be using stop entry orders placed either on the high or the low of the most recent fractal near the confluence.

Indicators:

- RenkoColorBars1

- Method: 24

- Filter: 20

- Steady: true

- TheTurtleTradingChannel

- MACD

- Fast EMA: 17

- Slow EMA: 31

- MACD SMA: 14

Preferred Time Frames: 1-hour, 4-hour and daily charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

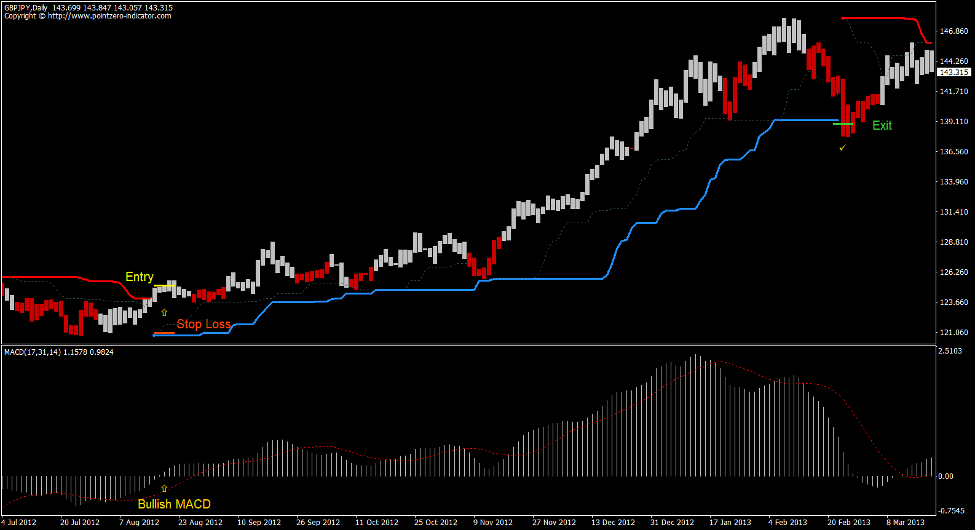

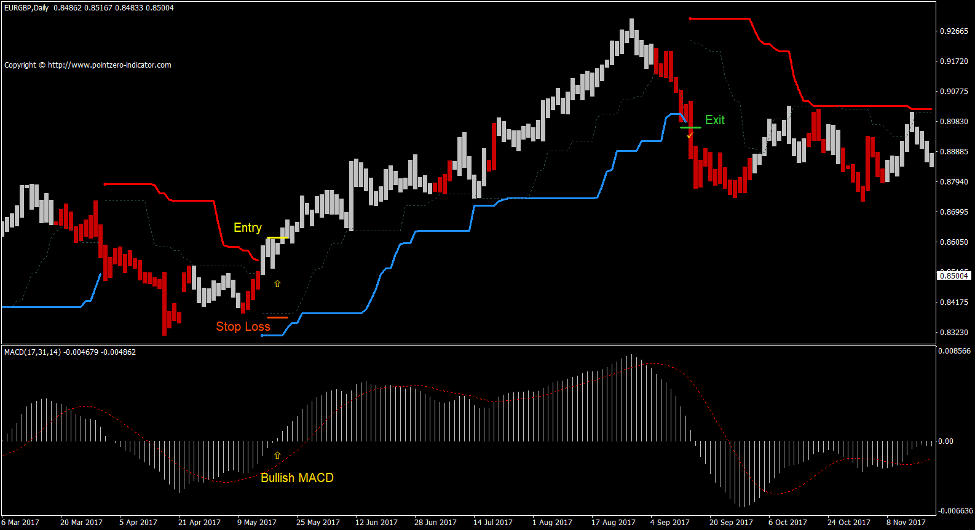

Buy Trade Setup

Entry

- The Renko Color Bars should change to silver.

- The Turtle Trading Channel line should shift below price action and should change to blue.

- The MACD histogram bars should cross above zero.

- Place a buy stop order on the high of the most recent fractal.

Stop Loss

- Set the stop loss on the support below the entry candle.

Exit

- Trail the stop loss below the blue Turtle Trading Channel line until stopped out in profit.

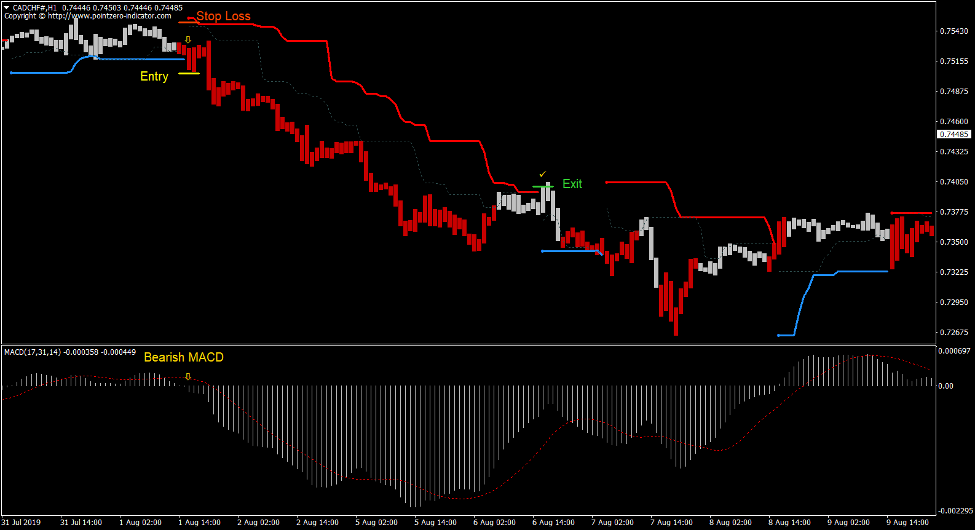

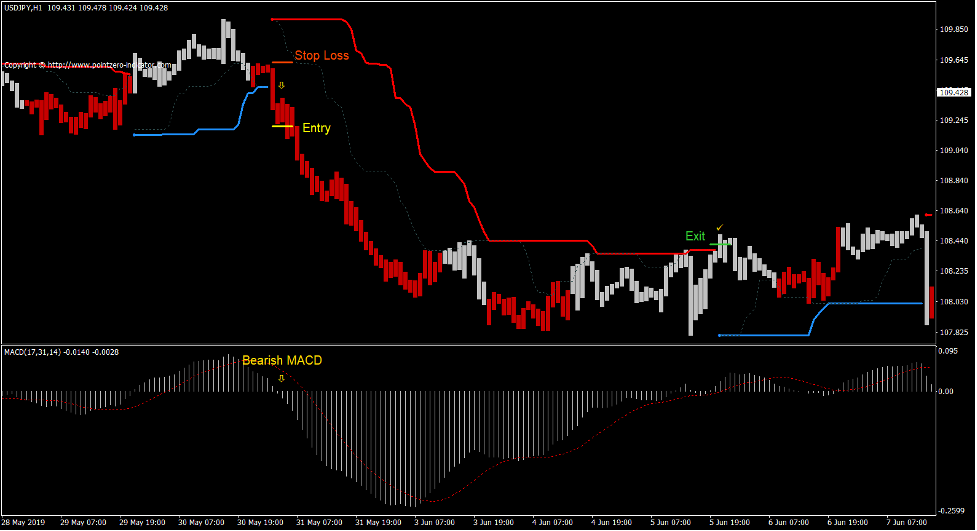

Sell Trade Setup

Entry

- The Renko Color Bars should change to red.

- The Turtle Trading Channel line should shift above price action and should change to red.

- The MACD histogram bars should cross below zero.

- Place a sell stop order on the low of the most recent fractal.

Stop Loss

- Set the stop loss on the resistance above the entry candle.

Exit

- Trail the stop loss above the red Turtle Trading Channel line until stopped out in profit.

Conclusion

This trading strategy is a new concept.

The idea of trading based on Renko Bars is a new way to trade the forex market, yet many traders have reported being profitable using the Renko Bars as an entry signal and using stop entry orders.

Trading using the Turtle Trading system is also a profitable trading strategy which some traders use.

Combining the two concepts together allows for a trade strategy with a positive outlook. Traders who could get a feel of the synergy between the two styles may use this strategy to earn from the forex market.

Forex Trading Strategies Installation Instructions

Renko Turtle Channel Forex Trading Strategy is a combination of Metatrader 4 (MT4) indicator(s) and template.

The essence of this forex strategy is to transform the accumulated history data and trading signals.

Renko Turtle Channel Forex Trading Strategy provides an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the naked eye.

Based on this information, traders can assume further price movement and adjust this strategy accordingly.

Recommended Forex MetaTrader 4 Trading Platform

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click Here for Step-By-Step XM Broker Account Opening Guide

How to install Renko Turtle Channel Forex Trading Strategy?

- Download Renko Turtle Channel Forex Trading Strategy.zip

- *Copy mq4 and ex4 files to your Metatrader Directory / experts / indicators /

- Copy tpl file (Template) to your Metatrader Directory / templates /

- Start or restart your Metatrader Client

- Select Chart and Timeframe where you want to test your forex strategy

- Right click on your trading chart and hover on “Template”

- Move right to select Renko Turtle Channel Forex Trading Strategy

- You will see Renko Turtle Channel Forex Trading Strategy is available on your Chart

*Note: Not all forex strategies come with mq4/ex4 files. Some templates are already integrated with the MT4 Indicators from the MetaTrader Platform.

Click here below to download:

Get Download Access